In this day and age of consuming every person loves a great deal. One way to gain significant savings on your purchases is through Solar Rebate Forms Federal Governments. Solar Rebate Forms Federal Governments are an effective marketing tactic used by manufacturers and retailers to provide customers with a partial return on their purchases once they've placed them. In this article, we'll dive into the world Solar Rebate Forms Federal Governments. We will explore the nature of them what they are, how they function, and ways you can increase the value of these incentives.

Get Latest Solar Rebate Forms Federal Government Below

Solar Rebate Forms Federal Government

Solar Rebate Forms Federal Government - Solar Rebate Forms Federal Government, Federal Tax Rebates For Solar, How To Claim Federal Solar Rebate, Federal Tax Credit For Solar Form, What Is The Federal Rebate For Solar Panels

Web 8 sept 2022 nbsp 0183 32 Federal Solar Tax Credit Resources The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar

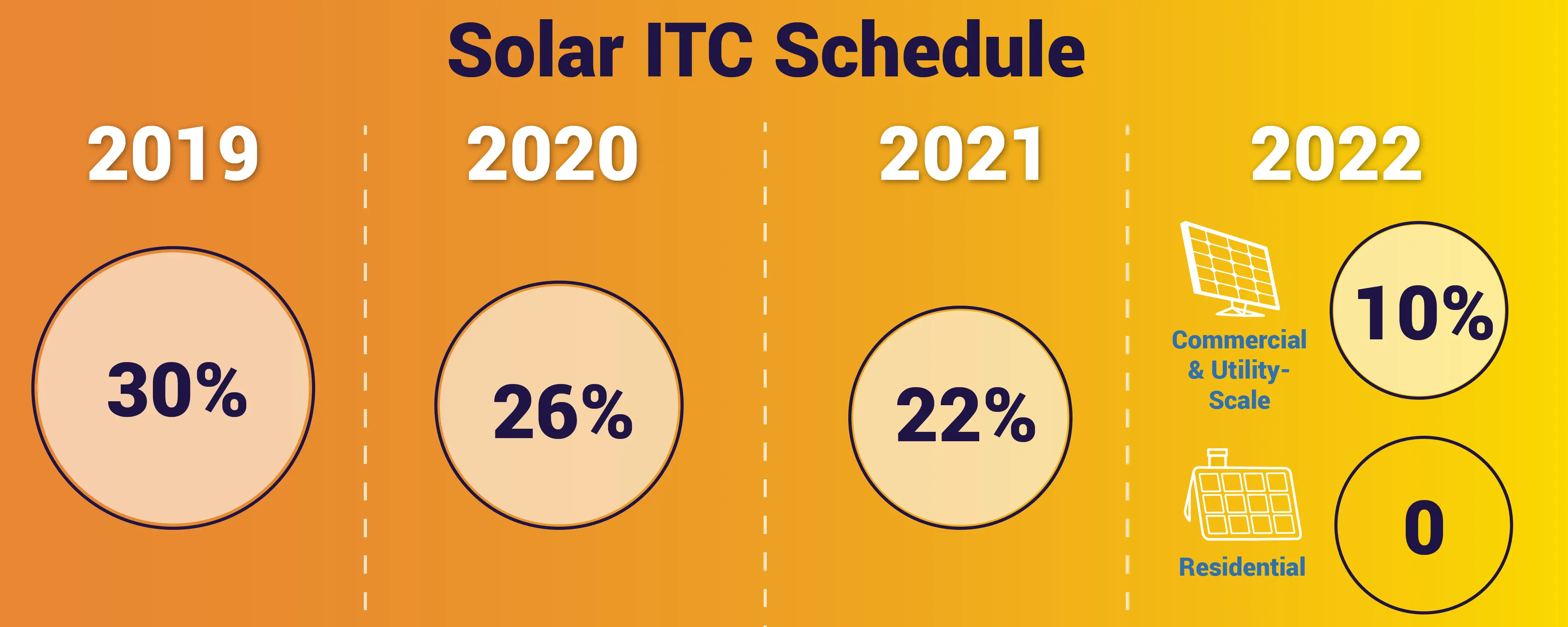

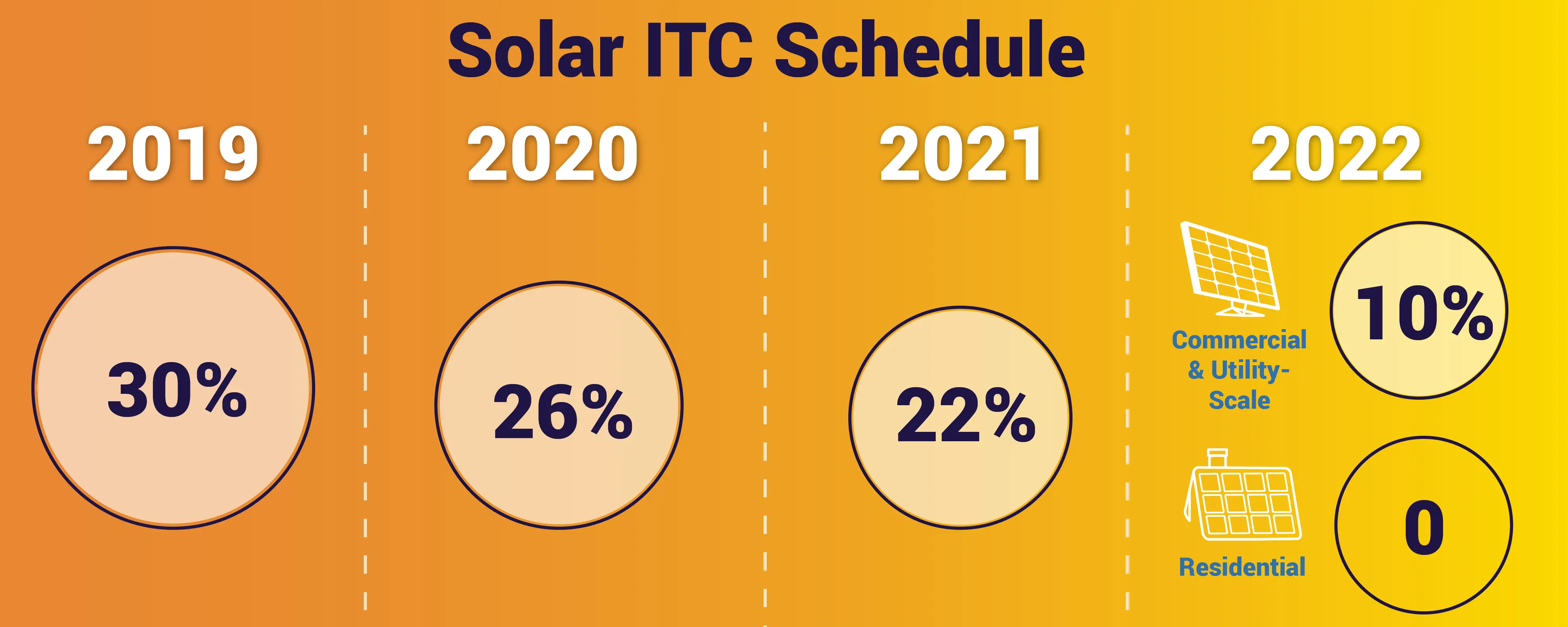

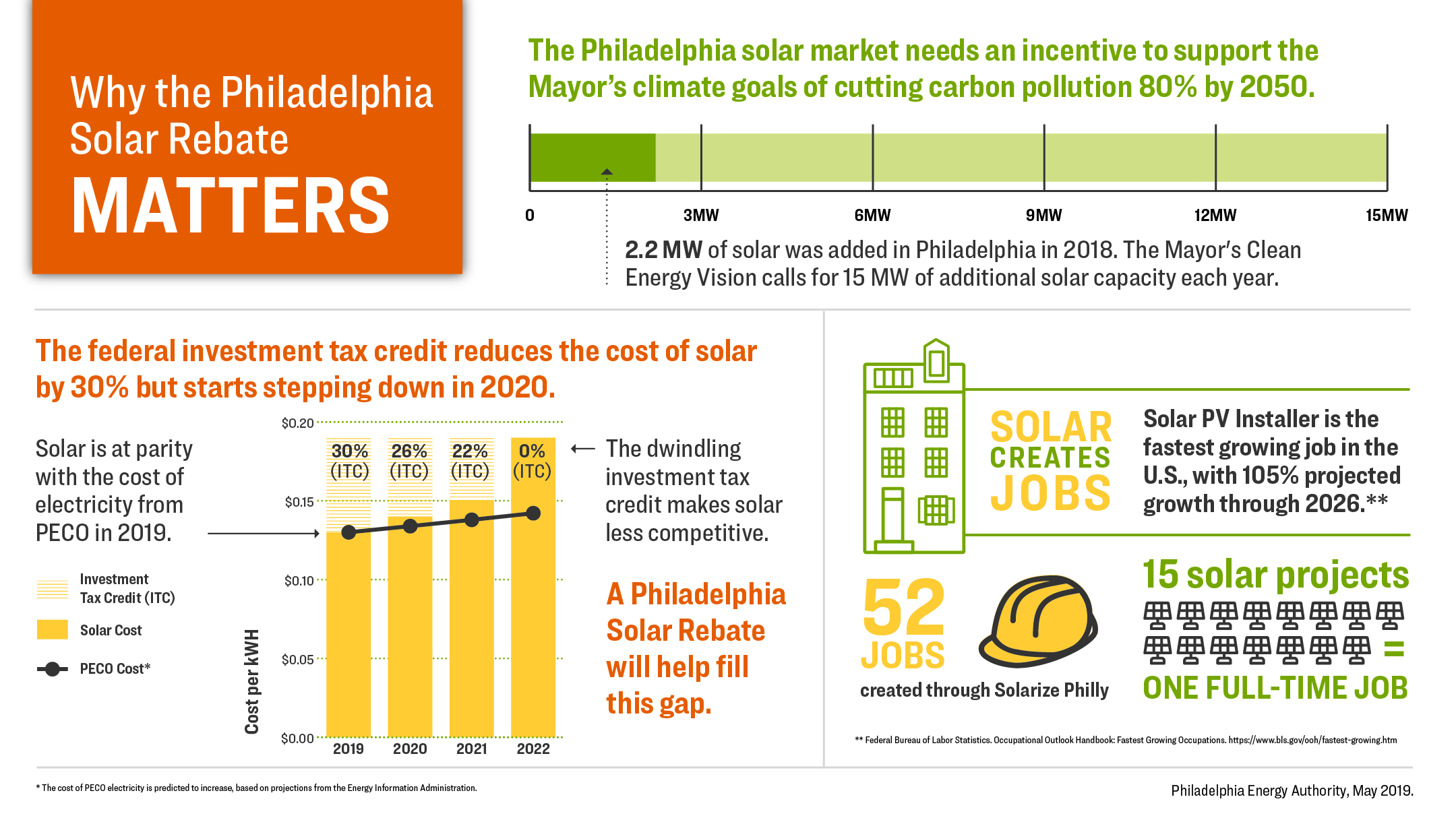

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

A Solar Rebate Forms Federal Government as it is understood in its simplest definition, is a refund given to a client after they've purchased a good or service. It's a very effective technique employed by companies to attract customers, increase sales and market specific products.

Types of Solar Rebate Forms Federal Government

Pin On Solar Power Info graphics

Pin On Solar Power Info graphics

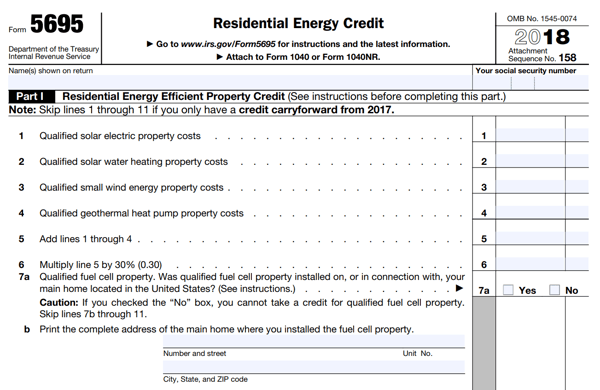

Web 17 f 233 vr 2023 nbsp 0183 32 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the

Cash Solar Rebate Forms Federal Government

Cash Solar Rebate Forms Federal Government is the most basic type of Solar Rebate Forms Federal Government. Customers receive a specific amount of money after purchasing a product. They are typically used to purchase more expensive items such electronics or appliances.

Mail-In Solar Rebate Forms Federal Government

Mail-in Solar Rebate Forms Federal Government require that customers submit an evidence of purchase for their reimbursement. They're somewhat more complicated, but they can provide significant savings.

Instant Solar Rebate Forms Federal Government

Instant Solar Rebate Forms Federal Government are applied at point of sale and reduce the cost of purchase immediately. Customers do not have to wait long for savings through this kind of offer.

How Solar Rebate Forms Federal Government Work

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

Web Federal Financing Programs for Clean Energy PDF The Energy Department has compiled a comprehensive resource guide for federal programs that support the development of clean energy projects in the

The Solar Rebate Forms Federal Government Process

The process typically involves a few simple steps

-

Purchase the product: Then then, you buy the item the way you normally do.

-

Fill out your Solar Rebate Forms Federal Government forms: The Solar Rebate Forms Federal Government form will have to provide some information like your address, name, and purchase details, to receive your Solar Rebate Forms Federal Government.

-

Send in the Solar Rebate Forms Federal Government It is dependent on the kind of Solar Rebate Forms Federal Government you may have to submit a form by mail or send it via the internet.

-

Wait for approval: The business will evaluate your claim to ensure it meets the rules and regulations of the Solar Rebate Forms Federal Government.

-

You will receive your Solar Rebate Forms Federal Government Once it's approved, you'll receive your refund through a check, or a prepaid card or another option specified by the offer.

Pros and Cons of Solar Rebate Forms Federal Government

Advantages

-

Cost savings Solar Rebate Forms Federal Government can dramatically decrease the price for the item.

-

Promotional Deals They encourage customers to try new products and brands.

-

Help to Increase Sales: Solar Rebate Forms Federal Government can boost an organization's sales and market share.

Disadvantages

-

Complexity Mail-in Solar Rebate Forms Federal Government particularly, can be cumbersome and take a long time to complete.

-

End Dates Some Solar Rebate Forms Federal Government have the strictest deadlines for submission.

-

Risk of Non-Payment Customers may have their Solar Rebate Forms Federal Government delayed if they don't follow the rules exactly.

Download Solar Rebate Forms Federal Government

[su_button url="https://printablerebateform.net/?s=Solar Rebate Forms Federal Government" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Solar Rebate Forms Federal Government[/su_button]

FAQs

1. Are Solar Rebate Forms Federal Government similar to discounts? No, Solar Rebate Forms Federal Government are partial reimbursement after purchase, while discounts lower the purchase price at time of sale.

2. Are there any Solar Rebate Forms Federal Government that I can use on the same item It's dependent on the terms and conditions of Solar Rebate Forms Federal Government deals and product's admissibility. Certain companies may permit it, but some will not.

3. How long does it take to get a Solar Rebate Forms Federal Government? The length of time can vary, but typically it will range from several weeks to few months to get your Solar Rebate Forms Federal Government.

4. Do I need to pay taxes upon Solar Rebate Forms Federal Government funds? most circumstances, Solar Rebate Forms Federal Government amounts are not considered taxable income.

5. Do I have confidence in Solar Rebate Forms Federal Government deals from lesser-known brands It's crucial to research and confirm that the brand giving the Solar Rebate Forms Federal Government is reputable before making a purchase.

How To Claim The Solar Tax Credit Using IRS Form 5695

How To File The Federal Solar Tax Credit A Step By Step Guide

Check more sample of Solar Rebate Forms Federal Government below

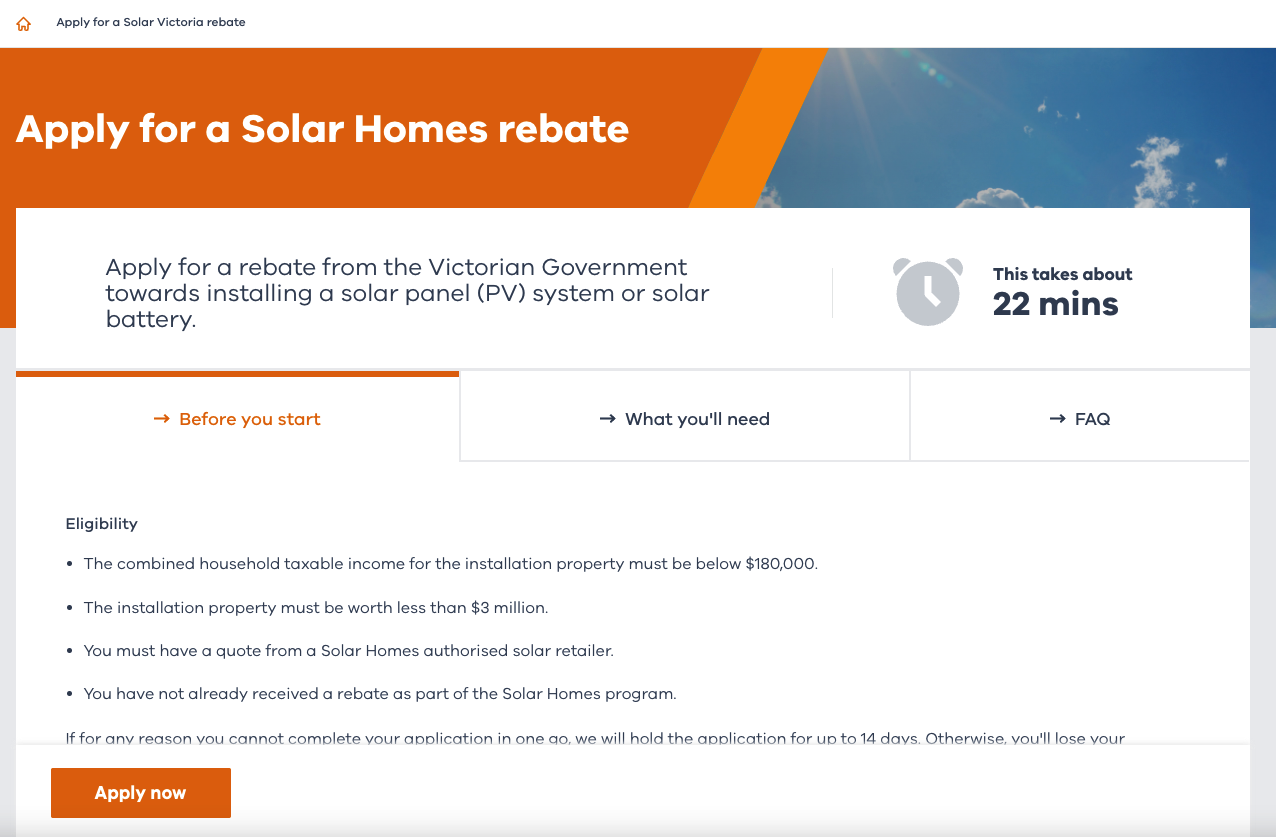

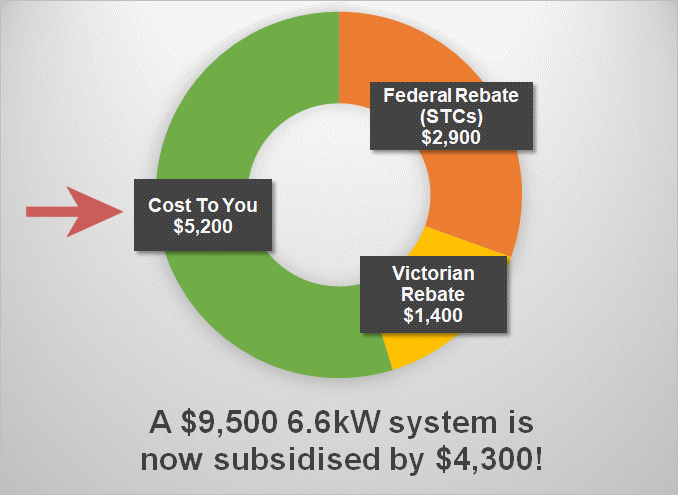

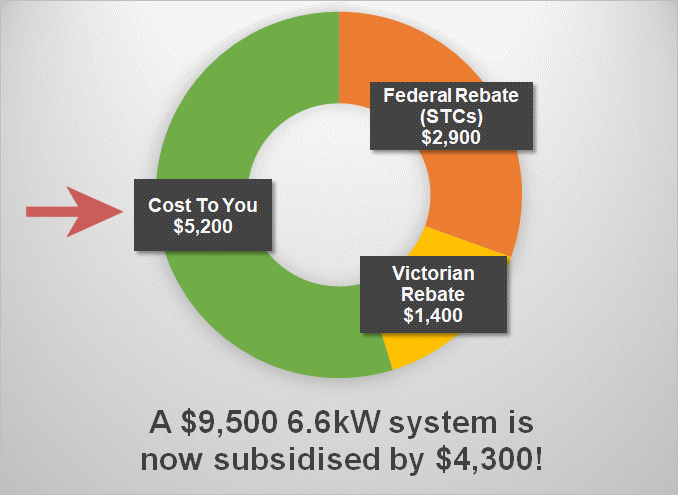

Solar Rebate Victoria 2022 Printable Rebate Form

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Benefits Of Government Solar Rebates Program Solarscanner au

Victorian Solar Rebate Explained SolarQuotes

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Benefits Of Government Solar Rebates Program Solarscanner au

Victorian Solar Rebate Explained SolarQuotes

Councilwoman Reynolds Brown Introduces Legislation To Establish A Solar

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

Solar Rebate NSW 2021 Your Guide To The NSW Solar Rebate Scheme