In our current world of high-end consumer goods people love a good bargain. One method of gaining significant savings for your purchases is through Pennsylvania Corporate Tax Return Forms. The use of Pennsylvania Corporate Tax Return Forms is a method that retailers and manufacturers use to give customers a part discount on purchases they made after they've done so. In this article, we'll go deeper into the realm of Pennsylvania Corporate Tax Return Forms. We will explore what they are about, how they work, and how you can maximise your savings using these low-cost incentives.

Get Latest Pennsylvania Corporate Tax Return Form Below

Pennsylvania Corporate Tax Return Form

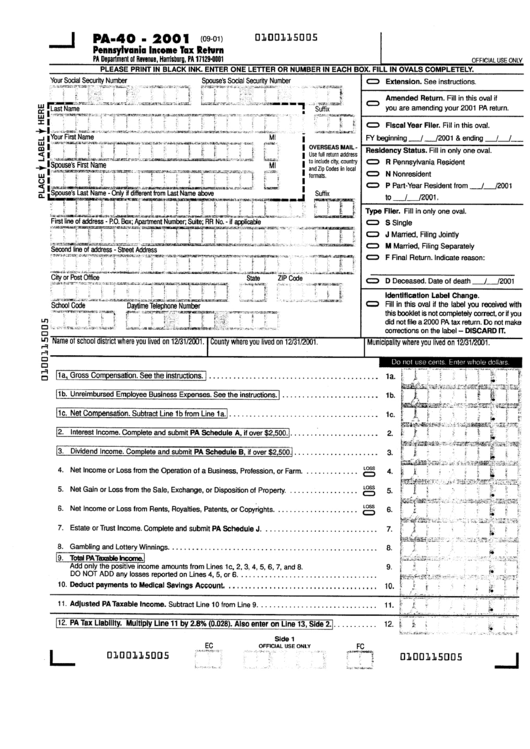

Pennsylvania Corporate Tax Return Form -

How do I find the instructions for the PA Corporate Tax Report RCT 101 The instruction book for the PA Corporate Tax Report is the REV 1200 and can be

Inactive PA Corporate Net Income Tax Report and RCT 128C Report of Change in PA Corporate Net Income Tax Report have an updated look for 2022 tax year 2

A Pennsylvania Corporate Tax Return Form as it is understood in its simplest type, is a reimbursement to a buyer after they've bought a product or service. It's a very effective technique employed by companies to attract buyers, increase sales or promote a specific product.

Types of Pennsylvania Corporate Tax Return Form

Form 2555 Ez Fillable Printable Forms Free Online

Form 2555 Ez Fillable Printable Forms Free Online

Corporation Taxes Attention Corporate Specialty Tax Account Holders Online filing and payment options for most Corporate Specialty Tax account holders will

A federal S corporation which has not elected not to be taxed as a Pennsylvania S corporation PA S corporation must file a PA 20S PA 65 Information

Cash Pennsylvania Corporate Tax Return Form

Cash Pennsylvania Corporate Tax Return Form is the most basic type of Pennsylvania Corporate Tax Return Form. The customer receives a particular amount of money back upon purchasing a product. These are usually used for the most expensive products like electronics or appliances.

Mail-In Pennsylvania Corporate Tax Return Form

Mail-in Pennsylvania Corporate Tax Return Form require that customers present documents of purchase to claim the refund. They're somewhat more involved, however they can yield huge savings.

Instant Pennsylvania Corporate Tax Return Form

Instant Pennsylvania Corporate Tax Return Form are applied right at the point of sale, which reduces the price instantly. Customers don't have to wait for savings in this manner.

How Pennsylvania Corporate Tax Return Form Work

Will And Just Like That Return For Season 2 Renewal Chances Explored

Will And Just Like That Return For Season 2 Renewal Chances Explored

The form is located on the department s website at www revenue pa gov RCT 106 INSERT SHEET APPORTIONMENT SCHEDULE FOR PA CORPORATE NET

The Pennsylvania Corporate Tax Return Form Process

The process typically comprises a handful of simple steps:

-

Buy the product: Firstly, you purchase the item the way you normally do.

-

Complete this Pennsylvania Corporate Tax Return Form request form. You'll need to provide some data, such as your name, address and the purchase details, in order in order to make a claim for your Pennsylvania Corporate Tax Return Form.

-

In order to submit the Pennsylvania Corporate Tax Return Form: Depending on the nature of Pennsylvania Corporate Tax Return Form you may have to either mail in a request form or send it via the internet.

-

Wait until the company approves: The company will evaluate your claim to verify that it is compliant with the Pennsylvania Corporate Tax Return Form's terms and conditions.

-

Redeem your Pennsylvania Corporate Tax Return Form After you've been approved, the amount you receive will be whether by check, prepaid card, or any other method as specified by the offer.

Pros and Cons of Pennsylvania Corporate Tax Return Form

Advantages

-

Cost Savings Pennsylvania Corporate Tax Return Form are a great way to decrease the price for products.

-

Promotional Deals These deals encourage customers to test new products or brands.

-

Boost Sales The benefits of a Pennsylvania Corporate Tax Return Form can improve the sales of a business and increase its market share.

Disadvantages

-

Complexity The mail-in Pennsylvania Corporate Tax Return Form particularly, can be cumbersome and tedious.

-

Days of expiration Many Pennsylvania Corporate Tax Return Form are subject to strict time limits for submission.

-

Risk of Not Being Paid Some customers might not be able to receive their Pennsylvania Corporate Tax Return Form if they don't adhere to the requirements precisely.

Download Pennsylvania Corporate Tax Return Form

[su_button url="https://printablerebateform.net/?s=Pennsylvania Corporate Tax Return Form" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Pennsylvania Corporate Tax Return Form[/su_button]

FAQs

1. Are Pennsylvania Corporate Tax Return Form equivalent to discounts? No, Pennsylvania Corporate Tax Return Form are an amount of money that is refunded after the purchase, and discounts are a reduction of your purchase cost at moment of sale.

2. Are there any Pennsylvania Corporate Tax Return Form that I can use on the same item This is dependent on conditions and conditions of Pennsylvania Corporate Tax Return Form offered and product's quality and eligibility. Some companies may allow it, and some don't.

3. How long does it take to receive an Pennsylvania Corporate Tax Return Form? The duration differs, but could be from several weeks to few months to get your Pennsylvania Corporate Tax Return Form.

4. Do I have to pay taxes of Pennsylvania Corporate Tax Return Form montants? most cases, Pennsylvania Corporate Tax Return Form amounts are not considered taxable income.

5. Should I be able to trust Pennsylvania Corporate Tax Return Form offers from lesser-known brands Do I need to conduct a thorough research to ensure that the name giving the Pennsylvania Corporate Tax Return Form is credible prior to making purchases.

Canada T2 Corporation Income Tax Return 2020 2022 Fill And Sign

Corporate Tax Return OLY PK NTN And Company Registration

Check more sample of Pennsylvania Corporate Tax Return Form below

Form Pa 40 Pennsylvania Income Tax Return 2001 Printable Pdf Download

Online Tax Return Form BKG Book Keeping Accounting Services

Form Published For Annual Tax Return Of VAT Individual Income Tax And

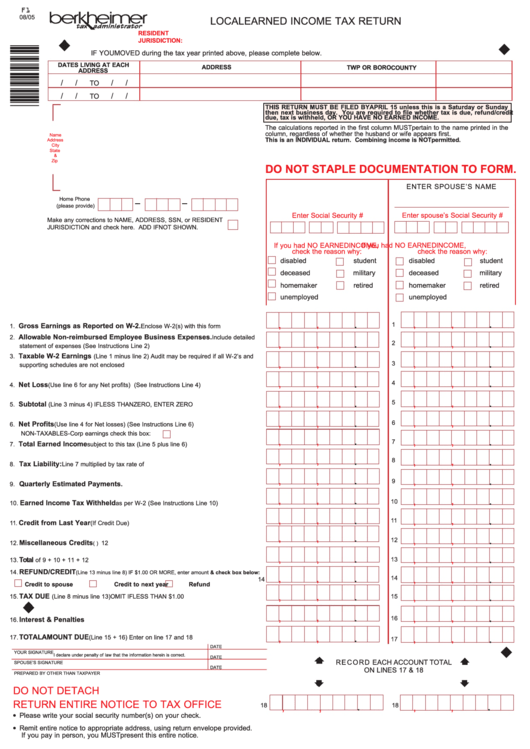

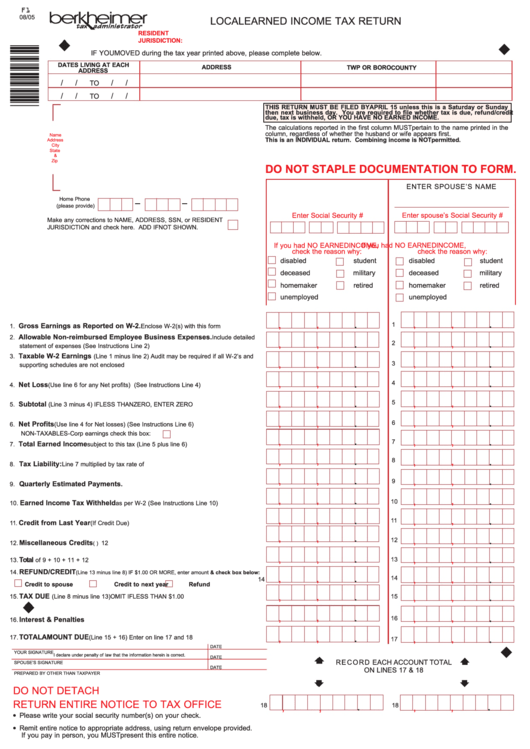

Form F1 Local Earned Income Tax Return Pennsylvania Printable Pdf

Income Statement High Resolution Stock Photography And Images Alamy

PR 482 0 2018 2022 Fill Out Tax Template Online US Legal Forms

https://www.revenue.pa.gov/FormsandPublications/...

Inactive PA Corporate Net Income Tax Report and RCT 128C Report of Change in PA Corporate Net Income Tax Report have an updated look for 2022 tax year 2

https://www.revenue.pa.gov/FormsandPublications/...

SCHEDULE A 1 Apportionment Schedule For Capital Stock Foreign Franchise Tax Include Form RCT 102 RCT 105 or RCT 106 SCHEDULE C 1 Apportionment Schedule For

Inactive PA Corporate Net Income Tax Report and RCT 128C Report of Change in PA Corporate Net Income Tax Report have an updated look for 2022 tax year 2

SCHEDULE A 1 Apportionment Schedule For Capital Stock Foreign Franchise Tax Include Form RCT 102 RCT 105 or RCT 106 SCHEDULE C 1 Apportionment Schedule For

Form F1 Local Earned Income Tax Return Pennsylvania Printable Pdf

Online Tax Return Form BKG Book Keeping Accounting Services

Income Statement High Resolution Stock Photography And Images Alamy

PR 482 0 2018 2022 Fill Out Tax Template Online US Legal Forms

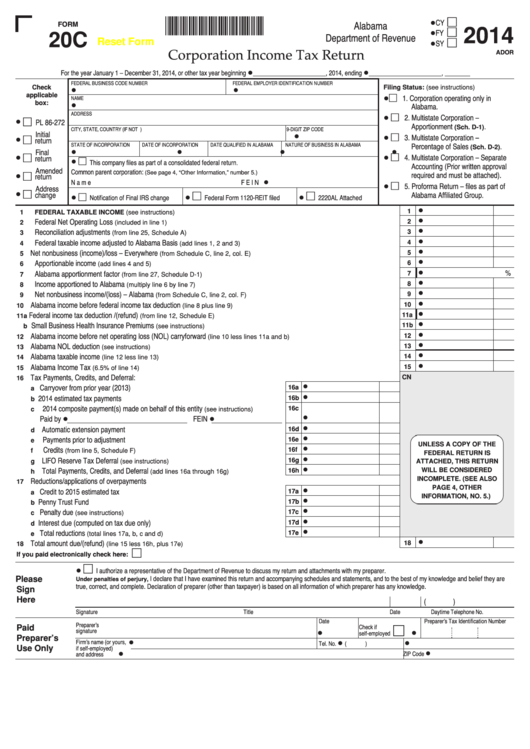

Fillable Form 20c Corporation Income Tax Return 2014 Printable Pdf

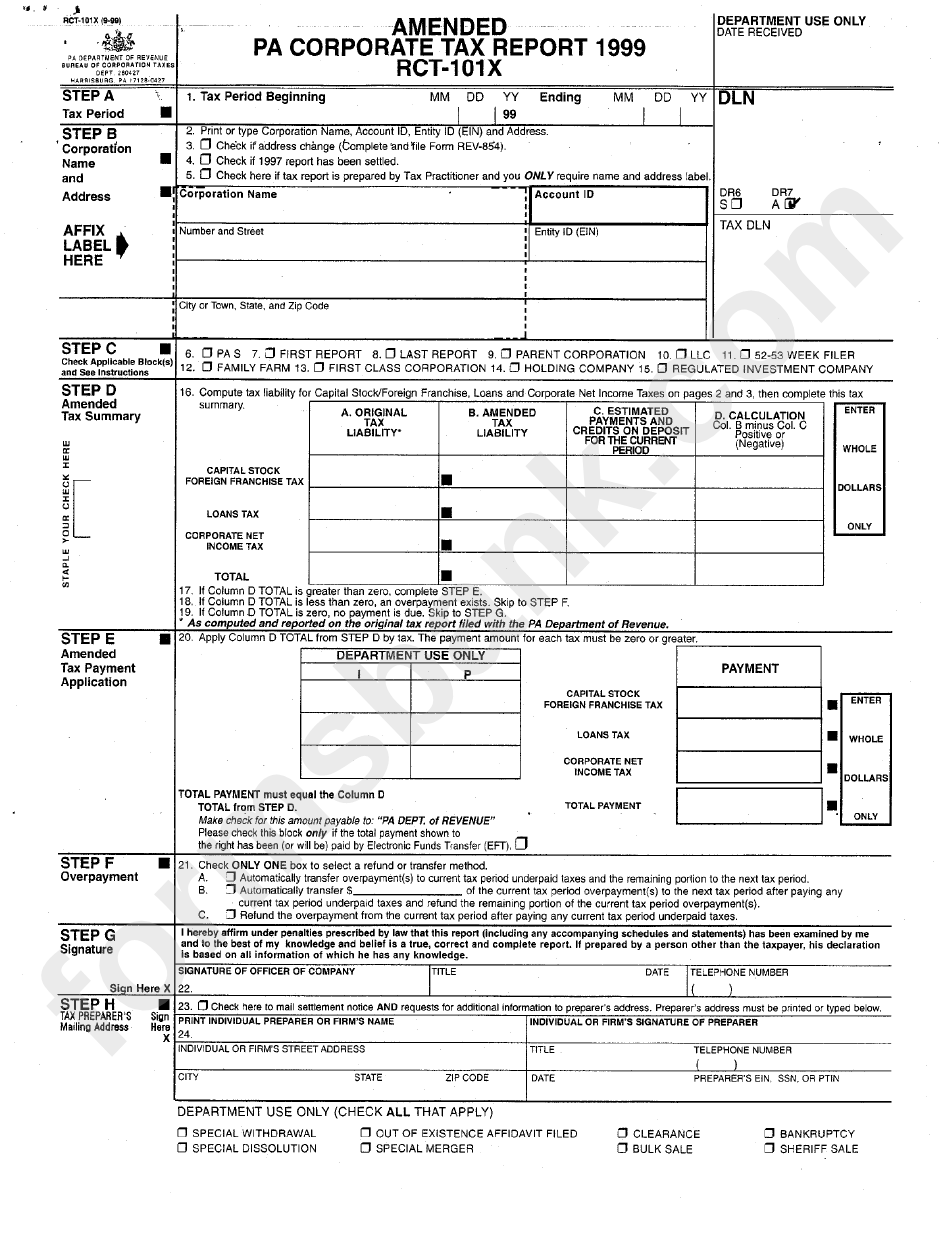

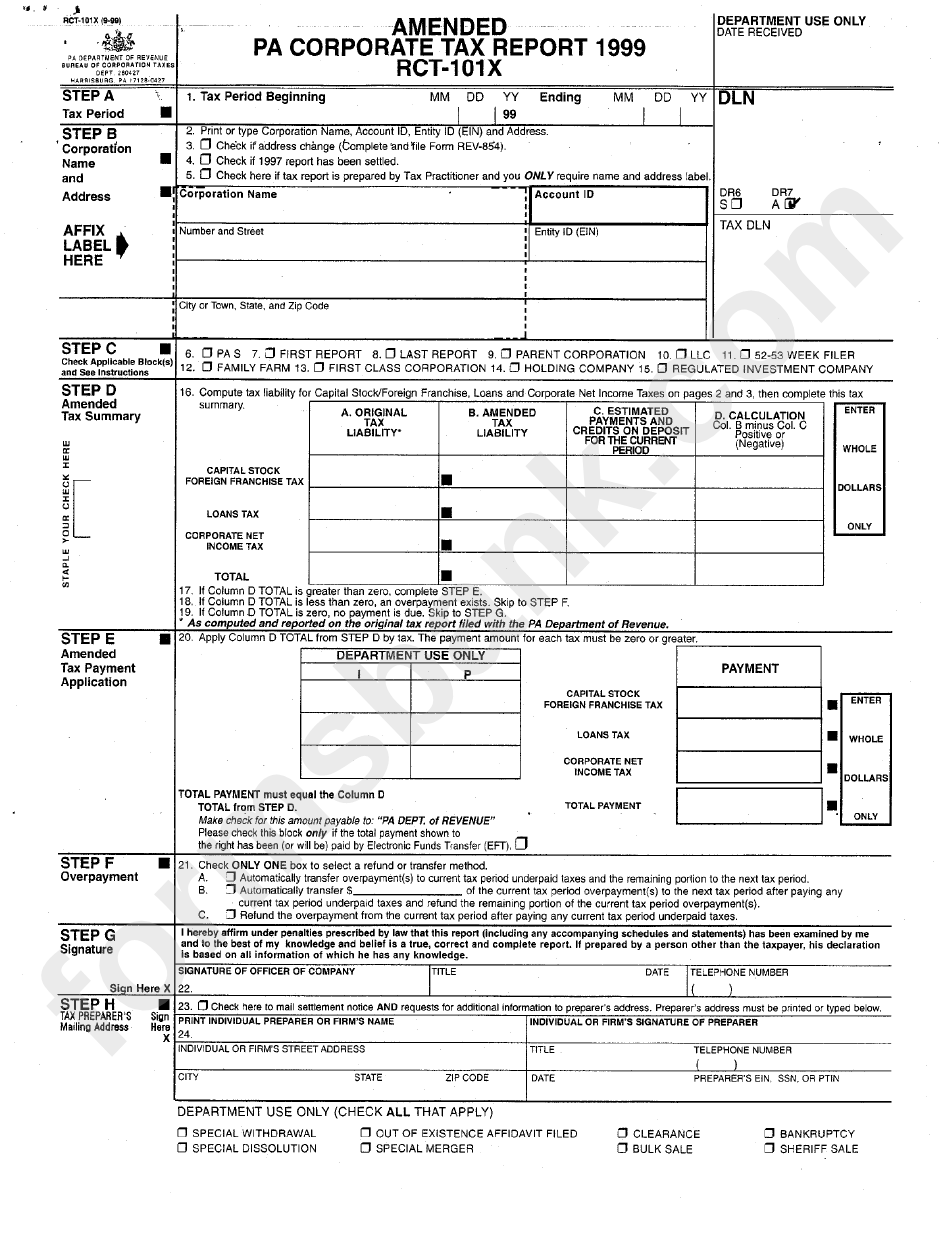

Form Rct 101x Amended Pa Corporate Tax Report 1999 Printable Pdf

Form Rct 101x Amended Pa Corporate Tax Report 1999 Printable Pdf

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey