In the modern world of consumerization everyone enjoys a good bargain. One way to earn substantial savings on your purchases is through Sa Tax Rebatess. The use of Sa Tax Rebatess is a method used by manufacturers and retailers to offer consumers a partial return on their purchases once they have created them. In this article, we will dive into the world Sa Tax Rebatess, exploring the nature of them what they are, how they function, and how you can maximise your savings through these cost-effective incentives.

Get Latest Sa Tax Rebates Below

Sa Tax Rebates

Sa Tax Rebates -

Web De tr 232 s nombreux exemples de phrases traduites contenant quot tax rebate quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises

Web 27 juin 2023 nbsp 0183 32 For the 2024 tax year i e the tax year commencing on 1 March 2023 and ending on 29 February 2024 the following rebates apply Primary rebate ZAR 17 235

A Sa Tax Rebates the simplest model, refers to a partial return to the customer after they've bought a product or service. It's a powerful instrument employed by companies to attract customers, increase sales, or promote a specific product.

Types of Sa Tax Rebates

Tax Rate Tables 2018 Brokeasshome

Tax Rate Tables 2018 Brokeasshome

Web What is SARS What is the tax year What are tax tables SARS tax tables tax brackets for individuals SARS tax tables for businesses Tax rates for trusts Tables for transfer

Web 6 d 233 c 2013 nbsp 0183 32 South Africa South Africa Taxes And Incentives For Renewable Energy 06 December 2013 by KPMG KPMG South Africa This edition of Taxes and Incentives for

Cash Sa Tax Rebates

Cash Sa Tax Rebates are probably the most simple kind of Sa Tax Rebates. Customers are offered a certain amount of money back upon purchasing a particular item. These are often used for high-ticket items like electronics or appliances.

Mail-In Sa Tax Rebates

Mail-in Sa Tax Rebates need customers to submit evidence of purchase to get their reimbursement. They're more complicated, but they can provide huge savings.

Instant Sa Tax Rebates

Instant Sa Tax Rebates will be applied at point of sale. They reduce prices immediately. Customers do not have to wait around for savings with this type.

How Sa Tax Rebates Work

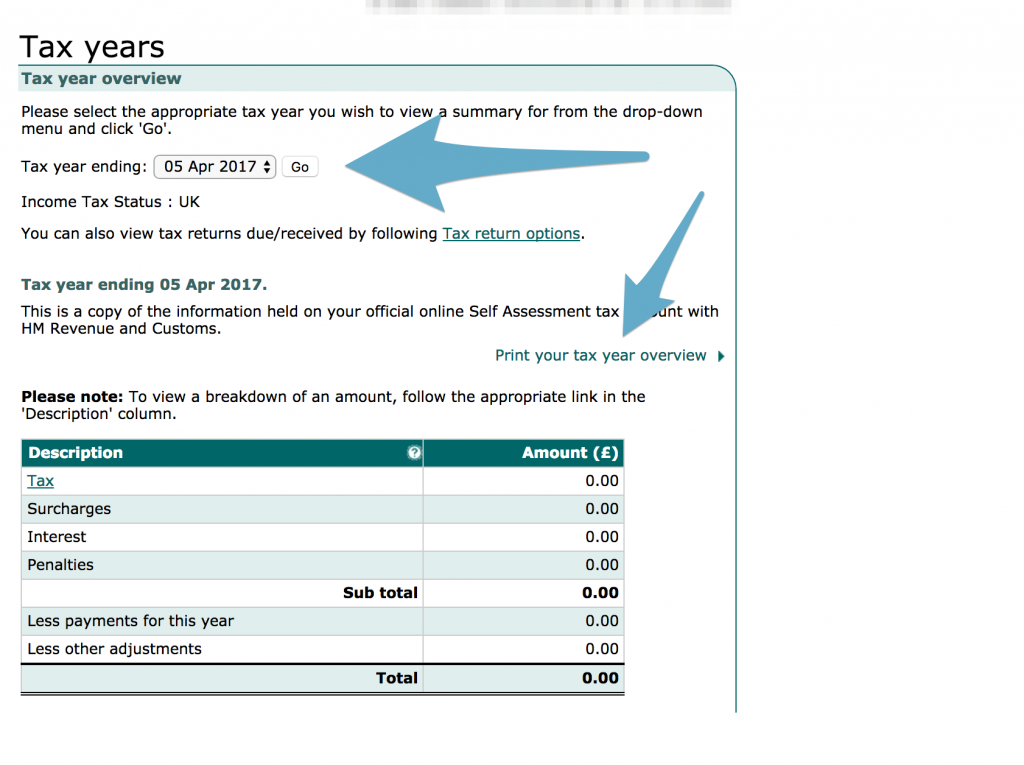

How To Print Your SA302 Or Tax Year Overview From HMRC Love

How To Print Your SA302 Or Tax Year Overview From HMRC Love

Web remboursement fiscal Traductions EN tax rebate substantif volume up 1 201 conomie tax rebate volume up remboursement fiscal m Exemples d usage English French

The Sa Tax Rebates Process

The process typically involves handful of simple steps:

-

Buy the product: At first you purchase the item exactly as you would normally.

-

Fill in your Sa Tax Rebates form: You'll need to give some specific information like your address, name, and details about your purchase, in order to receive your Sa Tax Rebates.

-

Submit the Sa Tax Rebates According to the type of Sa Tax Rebates you could be required to send in a form, or make it available online.

-

Wait for approval: The company will scrutinize your submission to make sure it is in line with the Sa Tax Rebates's terms and conditions.

-

Take advantage of your Sa Tax Rebates After you've been approved, you'll be able to receive your reimbursement, using a check or prepaid card, or any other way specified in the offer.

Pros and Cons of Sa Tax Rebates

Advantages

-

Cost savings A Sa Tax Rebates can significantly lower the cost you pay for the item.

-

Promotional Offers The aim is to encourage customers to explore new products or brands.

-

Enhance Sales: Sa Tax Rebates can boost the sales of a business and increase its market share.

Disadvantages

-

Complexity: Mail-in Sa Tax Rebates, particularly are often time-consuming and slow-going.

-

The Expiration Dates Most Sa Tax Rebates come with certain deadlines for submitting.

-

A risk of not being paid Certain customers could have their Sa Tax Rebates delayed if they don't comply with the rules exactly.

Download Sa Tax Rebates

[su_button url="https://printablerebateform.net/?s=Sa Tax Rebates" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Sa Tax Rebates[/su_button]

FAQs

1. Are Sa Tax Rebates the same as discounts? No, Sa Tax Rebates require a partial refund upon purchase, while discounts lower the cost of purchase at time of sale.

2. Do I have to use multiple Sa Tax Rebates for the same product It's contingent upon the terms applicable to Sa Tax Rebates is offered as well as the merchandise's eligibility. Some companies will allow this, whereas others will not.

3. How long will it take to get a Sa Tax Rebates? The timing differs, but it can take anywhere from a few weeks to a few months before you receive your Sa Tax Rebates.

4. Do I need to pay taxes on Sa Tax Rebates amount? the majority of circumstances, Sa Tax Rebates amounts are not considered taxable income.

5. Should I be able to trust Sa Tax Rebates offers from brands that aren't well-known Do I need to conduct a thorough research and confirm that the company which is providing the Sa Tax Rebates is reputable before making purchases.

13 sa Form Eliminate Your Fears And Doubts About 13 sa Form AH

SA Tax Calculator Android Apps On Google Play

Check more sample of Sa Tax Rebates below

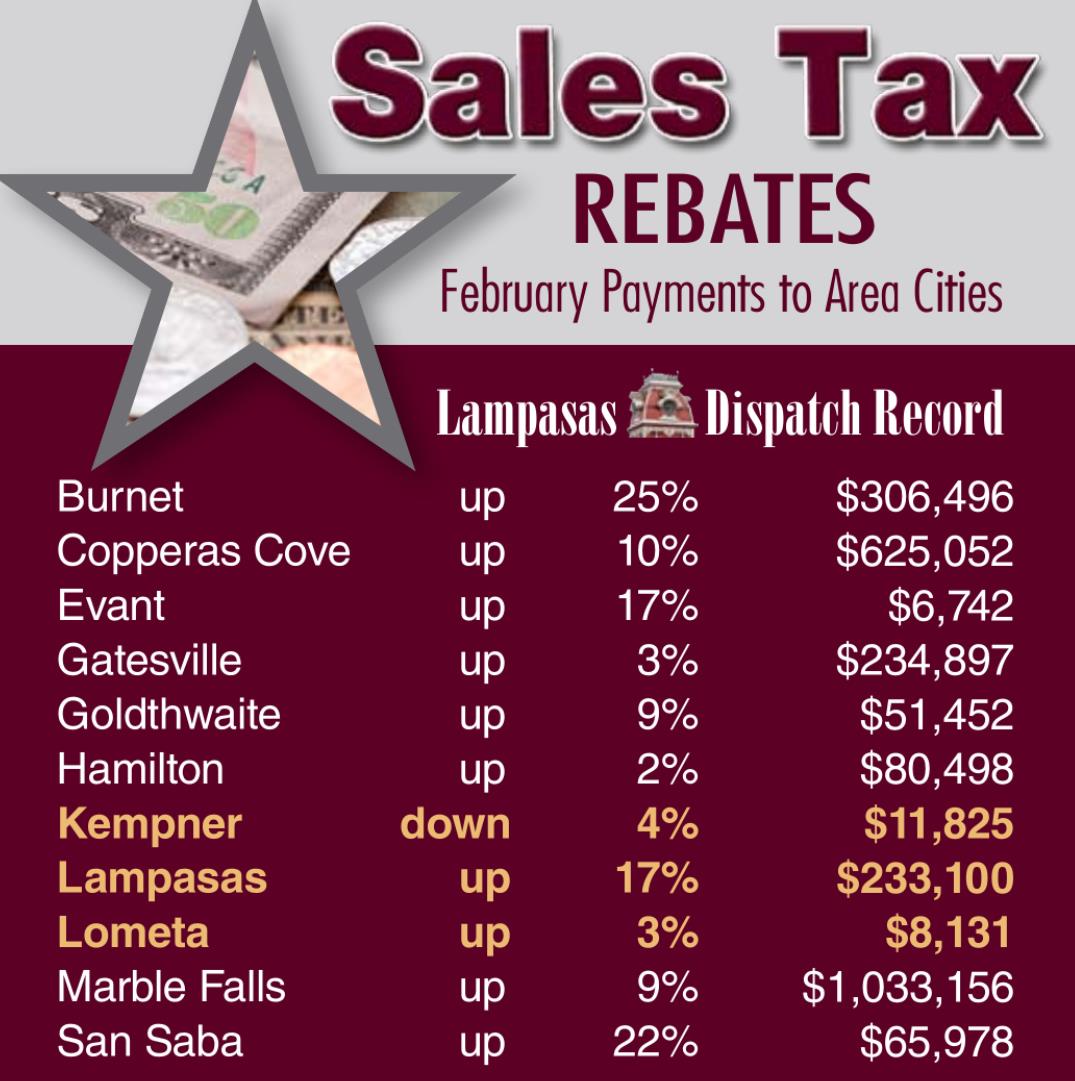

Sales Tax Rebates Continue Upward Trend Lampasas Dispatch Record

Income Tax Brackets 2020 South Africa PINCOMEQ

In SA Tax Credits For Medical Aid Contributions eBiz Money

SA Tax Calculator Android Apps On Google Play

2007 Tax Rebate Tax Deduction Rebates

Budget Highlights For 2021 22 Nexia SAB T

https://taxsummaries.pwc.com/south-africa/individual/other-tax-credits...

Web 27 juin 2023 nbsp 0183 32 For the 2024 tax year i e the tax year commencing on 1 March 2023 and ending on 29 February 2024 the following rebates apply Primary rebate ZAR 17 235

https://www2.deloitte.com/content/dam/Deloitte/za/Documen…

Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Note 1 Trusts for the benefit of ill or disabled persons and testamentary trusts

Web 27 juin 2023 nbsp 0183 32 For the 2024 tax year i e the tax year commencing on 1 March 2023 and ending on 29 February 2024 the following rebates apply Primary rebate ZAR 17 235

Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Note 1 Trusts for the benefit of ill or disabled persons and testamentary trusts

SA Tax Calculator Android Apps On Google Play

Income Tax Brackets 2020 South Africa PINCOMEQ

2007 Tax Rebate Tax Deduction Rebates

Budget Highlights For 2021 22 Nexia SAB T

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Cost Of Living In Johannesburg South Africa South Africa Tax

Cost Of Living In Johannesburg South Africa South Africa Tax

Max Achieving Financial Independence When Is The Best Time For