In this modern-day world of consumers people love a good bargain. One way to gain significant savings from your purchases is via Turbo Tax Recovery Rebate Credit Forms. Turbo Tax Recovery Rebate Credit Forms can be a way of marketing employed by retailers and manufacturers to offer customers a partial refund on their purchases after they've done so. In this article, we will go deeper into the realm of Turbo Tax Recovery Rebate Credit Forms, looking at the nature of them as well as how they work and how you can maximise the value of these incentives.

Get Latest Turbo Tax Recovery Rebate Credit Form Below

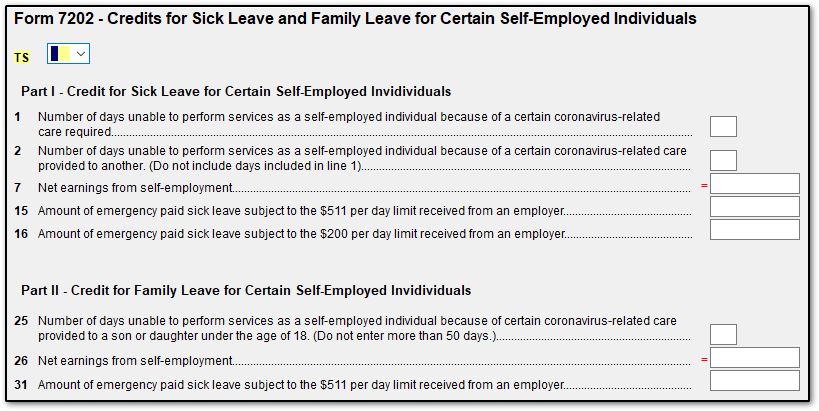

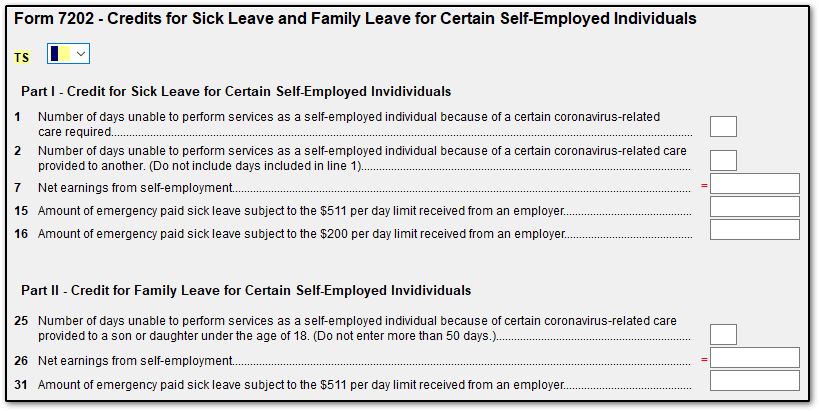

Turbo Tax Recovery Rebate Credit Form

Turbo Tax Recovery Rebate Credit Form -

Web 13 janv 2022 nbsp 0183 32 No matter how you file you will need to do the following to claim the 2021 Recovery Rebate Credit Compute the 2021 Recovery Rebate Credit amount using

Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for Alex 1 200 for Samantha 500 for

A Turbo Tax Recovery Rebate Credit Form in its simplest model, refers to a partial refund given to a client following the purchase of a product or service. This is a potent tool that businesses use to draw clients, increase sales and to promote certain products.

Types of Turbo Tax Recovery Rebate Credit Form

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Web 13 janv 2022 nbsp 0183 32 These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If you didn t get the full amount of the third Economic Impact

Web 6 janv 2021 nbsp 0183 32 In TurboTax Online to claim the Recovery Rebate credit please do the following Sign into your account and continue from where you left off Click on Federal in

Cash Turbo Tax Recovery Rebate Credit Form

Cash Turbo Tax Recovery Rebate Credit Form are by far the easiest kind of Turbo Tax Recovery Rebate Credit Form. Customers receive a specified amount of money when purchasing a particular item. This is often for high-ticket items like electronics or appliances.

Mail-In Turbo Tax Recovery Rebate Credit Form

Customers who want to receive mail-in Turbo Tax Recovery Rebate Credit Form must provide the proof of purchase to be eligible for their money back. They're somewhat more involved but can offer substantial savings.

Instant Turbo Tax Recovery Rebate Credit Form

Instant Turbo Tax Recovery Rebate Credit Form are applied at the moment of sale, cutting the purchase cost immediately. Customers don't need to wait long for savings with this type.

How Turbo Tax Recovery Rebate Credit Form Work

IRS CP 12R Recovery Rebate Credit Overpayment

IRS CP 12R Recovery Rebate Credit Overpayment

Web 11 avr 2021 nbsp 0183 32 Subtracting 4769 08 from 4829 40 is 60 32 So I think I should be receiving a Recovery Rebate Credit of 60 32 It s small but it s significant There is no

The Turbo Tax Recovery Rebate Credit Form Process

The procedure typically consists of a number of easy steps:

-

You purchase the item: First then, you buy the item as you normally would.

-

Fill out your Turbo Tax Recovery Rebate Credit Form request form. You'll have provide certain information like your name, address, and the purchase details, in order in order to make a claim for your Turbo Tax Recovery Rebate Credit Form.

-

To submit the Turbo Tax Recovery Rebate Credit Form: Depending on the nature of Turbo Tax Recovery Rebate Credit Form, you may need to send in a form, or submit it online.

-

Wait for approval: The business will go through your application to determine if it's in compliance with the terms and conditions of the Turbo Tax Recovery Rebate Credit Form.

-

Enjoy your Turbo Tax Recovery Rebate Credit Form: Once approved, you'll get your refund, either by check, prepaid card, or any other method specified by the offer.

Pros and Cons of Turbo Tax Recovery Rebate Credit Form

Advantages

-

Cost Savings A Turbo Tax Recovery Rebate Credit Form can significantly reduce the cost for an item.

-

Promotional Offers These promotions encourage consumers to test new products or brands.

-

Improve Sales Reward programs can boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Mail-in Turbo Tax Recovery Rebate Credit Form in particular difficult and lengthy.

-

Day of Expiration A lot of Turbo Tax Recovery Rebate Credit Form have specific deadlines for submission.

-

The risk of non-payment Certain customers could not receive Turbo Tax Recovery Rebate Credit Form if they don't observe the rules precisely.

Download Turbo Tax Recovery Rebate Credit Form

[su_button url="https://printablerebateform.net/?s=Turbo Tax Recovery Rebate Credit Form" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Turbo Tax Recovery Rebate Credit Form[/su_button]

FAQs

1. Are Turbo Tax Recovery Rebate Credit Form equivalent to discounts? Not necessarily, as Turbo Tax Recovery Rebate Credit Form are a partial refund after purchase whereas discounts will reduce the purchase price at the point of sale.

2. Can I use multiple Turbo Tax Recovery Rebate Credit Form on the same item The answer is dependent on the conditions that apply to the Turbo Tax Recovery Rebate Credit Form incentives and the specific product's acceptance. Certain companies might permit it, but others won't.

3. How long will it take to receive a Turbo Tax Recovery Rebate Credit Form? The timing differs, but it can take anywhere from a few weeks to a few months before you receive your Turbo Tax Recovery Rebate Credit Form.

4. Do I have to pay tax in relation to Turbo Tax Recovery Rebate Credit Form values? most situations, Turbo Tax Recovery Rebate Credit Form amounts are not considered taxable income.

5. Do I have confidence in Turbo Tax Recovery Rebate Credit Form deals from lesser-known brands It is essential to investigate and confirm that the brand offering the Turbo Tax Recovery Rebate Credit Form is legitimate prior to making an purchase.

Taxes Recovery Rebate Credit Recovery Rebate

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

Check more sample of Turbo Tax Recovery Rebate Credit Form below

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Track Your Recovery Rebate With This Worksheet Style Worksheets

Recovery Rebate Credit Worksheet Tax Guru Kertetter Letter Db

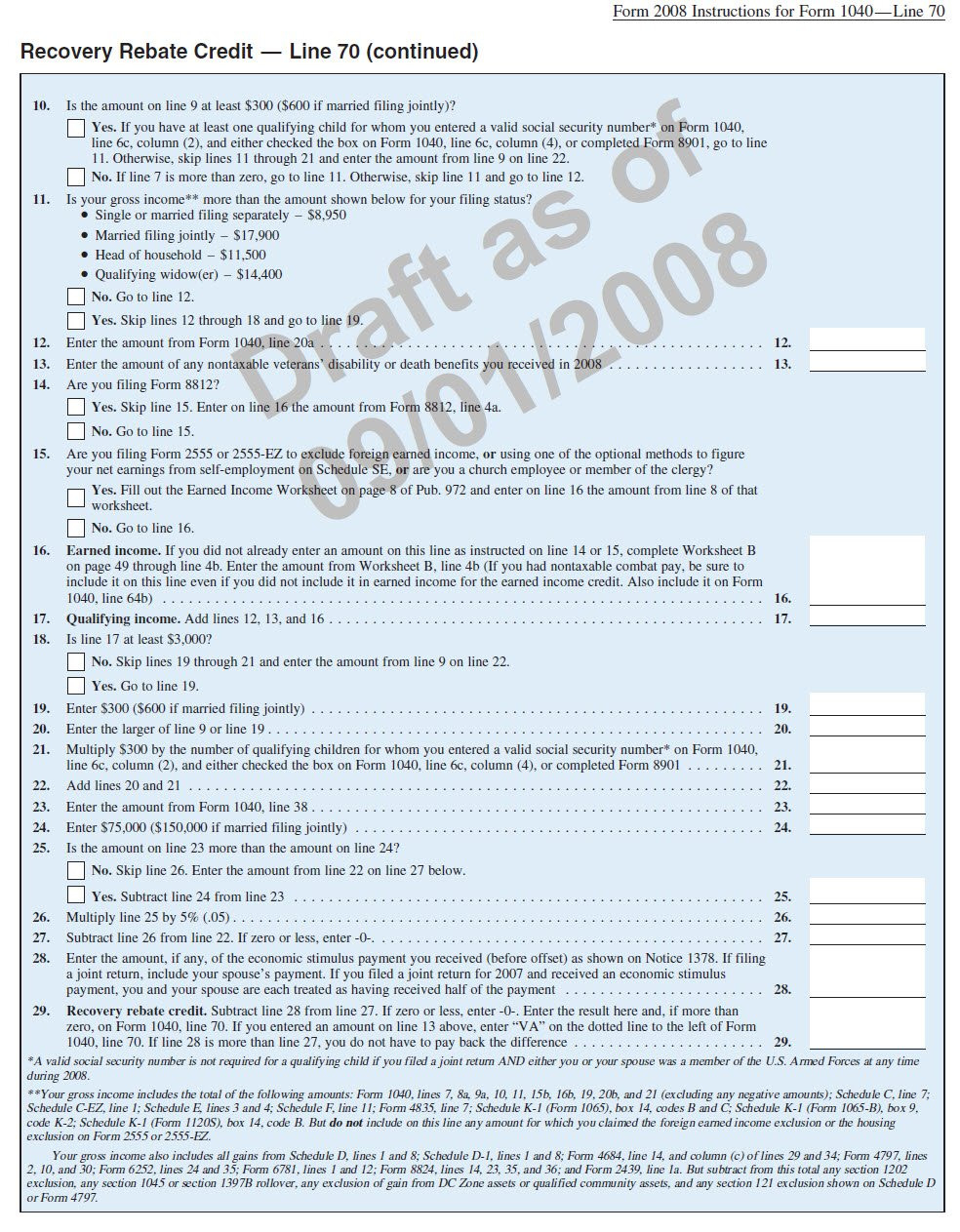

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

1040 EF Message 0006 Recovery Rebate Credit Drake20

https://turbotax.intuit.com/tax-tips/tax-relief/w…

Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for Alex 1 200 for Samantha 500 for

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for Alex 1 200 for Samantha 500 for

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Track Your Recovery Rebate With This Worksheet Style Worksheets

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

1040 EF Message 0006 Recovery Rebate Credit Drake20

Recovery Rebate Credit Form Printable Rebate Form

The Recovery Rebate Credit Calculator ShauntelRaya

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Credit Printable Rebate Form