Today, in a world that is driven by the consumer everyone is looking for a great bargain. One way to score significant savings from your purchases is via Rebate Recovery Credit Forms. Rebate Recovery Credit Forms are a method of marketing used by manufacturers and retailers to provide customers with a portion of a discount on purchases they made after they have created them. In this post, we'll investigate the world of Rebate Recovery Credit Forms, looking at what they are and how they work and how you can make the most of your savings with these cost-effective incentives.

Get Latest Rebate Recovery Credit Form Below

Rebate Recovery Credit Form

Rebate Recovery Credit Form -

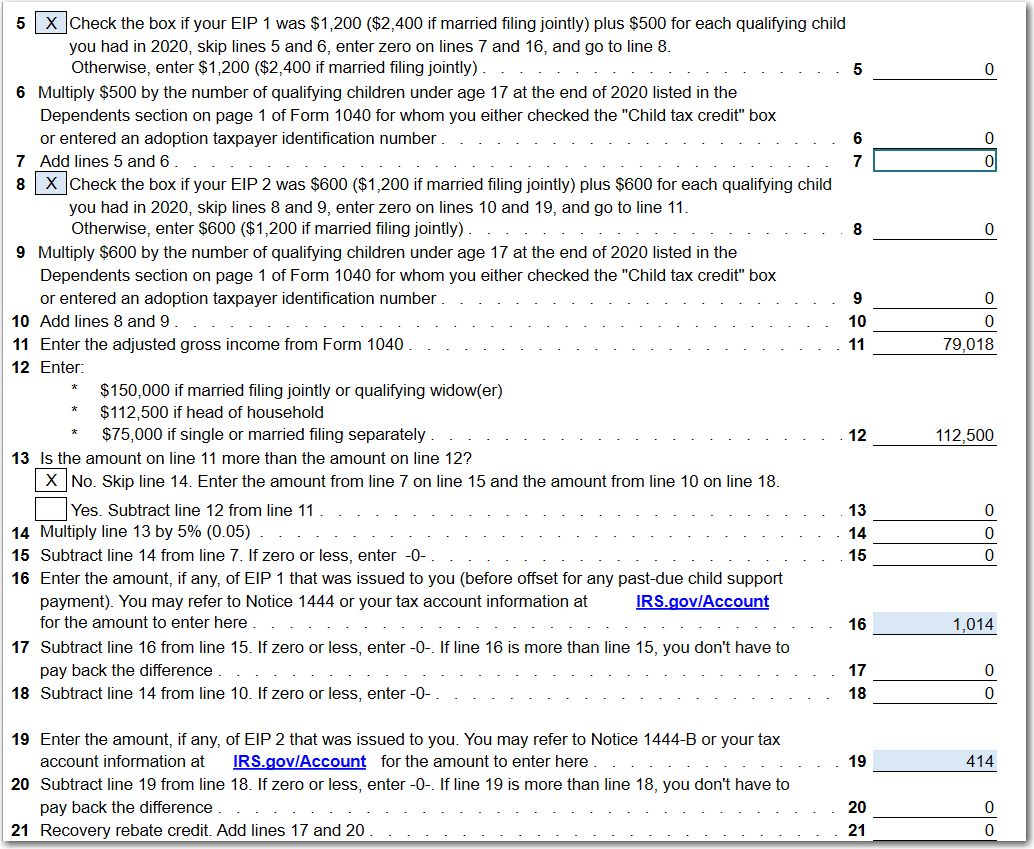

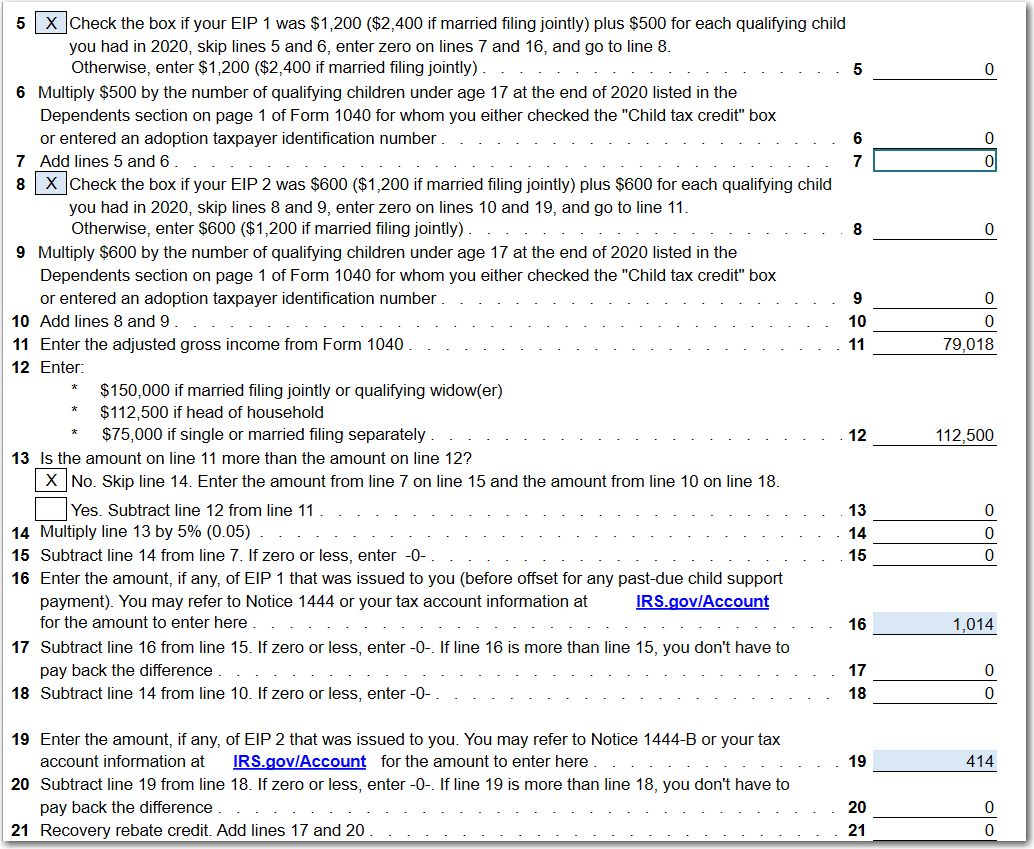

Web 13 janv 2022 nbsp 0183 32 No matter how you file you will need to do the following to claim the 2021 Recovery Rebate Credit Compute the 2021 Recovery Rebate Credit amount using

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

A Rebate Recovery Credit Form in its most basic form, is a refund offered to a customer after purchasing a certain product or service. It's a highly effective tool that businesses use to draw customers, boost sales, and market specific products.

Types of Rebate Recovery Credit Form

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how

Web 10 d 233 c 2021 nbsp 0183 32 If you must file an amended return to claim the Recovery Rebate Credit use the worksheet on page 59 of the 2020 instructions for Form 1040 and Form 1040 SR

Cash Rebate Recovery Credit Form

Cash Rebate Recovery Credit Form is the most basic kind of Rebate Recovery Credit Form. Customers are offered a certain sum of money back when purchasing a item. This is often for expensive items such as electronics or appliances.

Mail-In Rebate Recovery Credit Form

Customers who want to receive mail-in Rebate Recovery Credit Form must present the proof of purchase to be eligible for their cash back. They're somewhat more involved, however they can yield significant savings.

Instant Rebate Recovery Credit Form

Instant Rebate Recovery Credit Form will be applied at point of sale, and can reduce prices immediately. Customers don't have to wait long for savings in this manner.

How Rebate Recovery Credit Form Work

IRS CP 12R Recovery Rebate Credit Overpayment

IRS CP 12R Recovery Rebate Credit Overpayment

Web If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax

The Rebate Recovery Credit Form Process

The process typically involves a handful of simple steps:

-

Buy the product: Firstly purchase the product like you would normally.

-

Complete your Rebate Recovery Credit Form form: You'll have to supply some details, such as your name, address, and purchase information, to submit your Rebate Recovery Credit Form.

-

To submit the Rebate Recovery Credit Form In accordance with the nature of Rebate Recovery Credit Form you will need to submit a claim form to the bank or send it via the internet.

-

Wait for the company's approval: They will examine your application to ensure it meets the guidelines and conditions of the Rebate Recovery Credit Form.

-

Redeem your Rebate Recovery Credit Form Once it's approved, you'll receive your refund whether by check, prepaid card or another option as per the terms of the offer.

Pros and Cons of Rebate Recovery Credit Form

Advantages

-

Cost savings The use of Rebate Recovery Credit Form can greatly cut the price you pay for a product.

-

Promotional Offers They encourage customers to experiment with new products, or brands.

-

Accelerate Sales Rebate Recovery Credit Form can help boost a company's sales and market share.

Disadvantages

-

Complexity mail-in Rebate Recovery Credit Form in particular is a time-consuming process and time-consuming.

-

Deadlines for Expiration Some Rebate Recovery Credit Form have the strictest deadlines for submission.

-

The risk of non-payment Some customers might miss out on Rebate Recovery Credit Form because they don't adhere to the rules exactly.

Download Rebate Recovery Credit Form

[su_button url="https://printablerebateform.net/?s=Rebate Recovery Credit Form" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Rebate Recovery Credit Form[/su_button]

FAQs

1. Are Rebate Recovery Credit Form similar to discounts? No, they are a partial refund after purchase, whereas discounts decrease the purchase price at the time of sale.

2. Are multiple Rebate Recovery Credit Form available for the same product? It depends on the conditions applicable to Rebate Recovery Credit Form offer and also the item's suitability. Certain companies might allow this, whereas others will not.

3. How long does it take to receive the Rebate Recovery Credit Form? The duration can vary, but typically it will take several weeks to a couple of months to receive your Rebate Recovery Credit Form.

4. Do I need to pay tax with respect to Rebate Recovery Credit Form quantities? most cases, Rebate Recovery Credit Form amounts are not considered taxable income.

5. Do I have confidence in Rebate Recovery Credit Form offers from brands that aren't well-known It's crucial to research to ensure that the name offering the Rebate Recovery Credit Form is credible prior to making a purchase.

Recovery Rebate Credit Taking Forever Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Check more sample of Rebate Recovery Credit Form below

The Recovery Rebate Credit Calculator ShauntelRaya

How Do I Claim The Recovery Rebate Credit On My Ta

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Taxes Recovery Rebate Credit Recovery Rebate

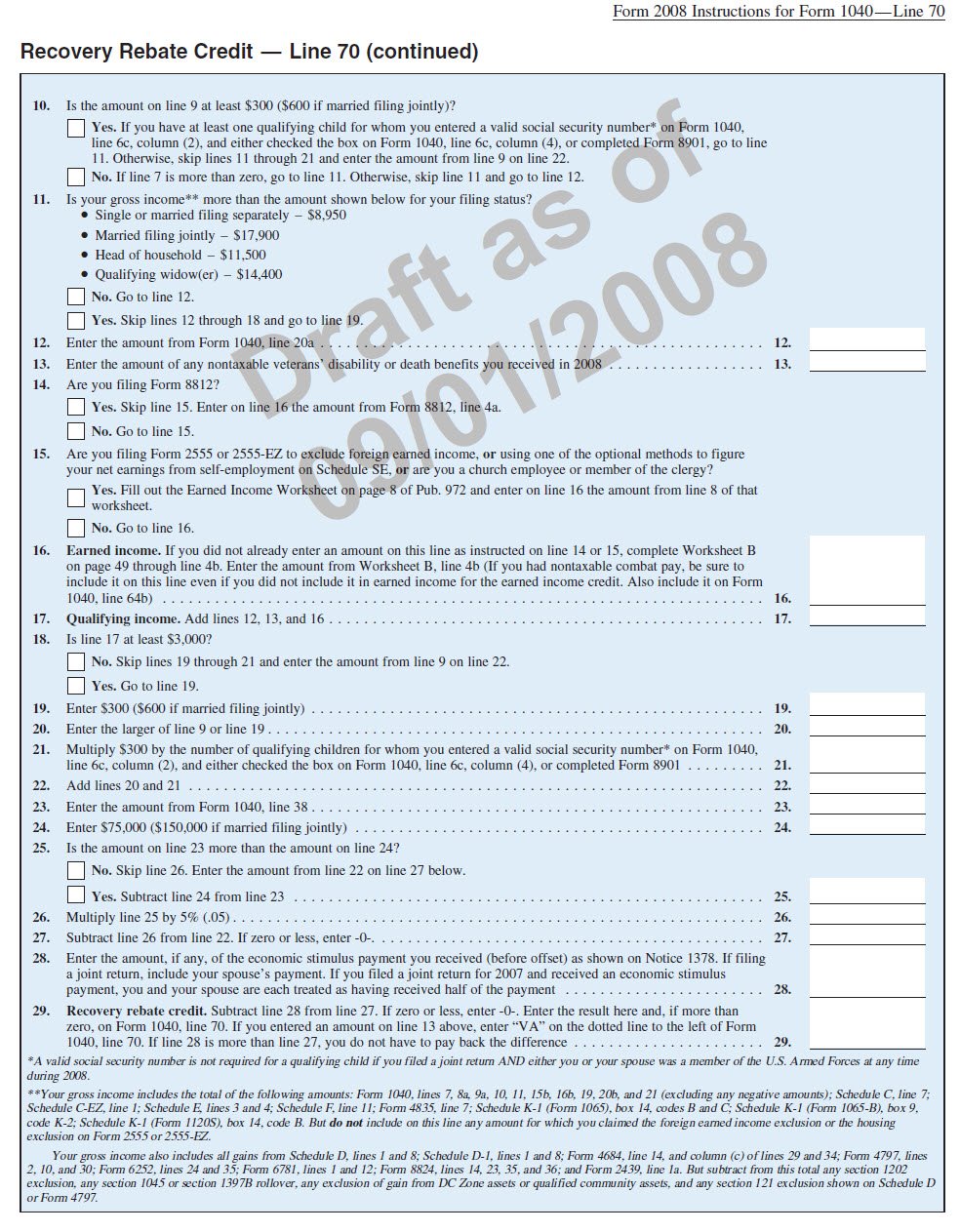

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-a...

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

How Do I Claim The Recovery Rebate Credit On My Ta

Taxes Recovery Rebate Credit Recovery Rebate

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Recovery Rebate Credit Worksheet 2020 Ideas 2022

1040 Line 30 Recovery Rebate Credit Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

2022 Form 1040 Line 30 Recovery Rebate Credit Recovery Rebate