In this modern-day world of consumers every person loves a great bargain. One way to score significant savings for your purchases is through Electric Car Rebate Forms. Electric Car Rebate Forms can be a way of marketing that retailers and manufacturers use for offering customers a percentage cash back on their purchases once they've placed them. In this post, we'll delve into the world of Electric Car Rebate Forms, exploring the nature of them as well as how they work as well as ways to maximize your savings using these low-cost incentives.

Get Latest Electric Car Rebate Form Below

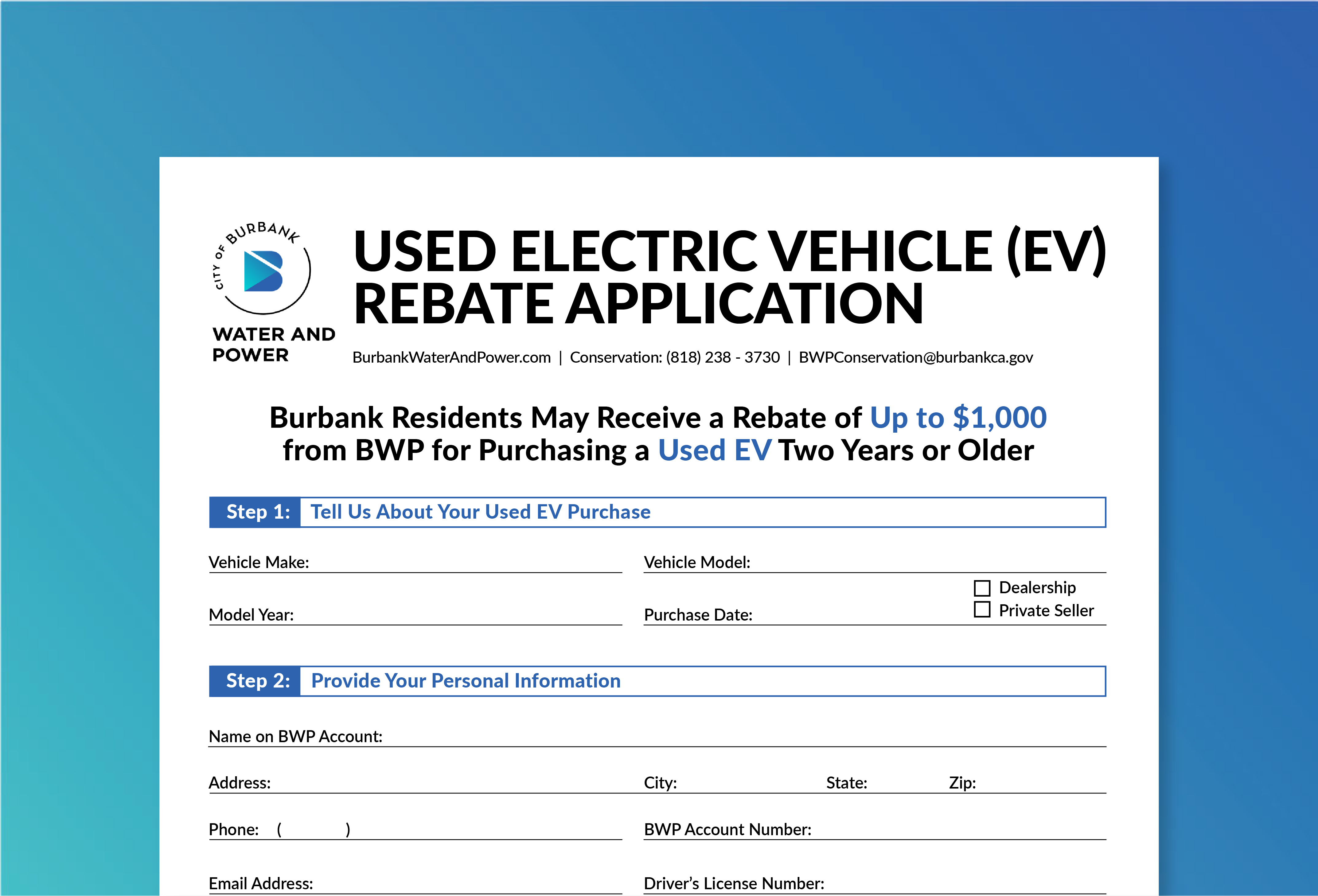

Electric Car Rebate Form

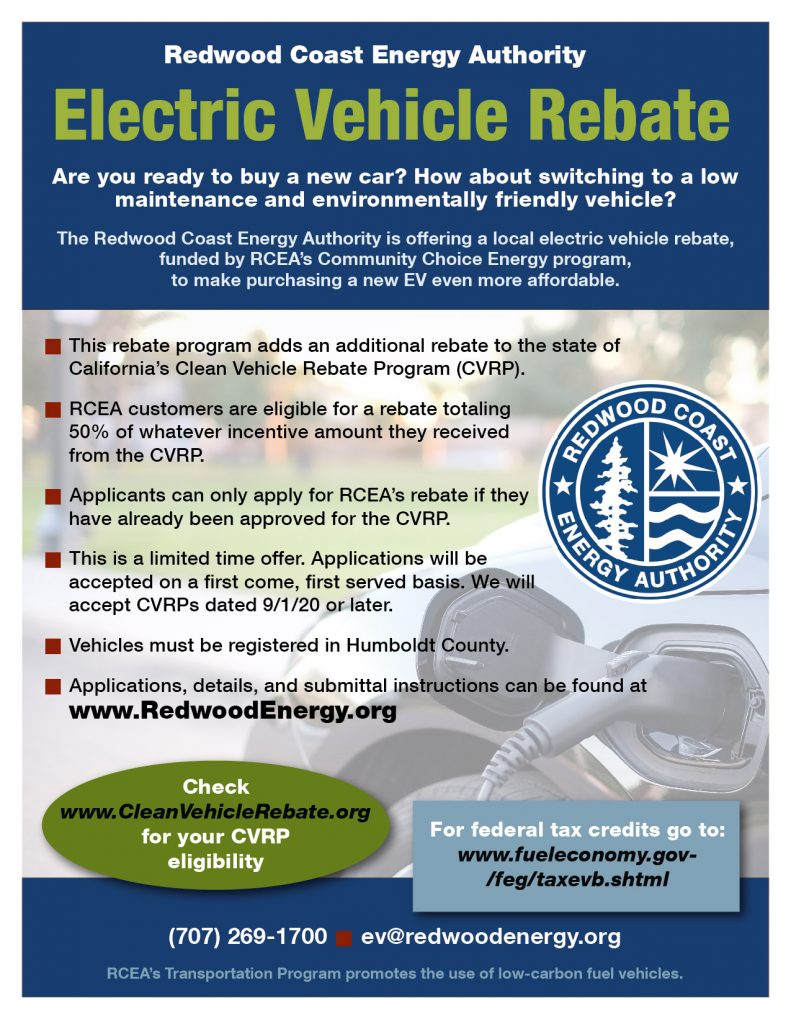

Electric Car Rebate Form - Electric Car Rebate Form, Electric Car Rebate Application, Oregon Electric Car Rebate Form, Electric Vehicle Credit Form 2022, Illinois Electric Car Rebate Form, California Electric Car Rebate Form, Electric Vehicle Rebate Application, Illinois Electric Vehicle Rebate Form, Nys Electric Car Credit Form, Bc Electric Car Rebate Application

Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Web 10 janv 2023 nbsp 0183 32 Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form

A Electric Car Rebate Form or Electric Car Rebate Form, in its most basic type, is a return to the customer who has purchased a particular product or service. It's a highly effective tool employed by companies to attract buyers, increase sales or promote a specific product.

Types of Electric Car Rebate Form

Electric Car Available Rebates 2023 Carrebate

Electric Car Available Rebates 2023 Carrebate

Web Submit an online application The Project Administrator Administrator or Center for Sustainable Energy will reserve funds for your rebate Submit supporting documentation

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for

Cash Electric Car Rebate Form

Cash Electric Car Rebate Form can be the simplest type of Electric Car Rebate Form. Customers are offered a certain amount of money in return for purchasing a particular item. These are often used for high-ticket items like electronics or appliances.

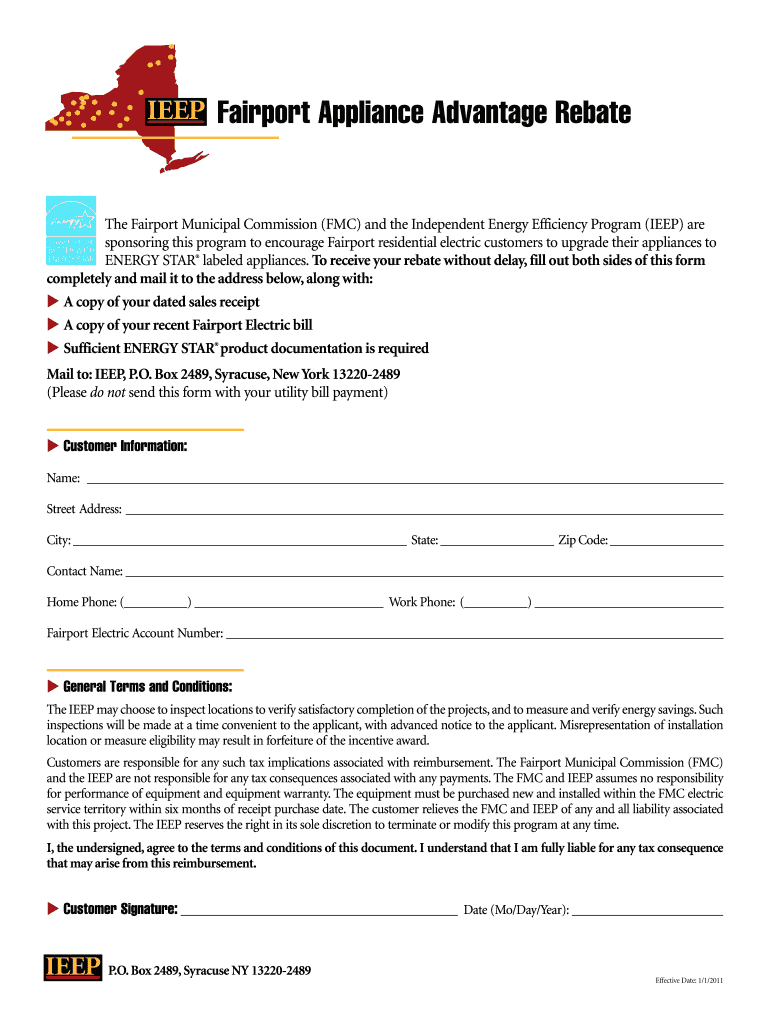

Mail-In Electric Car Rebate Form

Mail-in Electric Car Rebate Form require customers to send in proof of purchase in order to receive their money back. They're a bit more involved, but offer significant savings.

Instant Electric Car Rebate Form

Instant Electric Car Rebate Form are made at the point of sale. They reduce the cost of purchase immediately. Customers don't need to wait for their savings when they purchase this type of Electric Car Rebate Form.

How Electric Car Rebate Form Work

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Web 2 d 233 c 2022 nbsp 0183 32 File Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit with your tax return Starting in 2024 the credit will be claimable upfront at the time of purchase without needing to file

The Electric Car Rebate Form Process

The procedure typically consists of a few simple steps:

-

Then, you purchase the product, you buy the product just like you normally would.

-

Fill in this Electric Car Rebate Form form: You'll need to provide some information including your address, name, and purchase details, to apply for your Electric Car Rebate Form.

-

You must submit the Electric Car Rebate Form depending on the nature of Electric Car Rebate Form there may be a requirement to fill out a form and mail it in or upload it online.

-

Wait for approval: The company will go through your application to make sure that it's in accordance with the refund's conditions and terms.

-

Get your Electric Car Rebate Form Once it's approved, you'll receive the refund whether via check, credit card or through a different method specified by the offer.

Pros and Cons of Electric Car Rebate Form

Advantages

-

Cost savings: Electric Car Rebate Form can significantly decrease the price for the product.

-

Promotional Offers These promotions encourage consumers to try out new products or brands.

-

Increase Sales Electric Car Rebate Form are a great way to boost a company's sales and market share.

Disadvantages

-

Complexity Mail-in Electric Car Rebate Form particularly could be cumbersome and tedious.

-

The Expiration Dates Many Electric Car Rebate Form have deadlines for submission.

-

A risk of not being paid Customers may not receive Electric Car Rebate Form if they don't observe the rules exactly.

Download Electric Car Rebate Form

[su_button url="https://printablerebateform.net/?s=Electric Car Rebate Form" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Electric Car Rebate Form[/su_button]

FAQs

1. Are Electric Car Rebate Form similar to discounts? Not necessarily, as Electric Car Rebate Form are an amount of money that is refunded after the purchase, and discounts are a reduction of your purchase cost at point of sale.

2. Are there Electric Car Rebate Form that can be used on the same product This depends on the terms of the Electric Car Rebate Form is offered as well as the merchandise's ability to qualify. Certain companies might permit it, and some don't.

3. How long will it take to get a Electric Car Rebate Form What is the timeframe? will vary, but it may range from several weeks to few months before you receive your Electric Car Rebate Form.

4. Do I have to pay taxes regarding Electric Car Rebate Form values? most circumstances, Electric Car Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Electric Car Rebate Form offers from lesser-known brands It is essential to investigate to ensure that the name giving the Electric Car Rebate Form has a good reputation prior to making an investment.

California Electric Car Rebate 2022 Printable Rebate Form

Ca Electric Car Rebate Income ElectricRebate

Check more sample of Electric Car Rebate Form below

Delaware Electric Car Tax Rebate Printable Rebate Form

Index Of wp content uploads 2020 11

2011 Form NY IEEP Fairport Appliance Advantage Rebate Fill Online

Ouc Energy Rebates Fill Online Printable Fillable Blank PdfFiller

How The Drive Clean Rebate Works NYSERDA

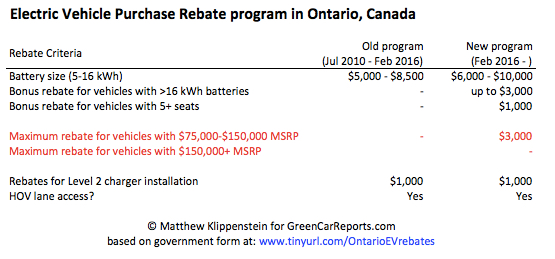

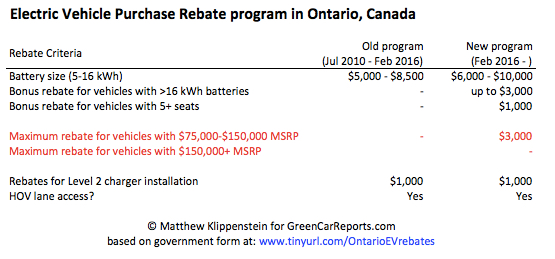

Ontario Ministry Of Transportation Electric Vehicles Rebate Transport

https://www.irs.gov/forms-pubs/about-form-8936

Web 10 janv 2023 nbsp 0183 32 Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form

https://www.truecar.com/blog/electric-vehicle-tax-credits-and-rebates...

Web 19 oct 2022 nbsp 0183 32 Currently modified adjusted gross income limits are 150 000 for an individual 225 000 for head of household and 300 000 for joint returns Any reported

Web 10 janv 2023 nbsp 0183 32 Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form

Web 19 oct 2022 nbsp 0183 32 Currently modified adjusted gross income limits are 150 000 for an individual 225 000 for head of household and 300 000 for joint returns Any reported

Ouc Energy Rebates Fill Online Printable Fillable Blank PdfFiller

Index Of wp content uploads 2020 11

How The Drive Clean Rebate Works NYSERDA

Ontario Ministry Of Transportation Electric Vehicles Rebate Transport

Electric Vehicle Rebate Available Until 3 31 McLeod Cooperative Power

How Do Federal Tax Credits Work FederalProTalk

How Do Federal Tax Credits Work FederalProTalk

Supplier Rebate Agreement Template