In the modern world of consumerization people love a good bargain. One way to earn substantial savings on your purchases is through Fuel Tax Credit Eligible Activitiess. Fuel Tax Credit Eligible Activitiess are a method of marketing used by manufacturers and retailers for offering customers a percentage cash back on their purchases once they have created them. In this article, we will investigate the world of Fuel Tax Credit Eligible Activitiess. We will explore what they are as well as how they work and the best way to increase your savings using these low-cost incentives.

Get Latest Fuel Tax Credit Eligible Activities Below

Fuel Tax Credit Eligible Activities

Fuel Tax Credit Eligible Activities -

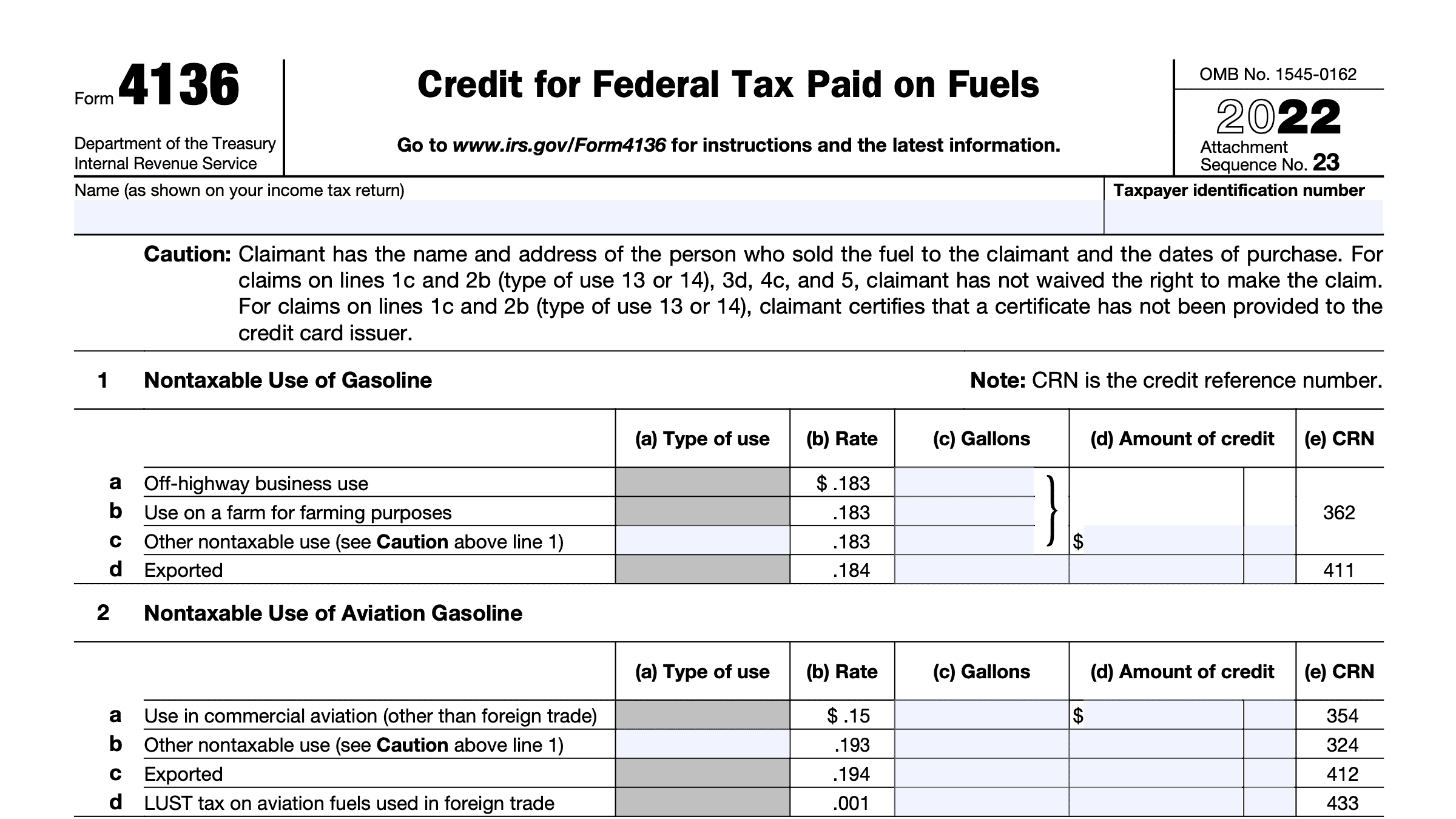

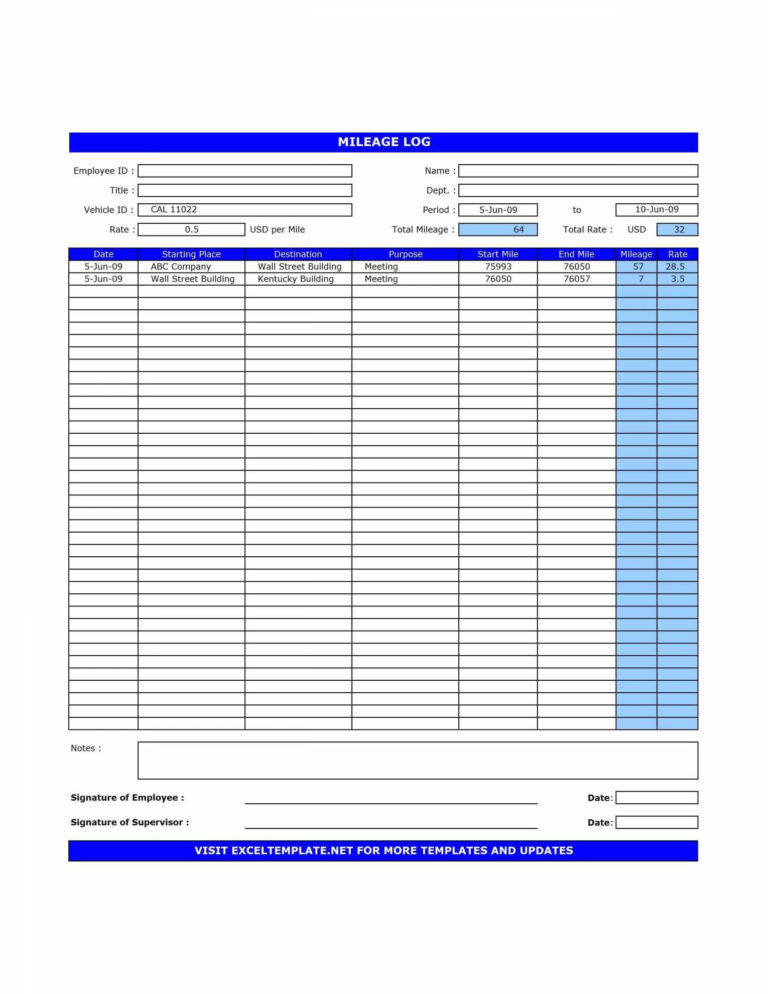

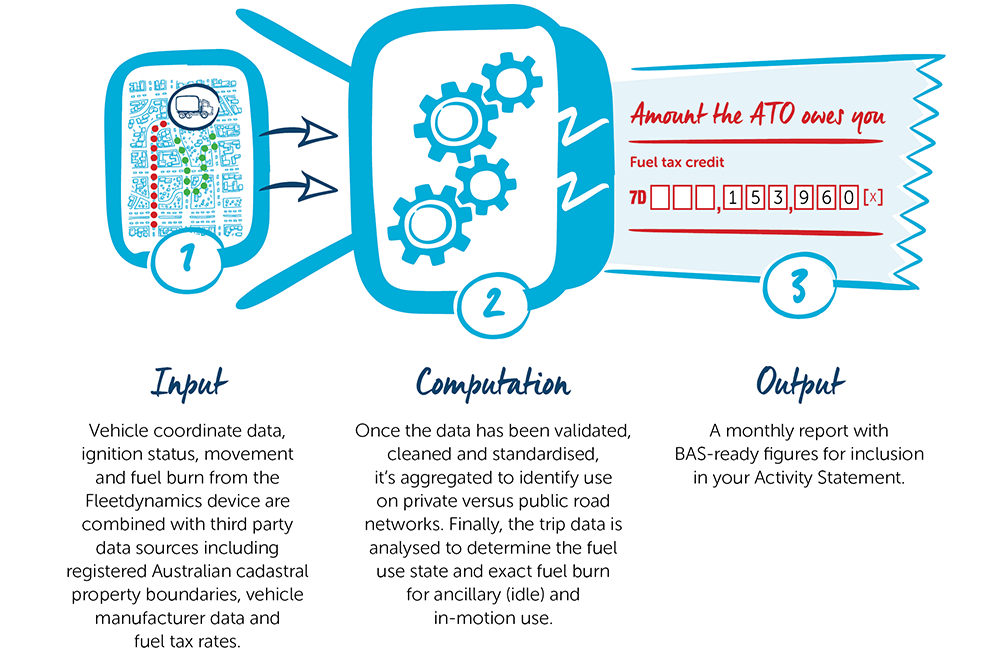

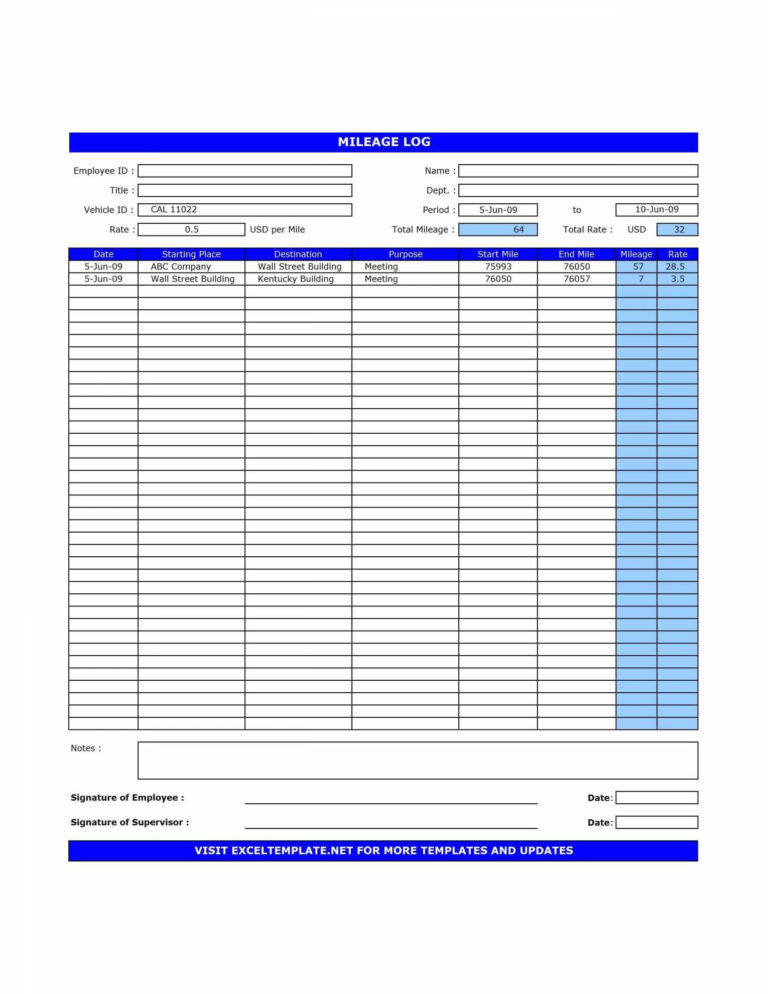

Step 1 Work out the eligible quantity Step 2 Check which rate applies for the fuel Step 3 Work out the amount Before claiming fuel tax credits on your Business activity statement BAS you need to work out your credits and determine what records you need to keep The amount you can claim depends on when you acquired the fuel

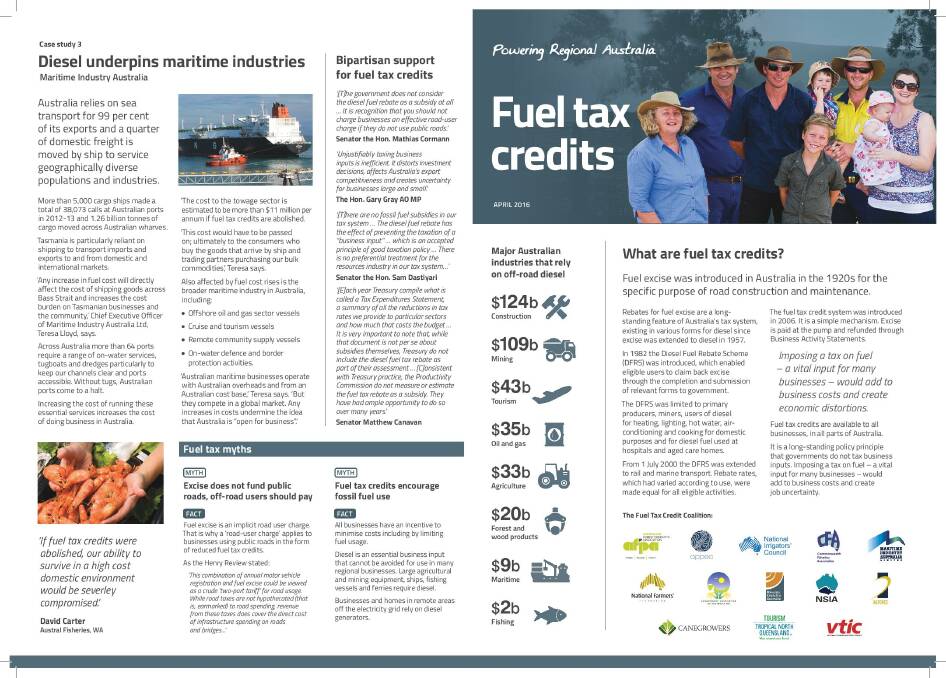

Fuels eligible for fuel tax credits To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to check if your fuel and activities are eligible See when you can claim fuel tax credits for liquid fuels and gaseous

A Fuel Tax Credit Eligible Activities as it is understood in its simplest format, is a payment to a consumer after they have purchased a product or service. It's a highly effective tool employed by companies to draw customers, increase sales and advertise specific products.

Types of Fuel Tax Credit Eligible Activities

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

This includes fuel used in business activities such as machinery plant equipment heavy vehicles light vehicles travelling off public roads or on private roads Tax credits are available based on the fuel tax credit rate when you bought the fuel the business activities you are using the fuel for Check if you can apply

The fuel tax credit is claimed through the ATO by submitting your Business Activity Statement BAS Eligibility to claim fuel tax credits In order to be eligible to claim fuel tax credits individuals and businesses have to meet specific criteria set by the ATO

Cash Fuel Tax Credit Eligible Activities

Cash Fuel Tax Credit Eligible Activities are the most basic type of Fuel Tax Credit Eligible Activities. Customers get a set amount of money back upon purchasing a particular item. This is often for products that are expensive, such as electronics or appliances.

Mail-In Fuel Tax Credit Eligible Activities

Mail-in Fuel Tax Credit Eligible Activities require that customers send in proof of purchase to receive the money. They're a little more involved, but offer significant savings.

Instant Fuel Tax Credit Eligible Activities

Instant Fuel Tax Credit Eligible Activities are applied right at the point of sale, reducing the price instantly. Customers don't need to wait for their savings in this manner.

How Fuel Tax Credit Eligible Activities Work

Fuel Tax Credit Calculator Banlaw

Fuel Tax Credit Calculator Banlaw

On this page How to register for fuel tax credits How to cancel your registration for fuel tax credits You can claim credits for the fuel tax excise or customs duty included in the price of fuel you use in your business activities Some fuels and activities are not eligible for fuel tax credits including

The Fuel Tax Credit Eligible Activities Process

The procedure usually involves a number of easy steps:

-

You purchase the item: First then, you buy the item just like you normally would.

-

Complete this Fuel Tax Credit Eligible Activities template: You'll need to supply some details, such as your address, name, and details about your purchase, in order in order to take advantage of your Fuel Tax Credit Eligible Activities.

-

Submit the Fuel Tax Credit Eligible Activities Based on the nature of Fuel Tax Credit Eligible Activities it is possible that you need to submit a form by mail or upload it online.

-

Wait for the company's approval: They will go through your application to ensure it meets the Fuel Tax Credit Eligible Activities's terms and conditions.

-

Redeem your Fuel Tax Credit Eligible Activities Once it's approved, the amount you receive will be through a check, or a prepaid card, or other procedure specified by the deal.

Pros and Cons of Fuel Tax Credit Eligible Activities

Advantages

-

Cost savings Rewards can drastically lower the cost you pay for the item.

-

Promotional Offers: They encourage customers to try new products and brands.

-

Help to Increase Sales Reward programs can boost the company's sales as well as market share.

Disadvantages

-

Complexity Pay-in Fuel Tax Credit Eligible Activities via mail, in particular difficult and demanding.

-

Day of Expiration Many Fuel Tax Credit Eligible Activities have strict time limits for submission.

-

A risk of not being paid: Some customers may not receive their refunds if they do not follow the rules precisely.

Download Fuel Tax Credit Eligible Activities

[su_button url="https://printablerebateform.net/?s=Fuel Tax Credit Eligible Activities" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Fuel Tax Credit Eligible Activities[/su_button]

FAQs

1. Are Fuel Tax Credit Eligible Activities the same as discounts? No, Fuel Tax Credit Eligible Activities involve partial reimbursement after purchase, whereas discounts reduce their price at time of sale.

2. Can I make use of multiple Fuel Tax Credit Eligible Activities on the same item? It depends on the conditions and conditions of Fuel Tax Credit Eligible Activities offers and the product's eligibility. Some companies may allow it, but some will not.

3. How long will it take to receive an Fuel Tax Credit Eligible Activities What is the timeframe? differs, but could be anywhere from a few weeks up to a couple of months for you to receive your Fuel Tax Credit Eligible Activities.

4. Do I need to pay tax of Fuel Tax Credit Eligible Activities values? the majority of situations, Fuel Tax Credit Eligible Activities amounts are not considered taxable income.

5. Can I trust Fuel Tax Credit Eligible Activities offers from brands that aren't well-known it is crucial to conduct research and confirm that the company providing the Fuel Tax Credit Eligible Activities is reputable prior to making an acquisition.

IRS Form 4136 A Guide To Federal Taxes Paid On Fuels

Fuel Tax Credit Rates Have Increased Business Wise

Check more sample of Fuel Tax Credit Eligible Activities below

Fuel Tax Credit UPDATED JUNE 2022

Ifta Fuel Tax Spreadsheet For Tax Worksheet Excel New Fuel Tax

FUEL TAX CREDIT RATE INCREASE FROM 5 FEBRUARY 2018 Stubbs Wallace

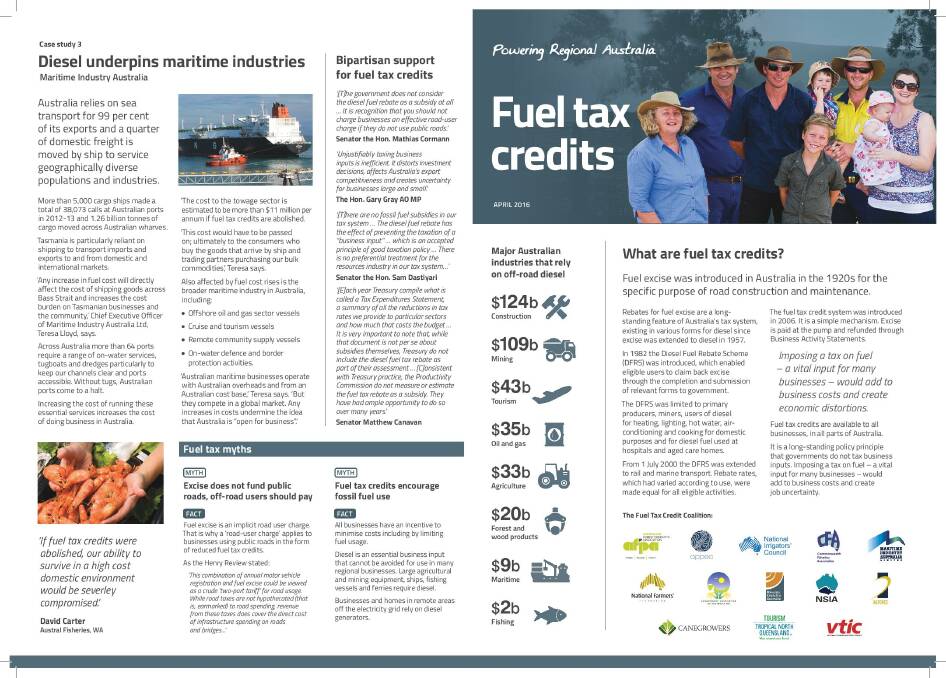

Productive Industries Forced To Again Defend Diesel Fuel Credits

Fuel Tax Credits CIB Accountants Advisers

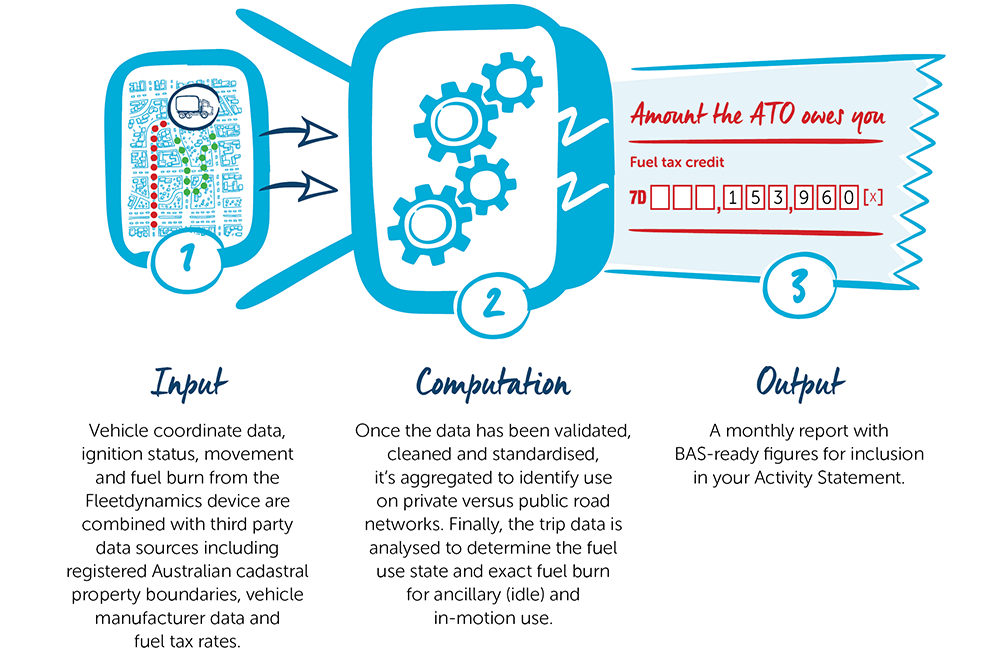

Fuel Tax Credit Computation Telematics Fleetcare

https://www. ato.gov.au /.../eligibility/eligible-fuels

Fuels eligible for fuel tax credits To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to check if your fuel and activities are eligible See when you can claim fuel tax credits for liquid fuels and gaseous

https://www. ato.gov.au /businesses-and...

Work out your eligibility for fuel tax credits See also Eligible fuels Eligible activities Ineligible fuels and activities You can claim fuel tax credits for eligible fuel you acquire and use in your business activities Some fuels and activities are not eligible for fuel tax credits

Fuels eligible for fuel tax credits To be eligible for claiming fuel tax credits a fuel must be taxable That is fuel tax excise or customs duty must be paid on it You can use our Fuel tax credit eligibility tool to check if your fuel and activities are eligible See when you can claim fuel tax credits for liquid fuels and gaseous

Work out your eligibility for fuel tax credits See also Eligible fuels Eligible activities Ineligible fuels and activities You can claim fuel tax credits for eligible fuel you acquire and use in your business activities Some fuels and activities are not eligible for fuel tax credits

Productive Industries Forced To Again Defend Diesel Fuel Credits

Ifta Fuel Tax Spreadsheet For Tax Worksheet Excel New Fuel Tax

Fuel Tax Credits CIB Accountants Advisers

Fuel Tax Credit Computation Telematics Fleetcare

Funding Archives Factory Media Centre

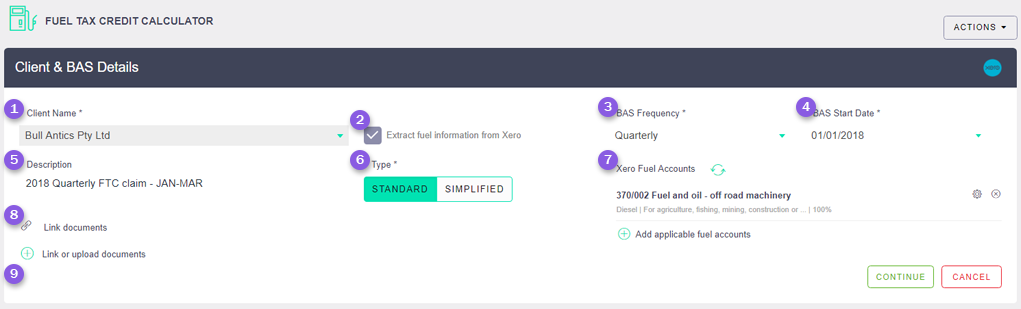

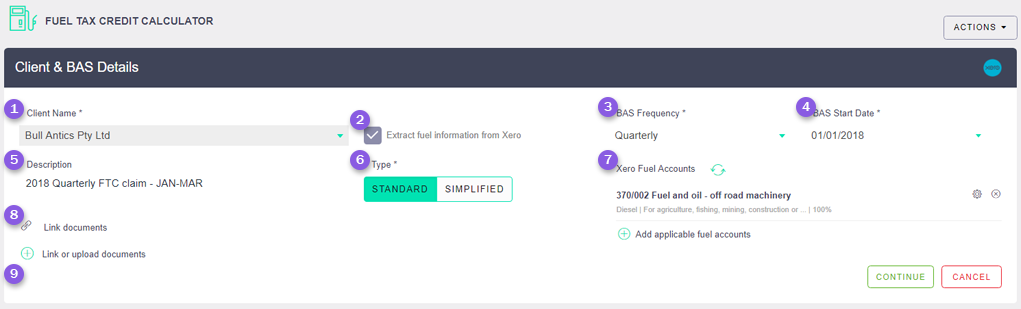

Fuel Tax Credit Calculator AccountKit Support Center

Fuel Tax Credit Calculator AccountKit Support Center

Are You Planning To Take Advantage Of The IRS s Employer Tax Credit For