Today, in a world that is driven by the consumer we all love a good bargain. One of the ways to enjoy substantial savings on your purchases is by using Illinois Tax Return Forms. The use of Illinois Tax Return Forms is a method used by manufacturers and retailers for offering customers a percentage return on their purchases once they have bought them. In this article, we will explore the world of Illinois Tax Return Forms. We'll discuss the nature of them as well as how they work and ways to maximize your savings using these low-cost incentives.

Get Latest Illinois Tax Return Form Below

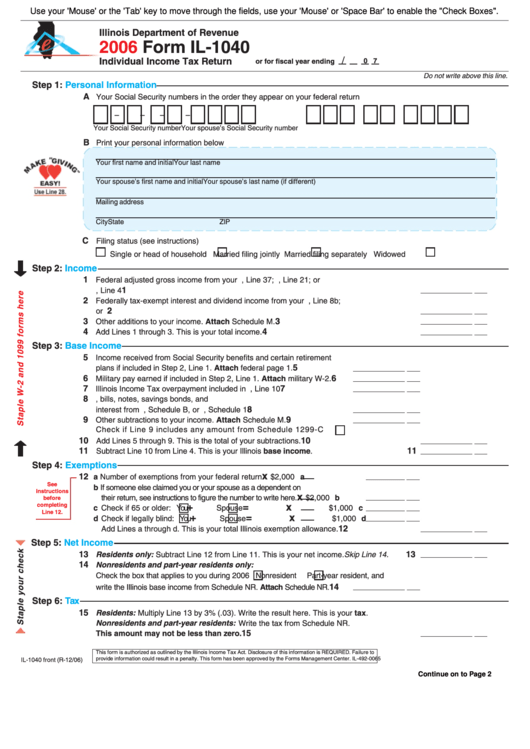

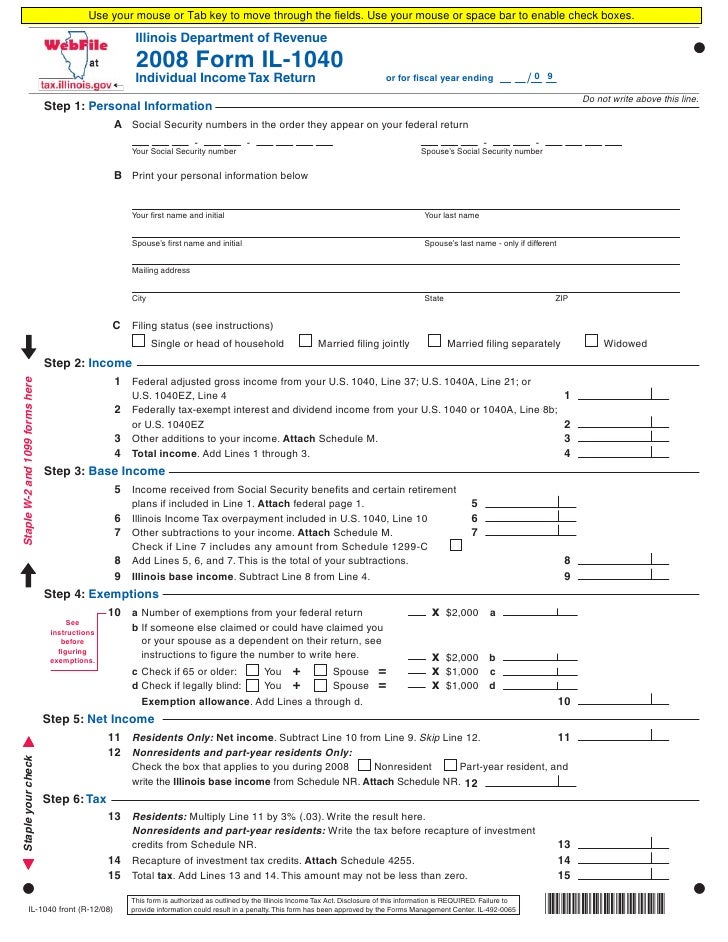

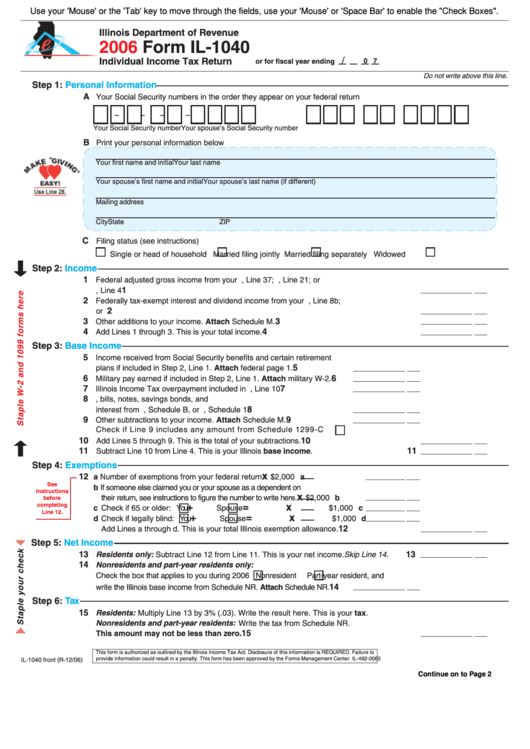

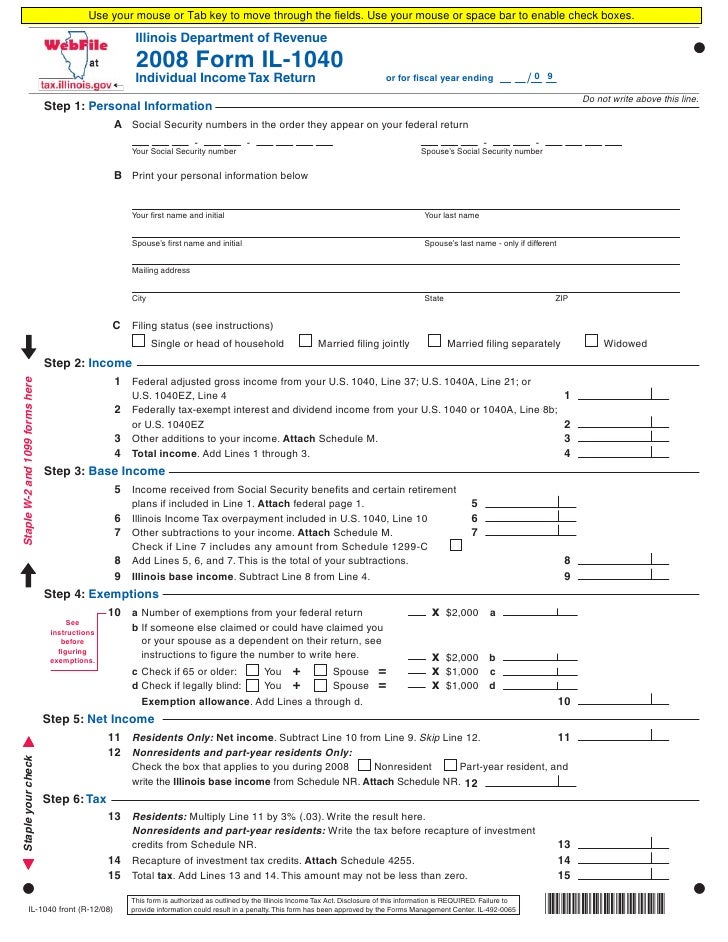

Illinois Tax Return Form

Illinois Tax Return Form -

Trending Forms 2023 IL 1040 Individual Income Tax Return 2023 IL 1040 Instructions 2023 Schedule IL E EIC Illinois Exemption and Earned Income Credit 2023 Schedule

Individual Income Tax Return IL 1040 X Instructions html English pdf Espa ol pdf Amended Individual Income Tax Return IL 1040 ES 2024 Estimated Income Tax

A Illinois Tax Return Form is, in its most basic form, is a payment to a consumer after having purchased a item or service. It's an effective way that businesses use to draw customers, increase sales and to promote certain products.

Types of Illinois Tax Return Form

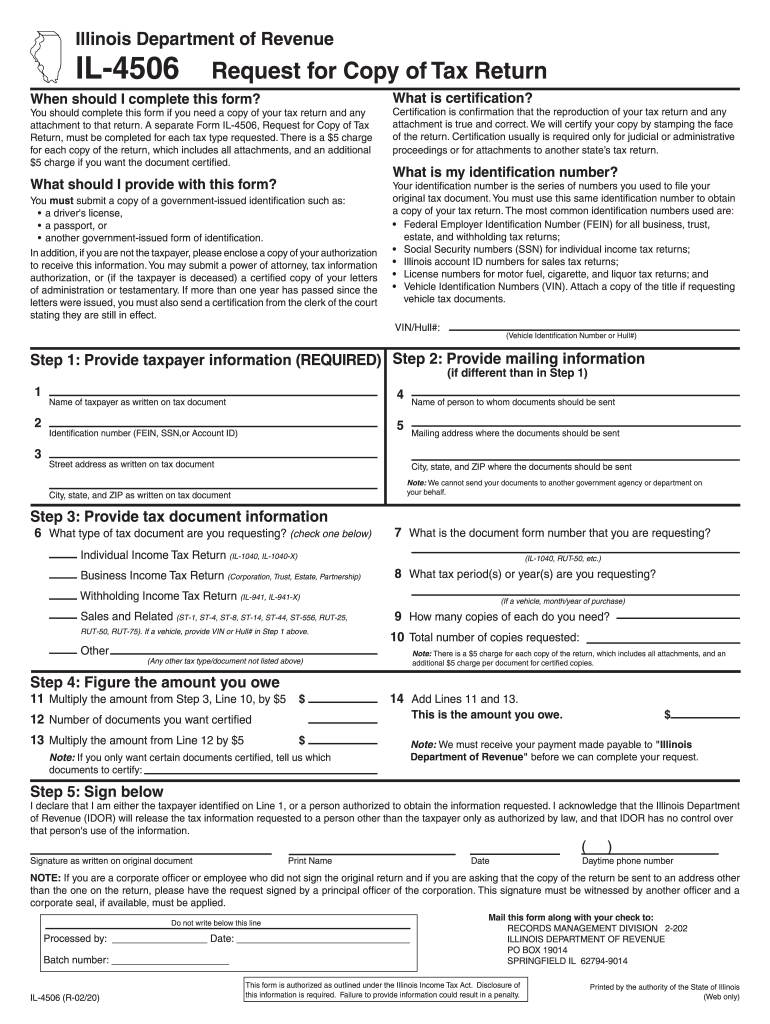

Fill Free Fillable IL 4506 Request For Copy Of Tax Return Illinois

Fill Free Fillable IL 4506 Request For Copy Of Tax Return Illinois

Form IL 1040 Due Date The due date for filing your 2023 Form IL 1040 and paying any tax you owe is April 15 2024 Income Tax Rate The Illinois income tax rate is 4 95 percent

The most common Illinois income tax form is the IL 1040 This form is used by Illinois residents who file an individual income tax return Here is a comprehensive list of

Cash Illinois Tax Return Form

Cash Illinois Tax Return Form are the most straightforward type of Illinois Tax Return Form. Customers receive a certain sum of money back when purchasing a item. This is often for large-ticket items such as electronics and appliances.

Mail-In Illinois Tax Return Form

Customers who want to receive mail-in Illinois Tax Return Form must present their proof of purchase before receiving the refund. They're a little more involved, but can result in huge savings.

Instant Illinois Tax Return Form

Instant Illinois Tax Return Form apply at the place of purchase, reducing prices immediately. Customers don't have to wait around for savings through this kind of offer.

How Illinois Tax Return Form Work

How To Use Aadhaar Card For Electronic Tax Return Verification

How To Use Aadhaar Card For Electronic Tax Return Verification

Preparing to fill out Form IL 1040 includes several materials Copy of your federal income tax return Income statements W 2 and 1099 forms Tax returns filed in other

The Illinois Tax Return Form Process

The procedure usually involves a few easy steps:

-

You purchase the item: First purchase the product the way you normally do.

-

Fill out this Illinois Tax Return Form request form. You'll have to fill in some information, such as your name, address, and the purchase details, in order to receive your Illinois Tax Return Form.

-

In order to submit the Illinois Tax Return Form depending on the type of Illinois Tax Return Form you may have to submit a form by mail or send it via the internet.

-

Wait for approval: The company will scrutinize your submission for compliance with Illinois Tax Return Form's terms and conditions.

-

Enjoy your Illinois Tax Return Form After you've been approved, you'll receive the refund whether by check, prepaid card or through a different procedure specified by the deal.

Pros and Cons of Illinois Tax Return Form

Advantages

-

Cost Savings: Illinois Tax Return Form can significantly decrease the price for a product.

-

Promotional Deals Customers are enticed to try out new products or brands.

-

increase sales Illinois Tax Return Form can increase the company's sales as well as market share.

Disadvantages

-

Complexity mail-in Illinois Tax Return Form in particular the case of HTML0, can be a hassle and take a long time to complete.

-

Deadlines for Expiration Most Illinois Tax Return Form come with rigid deadlines to submit.

-

The risk of non-payment Some customers might not receive their Illinois Tax Return Form if they do not follow the rules exactly.

Download Illinois Tax Return Form

[su_button url="https://printablerebateform.net/?s=Illinois Tax Return Form" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Illinois Tax Return Form[/su_button]

FAQs

1. Are Illinois Tax Return Form the same as discounts? No, Illinois Tax Return Form are a partial refund after the purchase, whereas discounts decrease the price of the purchase at the moment of sale.

2. Do I have to use multiple Illinois Tax Return Form on the same item It is contingent on the conditions that apply to the Illinois Tax Return Form promotions and on the products suitability. Some companies will allow it, while others won't.

3. What is the time frame to receive the Illinois Tax Return Form? The period can vary, but typically it will be from several weeks to couple of months to receive your Illinois Tax Return Form.

4. Do I have to pay taxes upon Illinois Tax Return Form the amount? the majority of situations, Illinois Tax Return Form amounts are not considered to be taxable income.

5. Do I have confidence in Illinois Tax Return Form offers from brands that aren't well-known You must research and verify that the brand offering the Illinois Tax Return Form is trustworthy prior to making the purchase.

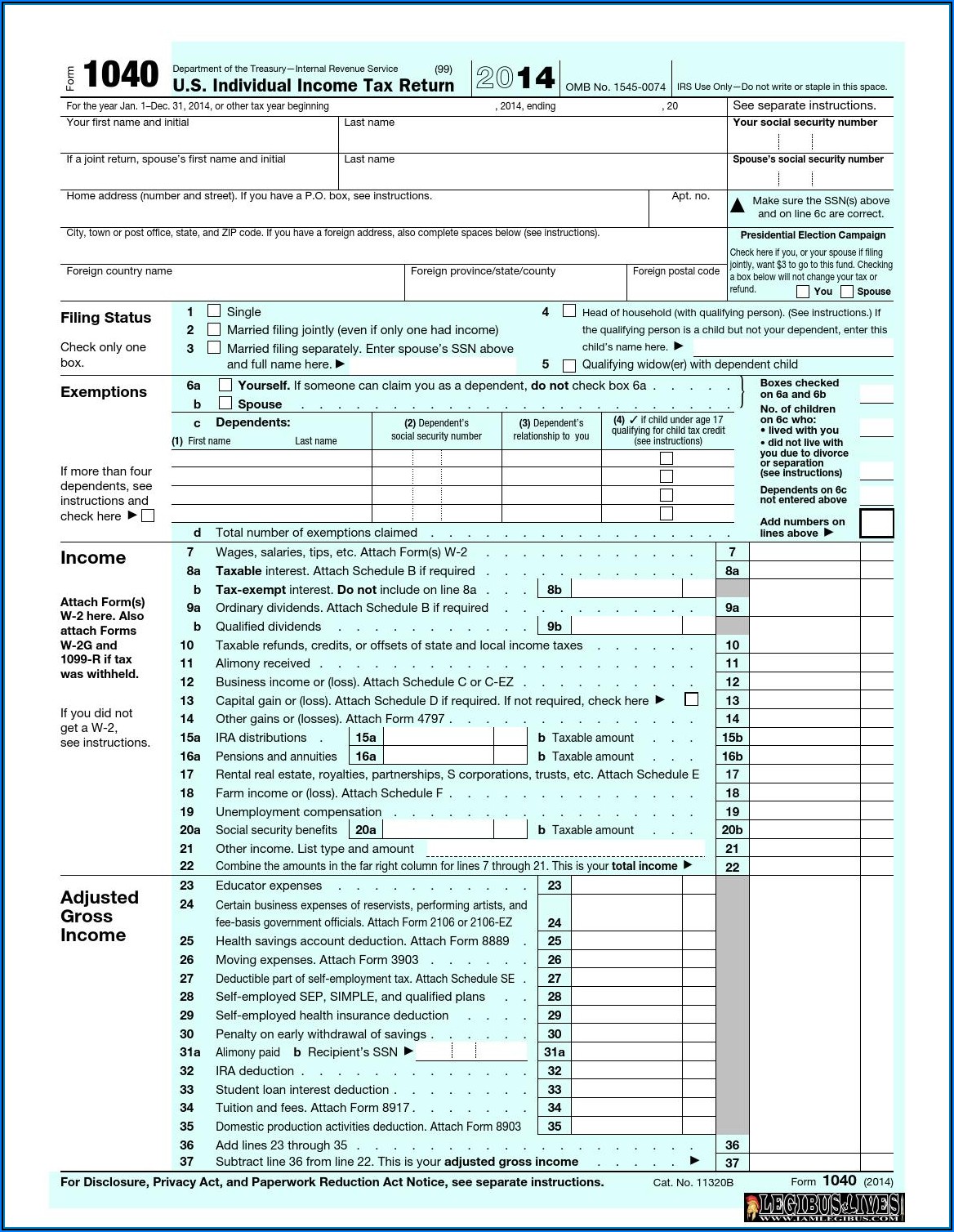

Federal Tax Return Forms 1040a Form Resume Examples 7NYA00ng9p

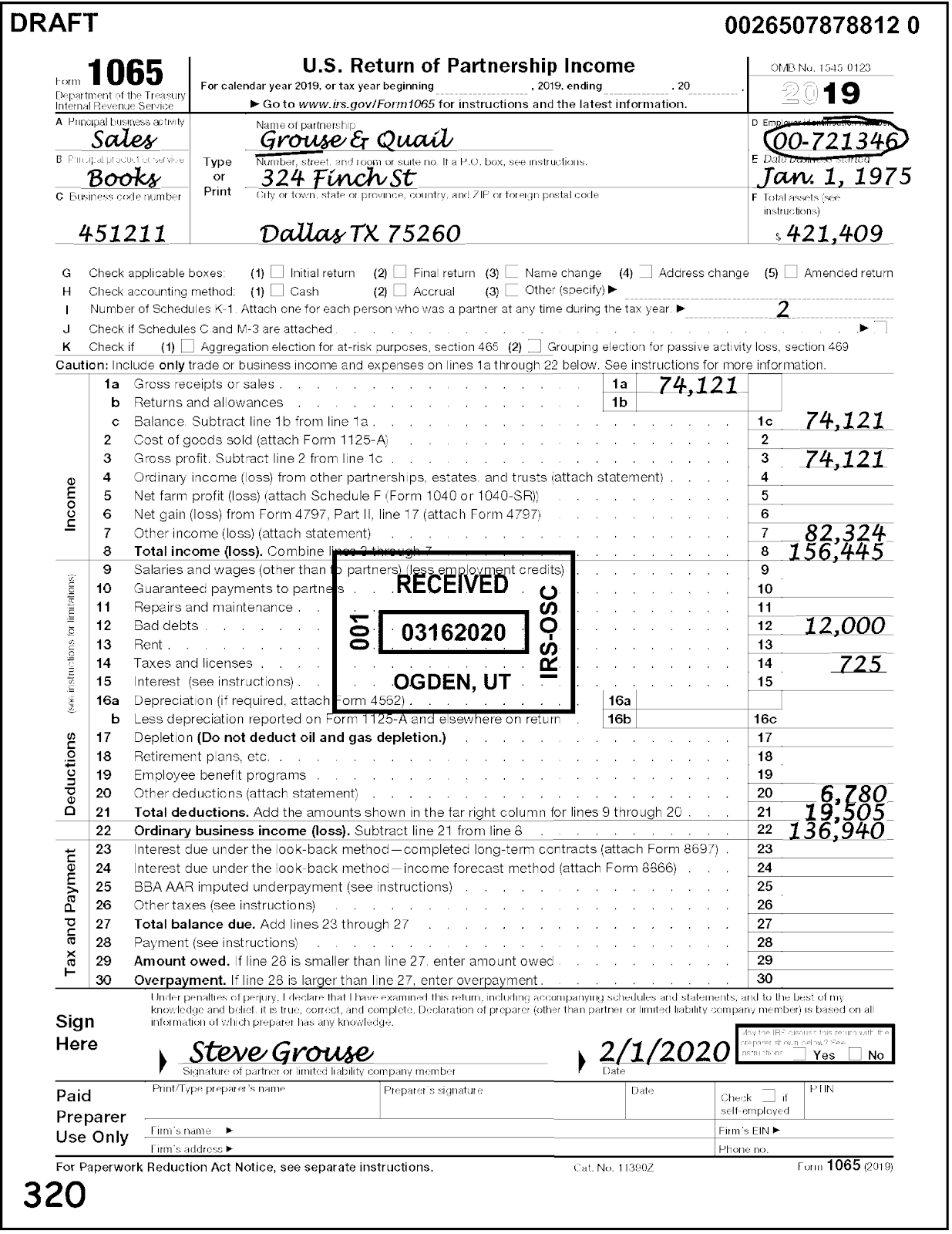

U S Tax Return For Partnership Income Form 1065 Meru Accounting

Check more sample of Illinois Tax Return Form below

Tax Return Tax Return Less Than Expected 2017

Il W 4 Form 2023 Printable Forms Free Online

Illinois Tax Forms Fill Out Sign Online DocHub

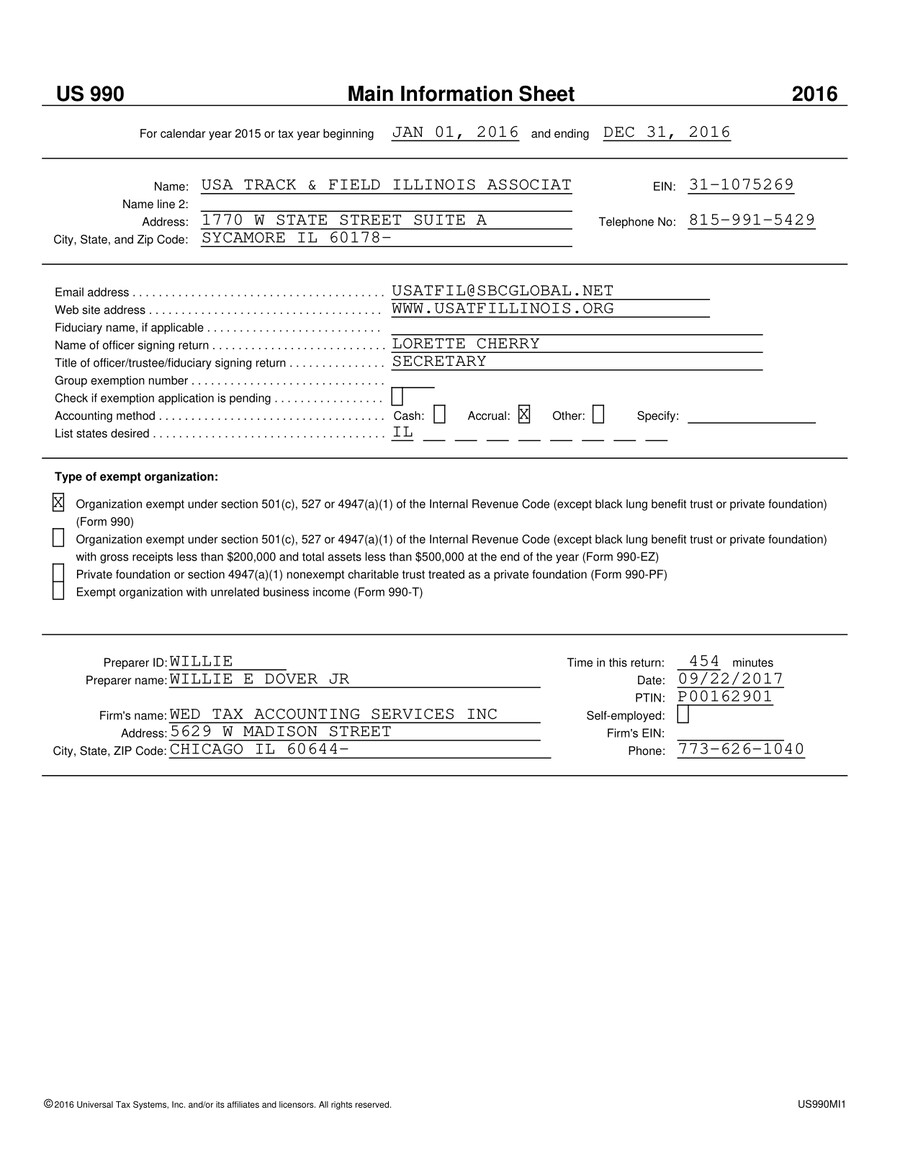

2016 USATF Illinois Tax Return By USATF Flipsnack

Illinois Individual Income Tax Return

2017 Form IL DoR IL 1040 X Fill Online Printable Fillable Blank

https:// tax.illinois.gov /forms/incometax/currentyear/individual.html

Individual Income Tax Return IL 1040 X Instructions html English pdf Espa ol pdf Amended Individual Income Tax Return IL 1040 ES 2024 Estimated Income Tax

https:// tax.illinois.gov /forms/incometax/individual.html

Individual Income Tax Forms Current Year Prior Years Use Tax Note Illinois estate inheritance taxes are not administered by the Illinois Department of Revenue

Individual Income Tax Return IL 1040 X Instructions html English pdf Espa ol pdf Amended Individual Income Tax Return IL 1040 ES 2024 Estimated Income Tax

Individual Income Tax Forms Current Year Prior Years Use Tax Note Illinois estate inheritance taxes are not administered by the Illinois Department of Revenue

2016 USATF Illinois Tax Return By USATF Flipsnack

Il W 4 Form 2023 Printable Forms Free Online

Illinois Individual Income Tax Return

2017 Form IL DoR IL 1040 X Fill Online Printable Fillable Blank

Il Form 505 I Printable Printable Forms Free Online

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

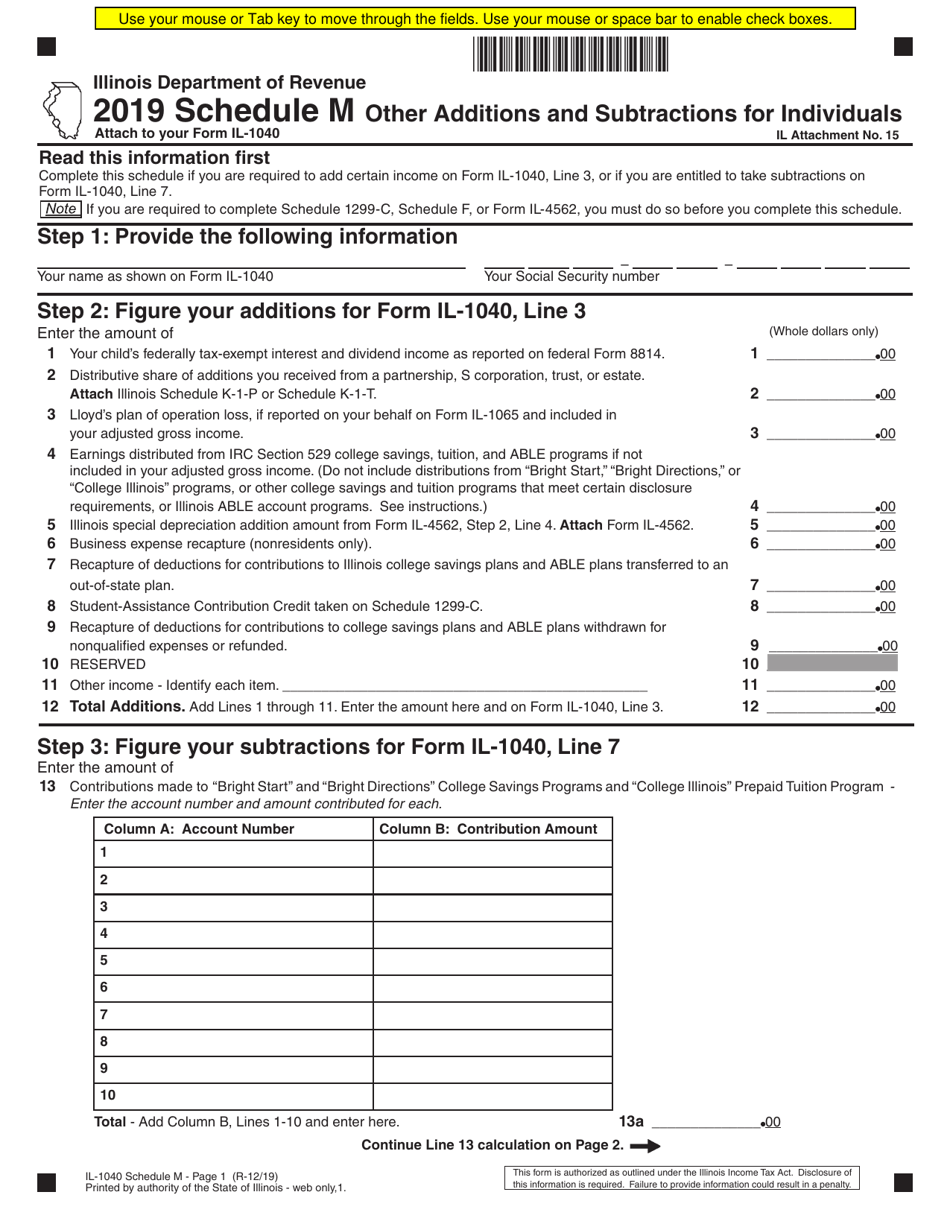

Form IL 1040 Schedule M 2019 Fill Out Sign Online And Download