In today's world of consumerism everyone enjoys a good deal. One way to make substantial savings on your purchases is by using Pa State Tax Return Statuss. Pa State Tax Return Statuss are a method of marketing that retailers and manufacturers use in order to offer customers a small refund on purchases made after they have created them. In this article, we will look into the world of Pa State Tax Return Statuss, examining the nature of them, how they work, and how you can maximize your savings through these cost-effective incentives.

Get Latest Pa State Tax Return Status Below

Pa State Tax Return Status

Pa State Tax Return Status -

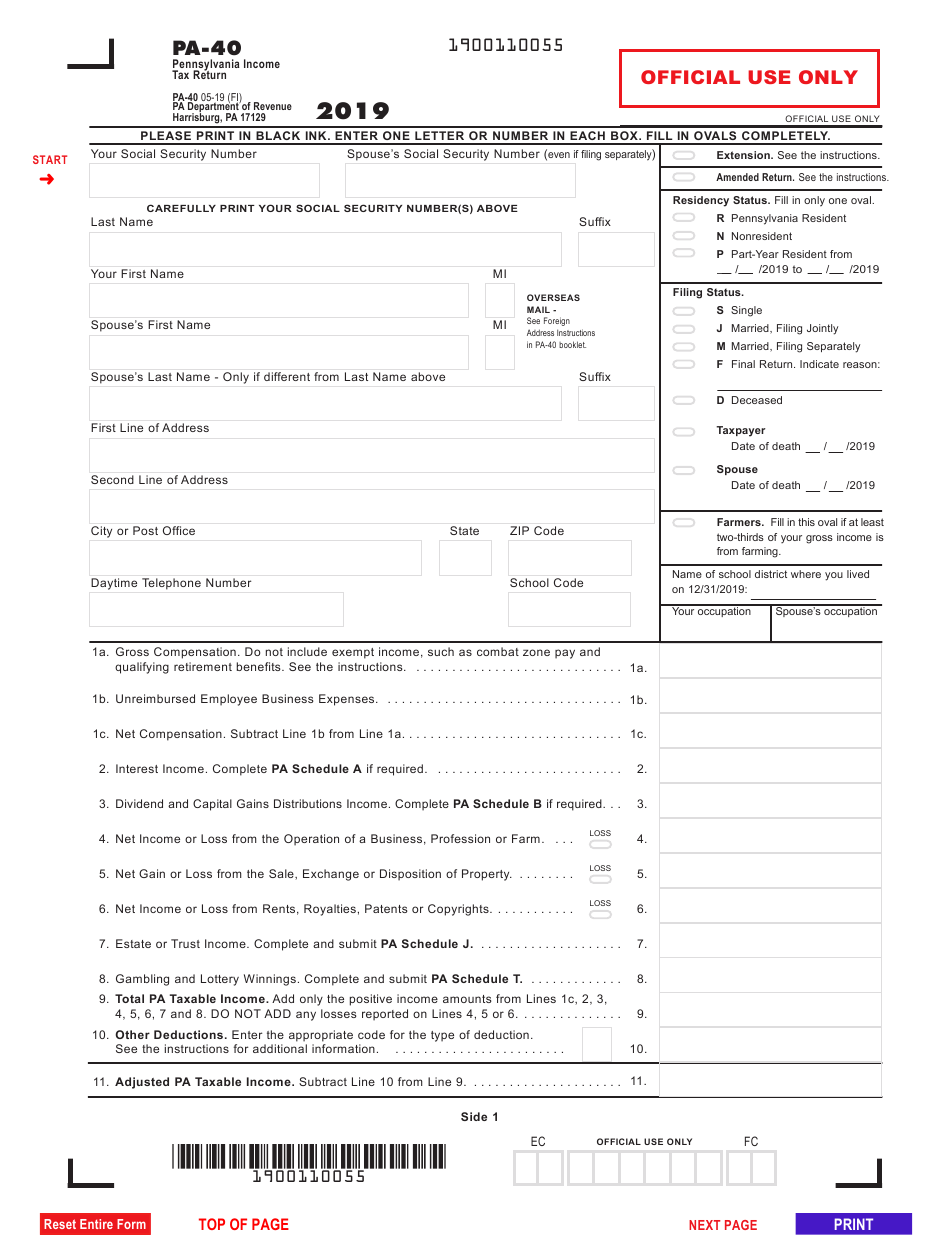

File My Taxes PA e File Where s My Income Tax Refund myPATH Make a Payment Property Tax Rent Rebate Status File Your 2023 PA 40 Customer Service Instructional Videos Where s My Income Tax Refund myPATH Make a Payment Property Tax Rent Rebate Status File Your 2023 PA 40

Features myPATH offers to all filers include The ability to view detailed Statement of Accounts for personal income tax Verifying 1099 amounts changing 1099 delivery preferences and viewing complete 1099s File Your PA Personal Income Tax Return Online For Free With myPATH Fact Sheet DPO 86

A Pa State Tax Return Status at its most basic model, refers to a partial refund given to a client after they've bought a product or service. This is a potent tool utilized by businesses to attract customers, increase sales, or promote a specific product.

Types of Pa State Tax Return Status

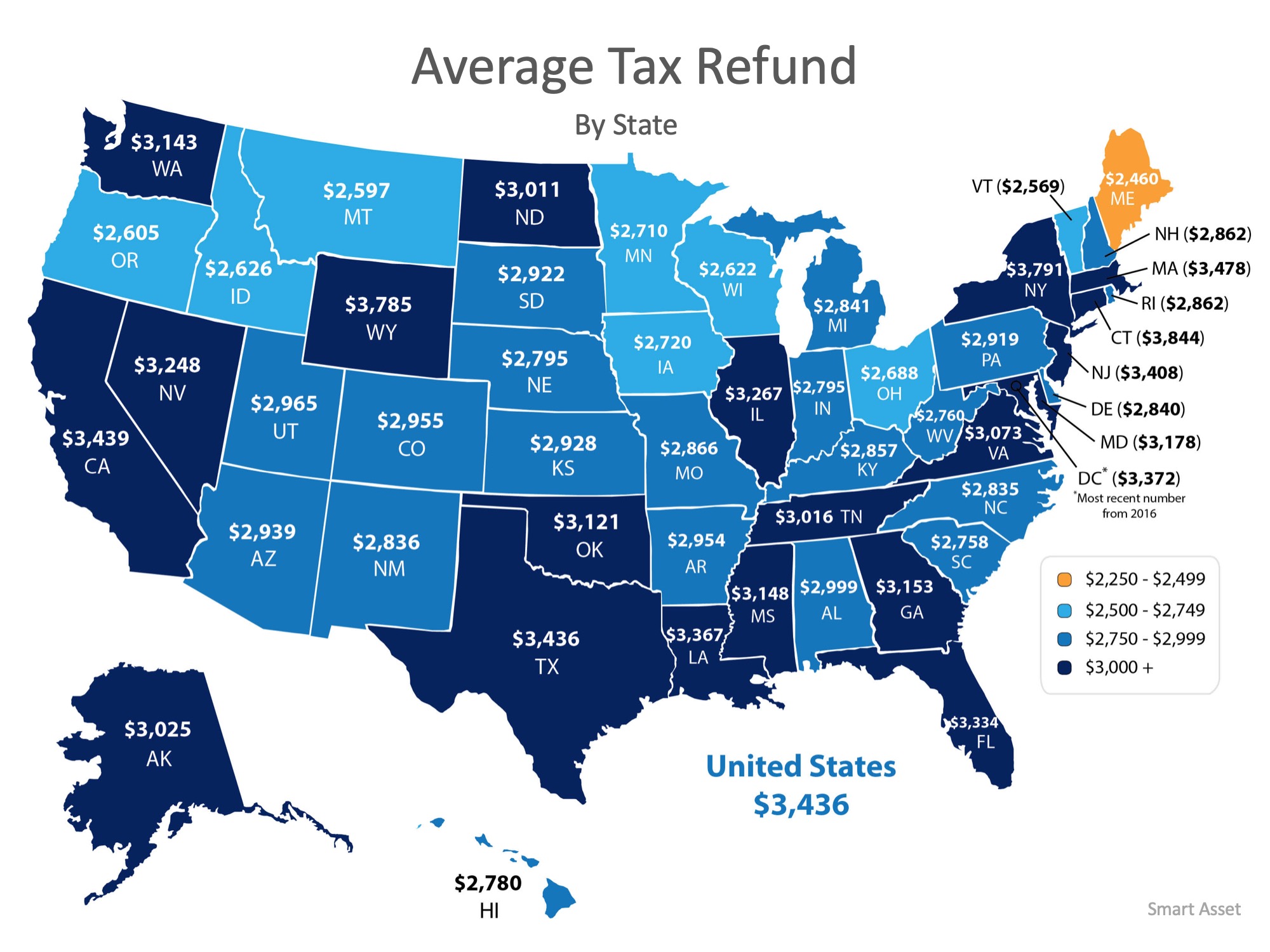

Here s The Average IRS Tax Refund Amount By State GOBankingRates

Here s The Average IRS Tax Refund Amount By State GOBankingRates

Pennsylvanians have the option to submit PA Personal Income Tax returns online with the Department of Revenue s myPATH system Filing online leads to fast processing easy direct deposit options and automatic calculators

How do I track my Pennsylvania tax refund TurboTax HelpIntuit How do I track my Pennsylvania tax refund SOLVED by TurboTax 2373 Updated December 19 2023 Statement from the Department of Revenue If you filed electronically it takes approximately 4 weeks to process your tax return

Cash Pa State Tax Return Status

Cash Pa State Tax Return Status are probably the most simple kind of Pa State Tax Return Status. The customer receives a particular amount of money in return for buying a product. This is often for large-ticket items such as electronics and appliances.

Mail-In Pa State Tax Return Status

Mail-in Pa State Tax Return Status require the customer to submit the proof of purchase in order to receive their reimbursement. They're somewhat more complicated but could provide significant savings.

Instant Pa State Tax Return Status

Instant Pa State Tax Return Status are applied at point of sale, and can reduce the price instantly. Customers don't need to wait long for savings through this kind of offer.

How Pa State Tax Return Status Work

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

MyPATH offers a free option for filing Pennsylvania personal income tax returns in addition to other tax filing options Taxpayers that choose to file their PA 40 through myPATH do not need to have a myPATH profile to do so Filing is a non logged in feature that can be used by most taxpayers

The Pa State Tax Return Status Process

The process typically comprises a number of easy steps:

-

Purchase the product: First you purchase the item like you would normally.

-

Fill in this Pa State Tax Return Status Form: To claim the Pa State Tax Return Status you'll have to provide some data including your name, address and information about the purchase to claim your Pa State Tax Return Status.

-

Submit the Pa State Tax Return Status: Depending on the kind of Pa State Tax Return Status you could be required to either mail in a request form or submit it online.

-

Wait until the company approves: The company will examine your application and ensure that it's compliant with refund's conditions and terms.

-

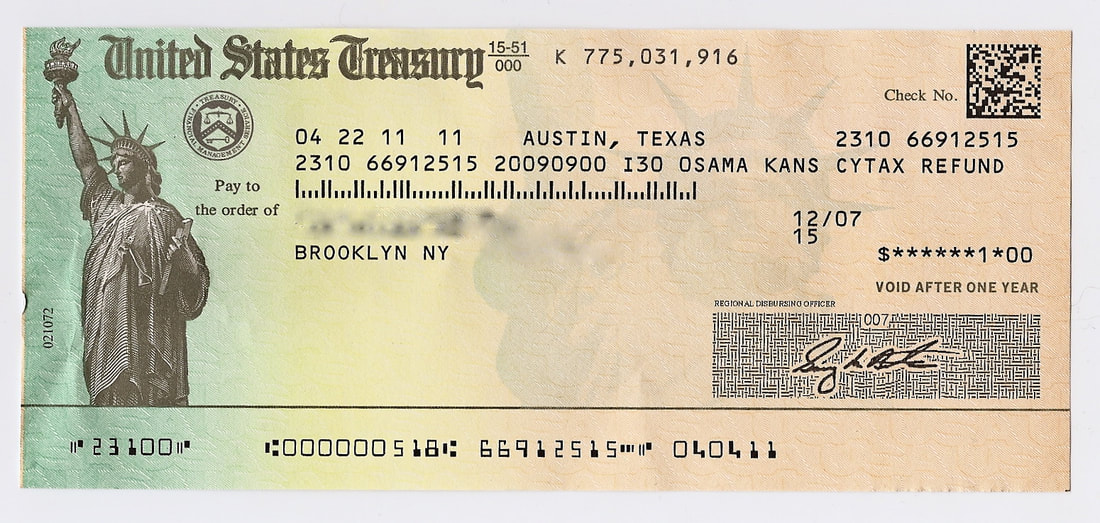

Get your Pa State Tax Return Status After approval, you'll receive your money back, whether by check, prepaid card, or any other option as per the terms of the offer.

Pros and Cons of Pa State Tax Return Status

Advantages

-

Cost savings The use of Pa State Tax Return Status can greatly decrease the price for an item.

-

Promotional Offers These promotions encourage consumers to try new products or brands.

-

boost sales The benefits of a Pa State Tax Return Status can improve the sales of a business and increase its market share.

Disadvantages

-

Complexity: Mail-in Pa State Tax Return Status, in particular difficult and demanding.

-

Day of Expiration A majority of Pa State Tax Return Status have very strict deadlines for filing.

-

Risk of not receiving payment: Some customers may lose their Pa State Tax Return Status in the event that they don't adhere to the requirements exactly.

Download Pa State Tax Return Status

[su_button url="https://printablerebateform.net/?s=Pa State Tax Return Status" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Pa State Tax Return Status[/su_button]

FAQs

1. Are Pa State Tax Return Status the same as discounts? Not necessarily, as Pa State Tax Return Status are one-third of the amount refunded following purchase, while discounts lower the purchase price at the time of sale.

2. Are there multiple Pa State Tax Return Status I can get on the same product What is the best way to do it? It's contingent on conditions for the Pa State Tax Return Status deals and product's suitability. Certain companies might allow it, but others won't.

3. How long does it take to receive the Pa State Tax Return Status? The length of time will differ, but can range from several weeks to couple of months for you to receive your Pa State Tax Return Status.

4. Do I need to pay tax for Pa State Tax Return Status amount? the majority of situations, Pa State Tax Return Status amounts are not considered taxable income.

5. Can I trust Pa State Tax Return Status offers from brands that aren't well-known It's crucial to research and make sure that the company giving the Pa State Tax Return Status has a good reputation prior to making an purchase.

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Pennsylvania State Withholding Form 2023 Printable Forms Free Online

Check more sample of Pa State Tax Return Status below

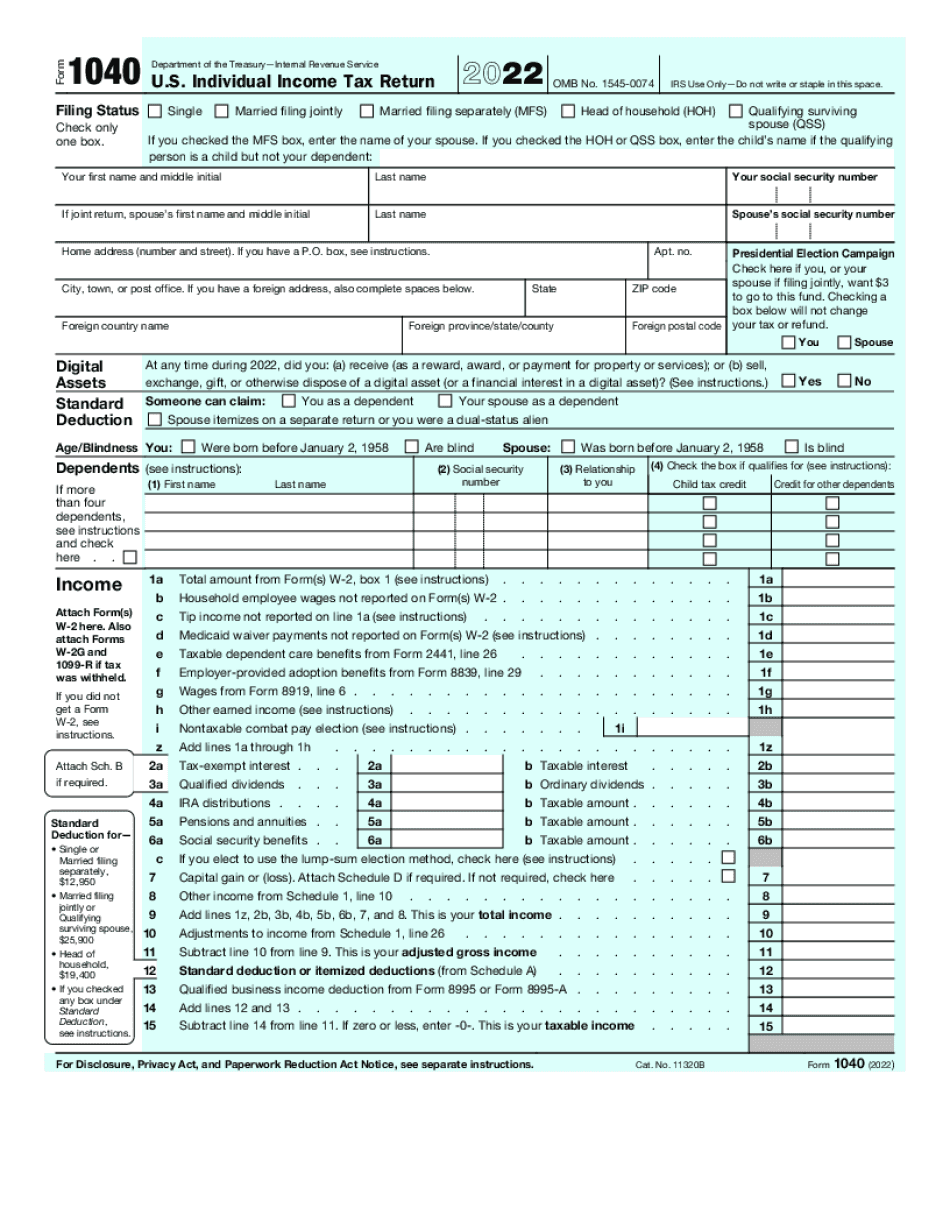

Form 1040a 2023 Fill Online Printable Fillable Blank

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Pa State Tax Forms Printable Printable Form 2024

Irs Tax Return Status Sdirecthac

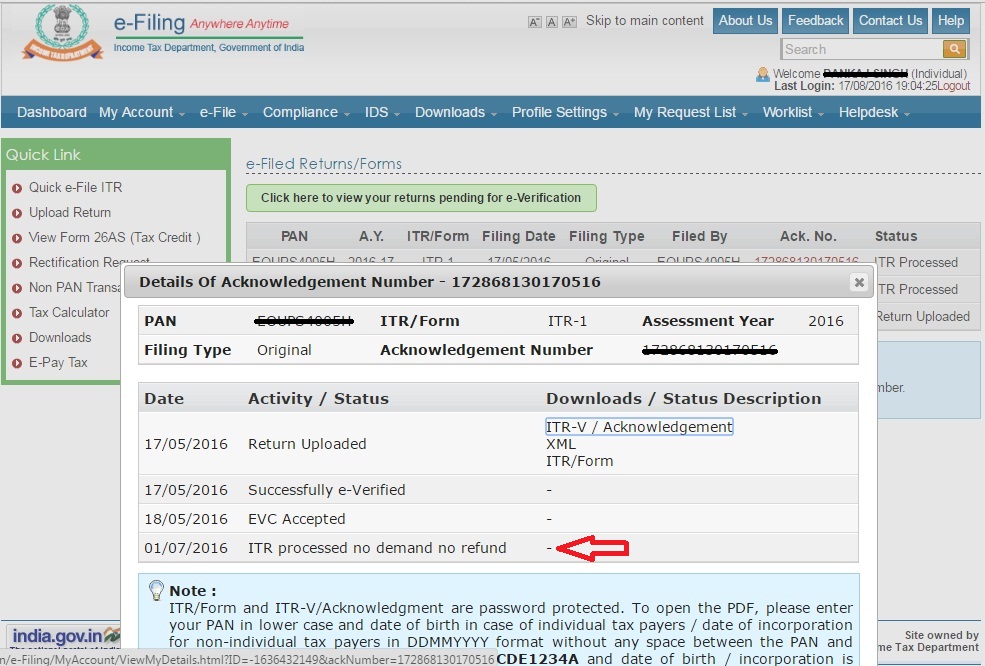

Guide To Check Income Tax Return Status

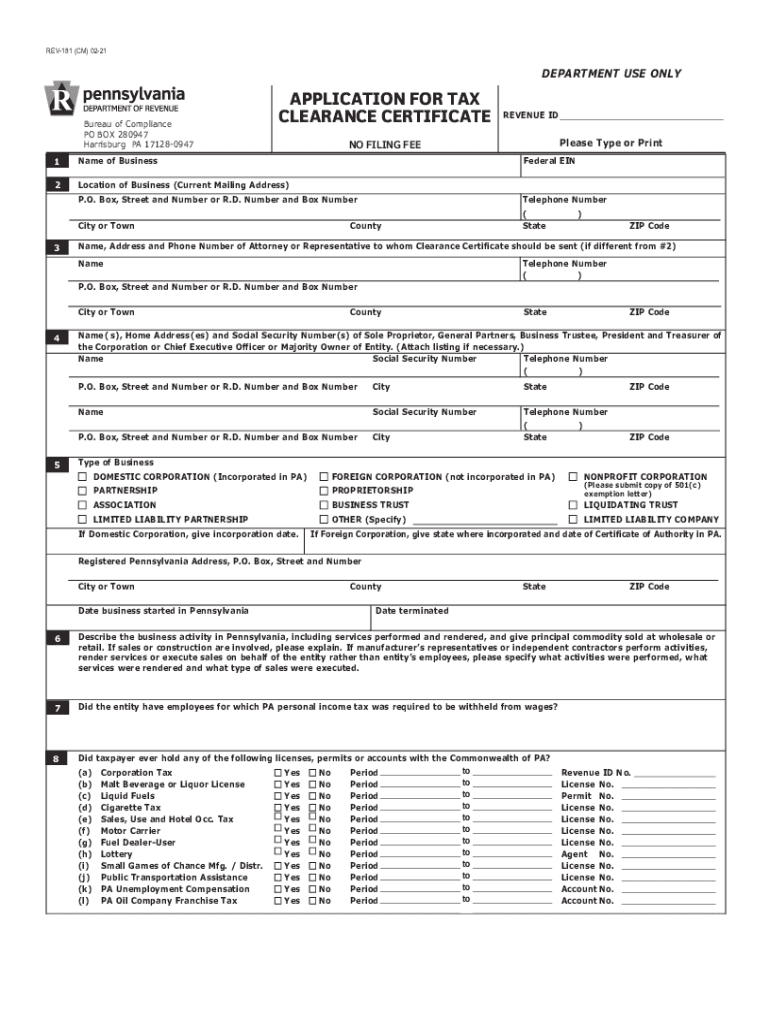

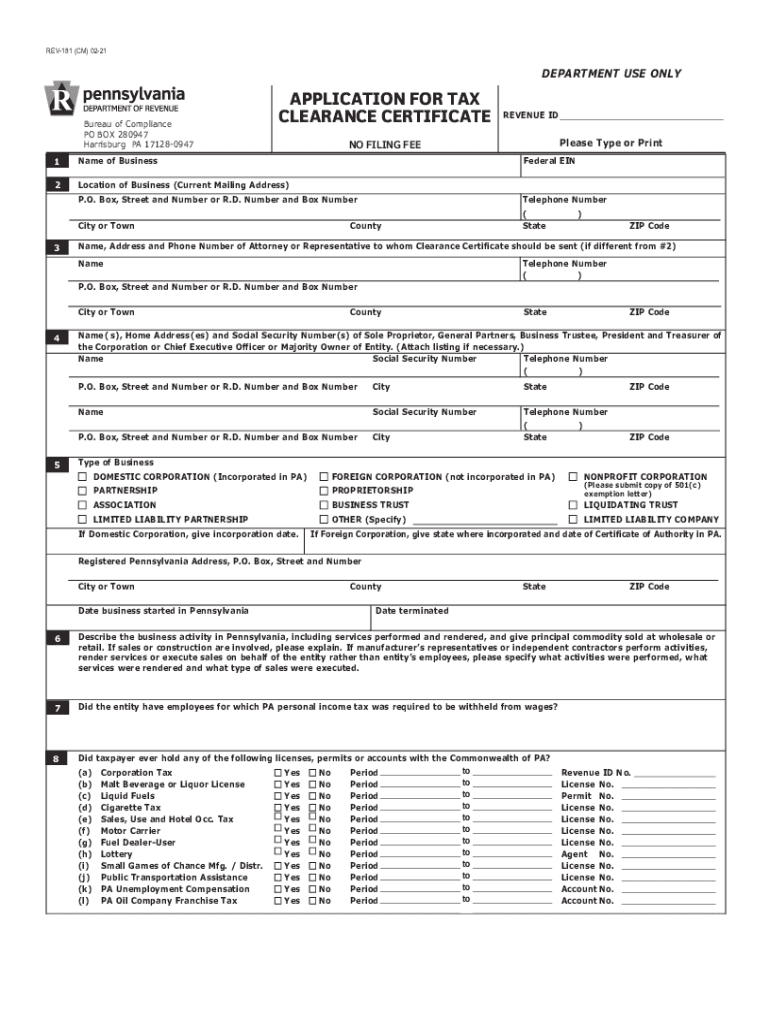

PA DoR REV 181 2021 2022 Fill Out Tax Template Online US Legal Forms

https://www.revenue.pa.gov/OnlineServices/mypath/...

Features myPATH offers to all filers include The ability to view detailed Statement of Accounts for personal income tax Verifying 1099 amounts changing 1099 delivery preferences and viewing complete 1099s File Your PA Personal Income Tax Return Online For Free With myPATH Fact Sheet DPO 86

https://www.revenue.pa.gov/OnlineServices/mypath

Make return payments estimated tax payments and extension payments individuals fiduciaries and partnerships Submit documentation in response to certain letters File a personal income tax return Apply for a Property Tax Rent rebate Check the status of an individual refund or rebate Track payments and

Features myPATH offers to all filers include The ability to view detailed Statement of Accounts for personal income tax Verifying 1099 amounts changing 1099 delivery preferences and viewing complete 1099s File Your PA Personal Income Tax Return Online For Free With myPATH Fact Sheet DPO 86

Make return payments estimated tax payments and extension payments individuals fiduciaries and partnerships Submit documentation in response to certain letters File a personal income tax return Apply for a Property Tax Rent rebate Check the status of an individual refund or rebate Track payments and

Irs Tax Return Status Sdirecthac

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Guide To Check Income Tax Return Status

PA DoR REV 181 2021 2022 Fill Out Tax Template Online US Legal Forms

How To Check The Status Of Your Tax Refund Online Mental Floss

Where Is My Refund 2019 How Long Does It Take IRS To Process Taxes

Where Is My Refund 2019 How Long Does It Take IRS To Process Taxes

How To Check Income tax Return Status MyITreturn Help Center