In the modern world of consumerization everyone enjoys a good deal. One way to gain significant savings when you shop is with Federal Tax Rebates For Solars. Federal Tax Rebates For Solars are a method of marketing employed by retailers and manufacturers to provide customers with a partial payment on their purchases, after they've bought them. In this post, we'll dive into the world Federal Tax Rebates For Solars. We'll explore the nature of them as well as how they work and the best way to increase the value of these incentives.

Get Latest Federal Tax Rebates For Solar Below

Federal Tax Rebates For Solar

Federal Tax Rebates For Solar -

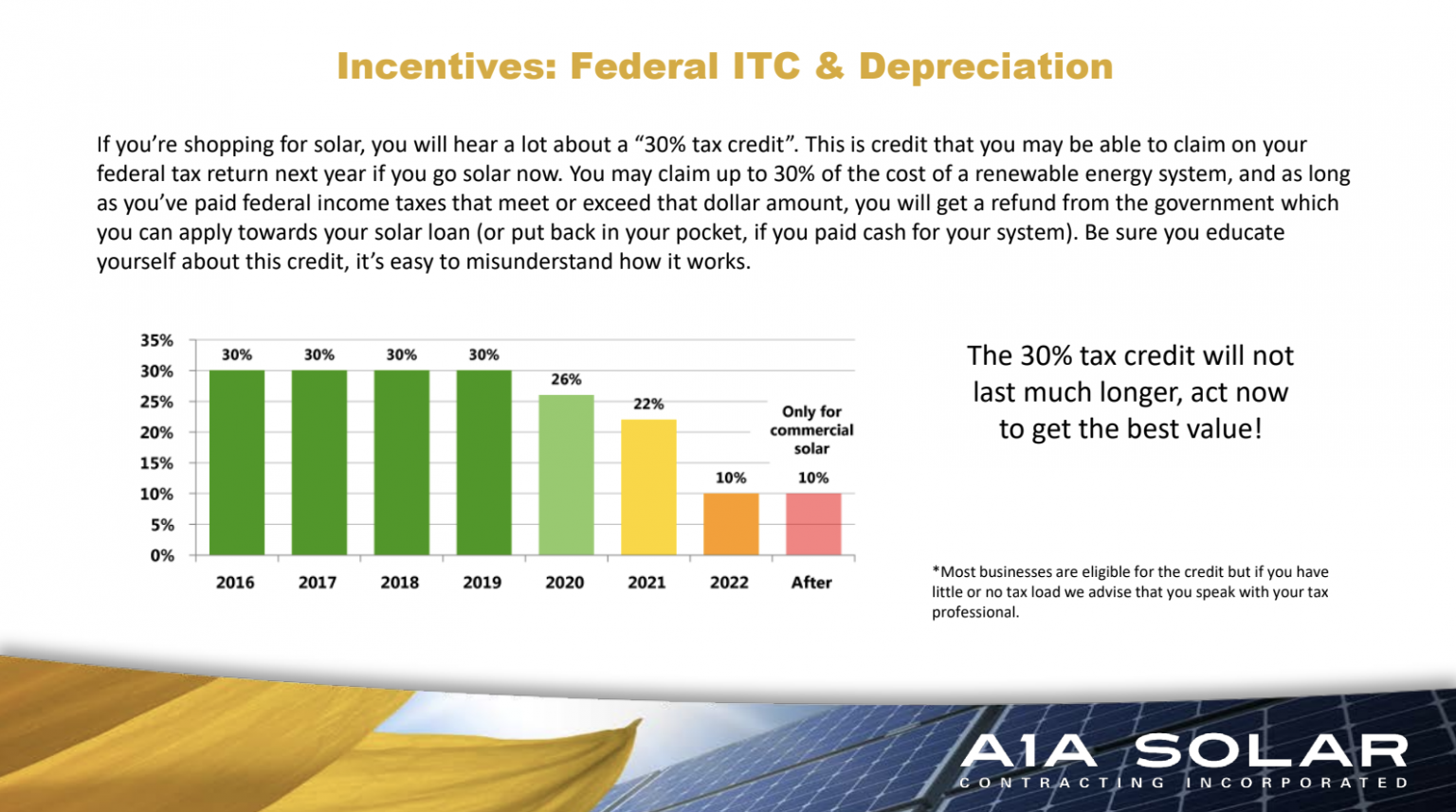

Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

Web your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave

A Federal Tax Rebates For Solar in its most basic version, is an ad-hoc refund to a purchaser after they've bought a product or service. It's a highly effective tool utilized by businesses to attract clients, increase sales and also to advertise certain products.

Types of Federal Tax Rebates For Solar

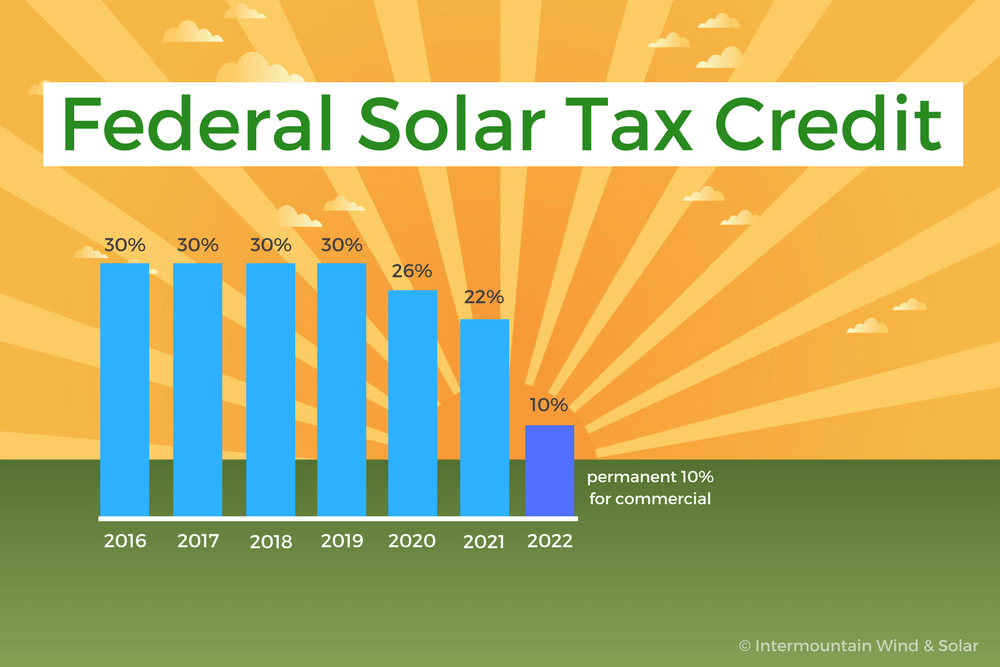

When Does The Federal Solar Tax Credit Expire IWS

When Does The Federal Solar Tax Credit Expire IWS

Web 26 juil 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation

Web 7 ao 251 t 2023 nbsp 0183 32 When you purchase a solar photovoltaic PV system during the tax year you are eligible for a Federal Solar Tax Credit that you can claim on your federal income

Cash Federal Tax Rebates For Solar

Cash Federal Tax Rebates For Solar are probably the most simple type of Federal Tax Rebates For Solar. Customers get a set amount of money in return for buying a product. These are typically applied to more expensive items such electronics or appliances.

Mail-In Federal Tax Rebates For Solar

Mail-in Federal Tax Rebates For Solar require customers to provide documents of purchase to claim their money back. They're a bit more complicated, but they can provide substantial savings.

Instant Federal Tax Rebates For Solar

Instant Federal Tax Rebates For Solar can be applied at the point of sale, which reduces your purchase cost instantly. Customers do not have to wait around for savings through this kind of offer.

How Federal Tax Rebates For Solar Work

Solar Tax Credits Rebates Missouri Arkansas

Solar Tax Credits Rebates Missouri Arkansas

Web 30 d 233 c 2022 nbsp 0183 32 In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 percent income tax credit for clean energy

The Federal Tax Rebates For Solar Process

The process usually involves a number of easy steps:

-

Purchase the product: Then you purchase the product just as you would ordinarily.

-

Fill out the Federal Tax Rebates For Solar Form: To claim the Federal Tax Rebates For Solar you'll have submit some information including your name, address, and information about the purchase in order to be eligible for a Federal Tax Rebates For Solar.

-

You must submit the Federal Tax Rebates For Solar Based on the type of Federal Tax Rebates For Solar you may have to fill out a paper form or send it via the internet.

-

Wait for the company's approval: They will go through your application to make sure it is in line with the Federal Tax Rebates For Solar's terms and conditions.

-

Get your Federal Tax Rebates For Solar When it's approved you'll get your refund, either by check, prepaid card, or by another method as specified by the offer.

Pros and Cons of Federal Tax Rebates For Solar

Advantages

-

Cost savings: Federal Tax Rebates For Solar can significantly reduce the price you pay for the item.

-

Promotional Deals These promotions encourage consumers to try new items or brands.

-

Enhance Sales The benefits of a Federal Tax Rebates For Solar can improve the company's sales as well as market share.

Disadvantages

-

Complexity Reward mail-ins in particular could be cumbersome and costly.

-

Days of expiration Many Federal Tax Rebates For Solar impose extremely strict deadlines to submit.

-

A risk of not being paid Some customers might lose their Federal Tax Rebates For Solar in the event that they don't follow the rules exactly.

Download Federal Tax Rebates For Solar

[su_button url="https://printablerebateform.net/?s=Federal Tax Rebates For Solar" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Federal Tax Rebates For Solar[/su_button]

FAQs

1. Are Federal Tax Rebates For Solar equivalent to discounts? No, Federal Tax Rebates For Solar are a partial refund after purchase, but discounts can reduce the purchase price at point of sale.

2. Can I get multiple Federal Tax Rebates For Solar on the same product It's dependent on the conditions applicable to Federal Tax Rebates For Solar offers and the product's ability to qualify. Certain companies allow it, and some don't.

3. How long does it take to get an Federal Tax Rebates For Solar? The amount of time varies, but it can be from several weeks to few months to get your Federal Tax Rebates For Solar.

4. Do I have to pay taxes on Federal Tax Rebates For Solar the amount? most cases, Federal Tax Rebates For Solar amounts are not considered to be taxable income.

5. Should I be able to trust Federal Tax Rebates For Solar deals from lesser-known brands Consider doing some research and verify that the organization offering the Federal Tax Rebates For Solar is credible prior to making an investment.

Congress Gets Renewable Tax Credit Extension Right Renewable Energy World

Solar Tax Credit Calculator KareenRoabie

Check more sample of Federal Tax Rebates For Solar below

Bc Rebates For Solar Power PowerRebate

Federal Solar Tax Credit Save Money On Solar KC Green Energy

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

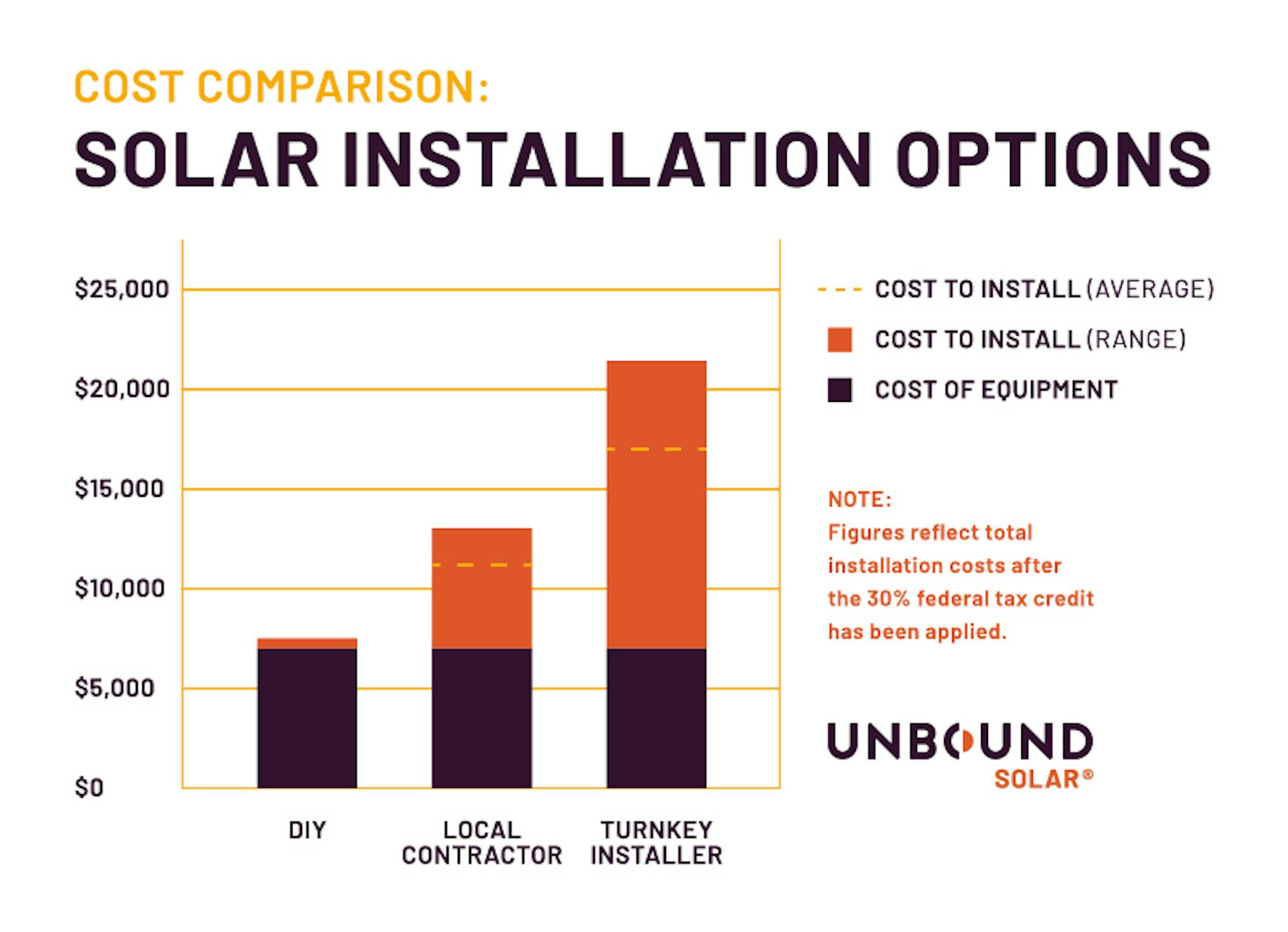

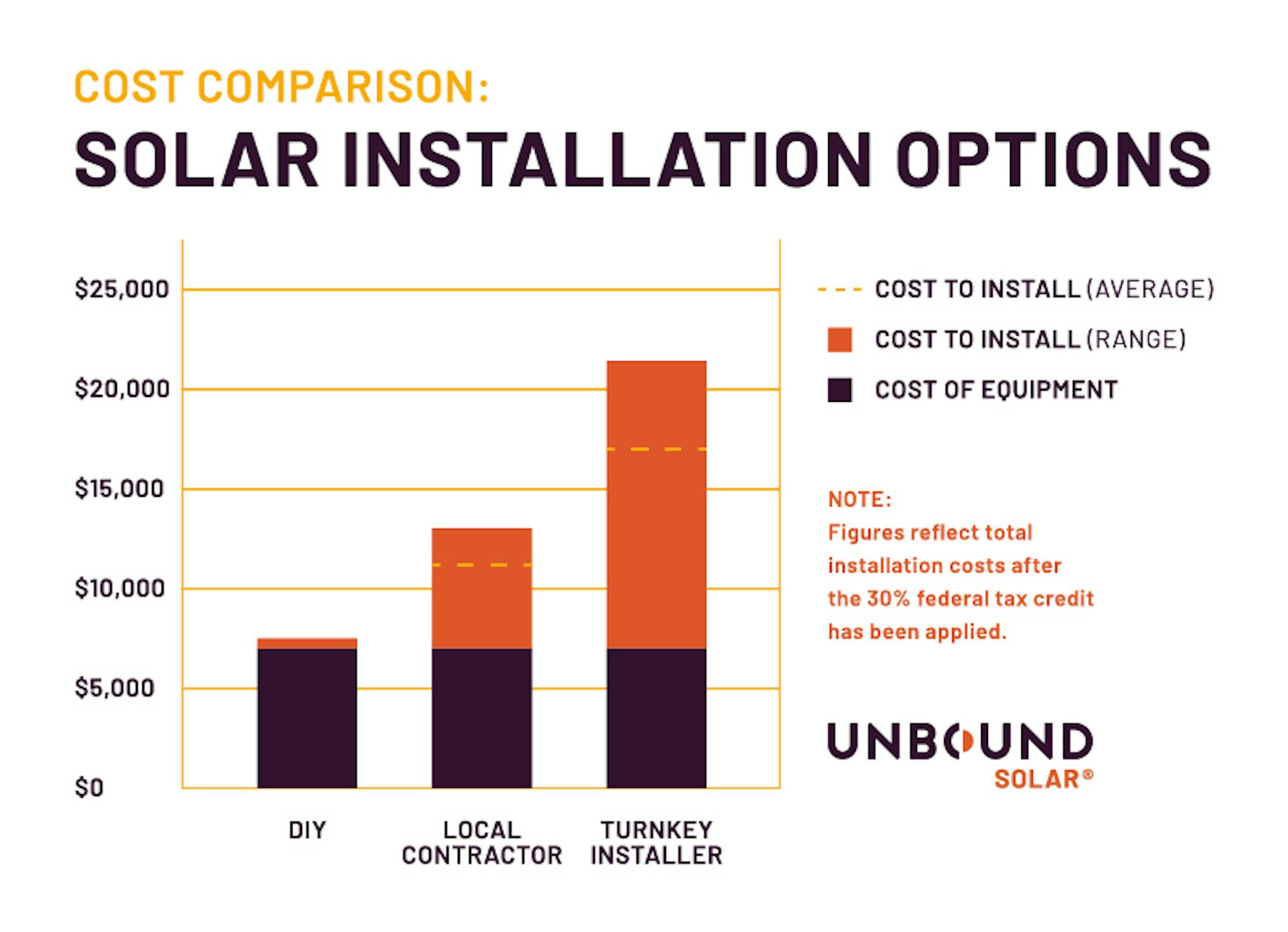

Solar Panel Tax Credit Unbound Solar

How To Claim The Federal Solar Tax Credit SAVKAT Inc

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave

https://www.energy.gov/eere/solar/articles/sol…

Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed

Web your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave

Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

Federal Solar Tax Credit Save Money On Solar KC Green Energy

Solar Panel Tax Credit Unbound Solar

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Frequently Asked Questions About The Federal Solar Tax Credit In 2020

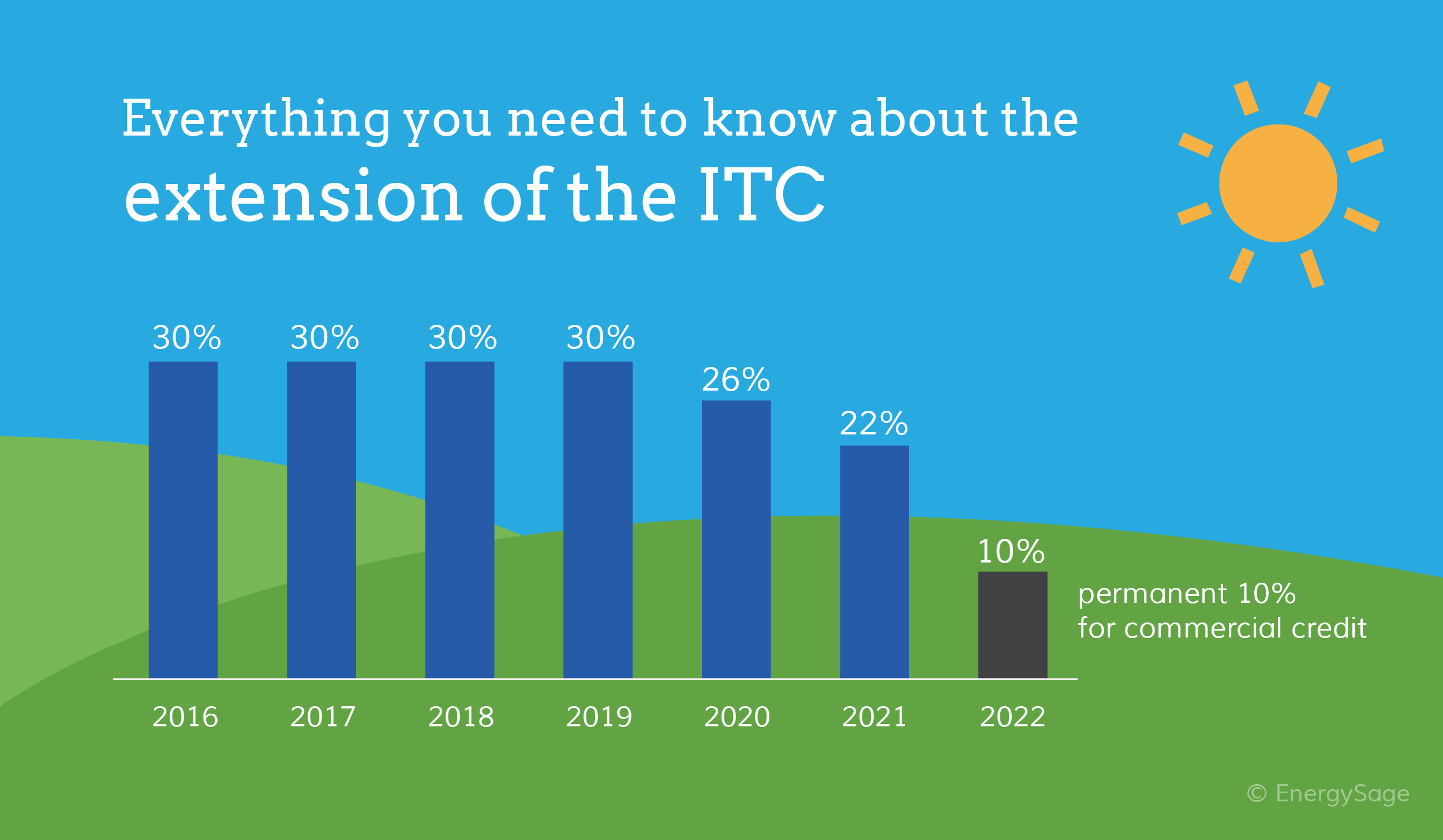

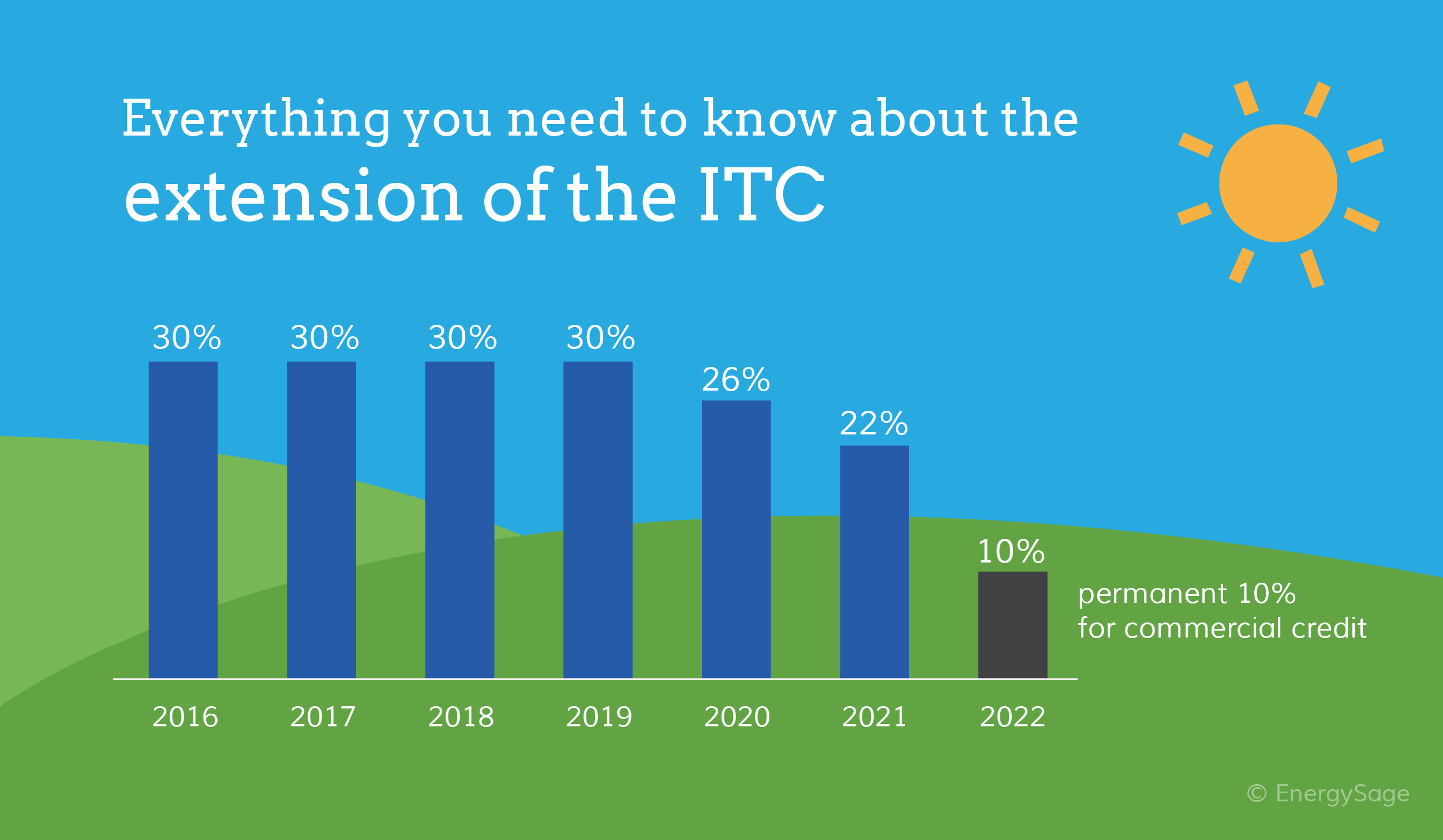

Solar Tax Credit Chart Energy Sage Sol Luna Solar

Solar Tax Credit Chart Energy Sage Sol Luna Solar

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More