In our modern, consumer-driven society every person loves a great bargain. One method of gaining substantial savings on your purchases is to use Solar Tax Rebate Forms. Solar Tax Rebate Forms are a marketing strategy that retailers and manufacturers use to provide customers with a portion of a refund on their purchases after they've done so. In this post, we'll explore the world of Solar Tax Rebate Forms, looking at what they are and how they work and how you can make the most of your savings by taking advantage of these cost-effective incentives.

Get Latest Solar Tax Rebate Form Below

Solar Tax Rebate Form

Solar Tax Rebate Form -

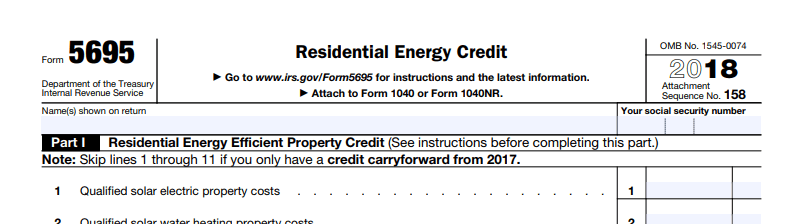

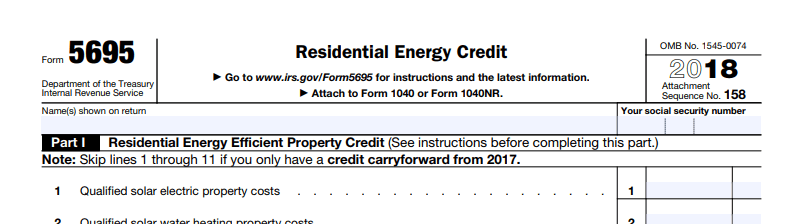

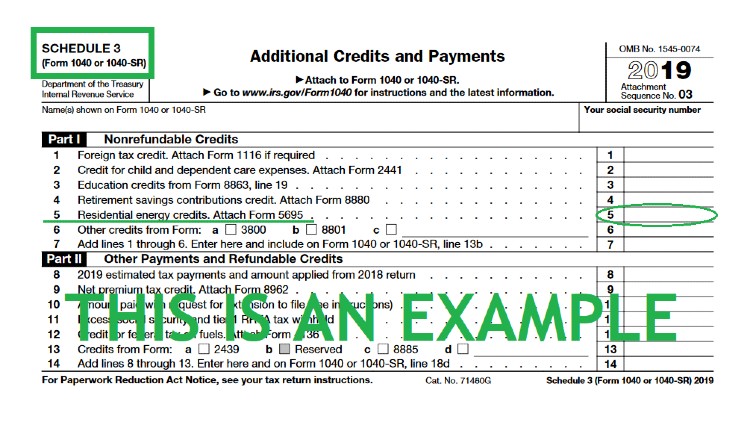

Web 8 oct 2021 nbsp 0183 32 The IRS has not yet released their revised Form 5695 so our example below uses 2021 s version and 26 tax credit amount One of the biggest immediate benefits of installing a solar electric system is that it

Web 5 avr 2023 nbsp 0183 32 Step by step instructions for using IRS Form 5695 to claim the federal solar tax credit For installations completed until 2023 the tax

A Solar Tax Rebate Form at its most basic type, is a return to the customer when they purchase a product or service. It's a very effective technique utilized by businesses to attract buyers, increase sales and market specific products.

Types of Solar Tax Rebate Form

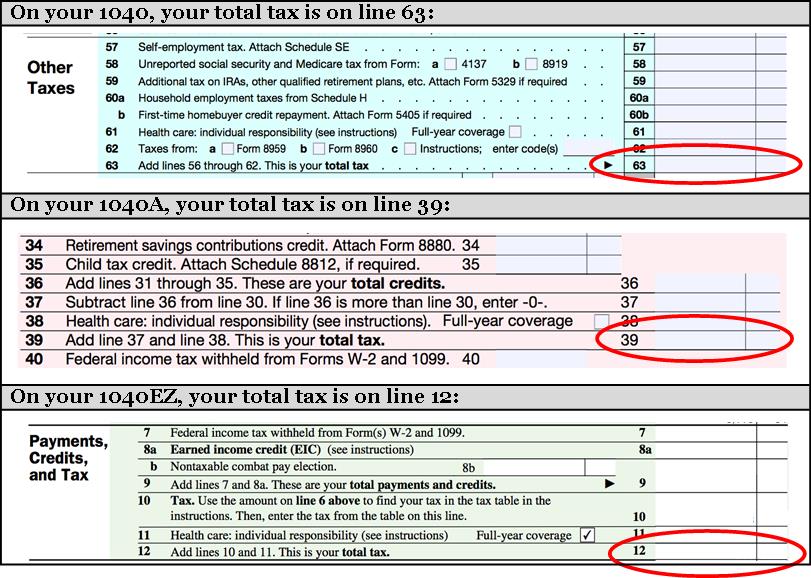

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

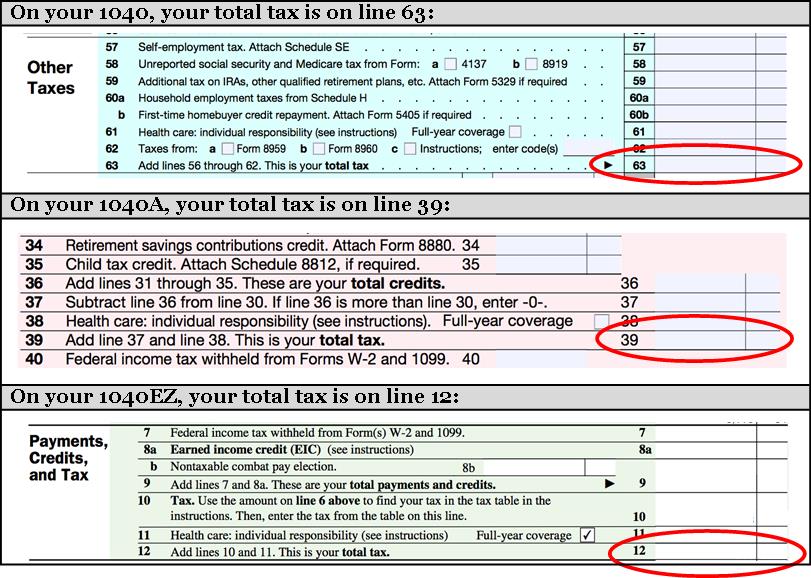

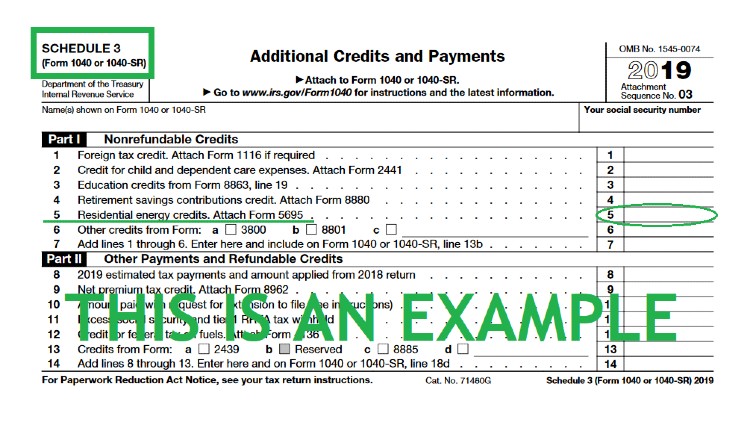

Web 26 avr 2023 nbsp 0183 32 You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for Form 5695 latest version You ll also need Receipts from your solar

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Cash Solar Tax Rebate Form

Cash Solar Tax Rebate Form is the most basic type of Solar Tax Rebate Form. Customers get a set amount of money after buying a product. These are usually used for more expensive items such electronics or appliances.

Mail-In Solar Tax Rebate Form

Mail-in Solar Tax Rebate Form require consumers to present proof of purchase in order to receive the money. They are a bit longer-lasting, however they offer huge savings.

Instant Solar Tax Rebate Form

Instant Solar Tax Rebate Form can be applied at the point of sale and reduce the cost of purchase immediately. Customers don't need to wait for their savings by using this method.

How Solar Tax Rebate Form Work

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Web 8 sept 2022 nbsp 0183 32 Federal Solar Tax Credit Resources The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar

The Solar Tax Rebate Form Process

The procedure typically consists of a few simple steps

-

Purchase the product: Then, you purchase the item in the same way you would normally.

-

Fill out this Solar Tax Rebate Form paper: You'll need to provide some data including your name, address, and purchase details to make a claim for your Solar Tax Rebate Form.

-

Make sure you submit the Solar Tax Rebate Form In accordance with the nature of Solar Tax Rebate Form you might need to fill out a form and mail it in or send it via the internet.

-

Wait for approval: The company is going to review your entry to determine if it's in compliance with the refund's conditions and terms.

-

Redeem your Solar Tax Rebate Form If it is approved, you'll receive a refund either by check, prepaid card, or any other method that is specified in the offer.

Pros and Cons of Solar Tax Rebate Form

Advantages

-

Cost savings Solar Tax Rebate Form could significantly reduce the cost for the item.

-

Promotional Offers They encourage customers to explore new products or brands.

-

Boost Sales A Solar Tax Rebate Form program can boost a company's sales and market share.

Disadvantages

-

Complexity Reward mail-ins particularly may be lengthy and take a long time to complete.

-

Expiration Dates Most Solar Tax Rebate Form come with specific deadlines for submission.

-

Risk of Not Being Paid Some customers might not be able to receive their Solar Tax Rebate Form if they don't comply with the rules exactly.

Download Solar Tax Rebate Form

[su_button url="https://printablerebateform.net/?s=Solar Tax Rebate Form" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Solar Tax Rebate Form[/su_button]

FAQs

1. Are Solar Tax Rebate Form equivalent to discounts? No, Solar Tax Rebate Form offer a partial refund after purchase, while discounts reduce prices at moment of sale.

2. Can I use multiple Solar Tax Rebate Form on the same product What is the best way to do it? It's contingent on terms applicable to Solar Tax Rebate Form promotions and on the products quality and eligibility. Certain companies may permit it, while some won't.

3. How long does it take to get the Solar Tax Rebate Form? The duration differs, but could be anywhere from a few weeks up to a couple of months to receive your Solar Tax Rebate Form.

4. Do I need to pay taxes regarding Solar Tax Rebate Form values? most cases, Solar Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Solar Tax Rebate Form offers from brands that aren't well-known You must research and make sure that the company giving the Solar Tax Rebate Form is reputable prior to making an purchase.

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

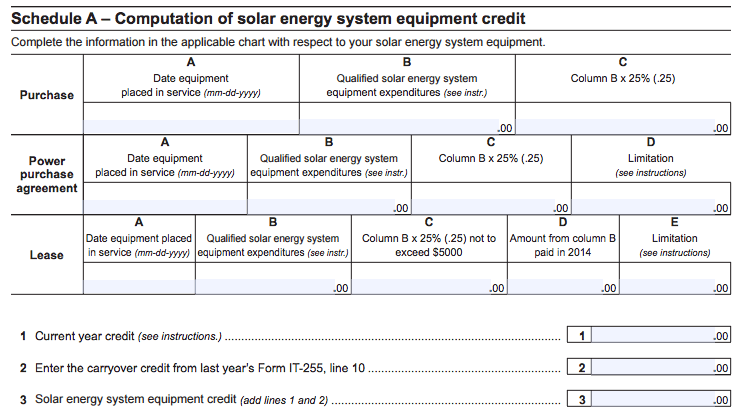

New York Solar Tax Credit Explained EnergySage

Check more sample of Solar Tax Rebate Form below

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

The Declining Federal Solar Tax Credit And Top Things To Know For 2019

How To Claim The Solar Tax Credit Using IRS Form 5695

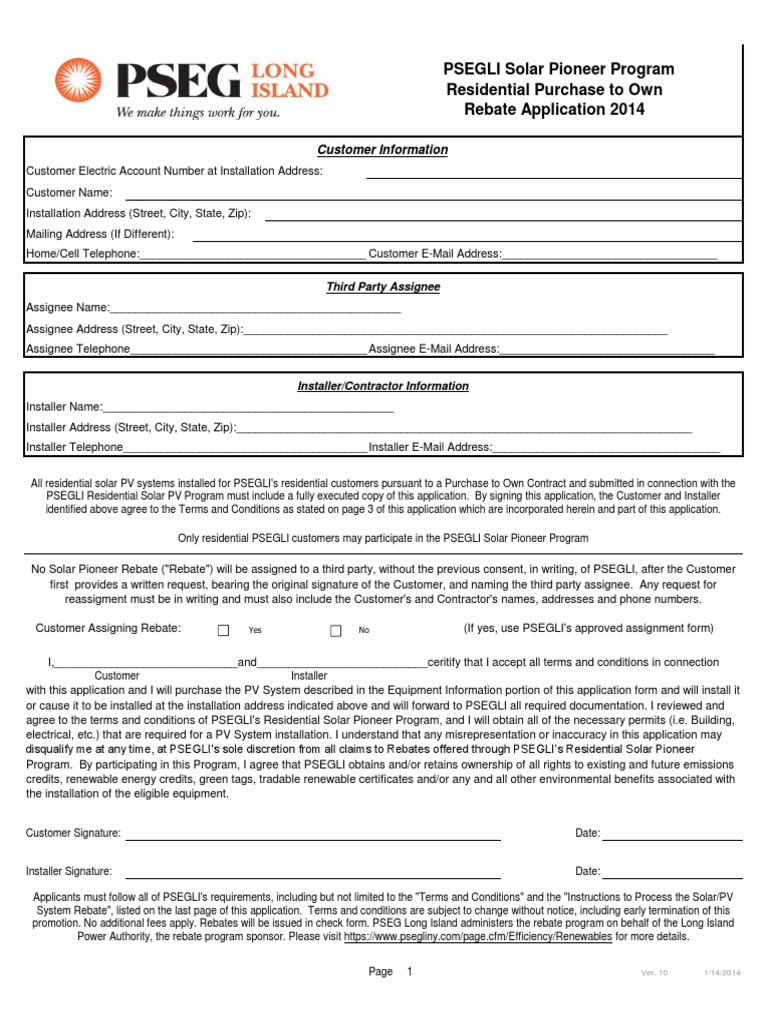

PSEG Long Island PSEGLI Solar Pioneer Program Residential

Filing For The Solar Tax Credit Wells Solar

Can You Use The 30 Federal Tax Credit For Solar The Energy Miser

https://www.solarreviews.com/blog/guide-to-cl…

Web 5 avr 2023 nbsp 0183 32 Step by step instructions for using IRS Form 5695 to claim the federal solar tax credit For installations completed until 2023 the tax

https://news.energysage.com/how-do-i-claim-the-solar-tax-credit

Web 22 sept 2022 nbsp 0183 32 Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating

Web 5 avr 2023 nbsp 0183 32 Step by step instructions for using IRS Form 5695 to claim the federal solar tax credit For installations completed until 2023 the tax

Web 22 sept 2022 nbsp 0183 32 Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating

PSEG Long Island PSEGLI Solar Pioneer Program Residential

The Declining Federal Solar Tax Credit And Top Things To Know For 2019

Filing For The Solar Tax Credit Wells Solar

Can You Use The 30 Federal Tax Credit For Solar The Energy Miser

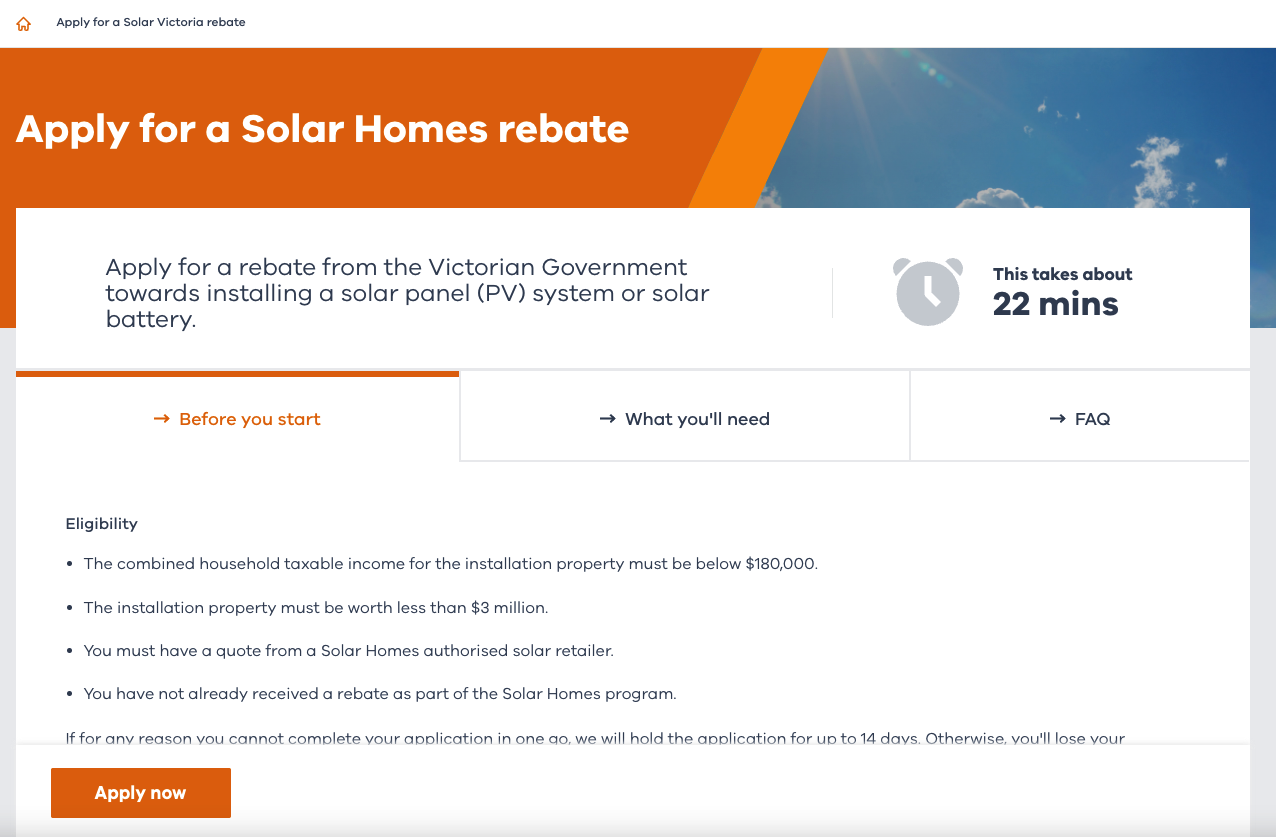

Solar Rebate Victoria 2022 Printable Rebate Form

Filing For The Solar Tax Credit Wells Solar

Filing For The Solar Tax Credit Wells Solar

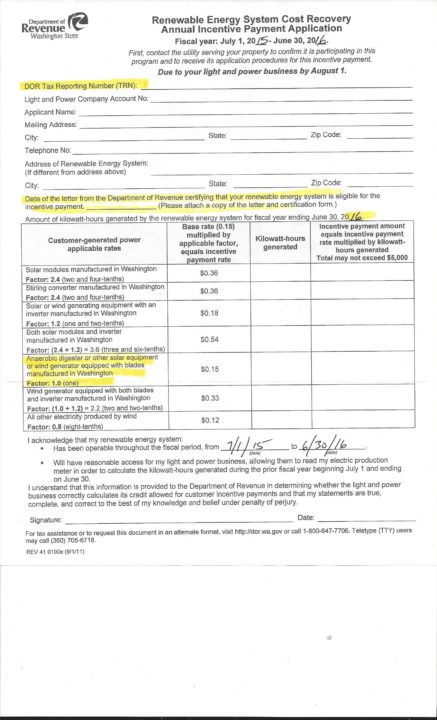

For All Solar Homeowners Remember The June 30th Production Meter