In today's world of consumerism, everyone loves a good bargain. One way to earn significant savings when you shop is with Stimulus Rebate Tax Forms. They are a form of marketing that retailers and manufacturers use to provide customers with a partial refund on their purchases after they have created them. In this article, we will delve into the world of Stimulus Rebate Tax Forms, exploring what they are and how they operate, and how you can make the most of your savings using these low-cost incentives.

Get Latest Stimulus Rebate Tax Form Below

Stimulus Rebate Tax Form

Stimulus Rebate Tax Form -

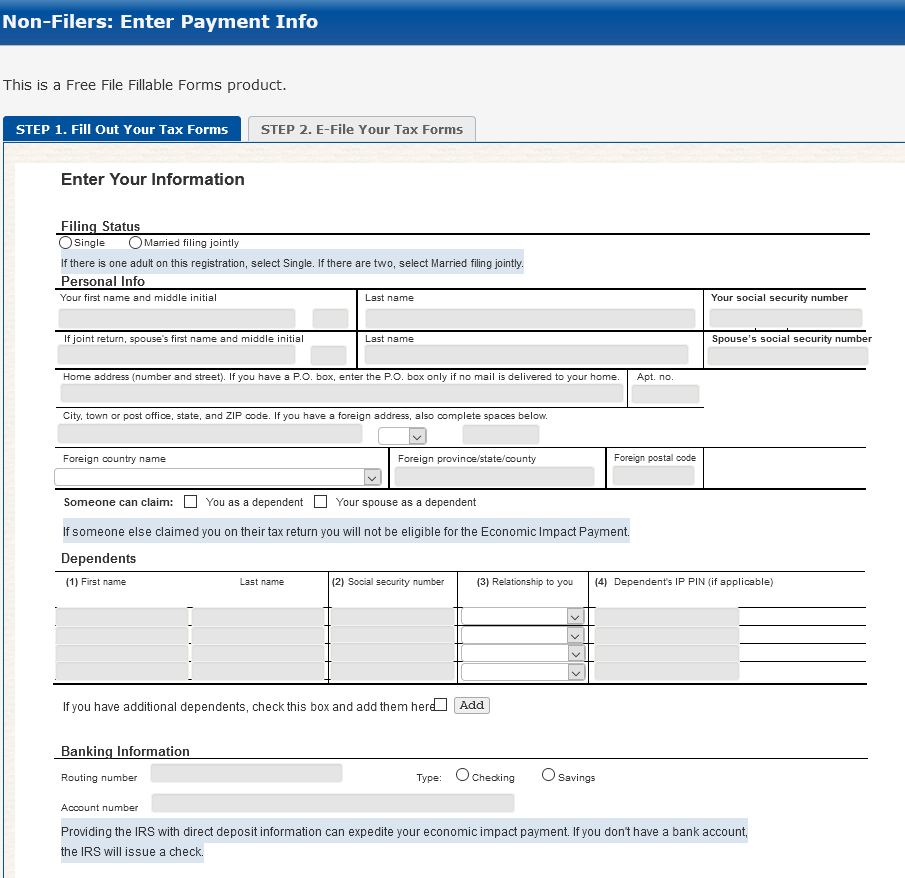

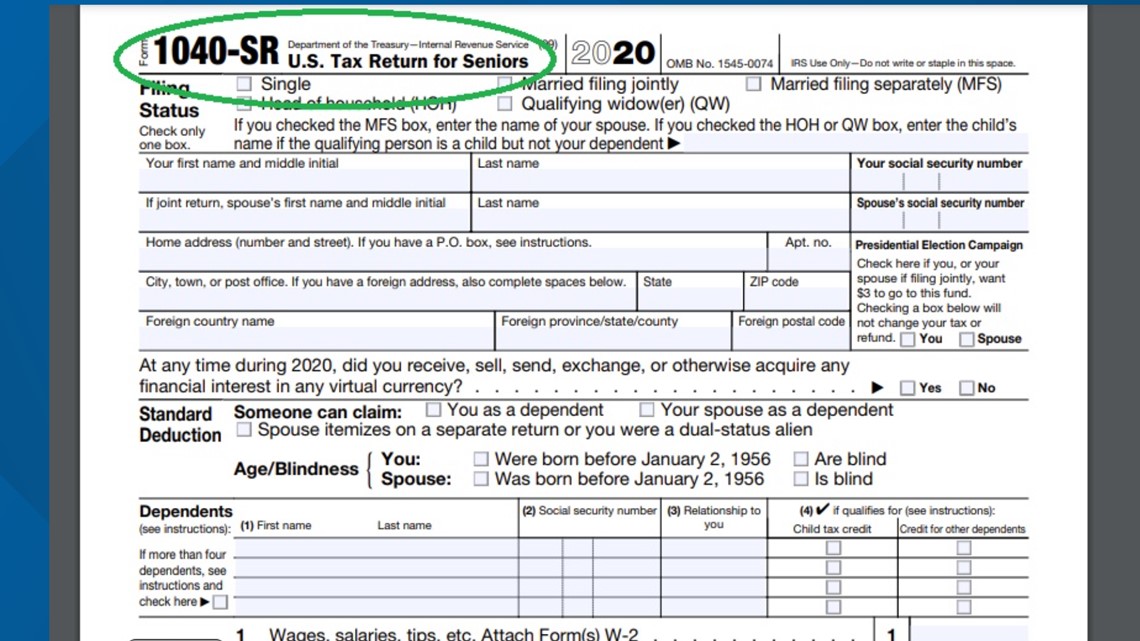

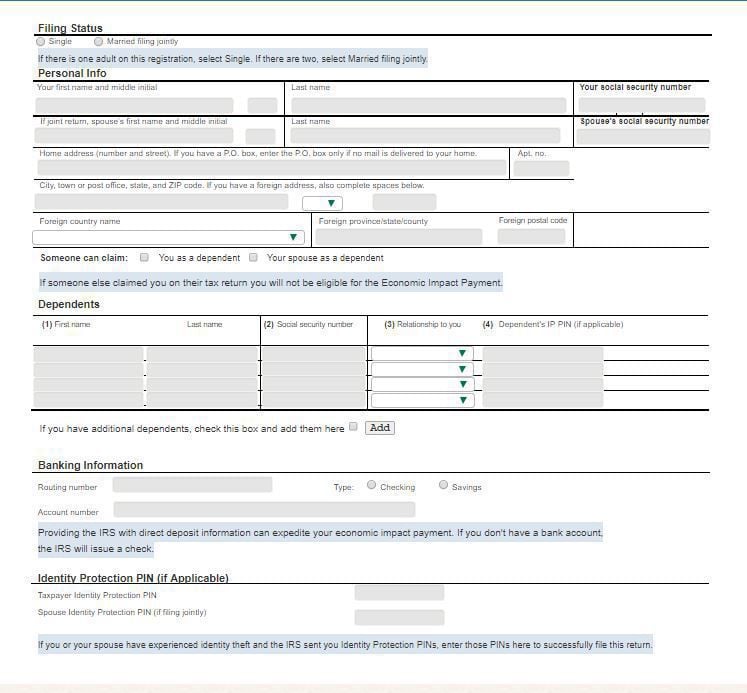

Web 13 janv 2021 nbsp 0183 32 You ll need to file the standard 1040 federal tax return form or the 1040 SR tax return for people 65 or older to get your missing stimulus money in the form of a

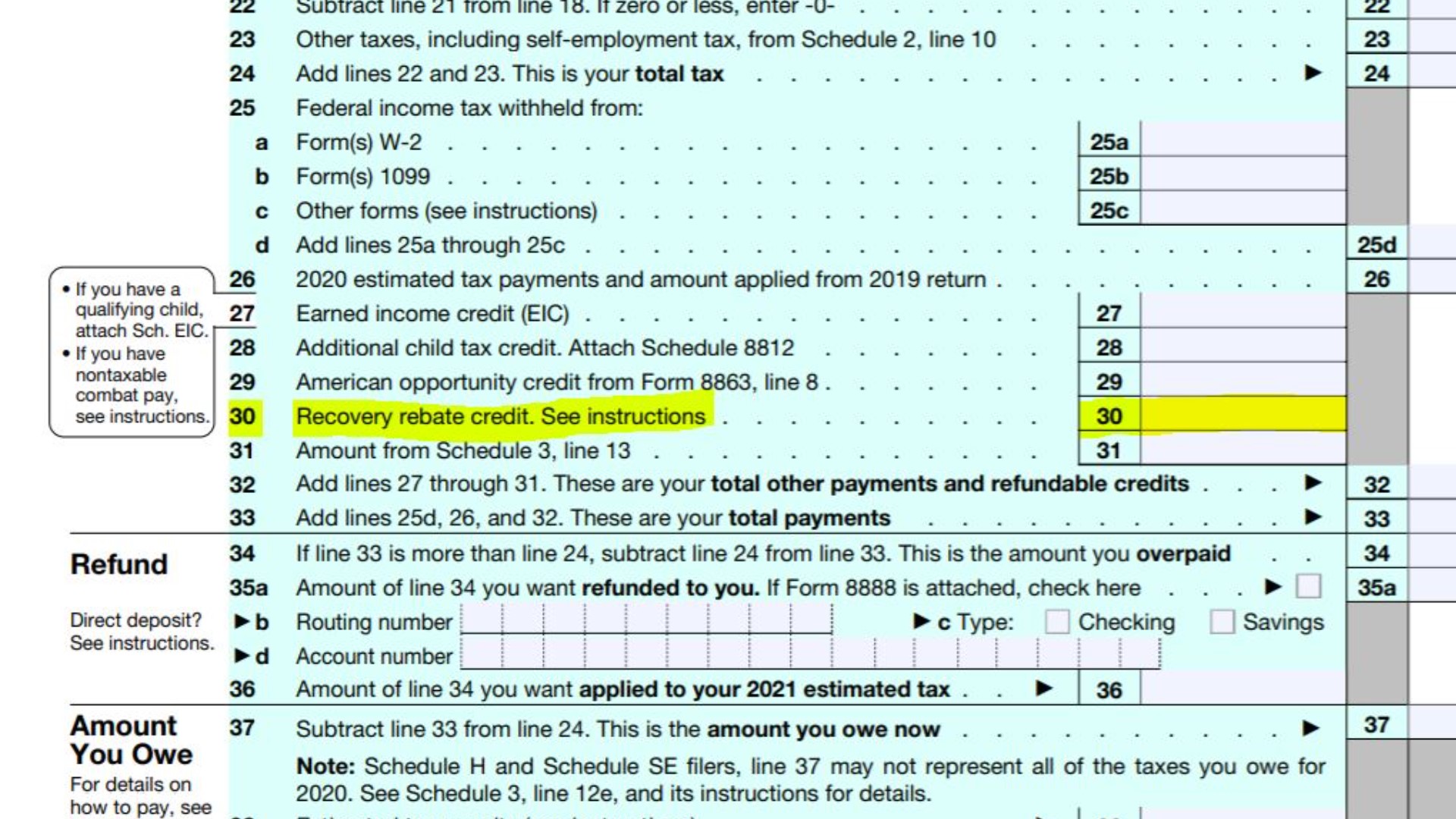

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of

A Stimulus Rebate Tax Form or Stimulus Rebate Tax Form, in its most basic form, is a partial refund offered to a customer when they purchase a product or service. It's a powerful method that companies use to attract customers, increase sales, as well as promote particular products.

Types of Stimulus Rebate Tax Form

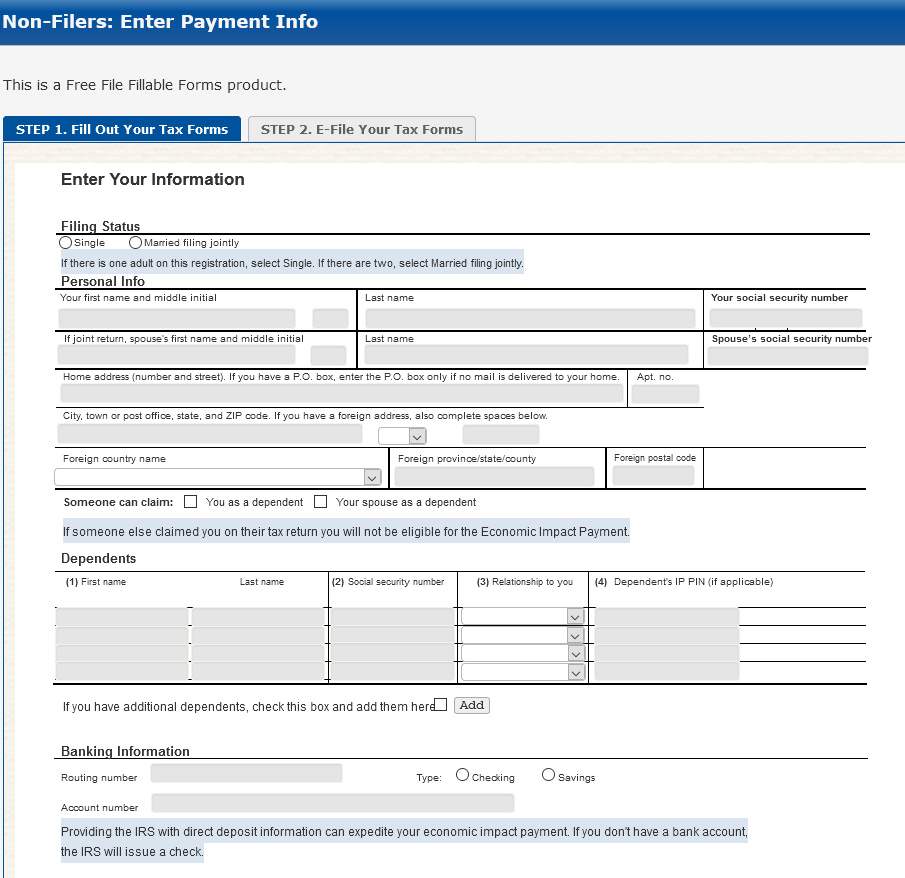

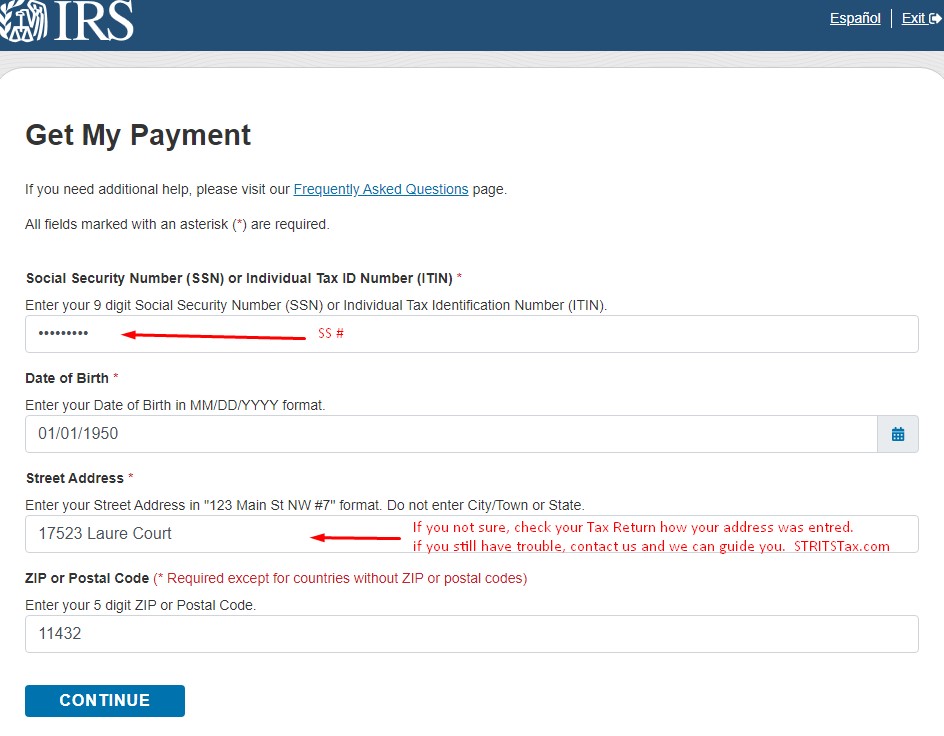

New IRS Site Could Make It Easy For Thieves To Intercept Some Stimulus

New IRS Site Could Make It Easy For Thieves To Intercept Some Stimulus

Web People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or

Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early opportunity

Cash Stimulus Rebate Tax Form

Cash Stimulus Rebate Tax Form are probably the most simple kind of Stimulus Rebate Tax Form. The customer receives a particular sum of money back when purchasing a product. This is often for more expensive items such electronics or appliances.

Mail-In Stimulus Rebate Tax Form

Customers who want to receive mail-in Stimulus Rebate Tax Form must provide an evidence of purchase for their money back. They're longer-lasting, however they offer substantial savings.

Instant Stimulus Rebate Tax Form

Instant Stimulus Rebate Tax Form can be applied at the point of sale, which reduces the cost of purchase immediately. Customers do not have to wait long for savings when they purchase this type of Stimulus Rebate Tax Form.

How Stimulus Rebate Tax Form Work

IRS Releases Draft Form 1040 Here s What s New For 2020 The Online

IRS Releases Draft Form 1040 Here s What s New For 2020 The Online

Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return

The Stimulus Rebate Tax Form Process

The procedure typically consists of a number of easy steps:

-

Purchase the item: First then, you buy the item as you normally would.

-

Fill out your Stimulus Rebate Tax Form Form: To claim the Stimulus Rebate Tax Form you'll need provide certain information, such as your name, address and the purchase details, in order in order to claim your Stimulus Rebate Tax Form.

-

Complete the Stimulus Rebate Tax Form The Stimulus Rebate Tax Form must be submitted in accordance with the kind of Stimulus Rebate Tax Form the recipient may be required to submit a claim form to the bank or upload it online.

-

Wait for approval: The business will scrutinize your submission to make sure that it's in accordance with the reimbursement's terms and condition.

-

Pay your Stimulus Rebate Tax Form Once it's approved, you'll receive your money back, whether by check, prepaid card, or any other way specified in the offer.

Pros and Cons of Stimulus Rebate Tax Form

Advantages

-

Cost savings Stimulus Rebate Tax Form can dramatically lower the cost you pay for the product.

-

Promotional Deals The aim is to encourage customers in trying new products or brands.

-

Increase Sales The benefits of a Stimulus Rebate Tax Form can improve companies' sales and market share.

Disadvantages

-

Complexity In particular, mail-in Stimulus Rebate Tax Form in particular may be lengthy and long-winded.

-

Expiration Dates Some Stimulus Rebate Tax Form have rigid deadlines to submit.

-

Risk of Not Being Paid Certain customers could not be able to receive their Stimulus Rebate Tax Form if they do not adhere to the guidelines precisely.

Download Stimulus Rebate Tax Form

[su_button url="https://printablerebateform.net/?s=Stimulus Rebate Tax Form" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Stimulus Rebate Tax Form[/su_button]

FAQs

1. Are Stimulus Rebate Tax Form equivalent to discounts? No, Stimulus Rebate Tax Form involve some form of refund following the purchase whereas discounts will reduce the cost of purchase at time of sale.

2. Can I make use of multiple Stimulus Rebate Tax Form on the same item? It depends on the terms in the Stimulus Rebate Tax Form incentives and the specific product's admissibility. Certain companies might permit it, while others won't.

3. How long will it take to receive an Stimulus Rebate Tax Form? The time frame will differ, but can take a couple of weeks or a few months to receive your Stimulus Rebate Tax Form.

4. Do I need to pay tax regarding Stimulus Rebate Tax Form values? most situations, Stimulus Rebate Tax Form amounts are not considered to be taxable income.

5. Should I be able to trust Stimulus Rebate Tax Form deals from lesser-known brands It's important to do your research and ensure that the business offering the Stimulus Rebate Tax Form is reputable prior making purchases.

How To Claim The Stimulus Money On Your Tax Return Wltx

How To Make Sure You Get Your Stimulus Check If You Didn t File A Tax

Check more sample of Stimulus Rebate Tax Form below

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit

HVAC Tax Stimulus Rebates Hvac Efficient Energy Use

Stimulus Check Fillable Form Printable Forms Free Online

How To Claim My Stimulus Check For My Newborn Do You Qualify For A

How To Treat The 2007 Economic Stimulus Rebate On Your 2008 Income Tax

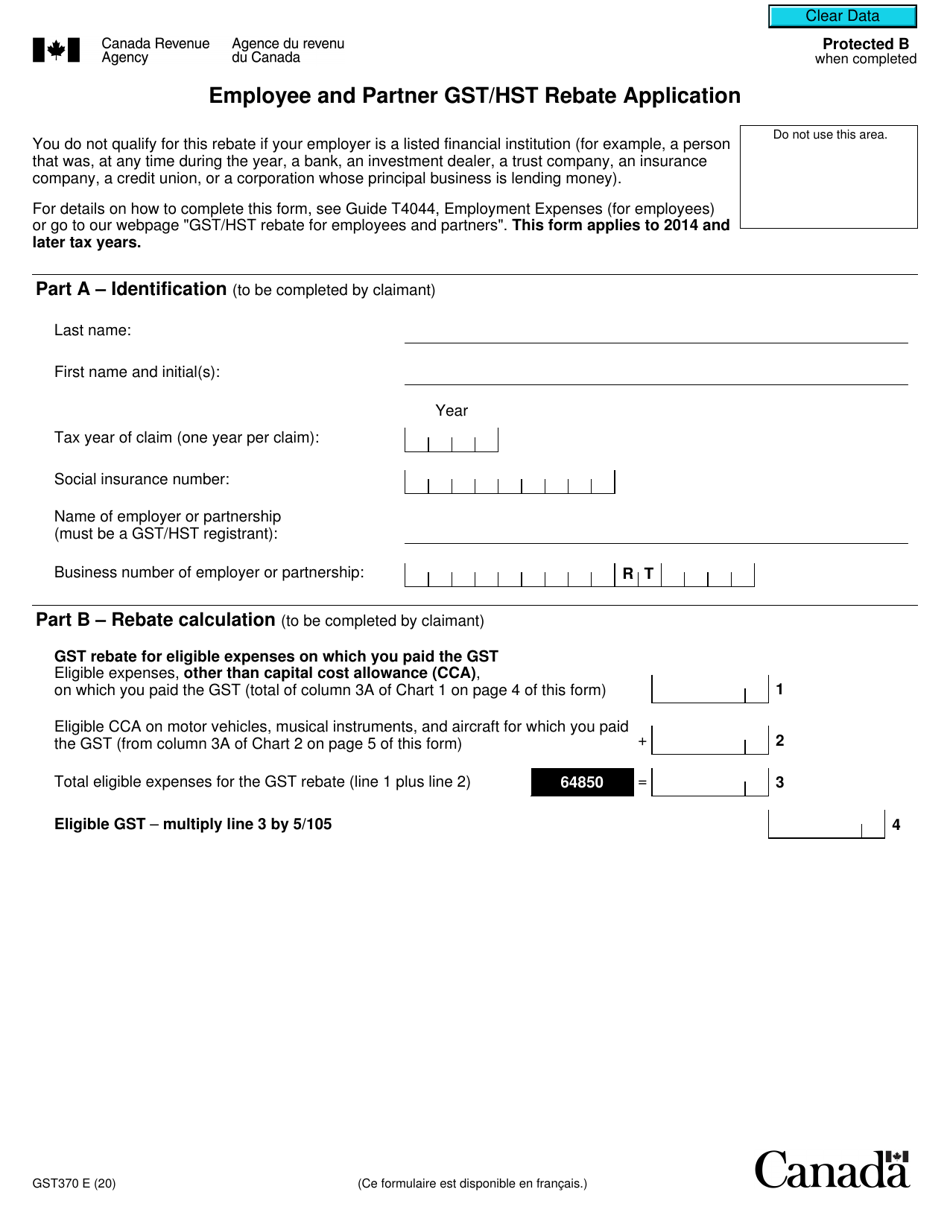

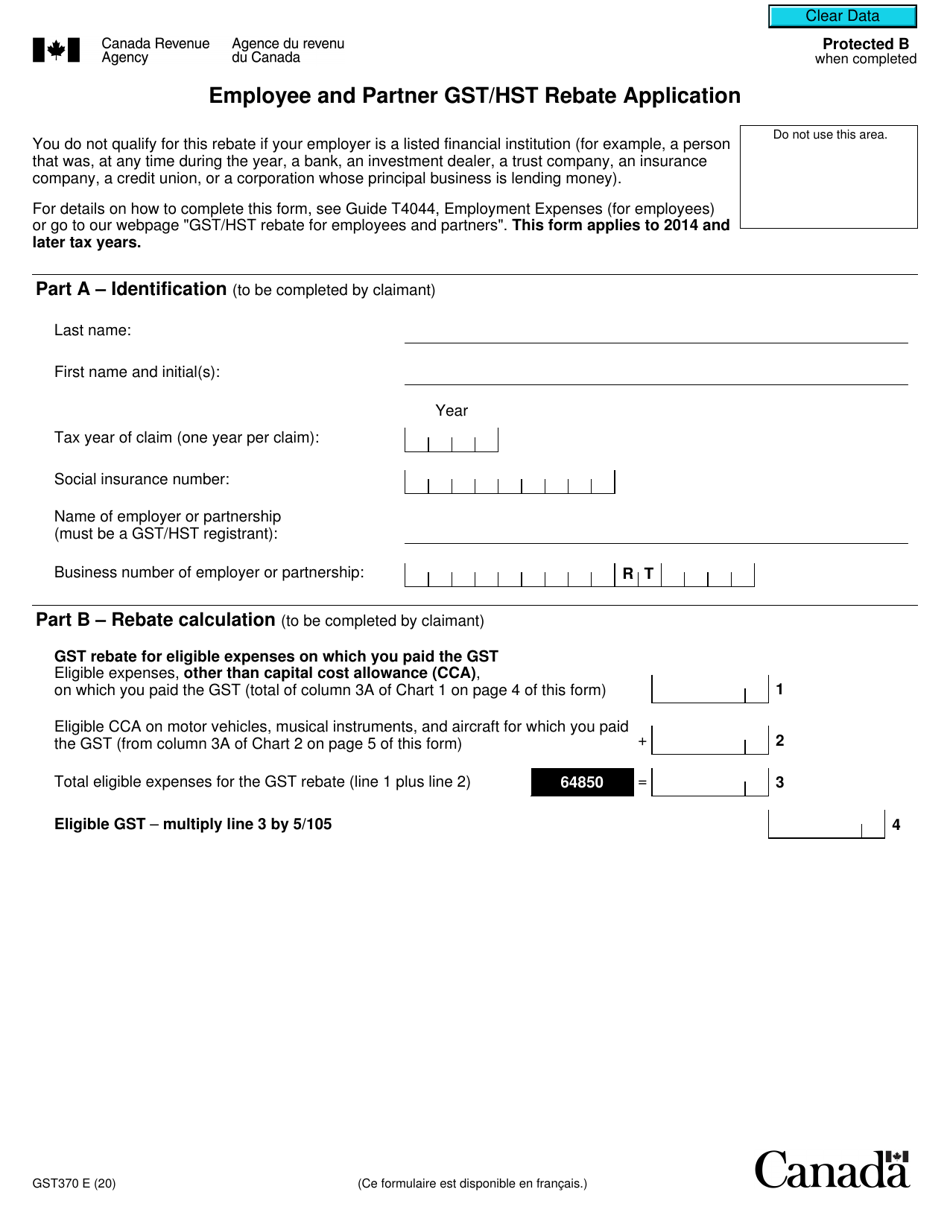

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

https://www.irs.gov/coronavirus/economic-im…

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

How To Claim My Stimulus Check For My Newborn Do You Qualify For A

HVAC Tax Stimulus Rebates Hvac Efficient Energy Use

How To Treat The 2007 Economic Stimulus Rebate On Your 2008 Income Tax

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

How Do I Claim The Recovery Rebate Credit On My Ta

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Stimulus Check Finder Income Tax Preparation Services STRITSTax