In this modern-day world of consumers everyone appreciates a great bargain. One way to gain significant savings on your purchases is through How Much Is Family Tax Benefit In Australias. How Much Is Family Tax Benefit In Australias are an effective marketing tactic used by manufacturers and retailers to offer consumers a partial cash back on their purchases once they've taken them. In this article, we'll examine the subject of How Much Is Family Tax Benefit In Australias. We will explore what they are as well as how they work and how you can maximize the savings you can make by using these cost-effective incentives.

Get Latest How Much Is Family Tax Benefit In Australia Below

How Much Is Family Tax Benefit In Australia

How Much Is Family Tax Benefit In Australia -

What Is The Family Tax Benefit Are You Eligible Canstar What are the rates for the Family Tax Benefit Part A and Family Tax Benefit Part B in 2022 Find out about eligibility and how

To be eligible for the part A 817 60 supplement your family s adjusted taxable income must be 80 000 or less The max FTB part B payment you can get is 4 730 You won t be eligible for

A How Much Is Family Tax Benefit In Australia as it is understood in its simplest format, is a reimbursement to a buyer after purchasing a certain product or service. It's a powerful method employed by companies to attract customers, increase sales and promote specific products.

Types of How Much Is Family Tax Benefit In Australia

Startup India Recognition Anbac Advisors Best CA Firm In Delhi

Startup India Recognition Anbac Advisors Best CA Firm In Delhi

7 minute read Listen Key facts Family Tax Benefit FTB is a government payment to help with the cost of raising children It is made up of 2 parts Part A and Part B You need to meet

To receive the FTB Part A your family s combined income must be 80 000 or less How much Family Tax Benefit Part A can I receive Your FTB A payment rate is

Cash How Much Is Family Tax Benefit In Australia

Cash How Much Is Family Tax Benefit In Australia are probably the most simple kind of How Much Is Family Tax Benefit In Australia. Customers receive a certain amount of cash back after buying a product. These are typically applied to the most expensive products like electronics or appliances.

Mail-In How Much Is Family Tax Benefit In Australia

Mail-in How Much Is Family Tax Benefit In Australia need customers to send in the proof of purchase to be eligible for their cash back. They are a bit longer-lasting, however they offer huge savings.

Instant How Much Is Family Tax Benefit In Australia

Instant How Much Is Family Tax Benefit In Australia will be applied at points of sale. This reduces the price of your purchase instantly. Customers don't need to wait for savings through this kind of offer.

How How Much Is Family Tax Benefit In Australia Work

Tax Benefits On Business Loans In India India Today

Tax Benefits On Business Loans In India India Today

The maximum rate per family for Family Tax Benefit B is 161 41 per fortnight when your youngest child is aged 0 5 years old and 112 56 when your youngest child is 5 18

The How Much Is Family Tax Benefit In Australia Process

The procedure typically consists of a handful of simple steps:

-

You purchase the item: First purchase the product in the same way you would normally.

-

Complete the How Much Is Family Tax Benefit In Australia Form: To claim the How Much Is Family Tax Benefit In Australia you'll need provide certain information, such as your name, address, and purchase details to make a claim for your How Much Is Family Tax Benefit In Australia.

-

Send in the How Much Is Family Tax Benefit In Australia The How Much Is Family Tax Benefit In Australia must be submitted in accordance with the nature of How Much Is Family Tax Benefit In Australia you will need to mail in a form or send it via the internet.

-

Wait for the company's approval: They will review your submission to ensure it meets the reimbursement's terms and condition.

-

Take advantage of your How Much Is Family Tax Benefit In Australia After being approved, the amount you receive will be using a check or prepaid card, or other option that's specified in the offer.

Pros and Cons of How Much Is Family Tax Benefit In Australia

Advantages

-

Cost savings The use of How Much Is Family Tax Benefit In Australia can greatly lower the cost you pay for the item.

-

Promotional Deals These deals encourage customers to experiment with new products, or brands.

-

boost sales: How Much Is Family Tax Benefit In Australia can boost a company's sales and market share.

Disadvantages

-

Complexity Pay-in How Much Is Family Tax Benefit In Australia via mail, particularly they can be time-consuming and take a long time to complete.

-

Extension Dates Many How Much Is Family Tax Benefit In Australia impose deadlines for submission.

-

The risk of non-payment Some customers might have their How Much Is Family Tax Benefit In Australia delayed if they don't adhere to the requirements exactly.

Download How Much Is Family Tax Benefit In Australia

[su_button url="https://printablerebateform.net/?s=How Much Is Family Tax Benefit In Australia" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download How Much Is Family Tax Benefit In Australia[/su_button]

FAQs

1. Are How Much Is Family Tax Benefit In Australia equivalent to discounts? No, How Much Is Family Tax Benefit In Australia involve an amount of money that is refunded after the purchase, while discounts lower the purchase price at the moment of sale.

2. Are there any How Much Is Family Tax Benefit In Australia that I can use on the same item This depends on the terms in the How Much Is Family Tax Benefit In Australia provides and the particular product's eligibility. Certain businesses may allow it, but others won't.

3. How long does it take to receive a How Much Is Family Tax Benefit In Australia? The duration will vary, but it may last from a few weeks until a few months before you receive your How Much Is Family Tax Benefit In Australia.

4. Do I need to pay taxes for How Much Is Family Tax Benefit In Australia the amount? most situations, How Much Is Family Tax Benefit In Australia amounts are not considered taxable income.

5. Should I be able to trust How Much Is Family Tax Benefit In Australia offers from lesser-known brands It's important to do your research and ensure that the brand which is providing the How Much Is Family Tax Benefit In Australia has a good reputation prior to making an purchase.

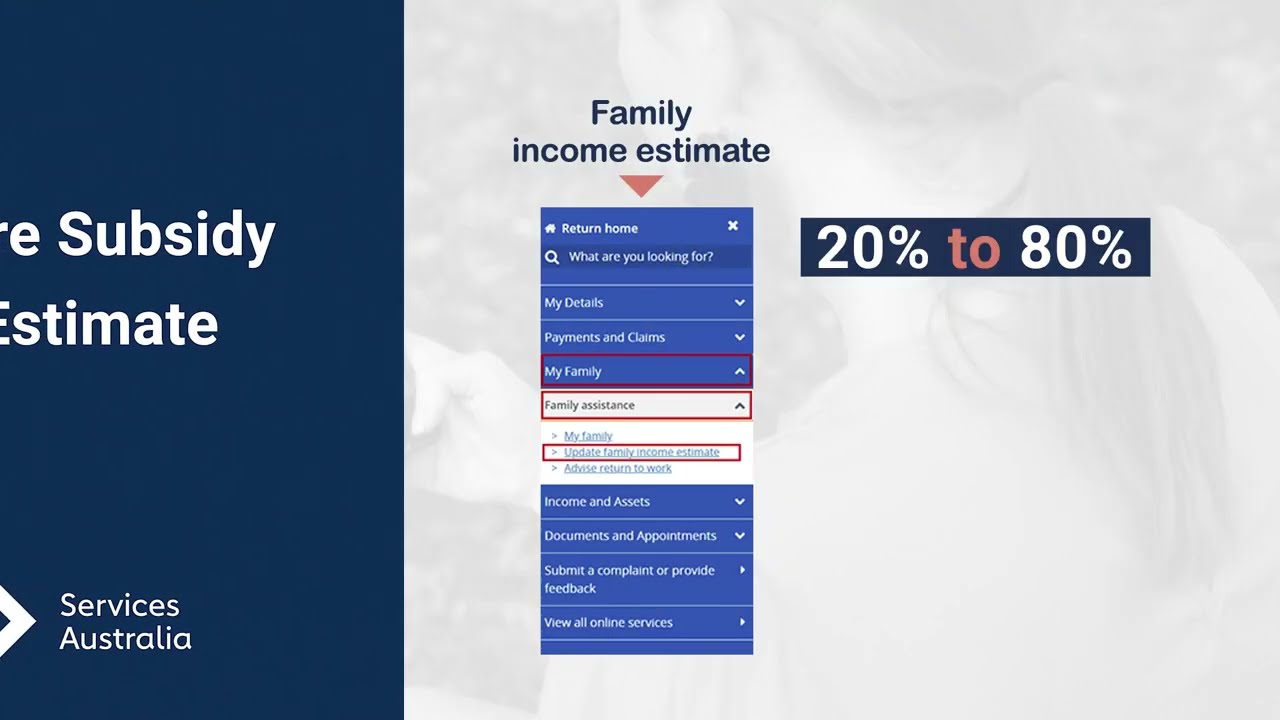

Child Care Subsidy Income Estimate YouTube

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

Check more sample of How Much Is Family Tax Benefit In Australia below

How Much Is 2 Million Life Insurance

Understanding The Family Tax Benefit TaxLeopard

Life Insurance And Income Tax Benefit With BIMTech In Hindi YouTube

Family Tax Benefit In 2019 Calculator Threshold Eligibility Online

Family Tax Benefit PART A PART B Care For Kids

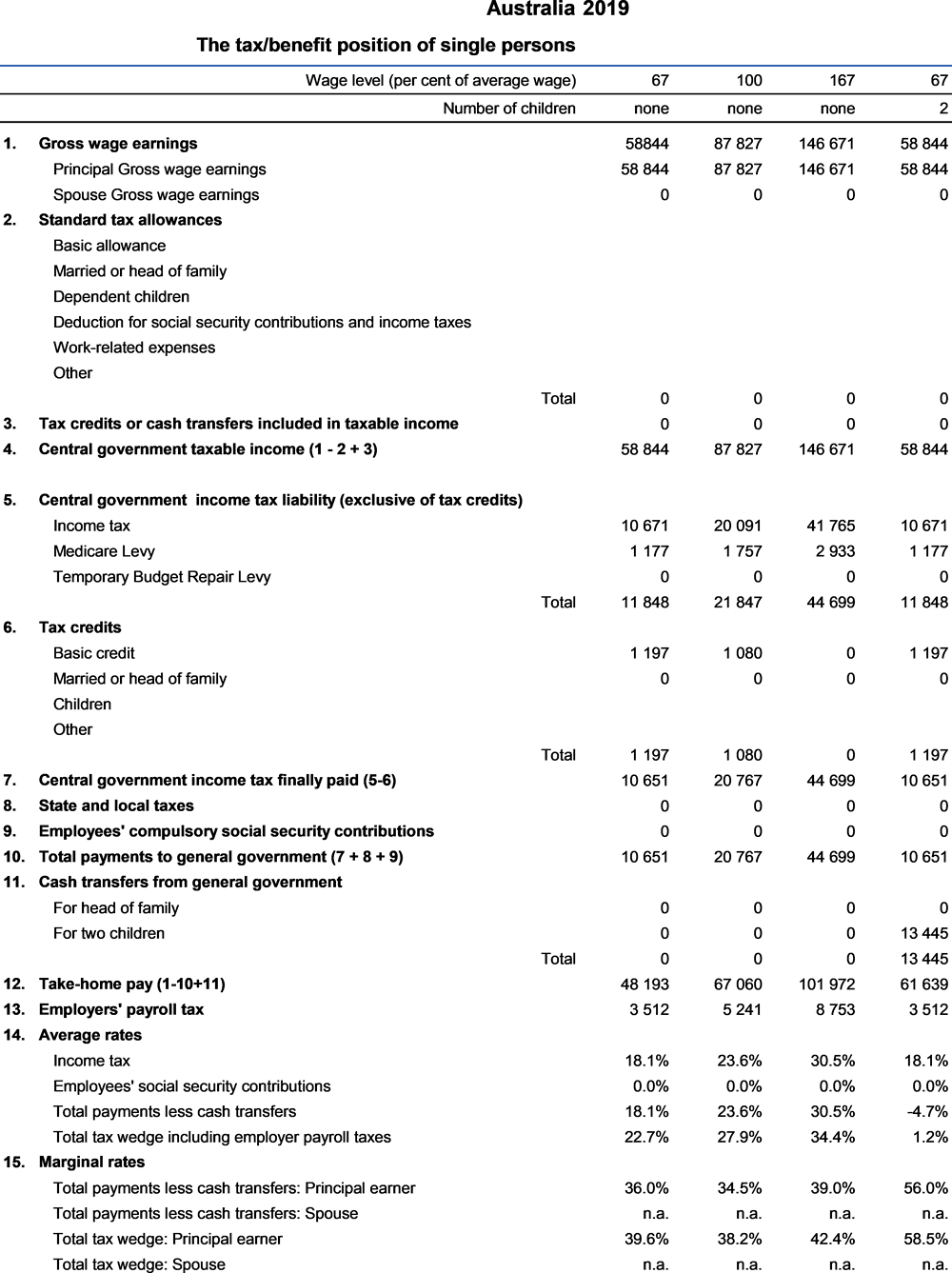

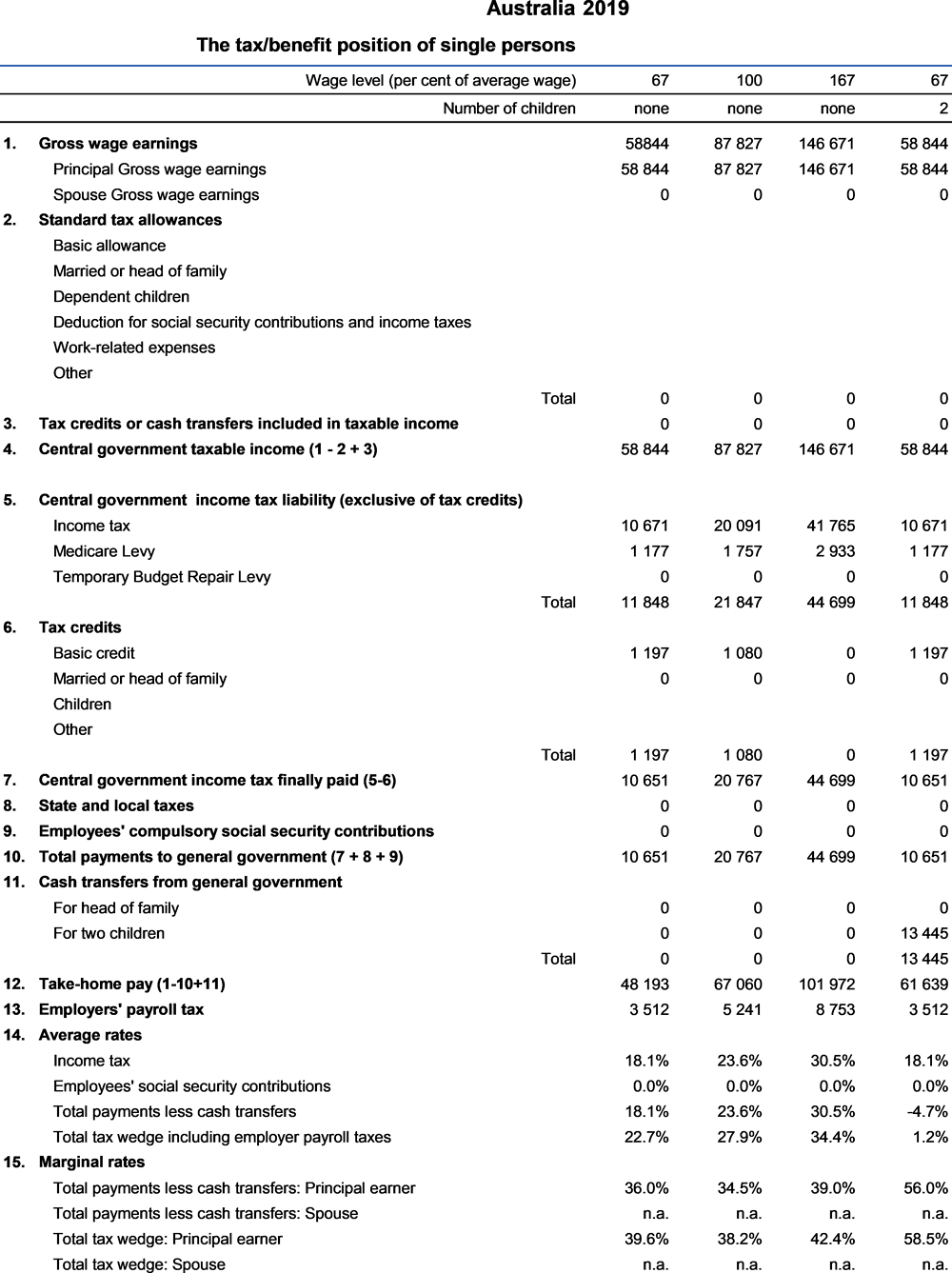

Australia Taxing Wages 2020 OECD ILibrary

www.bigdream.com.au/family-tax-benefit-calculator

To be eligible for the part A 817 60 supplement your family s adjusted taxable income must be 80 000 or less The max FTB part B payment you can get is 4 730 You won t be eligible for

my.gov.au/.../family-tax-benefit

Family Tax Benefit FTB is a payment from Services Australia Who can get it To get this you must have a dependent child or full time secondary student aged 16 to 19 who

To be eligible for the part A 817 60 supplement your family s adjusted taxable income must be 80 000 or less The max FTB part B payment you can get is 4 730 You won t be eligible for

Family Tax Benefit FTB is a payment from Services Australia Who can get it To get this you must have a dependent child or full time secondary student aged 16 to 19 who

Family Tax Benefit In 2019 Calculator Threshold Eligibility Online

Understanding The Family Tax Benefit TaxLeopard

Family Tax Benefit PART A PART B Care For Kids

Australia Taxing Wages 2020 OECD ILibrary

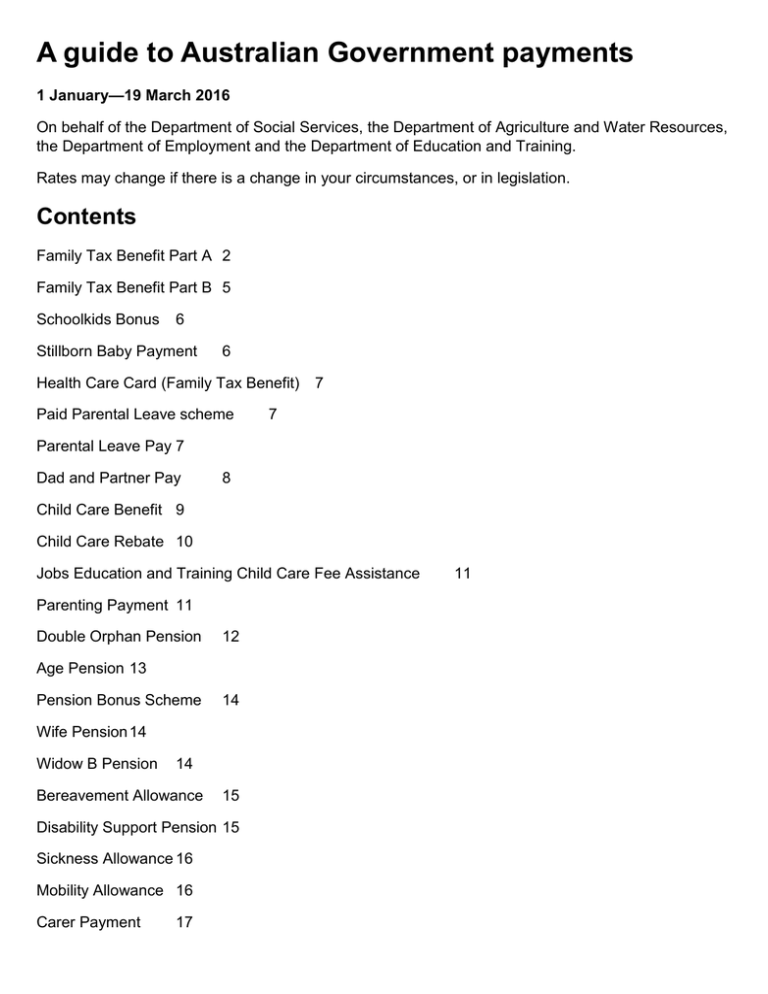

A Guide To Australian Government Payments

Family Tax Benefits FTB Payment Rates Toddle

Family Tax Benefits FTB Payment Rates Toddle

The 10 Top Tax Benefits For Businesses