Today, in a world that is driven by the consumer, everyone loves a good bargain. One method to get significant savings in your purchase is through Energy Tax Credit Forms. Energy Tax Credit Forms are marketing strategies that retailers and manufacturers use for offering customers a percentage reimbursement on their purchases following the time they have created them. In this post, we'll delve into the world of Energy Tax Credit Forms, examining what they are as well as how they work and how you can maximize your savings through these cost-effective incentives.

Get Latest Energy Tax Credit Form Below

Energy Tax Credit Form

Energy Tax Credit Form -

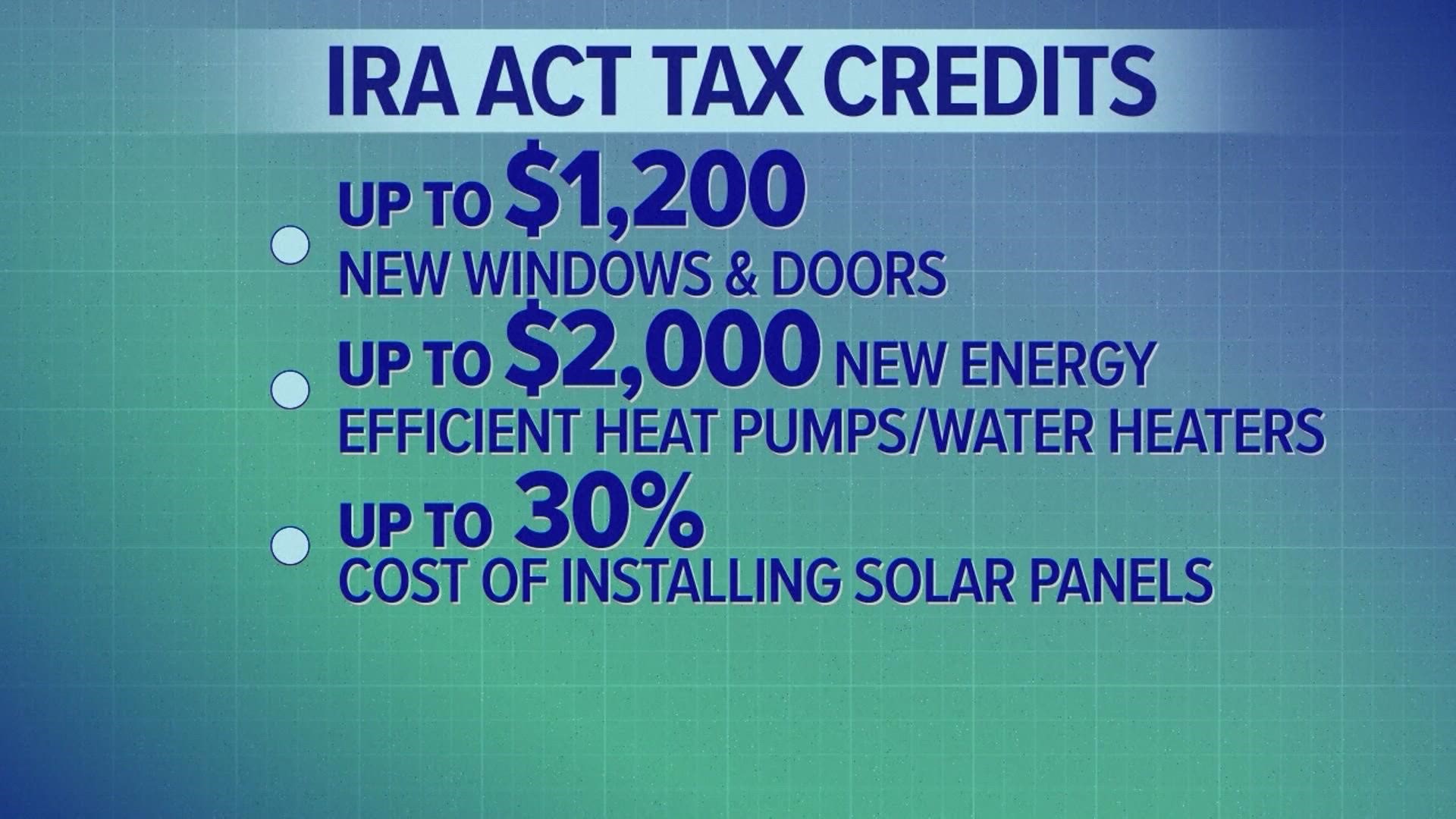

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax

A Energy Tax Credit Form in its most basic format, is a reimbursement to a buyer who has purchased a particular product or service. It's a very effective technique used by companies to attract customers, boost sales, and also to advertise certain products.

Types of Energy Tax Credit Form

Filing For The Solar Tax Credit Wells Solar

Filing For The Solar Tax Credit Wells Solar

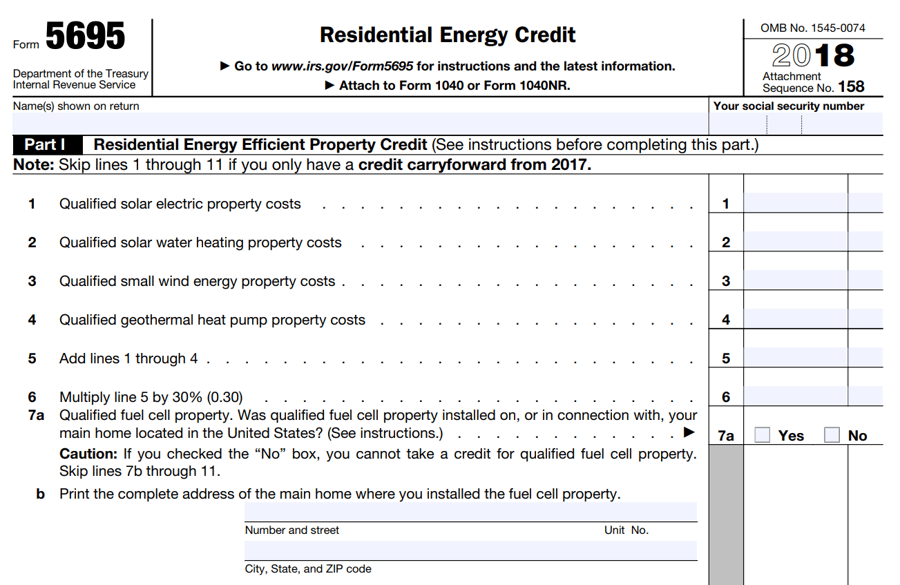

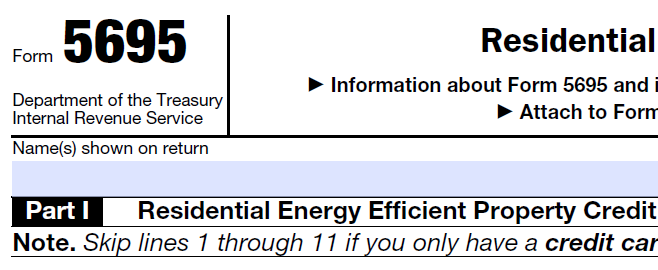

Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant

The residential energy credit is limited by your tax liability and can be carried forward to future tax years if your eligible home improvement costs exceed your

Cash Energy Tax Credit Form

Cash Energy Tax Credit Form can be the simplest kind of Energy Tax Credit Form. Customers receive a certain amount of money after buying a product. These are often used for the most expensive products like electronics or appliances.

Mail-In Energy Tax Credit Form

Mail-in Energy Tax Credit Form require customers to submit proof of purchase in order to receive the money. They're somewhat more involved but offer substantial savings.

Instant Energy Tax Credit Form

Instant Energy Tax Credit Form are applied at the point of sale, reducing prices immediately. Customers don't need to wait for their savings by using this method.

How Energy Tax Credit Form Work

What Is A Tax Credit Tax Credits Explained

What Is A Tax Credit Tax Credits Explained

Claiming tax credits for solar panels Installing solar panels on your home likely qualifies you for the residential clean energy credit from the federal government

The Energy Tax Credit Form Process

The procedure typically consists of a few steps:

-

Purchase the item: First make sure you purchase the product in the same way you would normally.

-

Fill in the Energy Tax Credit Form forms: The Energy Tax Credit Form form will need to fill in some information, such as your name, address along with the purchase details, to claim your Energy Tax Credit Form.

-

You must submit the Energy Tax Credit Form Based on the nature of Energy Tax Credit Form you will need to either mail in a request form or make it available online.

-

Wait until the company approves: The company is going to review your entry and ensure that it's compliant with Energy Tax Credit Form's terms and conditions.

-

Pay your Energy Tax Credit Form After approval, you'll receive a refund either by check, prepaid card, or another option specified by the offer.

Pros and Cons of Energy Tax Credit Form

Advantages

-

Cost Savings The use of Energy Tax Credit Form can greatly decrease the price for products.

-

Promotional Offers They encourage customers in trying new products or brands.

-

Enhance Sales Energy Tax Credit Form can enhance the company's sales as well as market share.

Disadvantages

-

Complexity mail-in Energy Tax Credit Form in particular could be cumbersome and slow-going.

-

Days of expiration Many Energy Tax Credit Form are subject to rigid deadlines to submit.

-

Risk of Not Being Paid Customers may miss out on Energy Tax Credit Form because they don't comply with the rules precisely.

Download Energy Tax Credit Form

[su_button url="https://printablerebateform.net/?s=Energy Tax Credit Form" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Energy Tax Credit Form[/su_button]

FAQs

1. Are Energy Tax Credit Form similar to discounts? Not at all, Energy Tax Credit Form provide a partial refund upon purchase, whereas discounts decrease costs at moment of sale.

2. Can I use multiple Energy Tax Credit Form on the same item It is contingent on the conditions that apply to the Energy Tax Credit Form provides and the particular product's quality and eligibility. Certain companies allow this, whereas others will not.

3. How long will it take to receive an Energy Tax Credit Form? The time frame varies, but it can take a couple of weeks or a couple of months before you get your Energy Tax Credit Form.

4. Do I need to pay tax on Energy Tax Credit Form amounts? In the majority of situations, Energy Tax Credit Form amounts are not considered taxable income.

5. Should I be able to trust Energy Tax Credit Form deals from lesser-known brands it is crucial to conduct research to ensure that the name giving the Energy Tax Credit Form is legitimate prior to making a purchase.

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Energy Tax Credits Armanino

Check more sample of Energy Tax Credit Form below

Application Form For Residential Energy Tax Credit Photovoltaic

Heated Up February 2018

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

Tax Credit Universal Credit Impact Of Announced Changes House Of

Form 5695 Residential Energy Credits 2014 Free Download

https://www.energystar.gov/about/federal-tax-credits

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax

https://www.energy.gov/eere/solar/homeowners-guide...

The installation of the system must be complete during the tax year Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax

The installation of the system must be complete during the tax year Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

Heated Up February 2018

Tax Credit Universal Credit Impact Of Announced Changes House Of

Form 5695 Residential Energy Credits 2014 Free Download

Irs Standard Deduction Worksheet

Tax Accounting Services Lee s Tax Service

Tax Accounting Services Lee s Tax Service

How The Solar Tax Credit Works California Sustainables