In this day and age of consuming we all love a good deal. One option to obtain significant savings on your purchases is to use Fuel Tax Rebate Eligibilitys. Fuel Tax Rebate Eligibilitys are a marketing strategy that retailers and manufacturers use to offer customers a reimbursement on their purchases following the time they've created them. In this post, we'll go deeper into the realm of Fuel Tax Rebate Eligibilitys. We will explore what they are and how they work and how you can make the most of your savings with these cost-effective incentives.

Get Latest Fuel Tax Rebate Eligibility Below

Fuel Tax Rebate Eligibility

Fuel Tax Rebate Eligibility - Fuel Tax Rebate Eligibility, Fuel Tax Credit Eligibility, Fuel Tax Credit Eligibility Tool, Fuel Tax Credit Eligibility Tool Ato, Fuel Tax Credit Eligible Vehicles, Fuel Tax Credit Eligible Activities, Fuel Tax Credit Rates Eligibility, Fuel Tax Credits Business Eligibility, What Is The Fuel Tax Rebate, How Much Is The Fuel Tax Rebate

Web 22 nov 2022 nbsp 0183 32 You can claim fuel tax credits for fuel you purchase manufacture or import for business use Work out if you are eligible for fuel tax credits with the ATO s Fuel tax

Web Eligibility To make a claim for fuel tax credits you must be registered for GST when you acquired the fuel fuel tax credits when you lodge the claim You can claim fuel tax

A Fuel Tax Rebate Eligibility, in its simplest form, is a partial payment to a consumer after they have purchased a product or service. It's an effective method that companies use to attract buyers, increase sales and promote specific products.

Types of Fuel Tax Rebate Eligibility

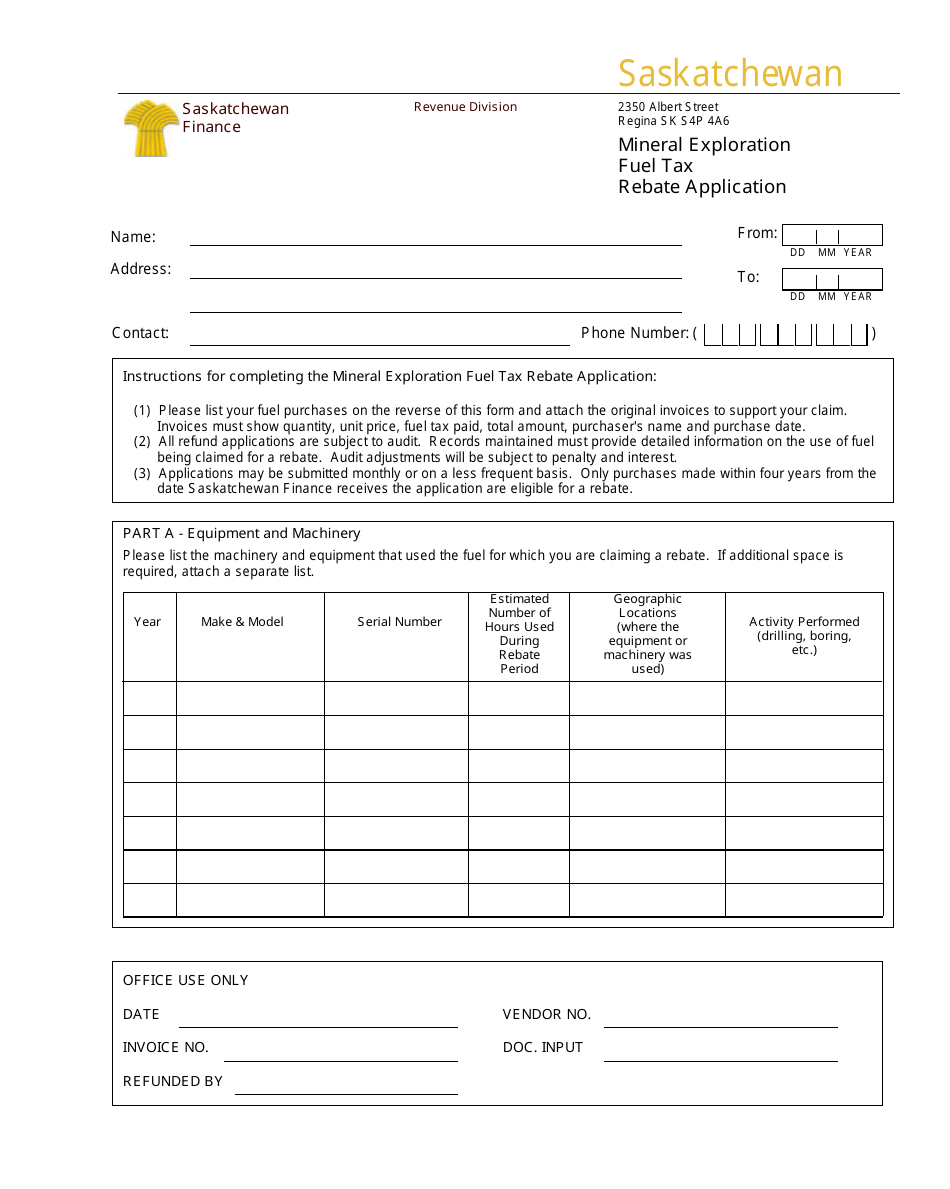

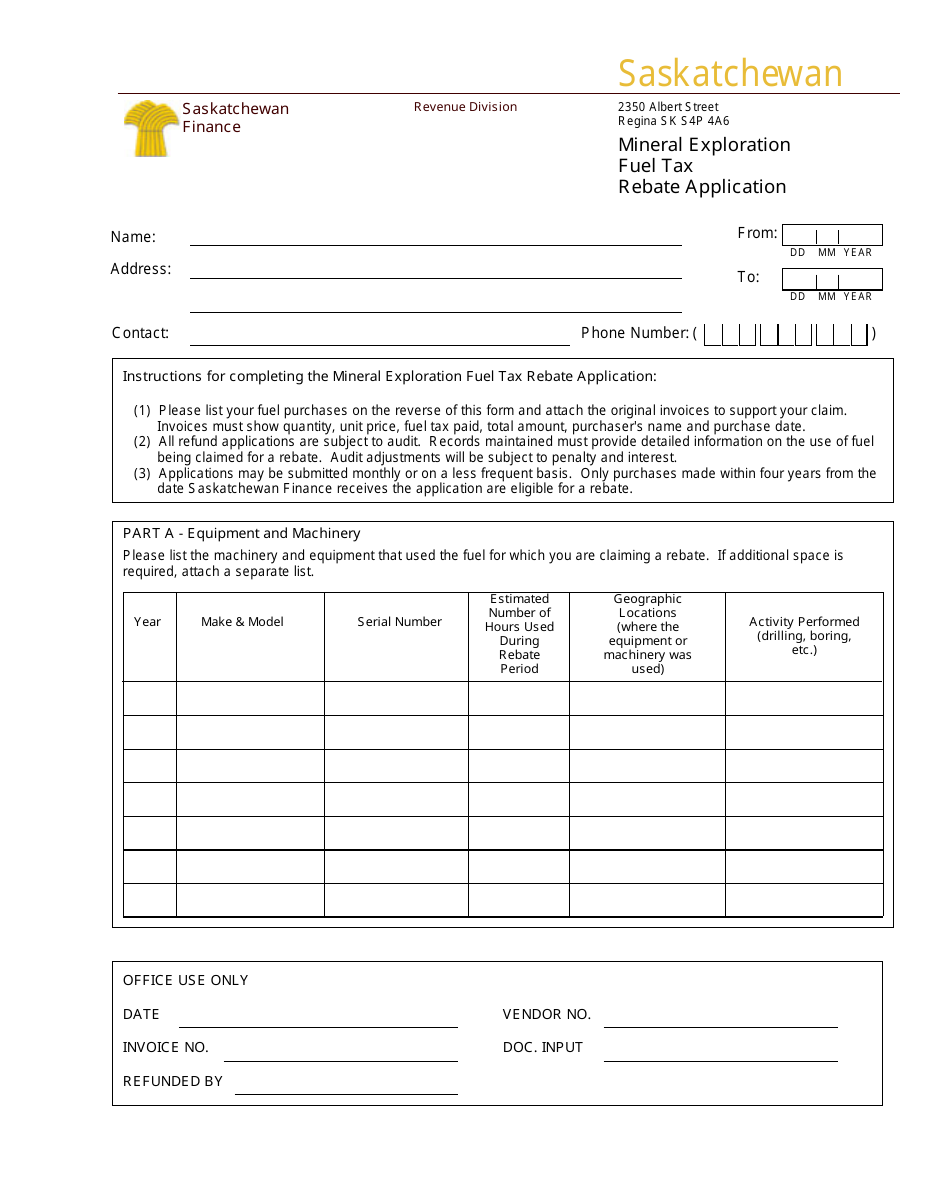

Saskatchewan Canada Mineral Exploration Fuel Tax Rebate Application

Saskatchewan Canada Mineral Exploration Fuel Tax Rebate Application

Web 7 mars 2023 nbsp 0183 32 Find out if you re eligible for fuel tax credits and how to make a claim 1 Check if you re eligible for fuel tax credits Businesses can claim credits for the fuel tax

Web Am I eligible for the Fuel Tax Credit Yes owner operator servicing is acceptable under Criterion 4 provided the maintenance requirements are met and you keep the relevant

Cash Fuel Tax Rebate Eligibility

Cash Fuel Tax Rebate Eligibility are probably the most simple kind of Fuel Tax Rebate Eligibility. Customers are given a certain amount back in cash after purchasing a product. These are usually used for expensive items such as electronics or appliances.

Mail-In Fuel Tax Rebate Eligibility

Mail-in Fuel Tax Rebate Eligibility need customers to provide proof of purchase to receive their money back. They're more involved, however they can yield significant savings.

Instant Fuel Tax Rebate Eligibility

Instant Fuel Tax Rebate Eligibility can be applied at the moment of sale, cutting your purchase cost instantly. Customers don't need to wait for their savings by using this method.

How Fuel Tax Rebate Eligibility Work

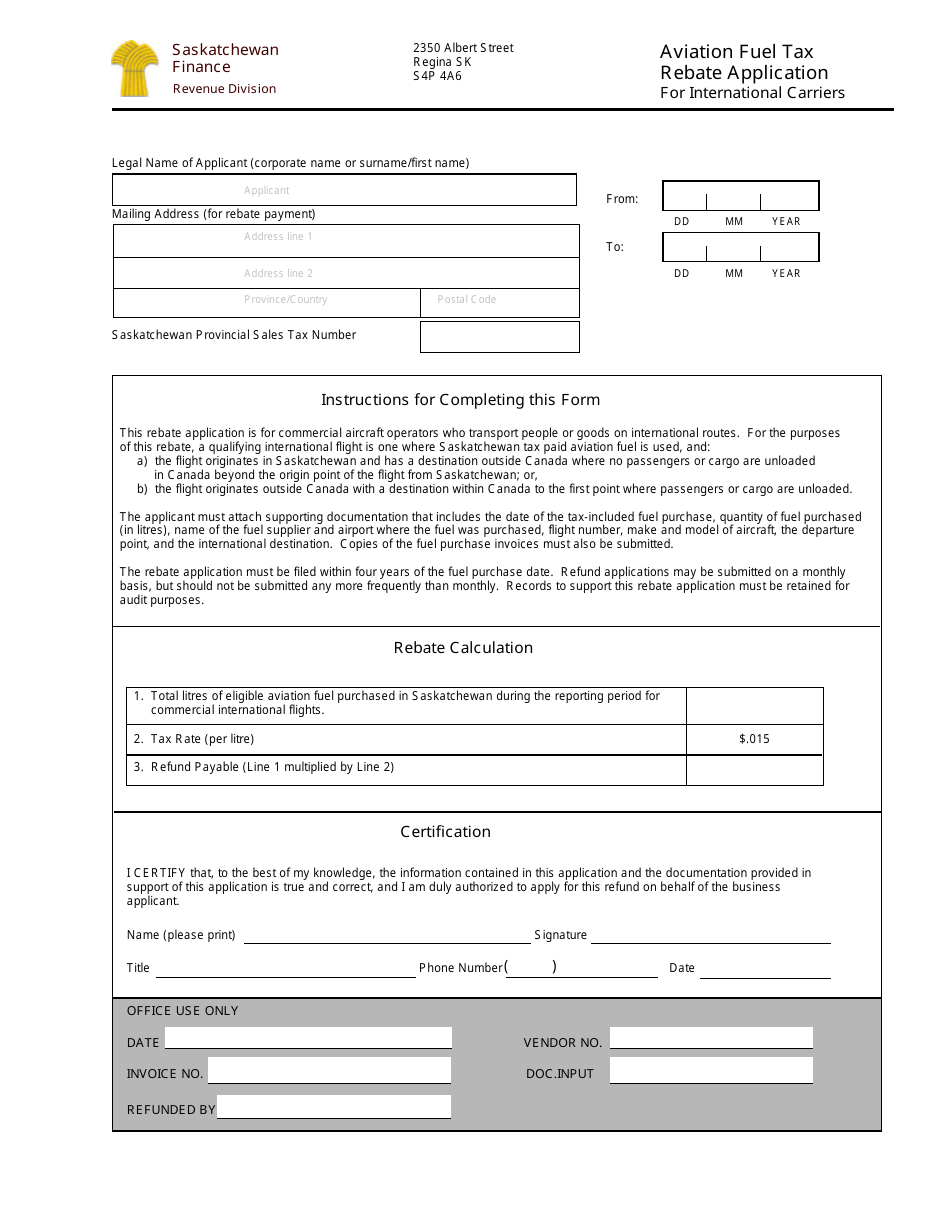

Saskatchewan Canada Aviation Fuel Tax Rebate Application For

Saskatchewan Canada Aviation Fuel Tax Rebate Application For

Web Fuel tax credits do not apply to the following Fuels used in light vehicles travelling on public roads GVM of 4 5 tonnes or less Fuels used in pre 1996 heavy vehicles that do not

The Fuel Tax Rebate Eligibility Process

The procedure typically consists of a few steps:

-

Purchase the item: First you purchase the product like you normally do.

-

Fill in your Fuel Tax Rebate Eligibility template: You'll have to give some specific information like your address, name, and information about the purchase in order to be eligible for a Fuel Tax Rebate Eligibility.

-

Make sure you submit the Fuel Tax Rebate Eligibility The Fuel Tax Rebate Eligibility must be submitted in accordance with the nature of Fuel Tax Rebate Eligibility you may have to send in a form, or send it via the internet.

-

Wait for the company's approval: They will look over your submission and ensure that it's compliant with rules and regulations of the Fuel Tax Rebate Eligibility.

-

Redeem your Fuel Tax Rebate Eligibility When it's approved you'll receive your cash back in the form of a check, prepaid card, or through another method specified by the offer.

Pros and Cons of Fuel Tax Rebate Eligibility

Advantages

-

Cost savings Rewards can drastically lower the cost you pay for an item.

-

Promotional Offers The aim is to encourage customers to experiment with new products, or brands.

-

boost sales Reward programs can boost a company's sales and market share.

Disadvantages

-

Complexity: Mail-in Fuel Tax Rebate Eligibility, in particular difficult and tedious.

-

Time Limits for Fuel Tax Rebate Eligibility A lot of Fuel Tax Rebate Eligibility have certain deadlines for submitting.

-

Risk of Not Being Paid: Some customers may not receive their refunds if they don't comply with the rules exactly.

Download Fuel Tax Rebate Eligibility

[su_button url="https://printablerebateform.net/?s=Fuel Tax Rebate Eligibility" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Fuel Tax Rebate Eligibility[/su_button]

FAQs

1. Are Fuel Tax Rebate Eligibility similar to discounts? No, Fuel Tax Rebate Eligibility offer only a partial reimbursement following the purchase, whereas discounts reduce your purchase cost at point of sale.

2. Are there multiple Fuel Tax Rebate Eligibility I can get on the same item? It depends on the conditions for the Fuel Tax Rebate Eligibility incentives and the specific product's suitability. Some companies may allow it, and some don't.

3. What is the time frame to get the Fuel Tax Rebate Eligibility? The length of time can vary, but typically it will range from several weeks to few months to receive your Fuel Tax Rebate Eligibility.

4. Do I have to pay taxes with respect to Fuel Tax Rebate Eligibility montants? most circumstances, Fuel Tax Rebate Eligibility amounts are not considered to be taxable income.

5. Do I have confidence in Fuel Tax Rebate Eligibility offers from lesser-known brands It's crucial to research to ensure that the name which is providing the Fuel Tax Rebate Eligibility is legitimate prior to making the purchase.

Fuel Tax Credit Atotaxrates info

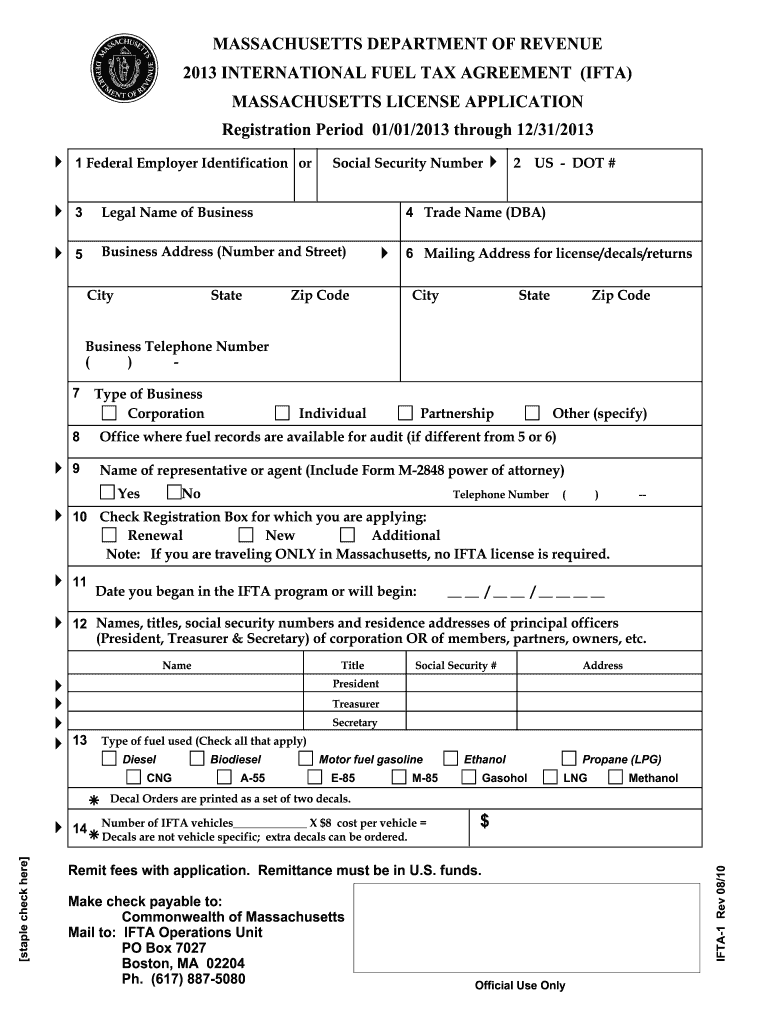

International Fuels Tax Agreement For Motor Carriers IFTA Fill Out

Check more sample of Fuel Tax Rebate Eligibility below

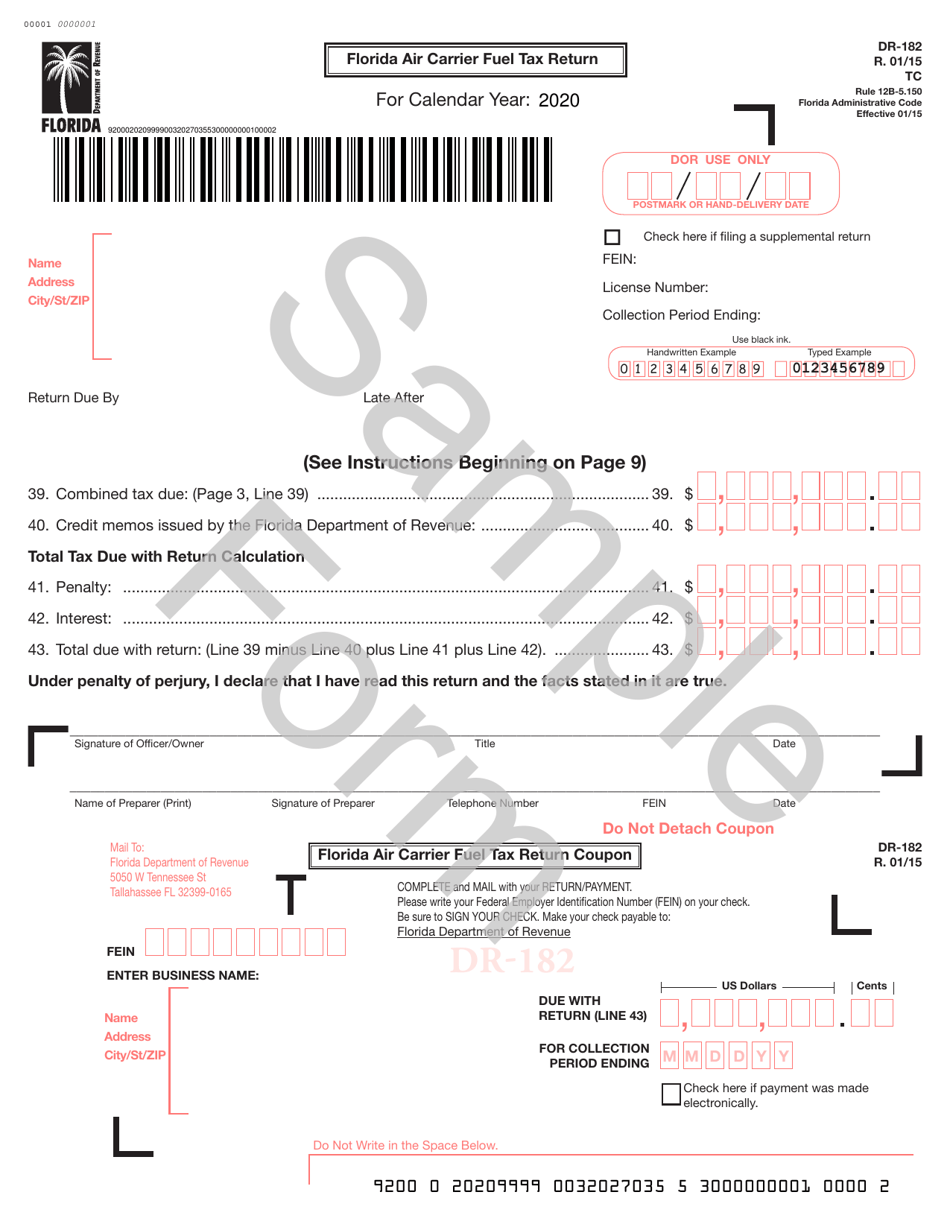

Form Dr 182 Download Printable Pdf Or Fill Online Florida Air Carrier

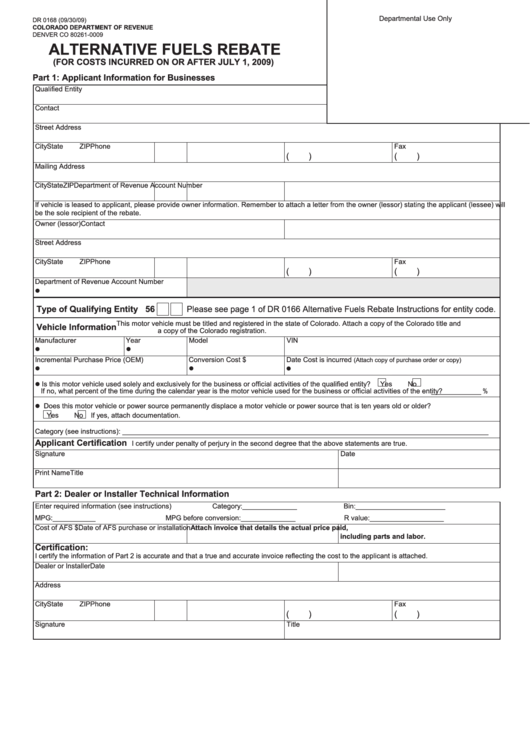

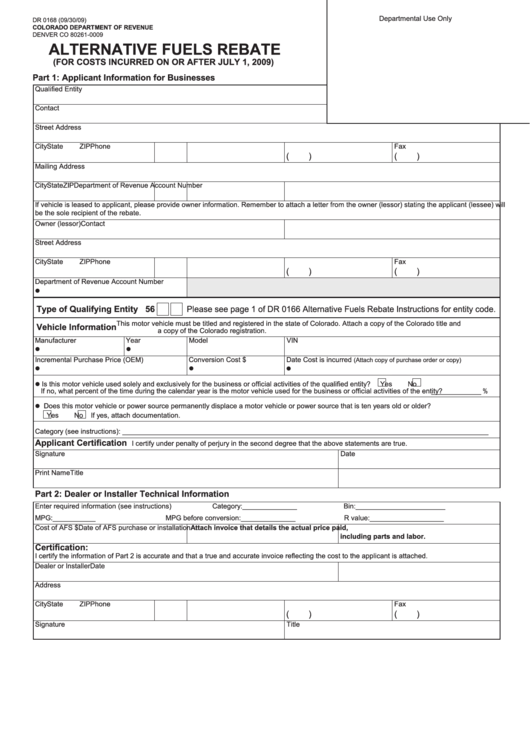

Form Dr 0168 Alternative Fuels Rebate 2009 Printable Pdf Download

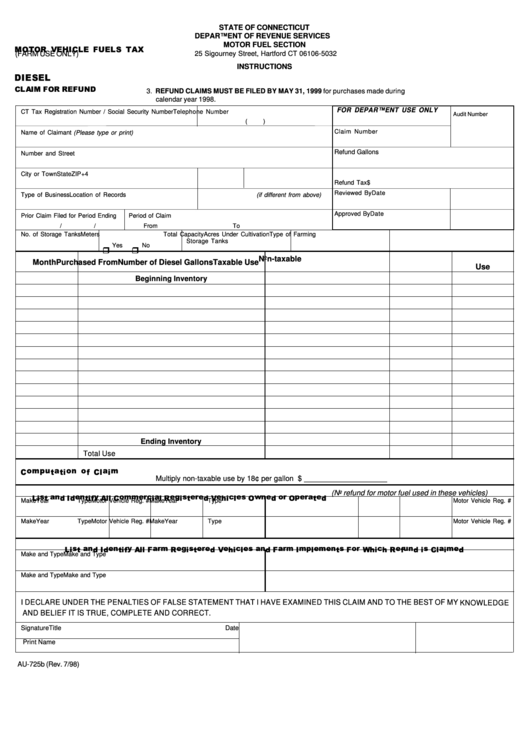

Fillable Form Au 725b Motor Vehicle Fuels Tax Farm Use Only

Fuel Tax Disability Application Form

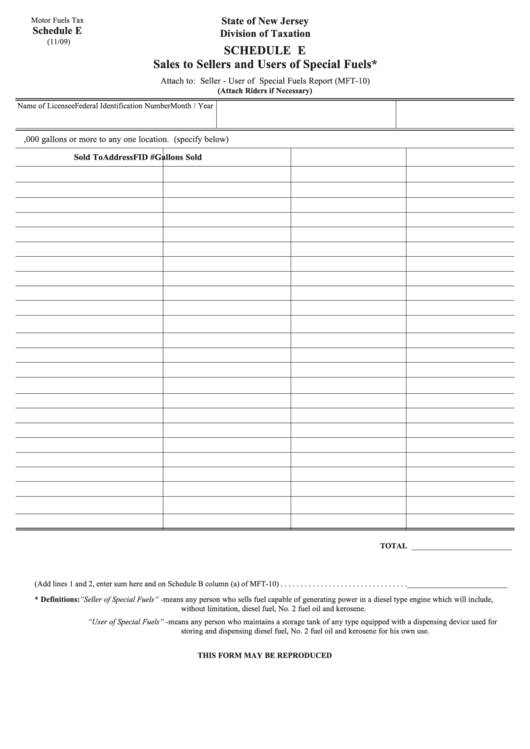

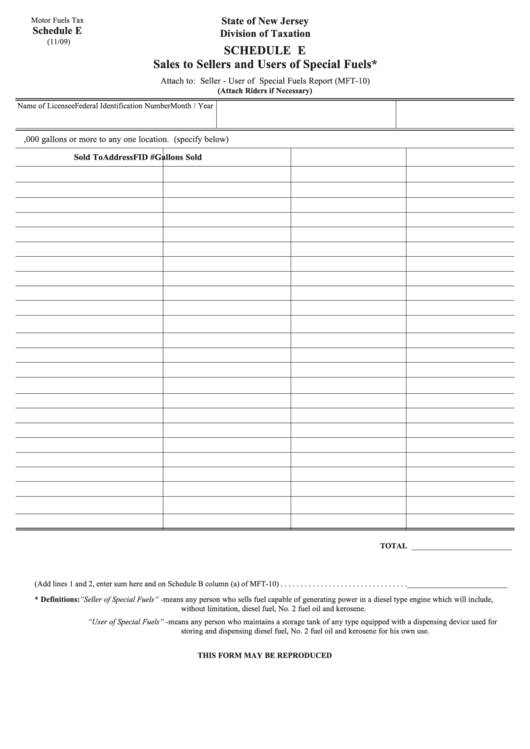

Fillable Motor Fuels Tax Schedule E Sales To Sellers And Users Of

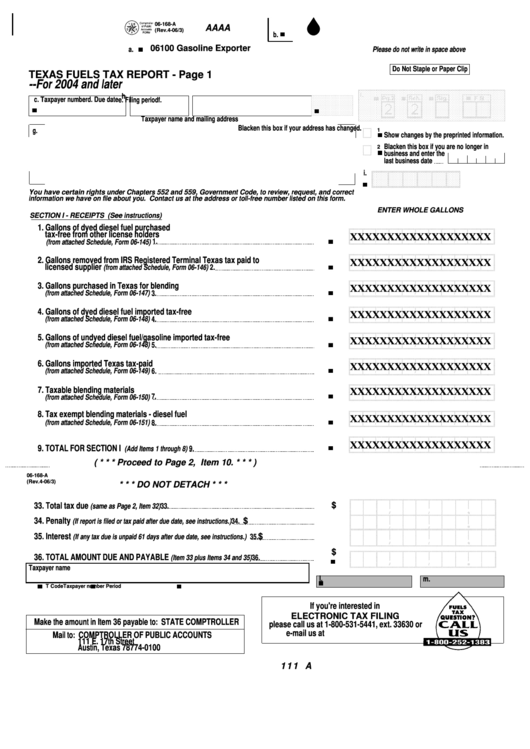

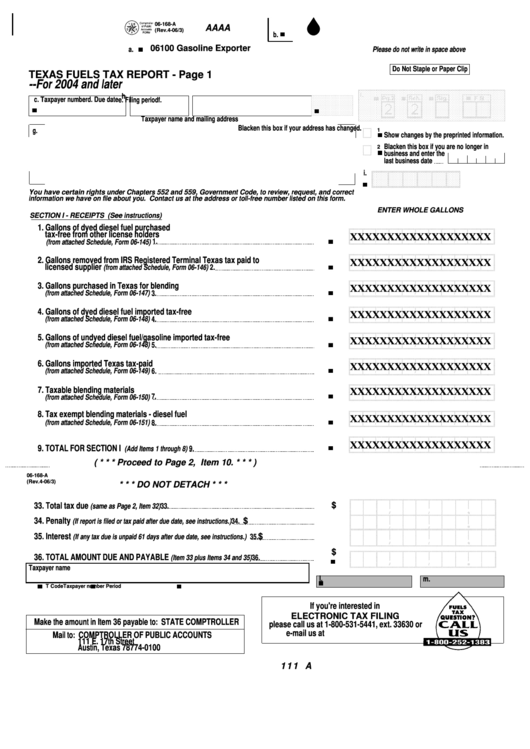

Fillable Form 06 168 Texas Fuels Tax Report 2004 Printable Pdf Download

https://www.ato.gov.au/.../Fuel-tax-credits---business/Eligibility

Web Eligibility To make a claim for fuel tax credits you must be registered for GST when you acquired the fuel fuel tax credits when you lodge the claim You can claim fuel tax

https://www.ato.gov.au/Calculators-and-tools/Fuel-tax-credit-tools

Web The following tools will help you check if you re eligible for fuel tax credits and work out the amount of fuel tax credits you can claim Eligibility tool check if you can claim fuel

Web Eligibility To make a claim for fuel tax credits you must be registered for GST when you acquired the fuel fuel tax credits when you lodge the claim You can claim fuel tax

Web The following tools will help you check if you re eligible for fuel tax credits and work out the amount of fuel tax credits you can claim Eligibility tool check if you can claim fuel

Fuel Tax Disability Application Form

Form Dr 0168 Alternative Fuels Rebate 2009 Printable Pdf Download

Fillable Motor Fuels Tax Schedule E Sales To Sellers And Users Of

Fillable Form 06 168 Texas Fuels Tax Report 2004 Printable Pdf Download

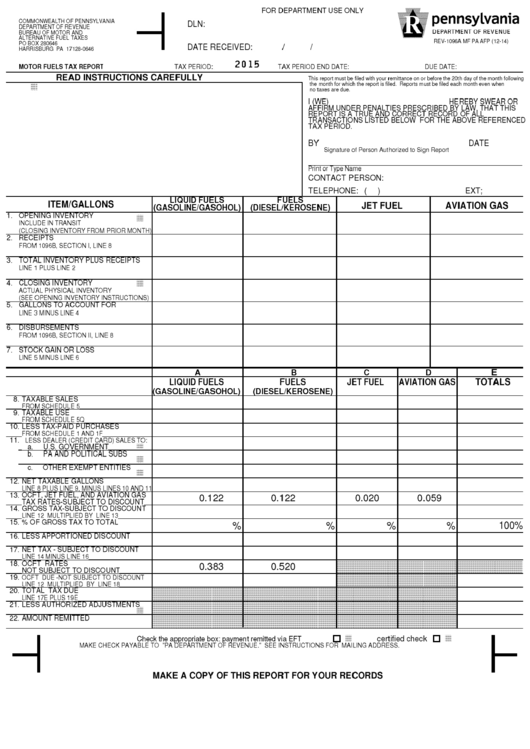

Top 6 Pennsylvania Form Rev 1096a Templates Free To Download In PDF Format

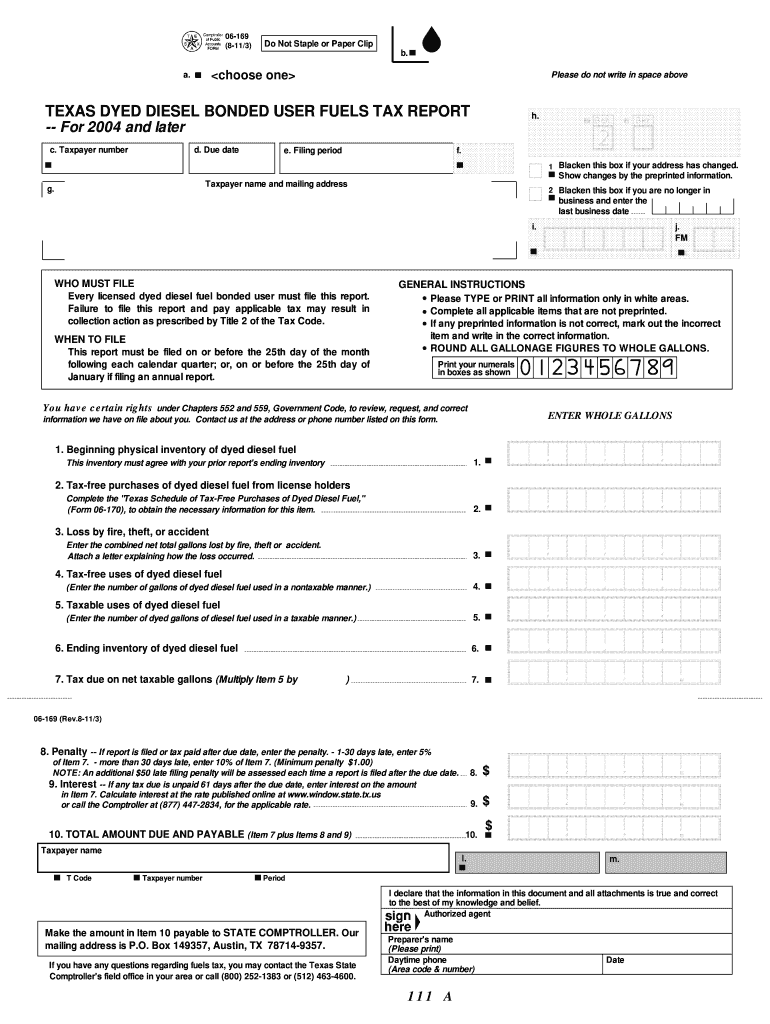

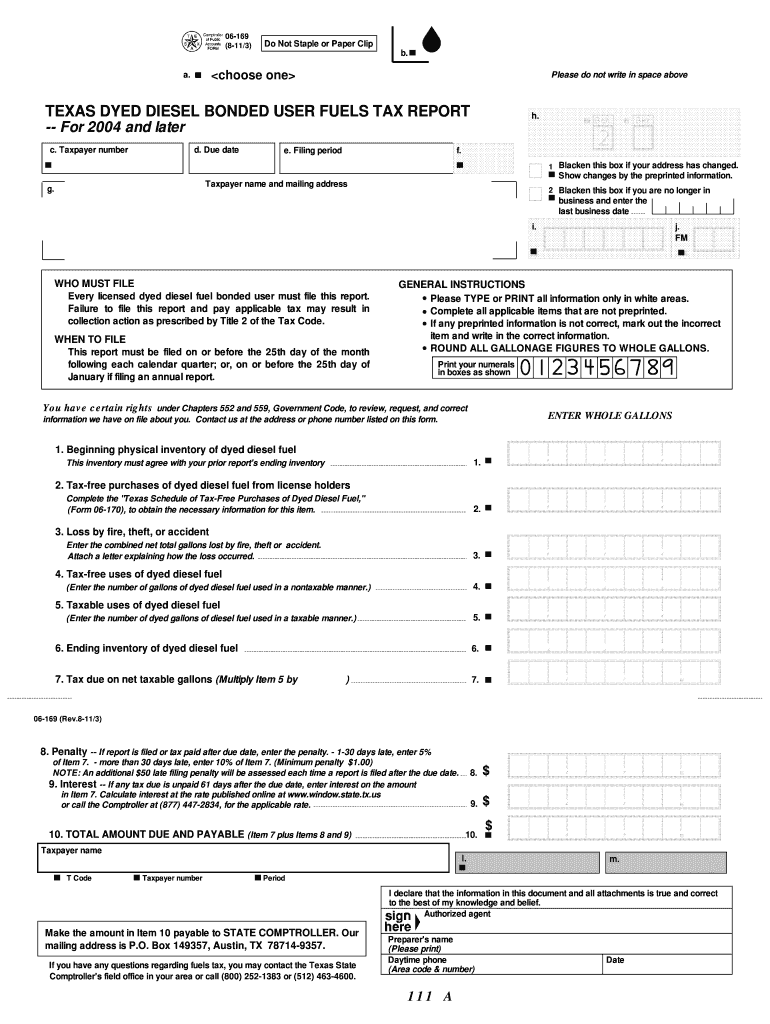

06 169 Fill Out Sign Online DocHub

06 169 Fill Out Sign Online DocHub

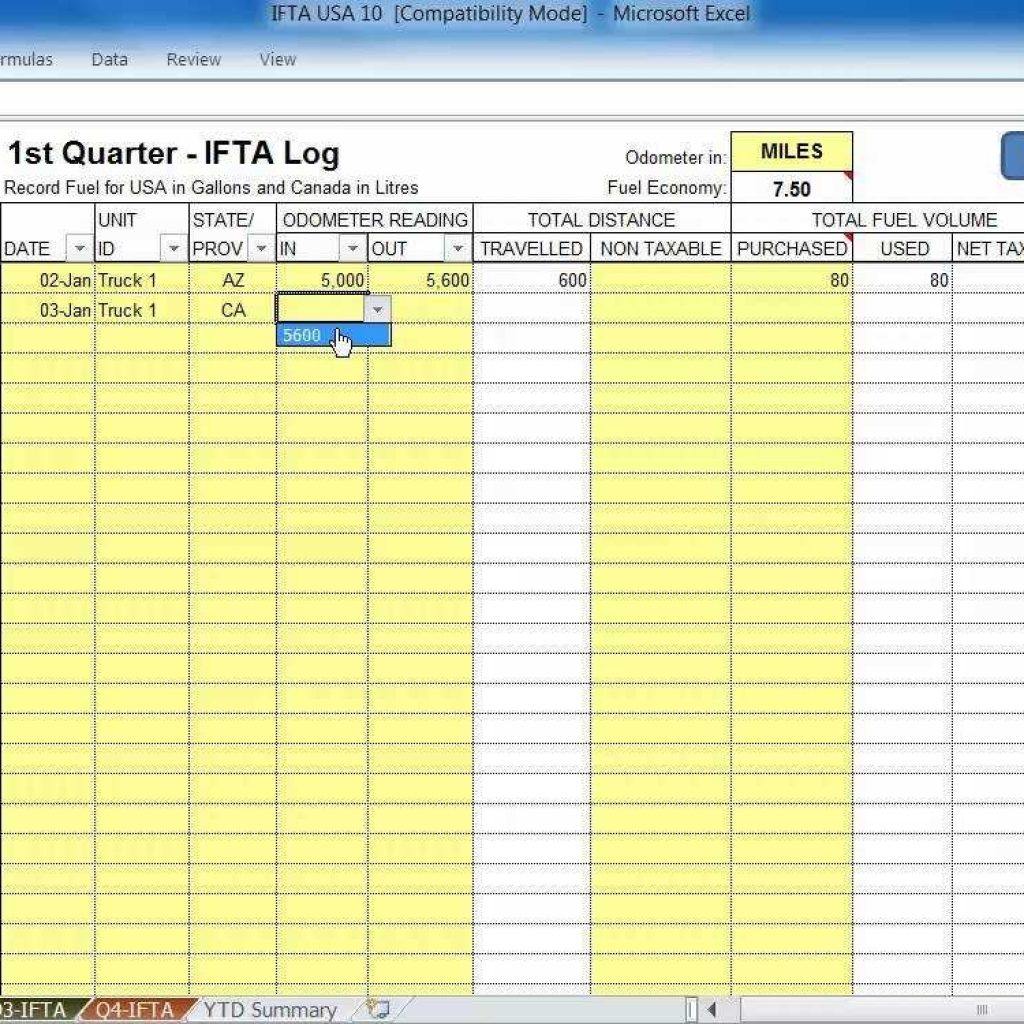

Ifta Fuel Tax Spreadsheet Db excel