In this day and age of consuming people love a good deal. One way to make significant savings from your purchases is via Solar Rebate Tax Forms. Solar Rebate Tax Forms can be a way of marketing used by manufacturers and retailers to provide customers with a portion of a refund on their purchases after they've bought them. In this article, we will take a look at the world that is Solar Rebate Tax Forms and explore what they are what they are, how they function, as well as ways to maximize your savings through these cost-effective incentives.

Get Latest Solar Rebate Tax Form Below

Solar Rebate Tax Form

Solar Rebate Tax Form - Solar Rebate Tax Form, Solar Rebate Tax Return, Solar Tax Credit Form 3468, Solar Tax Credit Form Instructions, Solar Credit Irs Form, Nys Solar Credit Tax Form, Solar Tax Credit Application, How Do Solar Tax Rebates Work, Federal Tax Rebates For Solar, Solar Rebate Explained

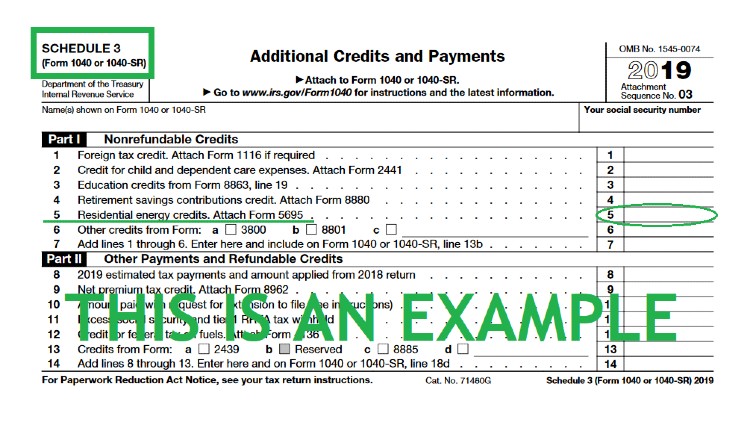

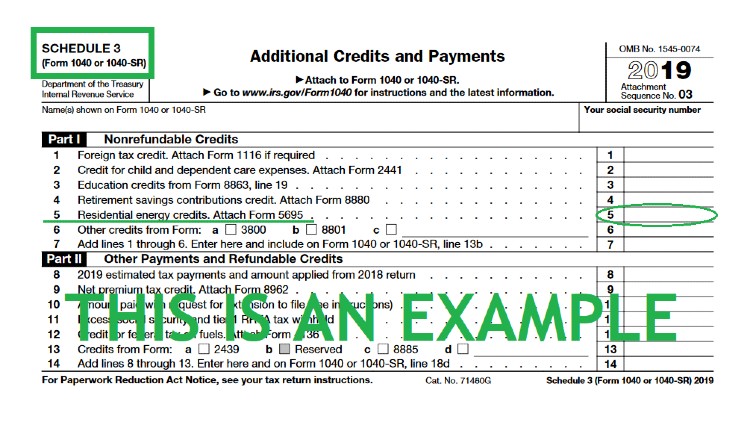

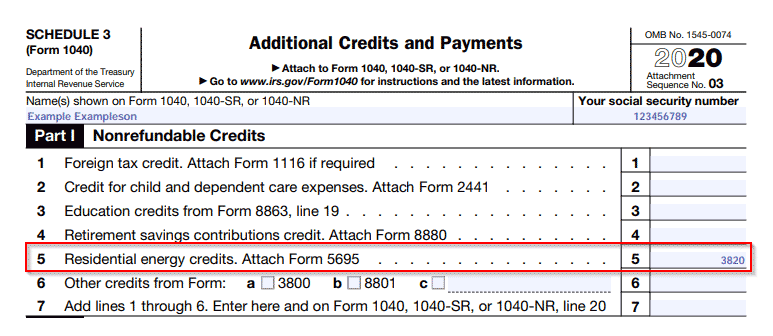

Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to

Web 28 ao 251 t 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may

A Solar Rebate Tax Form in its simplest form, is a partial reimbursement to a buyer after they've purchased a good or service. It's a powerful method that businesses use to draw customers, increase sales, or promote a specific product.

Types of Solar Rebate Tax Form

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Web What is the Solar Energy Tax Credit The Solar Tax Credit is a federal tax credit for solar systems you can claim on your income taxes and reduces your federal tax liability The tax credit is calculated based on a

Web 26 juil 2023 nbsp 0183 32 Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a

Cash Solar Rebate Tax Form

Cash Solar Rebate Tax Form can be the simplest kind of Solar Rebate Tax Form. Customers get a set amount of money back after purchasing a particular item. They are typically used to purchase expensive items such as electronics or appliances.

Mail-In Solar Rebate Tax Form

Mail-in Solar Rebate Tax Form require that customers submit proof of purchase to receive the refund. They're a little more involved but offer substantial savings.

Instant Solar Rebate Tax Form

Instant Solar Rebate Tax Form are made at the moment of sale, cutting the price of your purchase instantly. Customers don't need to wait until they can save in this manner.

How Solar Rebate Tax Form Work

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Web 4 avr 2023 nbsp 0183 32 Individuals that install rooftop solar panels qualify for a 25 rebate on the cost of new or unused solar panels up to a maximum rebate of R15 000 To take

The Solar Rebate Tax Form Process

The process generally involves a couple of steps that are easy to follow:

-

Buy the product: At first, you buy the product just like you normally would.

-

Fill in the Solar Rebate Tax Form request form. You'll have to supply some details like your name, address as well as the details of your purchase to make a claim for your Solar Rebate Tax Form.

-

To submit the Solar Rebate Tax Form It is dependent on the kind of Solar Rebate Tax Form you could be required to fill out a form and mail it in or upload it online.

-

Wait for approval: The company will look over your submission to make sure that it's in accordance with the refund's conditions and terms.

-

Receive your Solar Rebate Tax Form When it's approved you'll get your refund, using a check or prepaid card, or through another option that's specified in the offer.

Pros and Cons of Solar Rebate Tax Form

Advantages

-

Cost Savings: Solar Rebate Tax Form can significantly reduce the price you pay for the product.

-

Promotional Offers The aim is to encourage customers to experiment with new products, or brands.

-

Boost Sales Solar Rebate Tax Form can help boost the company's sales as well as market share.

Disadvantages

-

Complexity In particular, mail-in Solar Rebate Tax Form particularly are often time-consuming and time-consuming.

-

The Expiration Dates A lot of Solar Rebate Tax Form have extremely strict deadlines to submit.

-

The risk of non-payment: Some customers may not get their Solar Rebate Tax Form if they don't comply with the rules exactly.

Download Solar Rebate Tax Form

[su_button url="https://printablerebateform.net/?s=Solar Rebate Tax Form" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Solar Rebate Tax Form[/su_button]

FAQs

1. Are Solar Rebate Tax Form similar to discounts? No, the Solar Rebate Tax Form will be a partial refund after purchase, whereas discounts decrease the purchase price at the time of sale.

2. Are there multiple Solar Rebate Tax Form I can get for the same product It's dependent on the terms applicable to Solar Rebate Tax Form offers and the product's qualification. Some companies may allow it, while others won't.

3. How long will it take to get an Solar Rebate Tax Form? The timing is different, but it could take several weeks to a couple of months to receive your Solar Rebate Tax Form.

4. Do I need to pay tax of Solar Rebate Tax Form amounts? In the majority of cases, Solar Rebate Tax Form amounts are not considered to be taxable income.

5. Can I trust Solar Rebate Tax Form offers from lesser-known brands? It's essential to research and ensure that the brand that is offering the Solar Rebate Tax Form is legitimate prior to making a purchase.

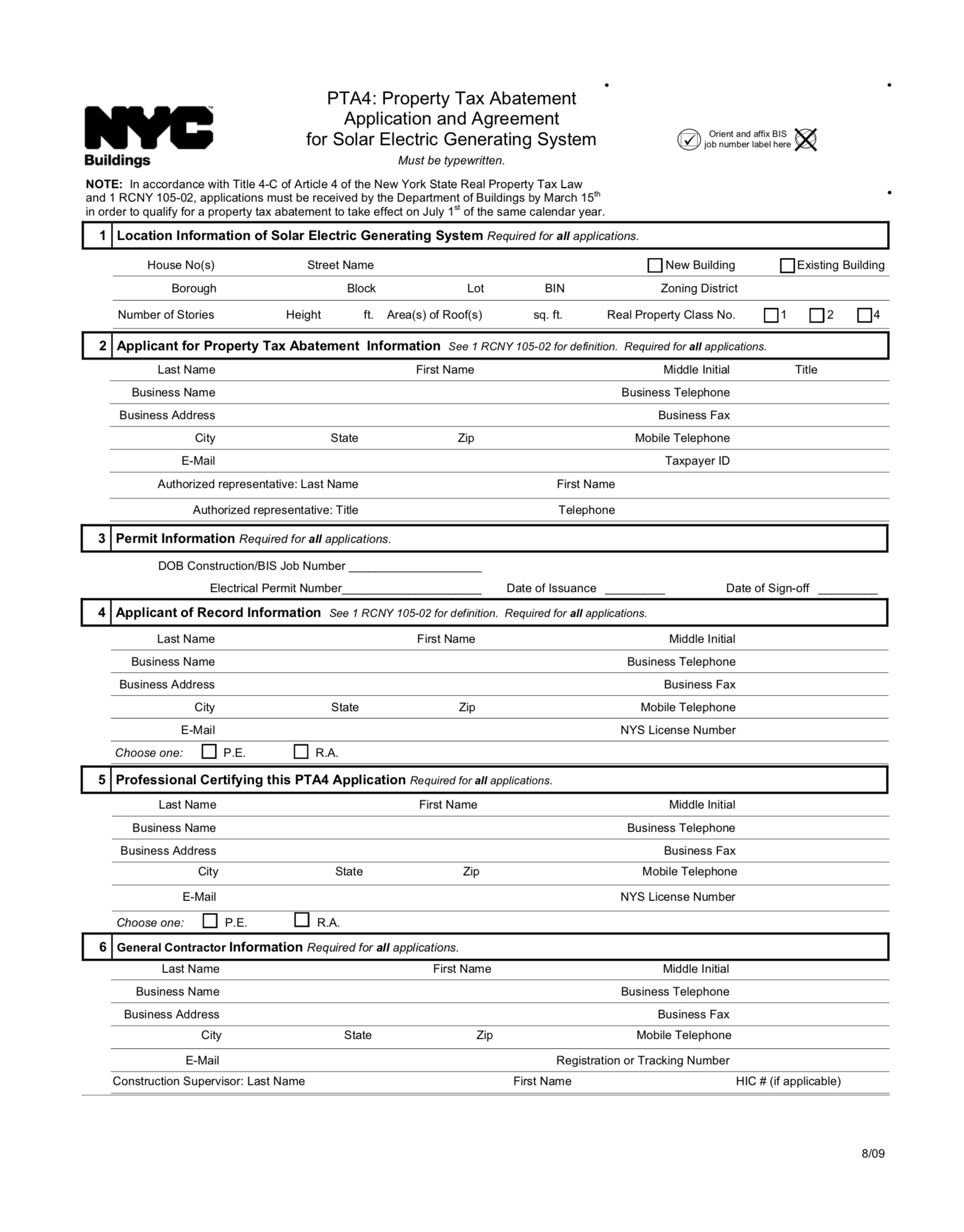

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

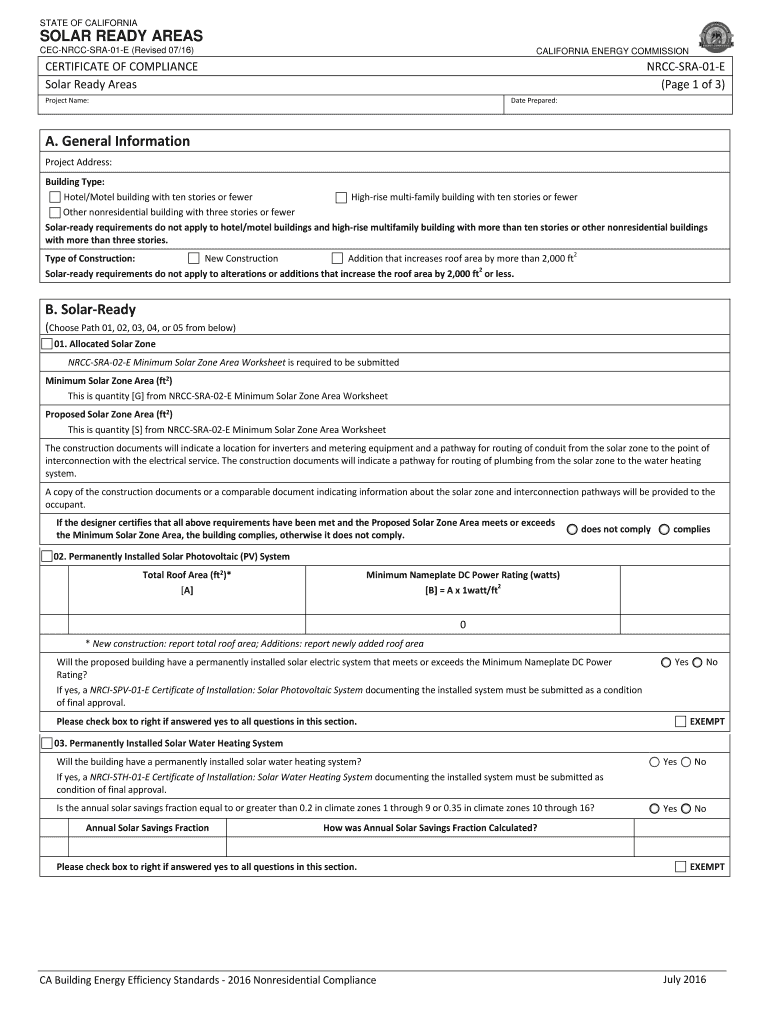

The California Solar Mandate Rolls Out In Here s How Fill Out And

Check more sample of Solar Rebate Tax Form below

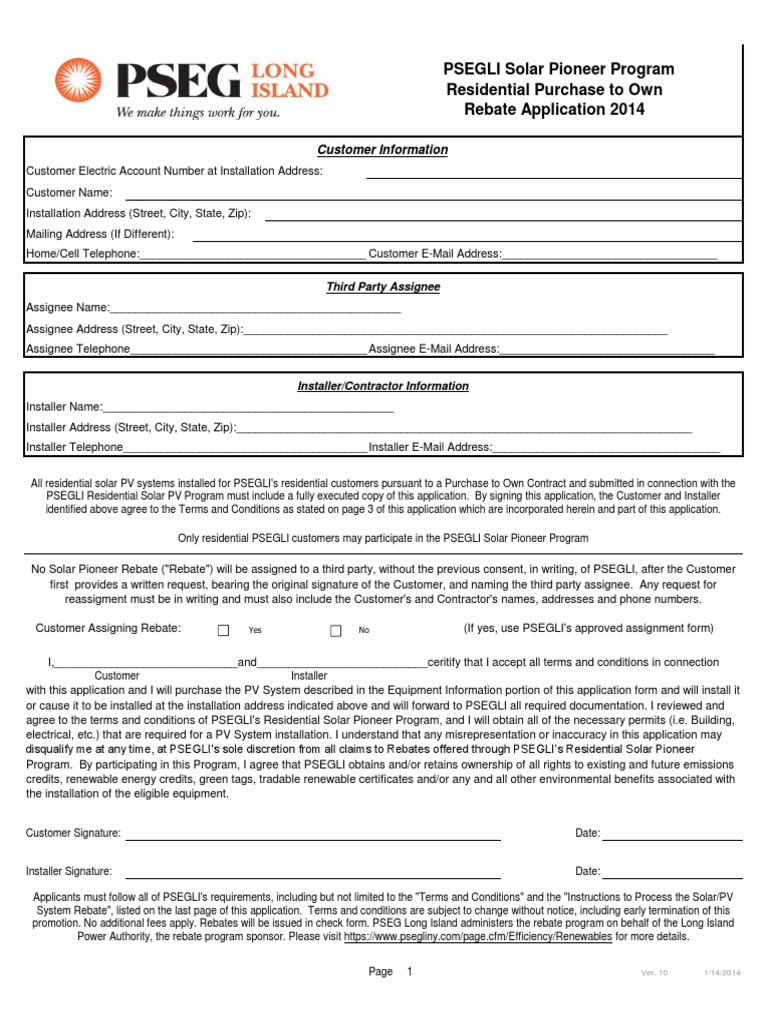

PSEG Long Island PSEGLI Solar Pioneer Program Residential

Solar Tax Credit And Your Boat

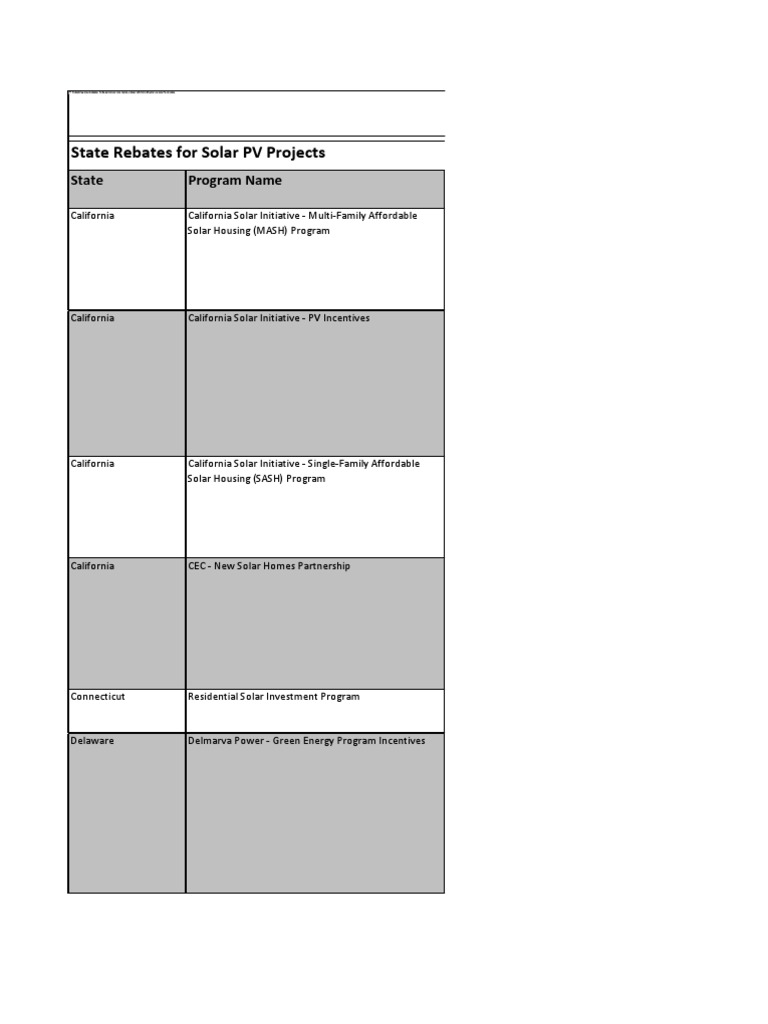

States Rebates For Solar PV Projects Photovoltaic System Renewable

Filing For The Solar Tax Credit Wells Solar

Filing For The Solar Tax Credit Wells Solar

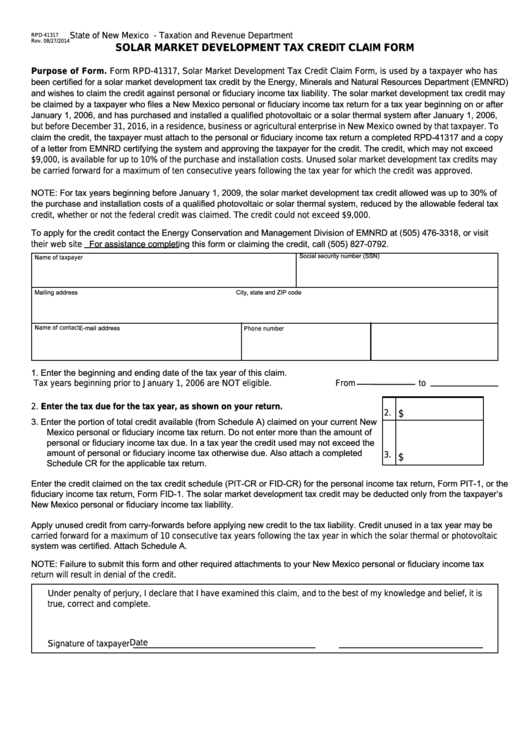

State of New Mexico Incentive Area Solar Energy Gross Receipts Tax

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 ao 251 t 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may

https://news.energysage.com/how-do-i-claim-the-solar-tax-credit

Web 22 sept 2022 nbsp 0183 32 To claim the solar tax credit you ll need to first determine if you re eligible then complete IRS form 5695 and finally add your renewable energy tax credit

Web 28 ao 251 t 2023 nbsp 0183 32 Residential Clean Energy Credit If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may

Web 22 sept 2022 nbsp 0183 32 To claim the solar tax credit you ll need to first determine if you re eligible then complete IRS form 5695 and finally add your renewable energy tax credit

Filing For The Solar Tax Credit Wells Solar

Solar Tax Credit And Your Boat

Filing For The Solar Tax Credit Wells Solar

State of New Mexico Incentive Area Solar Energy Gross Receipts Tax

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

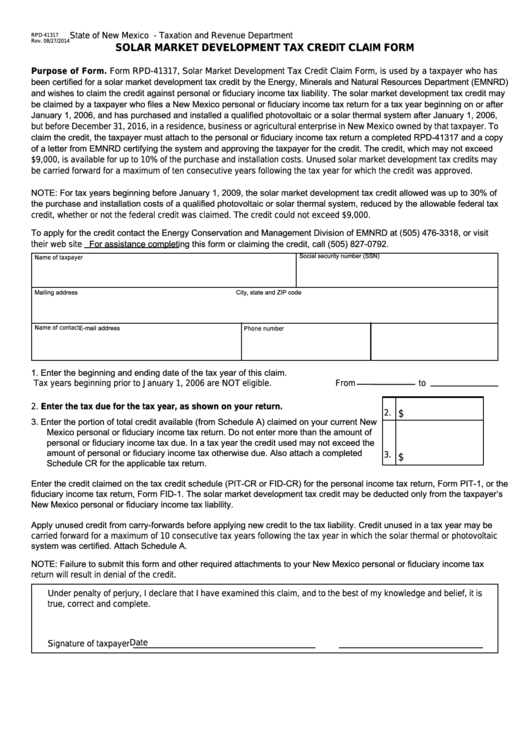

Fillable Form Rpd 41317 New Mexico Solar Market Development Tax

Fillable Form Rpd 41317 New Mexico Solar Market Development Tax

How To Claim The Solar Tax Credit Using IRS Form 5695