In today's world of consumerism people love a good bargain. One option to obtain significant savings on your purchases is through Solar Tax Credit Form 3468s. Solar Tax Credit Form 3468s are a method of marketing that retailers and manufacturers use to provide customers with a portion of a refund on their purchases after they've taken them. In this article, we'll investigate the world of Solar Tax Credit Form 3468s, exploring the nature of them about, how they work, and how you can maximize your savings through these efficient incentives.

Get Latest Solar Tax Credit Form 3468 Below

Solar Tax Credit Form 3468

Solar Tax Credit Form 3468 -

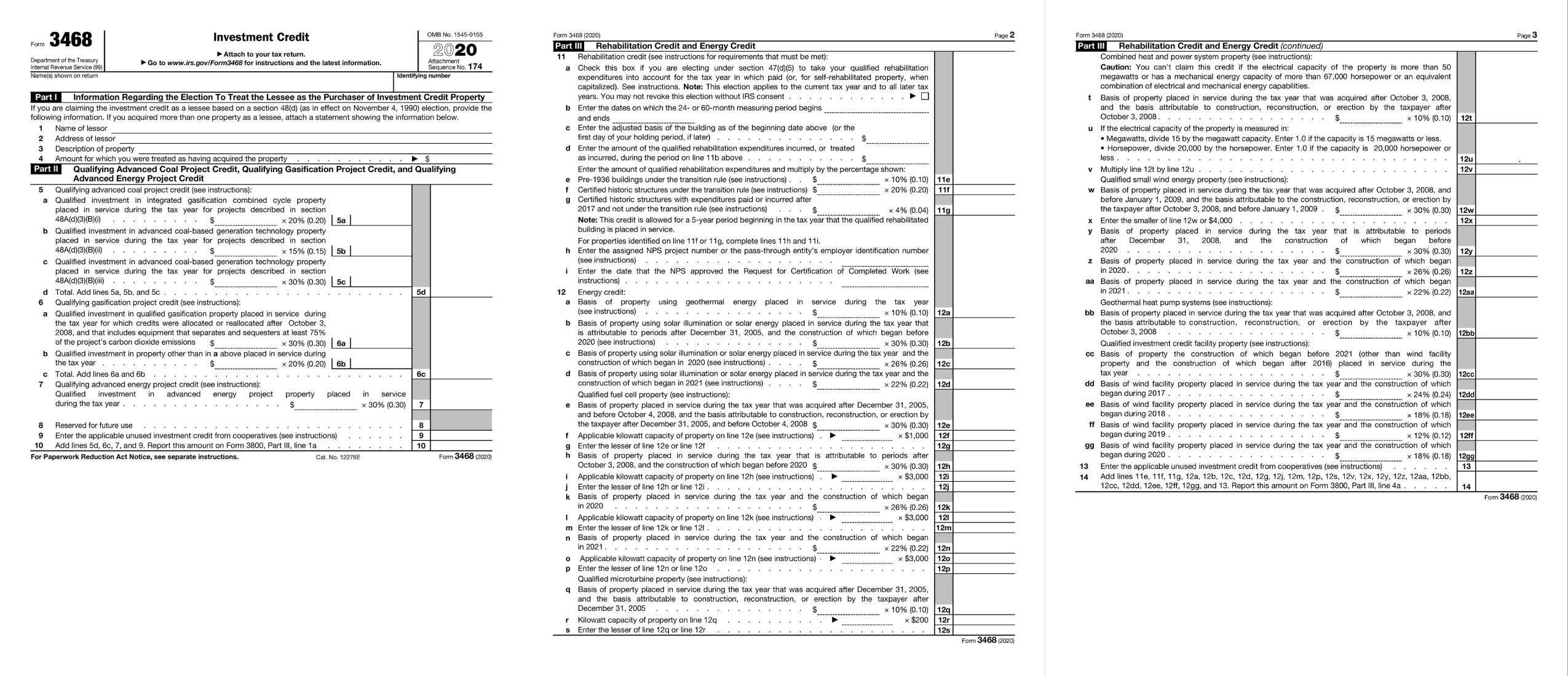

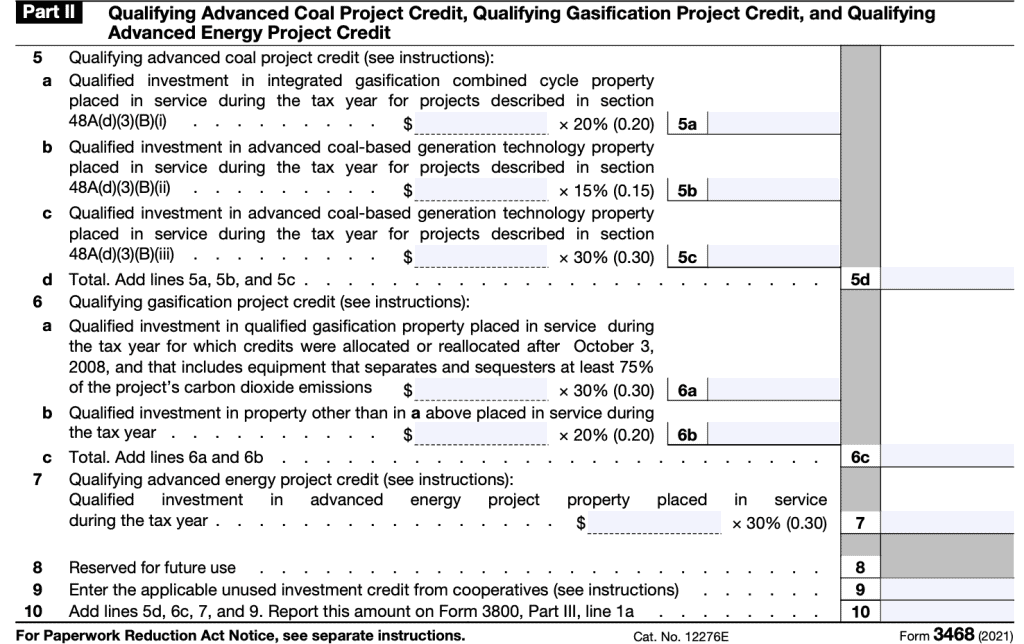

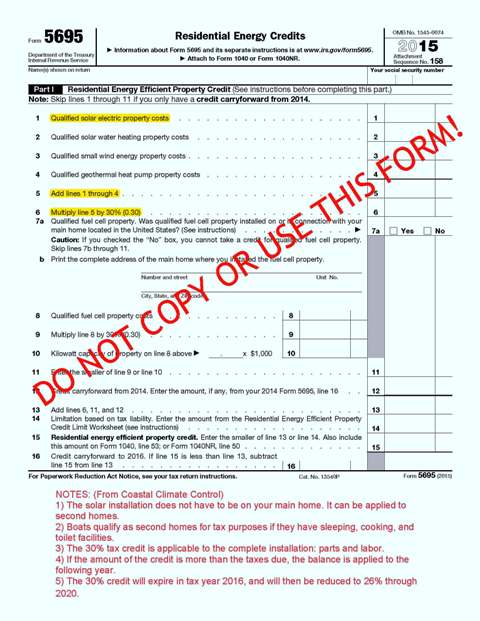

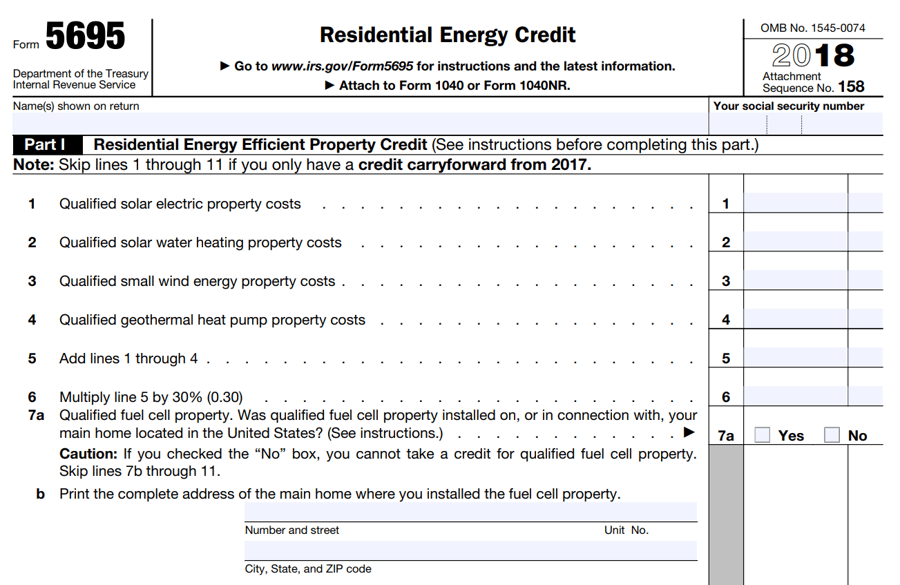

Steps to claim the Solar Tax Credit There are three major steps you ll need to take Determine if your system qualifies for the ITC Complete IRS Form 3468 solar

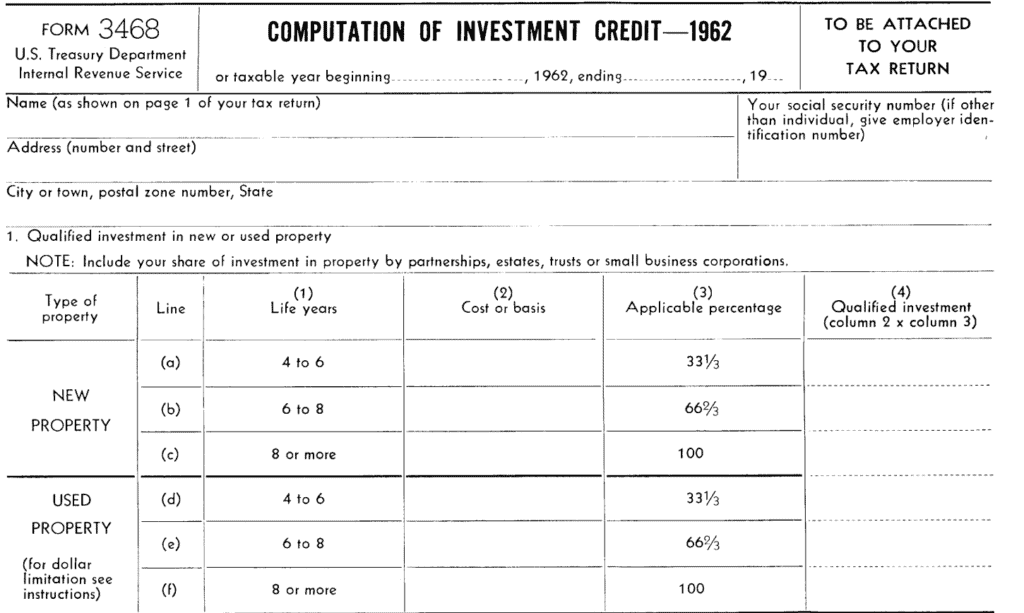

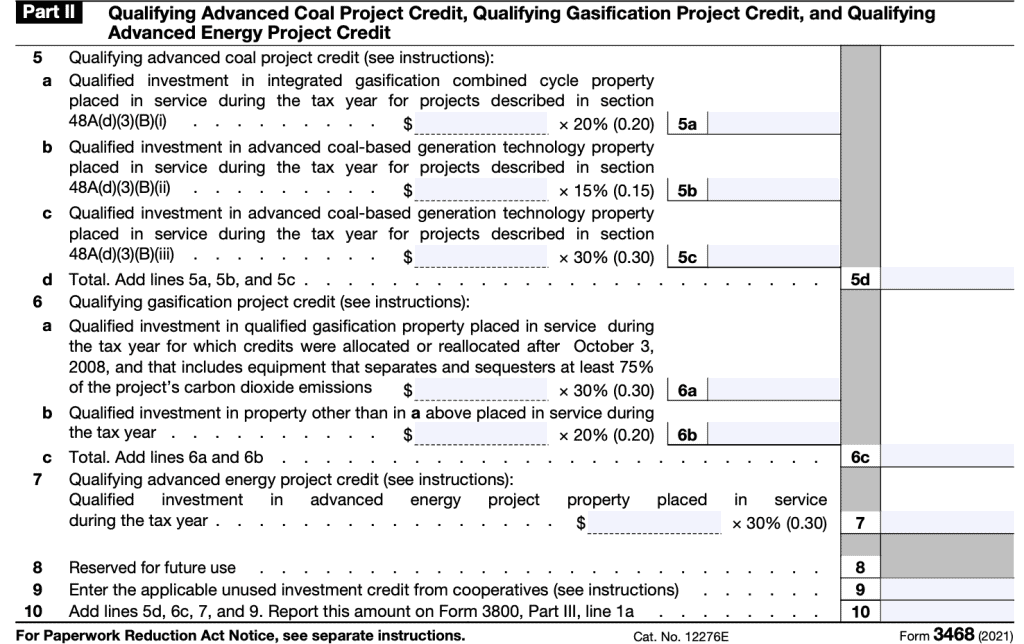

Purpose of Form Use a separate Form 3468 to enter information and amounts in the appropriate parts to claim a credit for each investment property and any unused

A Solar Tax Credit Form 3468 in its simplest type, is a return to the customer after they've purchased a good or service. It's an effective method used by businesses to attract customers, boost sales, and promote specific products.

Types of Solar Tax Credit Form 3468

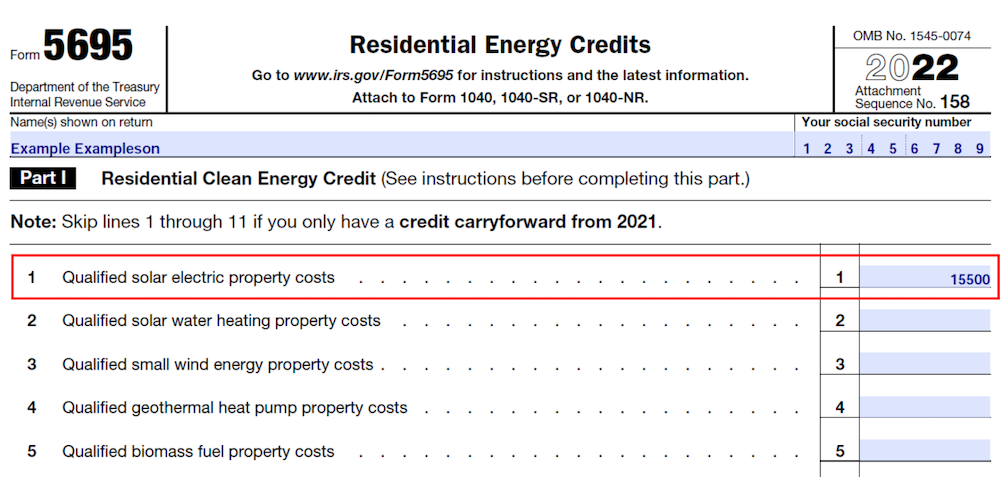

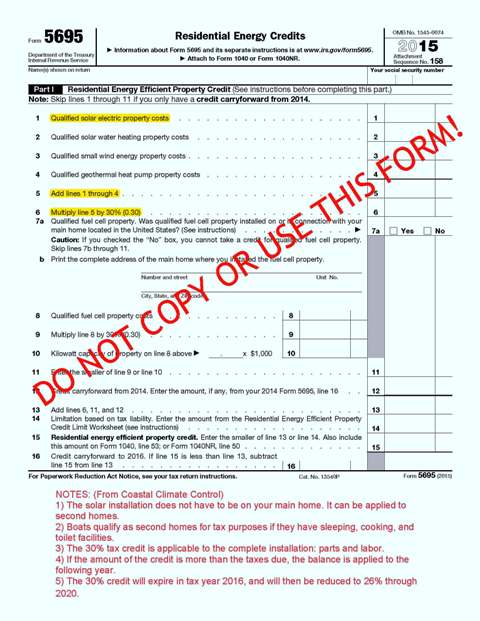

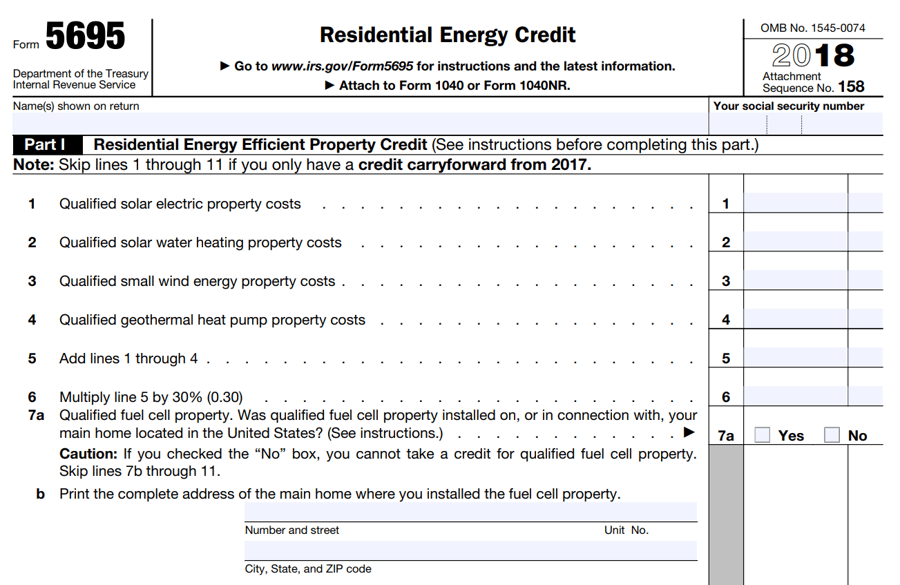

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Follow these steps to enter a solar energy credit in tax year 2022 and prior If depreciable enter the asset in Screen 16 Depreciation 4562 Go to the Investment

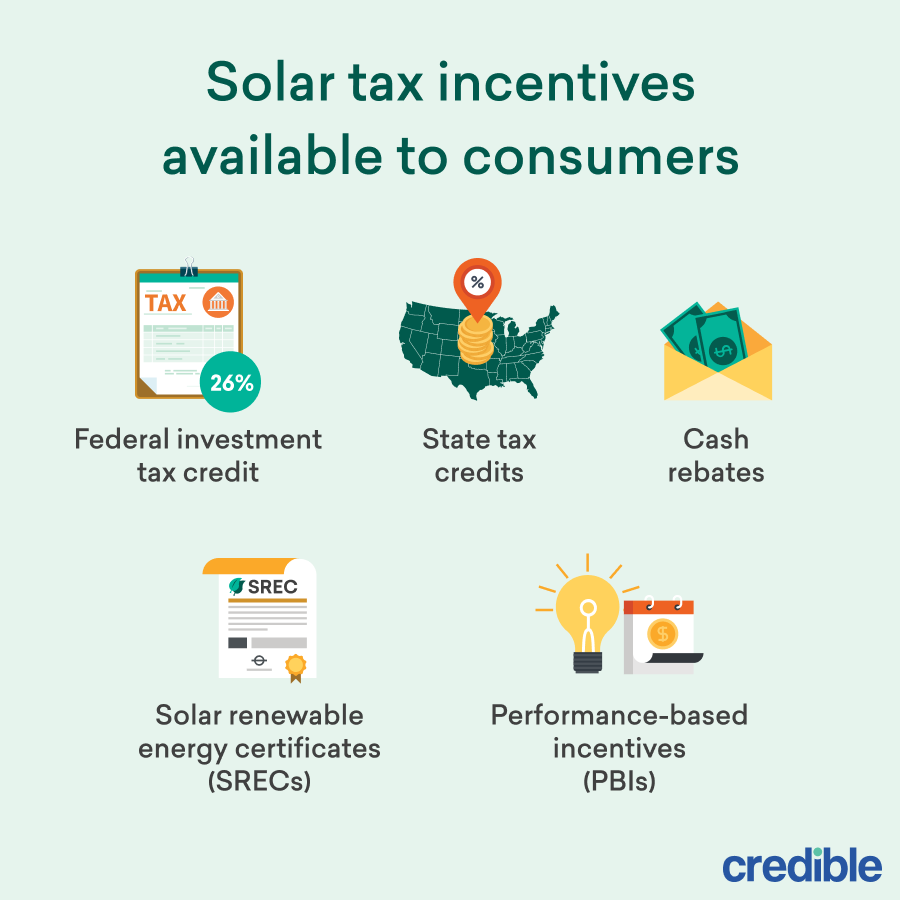

This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP

Cash Solar Tax Credit Form 3468

Cash Solar Tax Credit Form 3468 are the most straightforward type of Solar Tax Credit Form 3468. Clients receive a predetermined sum of money back when purchasing a product. These are typically for the most expensive products like electronics or appliances.

Mail-In Solar Tax Credit Form 3468

Mail-in Solar Tax Credit Form 3468 are based on the requirement that customers submit documents of purchase to claim the refund. They are a bit more involved, but offer significant savings.

Instant Solar Tax Credit Form 3468

Instant Solar Tax Credit Form 3468 apply at the point of sale, reducing the cost of purchase immediately. Customers do not have to wait for savings through this kind of offer.

How Solar Tax Credit Form 3468 Work

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Enter the amounts in the applicable field for basis of solar or energy property Form 3468 doesn t generate in the S Corporation return Instead the credit flows to the shareholder

The Solar Tax Credit Form 3468 Process

The procedure typically consists of a few steps

-

Purchase the product: Then, you purchase the item like you would normally.

-

Fill in the Solar Tax Credit Form 3468 questionnaire: you'll need to give some specific information including your name, address as well as the details of your purchase to receive your Solar Tax Credit Form 3468.

-

In order to submit the Solar Tax Credit Form 3468 depending on the type of Solar Tax Credit Form 3468 you could be required to send in a form, or upload it online.

-

Wait until the company approves: The company will evaluate your claim to determine if it's in compliance with the requirements of the Solar Tax Credit Form 3468.

-

Pay your Solar Tax Credit Form 3468 When it's approved you'll receive your money back, in the form of a check, prepaid card or another option that's specified in the offer.

Pros and Cons of Solar Tax Credit Form 3468

Advantages

-

Cost Savings Solar Tax Credit Form 3468 are a great way to cut the price you pay for an item.

-

Promotional Deals Incentivize customers to explore new products or brands.

-

boost sales The benefits of a Solar Tax Credit Form 3468 can improve sales for a company and also increase market share.

Disadvantages

-

Complexity Mail-in Solar Tax Credit Form 3468 in particular the case of HTML0, can be a hassle and tedious.

-

Expiration Dates Some Solar Tax Credit Form 3468 have the strictest deadlines for submission.

-

A risk of not being paid Some customers might not receive Solar Tax Credit Form 3468 if they do not follow the rules precisely.

Download Solar Tax Credit Form 3468

[su_button url="https://printablerebateform.net/?s=Solar Tax Credit Form 3468" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Solar Tax Credit Form 3468[/su_button]

FAQs

1. Are Solar Tax Credit Form 3468 equivalent to discounts? No, Solar Tax Credit Form 3468 offer one-third of the amount refunded following purchase, but discounts can reduce the cost of purchase at moment of sale.

2. Are there any Solar Tax Credit Form 3468 that I can use for the same product What is the best way to do it? It's contingent on conditions of the Solar Tax Credit Form 3468 offer and also the item's quality and eligibility. Certain companies allow the use of multiple Solar Tax Credit Form 3468, whereas other won't.

3. How long does it take to receive the Solar Tax Credit Form 3468? The period will differ, but can take anywhere from a few weeks to a several months to receive a Solar Tax Credit Form 3468.

4. Do I have to pay tax of Solar Tax Credit Form 3468 values? the majority of circumstances, Solar Tax Credit Form 3468 amounts are not considered to be taxable income.

5. Can I trust Solar Tax Credit Form 3468 offers from brands that aren't well-known It's important to do your research and verify that the brand offering the Solar Tax Credit Form 3468 is reliable prior to making purchases.

Solar Tax Credit Calculator NikiZsombor

IRS Form 3468 Guide To Claiming The Investment Tax Credit

Check more sample of Solar Tax Credit Form 3468 below

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

How To File The Federal Solar Tax Credit A Step By Step Guide

Irs Form 5695 Instructions 2023 Printable Forms Free Online

Solar Tax Credit And Your Boat Updated Blog

How To File The Federal Solar Tax Credit A Step By Step Guide

IRS Form 3468 Guide To Claiming The Investment Tax Credit

https://www.irs.gov/instructions/i3468

Purpose of Form Use a separate Form 3468 to enter information and amounts in the appropriate parts to claim a credit for each investment property and any unused

https://www.irs.gov/pub/irs-pdf/f3468.pdf

Does the project qualify as a solar or wind facility in connection with low income communities bonus credit per section 48 e 2 a Yes and the facility is located in a low

Purpose of Form Use a separate Form 3468 to enter information and amounts in the appropriate parts to claim a credit for each investment property and any unused

Does the project qualify as a solar or wind facility in connection with low income communities bonus credit per section 48 e 2 a Yes and the facility is located in a low

Solar Tax Credit And Your Boat Updated Blog

How To File The Federal Solar Tax Credit A Step By Step Guide

How To File The Federal Solar Tax Credit A Step By Step Guide

IRS Form 3468 Guide To Claiming The Investment Tax Credit

Everything You Need To Know About The Federal Solar Tax Credit

How To Claim The Solar Tax Credit Using IRS Form 5695

How To Claim The Solar Tax Credit Using IRS Form 5695

How To Claim The Federal Solar Investment Tax Credit Solar Sam