In today's consumer-driven world everybody loves a good bargain. One way to earn significant savings for your purchases is through Who Is Eligible To Claim Gst Hst Rebates. The use of Who Is Eligible To Claim Gst Hst Rebates is a method employed by retailers and manufacturers to provide customers with a partial refund for their purchases after they've made them. In this post, we'll go deeper into the realm of Who Is Eligible To Claim Gst Hst Rebates, examining the nature of them as well as how they work and the best way to increase the value of these incentives.

Get Latest Who Is Eligible To Claim Gst Hst Rebate Below

Who Is Eligible To Claim Gst Hst Rebate

Who Is Eligible To Claim Gst Hst Rebate -

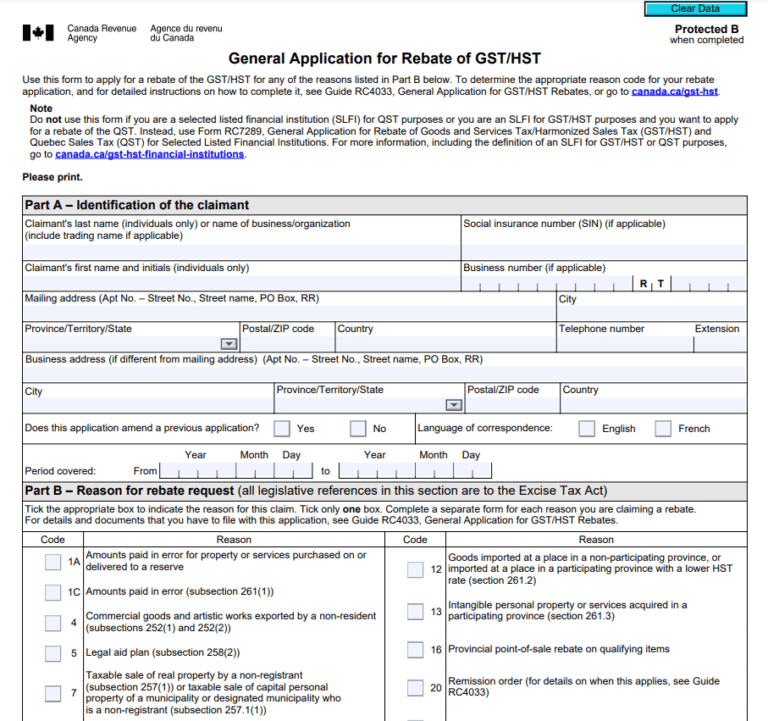

The employee and partners GST HST rebate is available to employees who are eligible to deduct employment expenses if their employer is a GST HST registrant Note that all

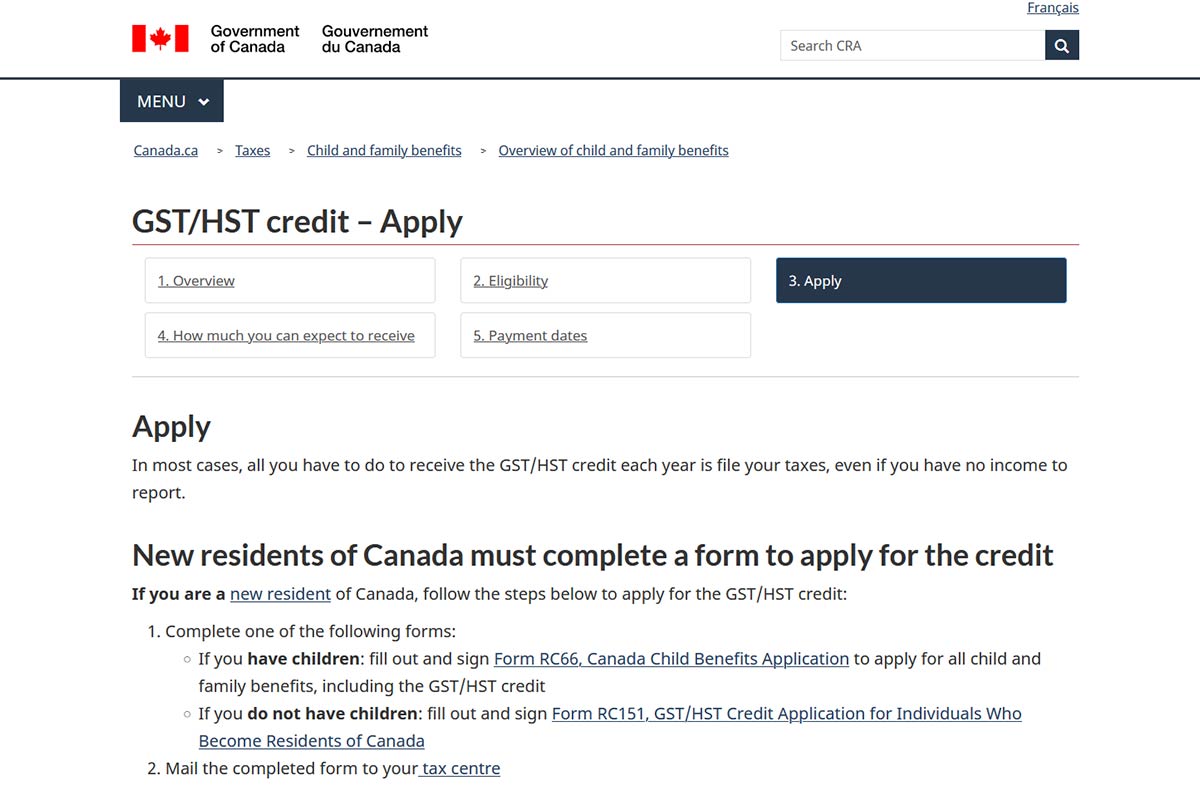

You are generally eligible for the GST HST credit if you are At least 19 years old If you are under 19 years old you must meet at least one of the following conditions during the

A Who Is Eligible To Claim Gst Hst Rebate in its most basic type, is a payment to a consumer who has purchased a particular product or service. This is a potent tool employed by companies to draw clients, increase sales and market specific products.

Types of Who Is Eligible To Claim Gst Hst Rebate

Who Can Claim GST HST Rebate Sproule Associates

Who Can Claim GST HST Rebate Sproule Associates

Who is eligible for the grocery rebate The rebate will be available to those who are eligible to receive the GST HST credit for January 2023 The rebate is based on your 2021 tax

If you were employed by a company or you re a member of a partnership that is a GST HST registrant you might be able to claim a rebate for the GST HST you paid on any

Cash Who Is Eligible To Claim Gst Hst Rebate

Cash Who Is Eligible To Claim Gst Hst Rebate is the most basic type of Who Is Eligible To Claim Gst Hst Rebate. Customers are given a certain amount of money back upon buying a product. These are typically for high-ticket items like electronics or appliances.

Mail-In Who Is Eligible To Claim Gst Hst Rebate

Mail-in Who Is Eligible To Claim Gst Hst Rebate require customers to submit an evidence of purchase for the money. They're somewhat longer-lasting, however they offer significant savings.

Instant Who Is Eligible To Claim Gst Hst Rebate

Instant Who Is Eligible To Claim Gst Hst Rebate are made at the point of sale, which reduces the purchase price immediately. Customers don't have to wait for their savings with this type.

How Who Is Eligible To Claim Gst Hst Rebate Work

GST Payment Dates 2021 2022 All You Need To Know Insurdinary 2022

GST Payment Dates 2021 2022 All You Need To Know Insurdinary 2022

GST HST credit helps low to moderate income families get back some of the taxes they pay on consumer goods Eligible applicants may receive quarterly payments from the CRA based on their prior year s income

The Who Is Eligible To Claim Gst Hst Rebate Process

The process typically comprises a couple of steps that are easy to follow:

-

Purchase the item: First, you buy the product just as you would ordinarily.

-

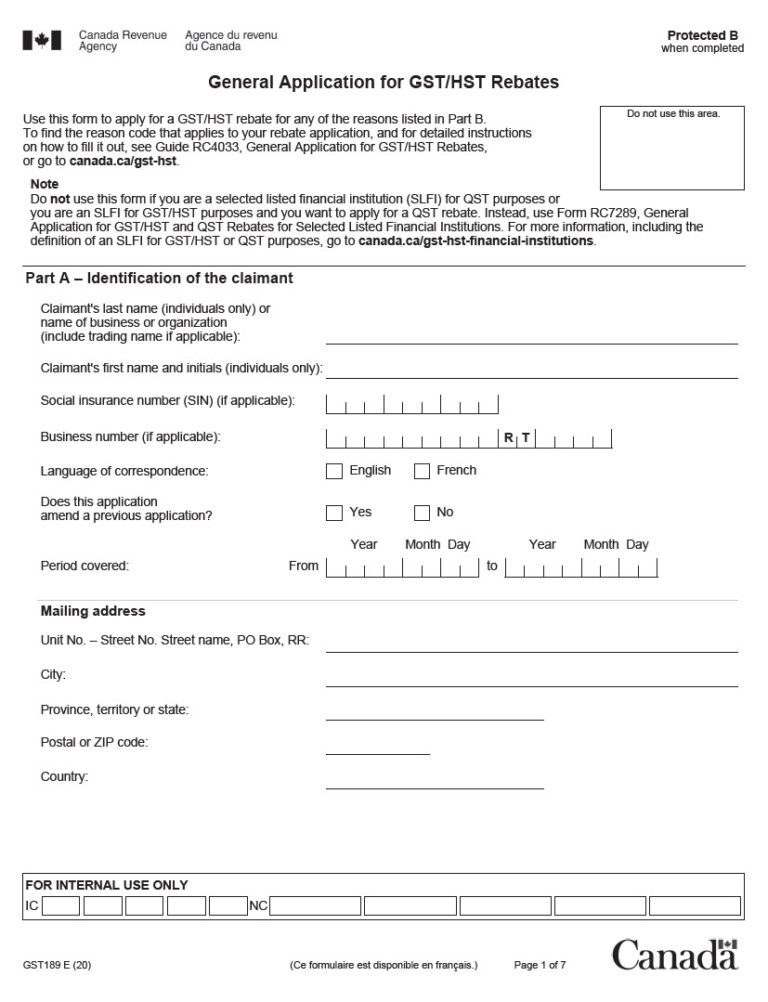

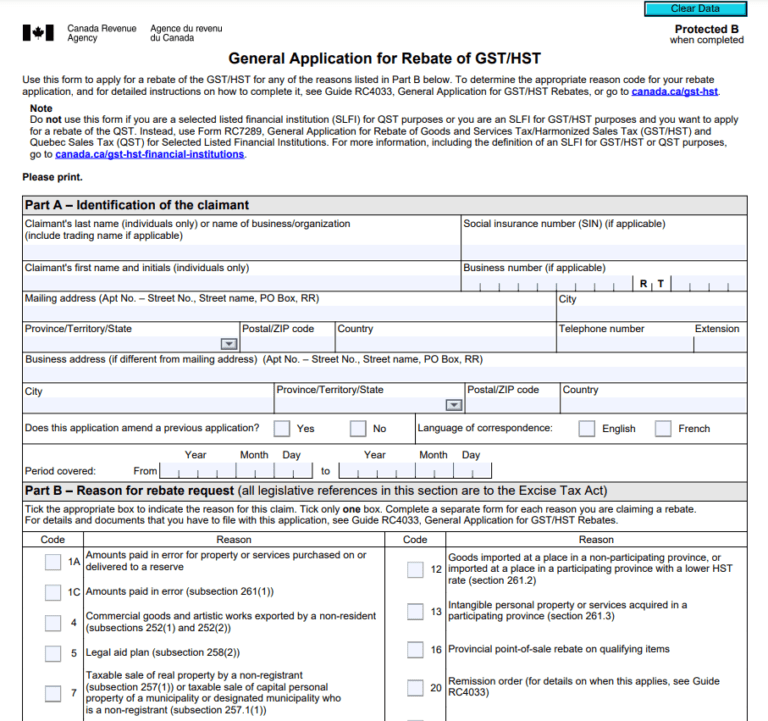

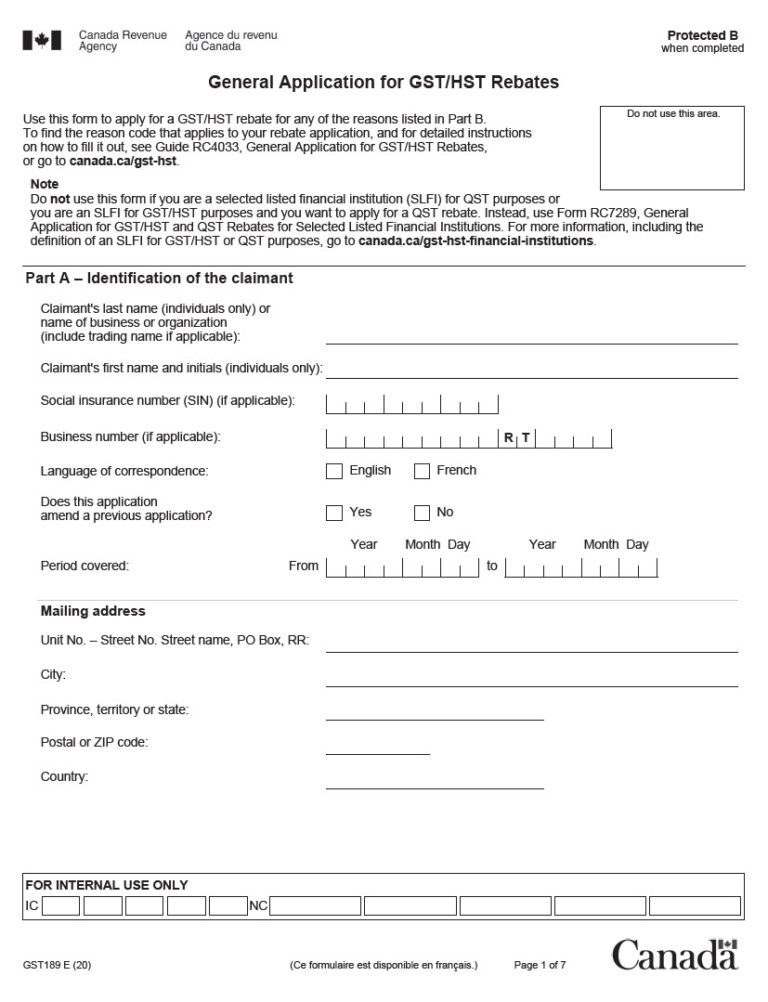

Fill in this Who Is Eligible To Claim Gst Hst Rebate template: You'll have to provide some data including your address, name, and details about your purchase, in order in order to make a claim for your Who Is Eligible To Claim Gst Hst Rebate.

-

Submit the Who Is Eligible To Claim Gst Hst Rebate The Who Is Eligible To Claim Gst Hst Rebate must be submitted in accordance with the kind of Who Is Eligible To Claim Gst Hst Rebate, you may need to either mail in a request form or send it via the internet.

-

Wait for approval: The business will look over your submission to determine if it's in compliance with the refund's conditions and terms.

-

Receive your Who Is Eligible To Claim Gst Hst Rebate When it's approved you'll receive the refund whether via check, credit card, or through another option specified by the offer.

Pros and Cons of Who Is Eligible To Claim Gst Hst Rebate

Advantages

-

Cost savings A Who Is Eligible To Claim Gst Hst Rebate can significantly reduce the price you pay for products.

-

Promotional Offers Incentivize customers to try new items or brands.

-

increase sales A Who Is Eligible To Claim Gst Hst Rebate program can boost companies' sales and market share.

Disadvantages

-

Complexity Reward mail-ins in particular is a time-consuming process and costly.

-

Expiration Dates A majority of Who Is Eligible To Claim Gst Hst Rebate have certain deadlines for submitting.

-

The risk of non-payment Some customers might not receive their refunds if they don't observe the rules precisely.

Download Who Is Eligible To Claim Gst Hst Rebate

[su_button url="https://printablerebateform.net/?s=Who Is Eligible To Claim Gst Hst Rebate" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Who Is Eligible To Claim Gst Hst Rebate[/su_button]

FAQs

1. Are Who Is Eligible To Claim Gst Hst Rebate equivalent to discounts? Not at all, Who Is Eligible To Claim Gst Hst Rebate provide only a partial reimbursement following the purchase whereas discounts will reduce costs at moment of sale.

2. Can I get multiple Who Is Eligible To Claim Gst Hst Rebate for the same product It is contingent on the terms of the Who Is Eligible To Claim Gst Hst Rebate offers and the product's eligibility. Some companies may allow it, while other companies won't.

3. How long does it take to get the Who Is Eligible To Claim Gst Hst Rebate? The timing can vary, but typically it will range from several weeks to few months for you to receive your Who Is Eligible To Claim Gst Hst Rebate.

4. Do I have to pay tax in relation to Who Is Eligible To Claim Gst Hst Rebate sums? the majority of circumstances, Who Is Eligible To Claim Gst Hst Rebate amounts are not considered to be taxable income.

5. Should I be able to trust Who Is Eligible To Claim Gst Hst Rebate deals from lesser-known brands It's crucial to research and confirm that the company that is offering the Who Is Eligible To Claim Gst Hst Rebate is legitimate prior to making an investment.

Who Is Eligible For The GST HST Credit

Who Is Eligible For HST New Home Rebate PrintableRebateForm

Check more sample of Who Is Eligible To Claim Gst Hst Rebate below

GST HST Public Service Bodies Rebate

GST Refund Form Rfd 01 Printable Rebate Form

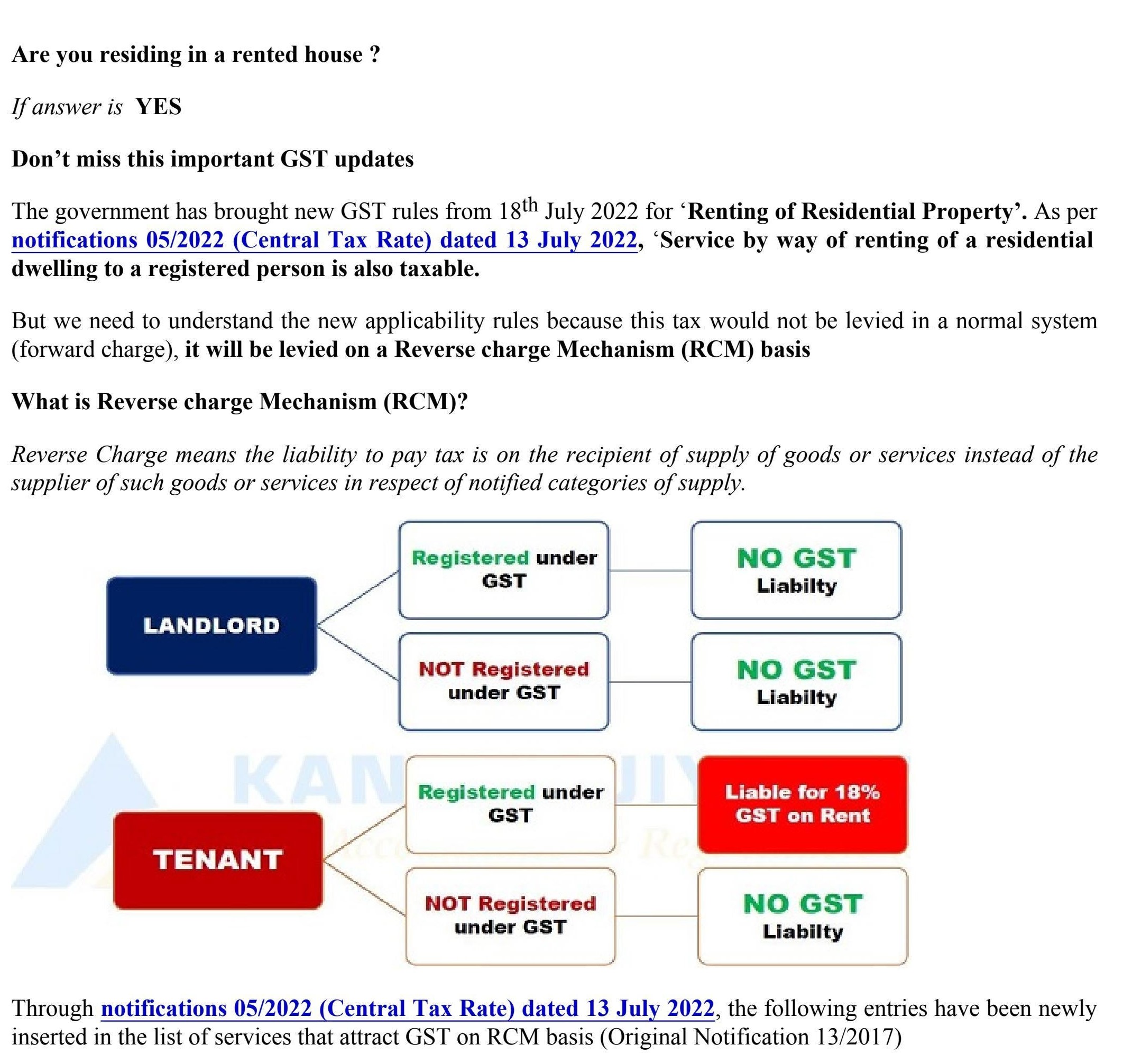

Is Vat Applicable On Commercial Rent

Home Addition Conversion And Renovation Rebates Services You Might Be

Am I Eligible For A GST HST Rebate

What Are My Options For GST HST Prior To Registration With The Canada

https://www.canada.ca/en/revenue-agency/services/...

You are generally eligible for the GST HST credit if you are At least 19 years old If you are under 19 years old you must meet at least one of the following conditions during the

https://turbotax.intuit.ca/tips/did-you-know-you...

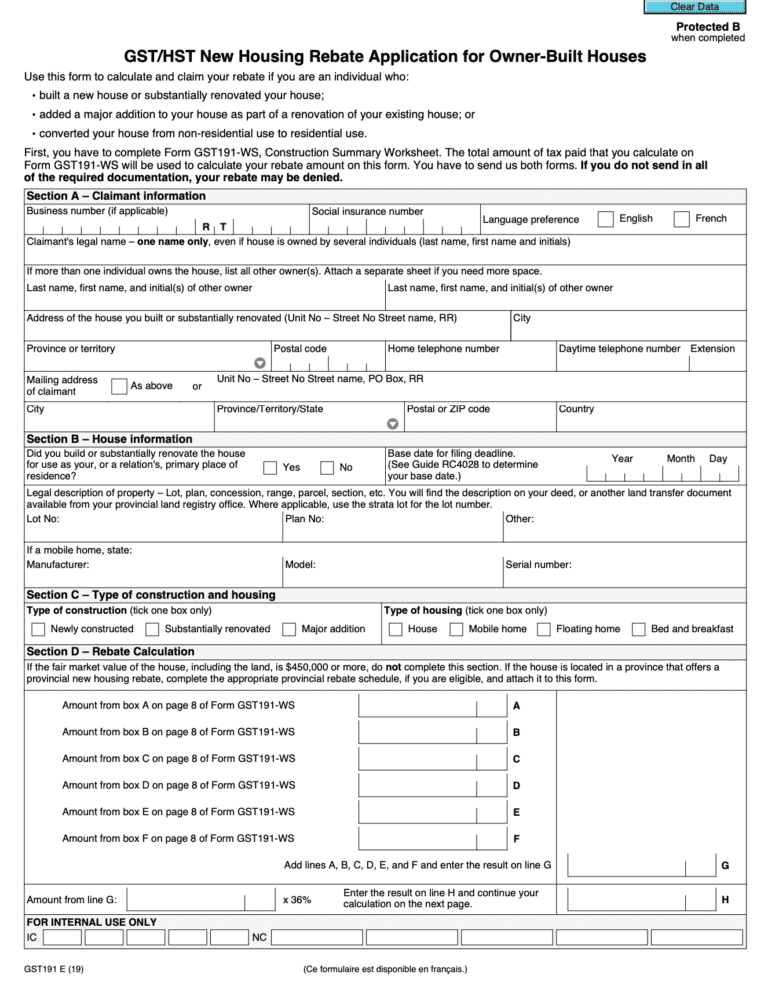

You may be eligible to claim a rebate of the difference in HST if you bring the supply or the service from one province to be used in another province Complete

You are generally eligible for the GST HST credit if you are At least 19 years old If you are under 19 years old you must meet at least one of the following conditions during the

You may be eligible to claim a rebate of the difference in HST if you bring the supply or the service from one province to be used in another province Complete

Home Addition Conversion And Renovation Rebates Services You Might Be

GST Refund Form Rfd 01 Printable Rebate Form

Am I Eligible For A GST HST Rebate

What Are My Options For GST HST Prior To Registration With The Canada

How To Complete A Canadian GST Return with Pictures WikiHow

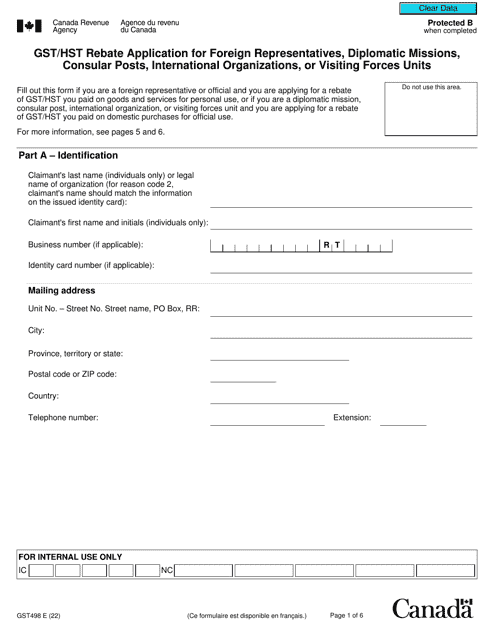

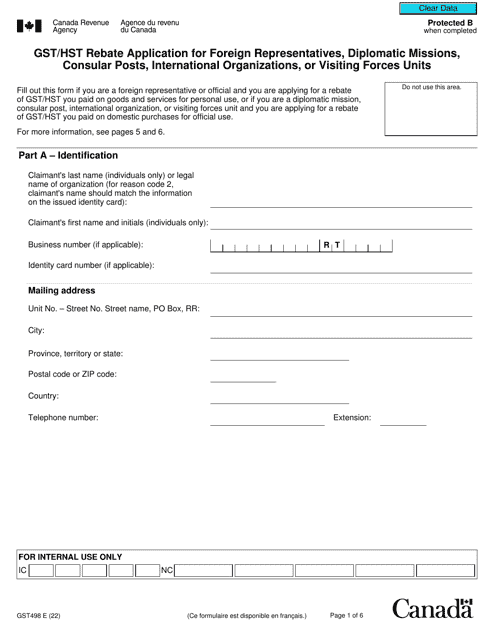

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Tax Rebate Blog Series GST HST New Housing Rebate