In our current world of high-end consumer goods people love a good deal. One option to obtain significant savings in your purchase is through Pennsylvania Tax Rebate Statuss. Pennsylvania Tax Rebate Statuss are a method of marketing employed by retailers and manufacturers to give customers a part refund on their purchases after they've taken them. In this article, we will look into the world of Pennsylvania Tax Rebate Statuss. We will explore what they are and how they operate, and how to maximize the value of these incentives.

Get Latest Pennsylvania Tax Rebate Status Below

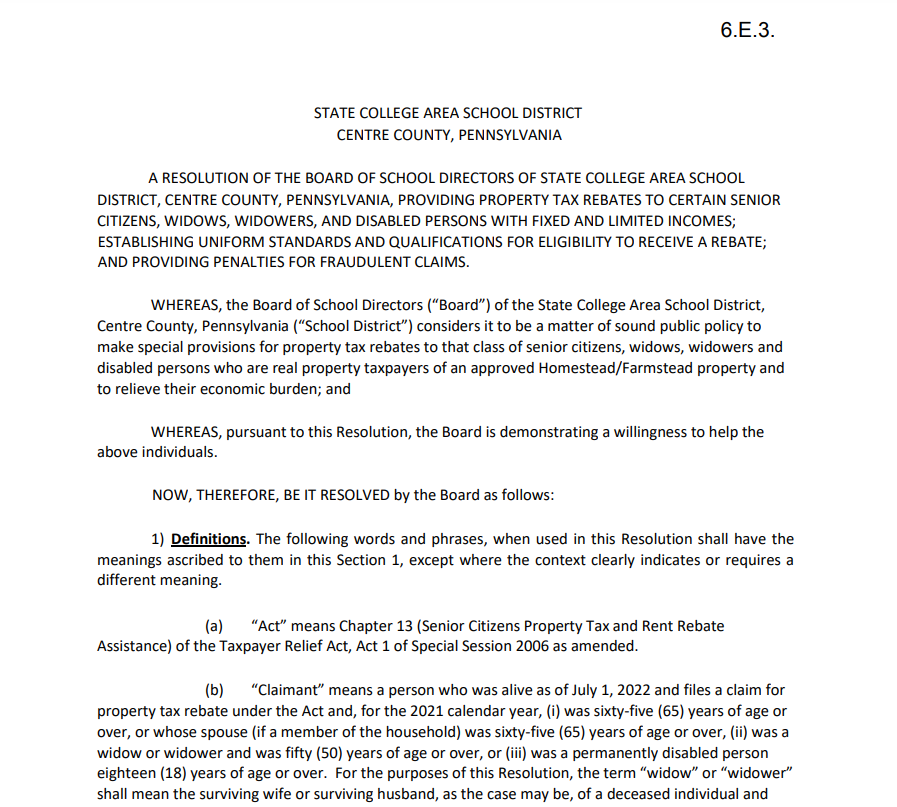

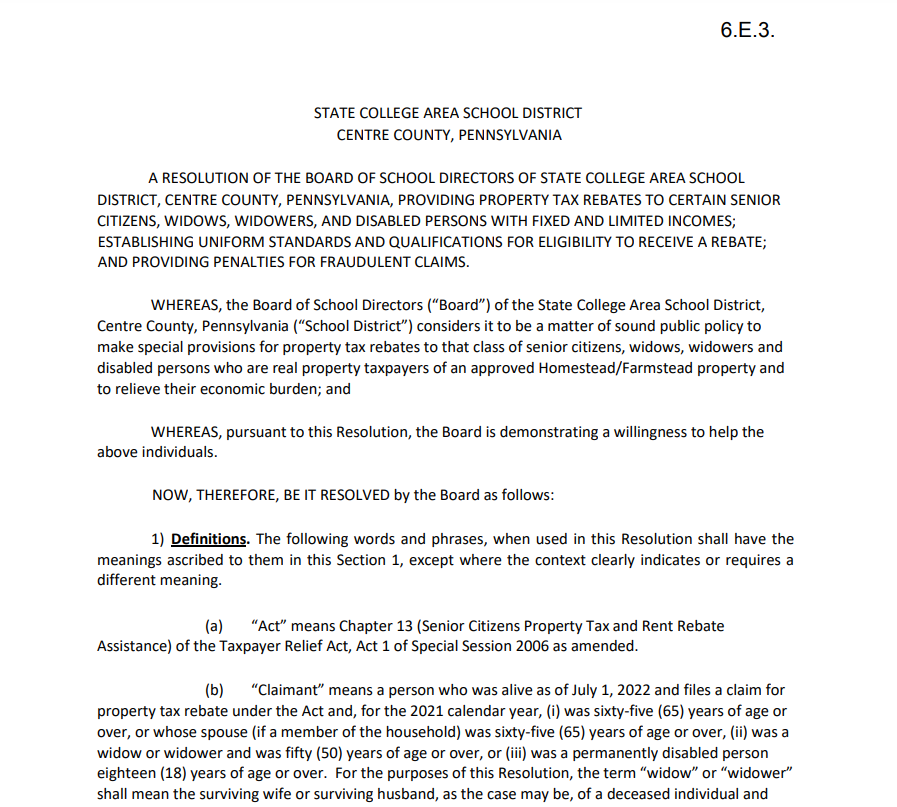

Pennsylvania Tax Rebate Status

Pennsylvania Tax Rebate Status -

Web 28 sept 2022 nbsp 0183 32 Normally the maximum rebate you can receive is 650 although homeowners in Philadelphia Pittsburgh and Scranton can get additional rebates

Web Features myPATH offers for Property Tax Rent Rebate claimants Fast processing and direct deposit options The quot Where s My Rebate quot system to track the status of a claim

A Pennsylvania Tax Rebate Status, in its simplest form, is a refund to a purchaser after they've bought a product or service. It's a powerful method employed by companies to attract customers, increase sales, or promote a specific product.

Types of Pennsylvania Tax Rebate Status

Pa Renters Rebate Status RentersRebate

Pa Renters Rebate Status RentersRebate

Web 27 avr 2009 nbsp 0183 32 You may check the status of a Property Tax Rent rebate you filed on myPATH You can also call the automated toll free number 1 888 PA TAXES 728

Web First the maximum standard rebate is increasing from 650 to 1 000 Second the income cap for both renters and homeowners will be made equal and increase to 45 000 a

Cash Pennsylvania Tax Rebate Status

Cash Pennsylvania Tax Rebate Status are by far the easiest type of Pennsylvania Tax Rebate Status. Customers are given a certain amount of money back upon purchasing a particular item. This is often for products that are expensive, such as electronics or appliances.

Mail-In Pennsylvania Tax Rebate Status

Customers who want to receive mail-in Pennsylvania Tax Rebate Status must send in documents of purchase to claim their cash back. They're a bit more involved, but can result in huge savings.

Instant Pennsylvania Tax Rebate Status

Instant Pennsylvania Tax Rebate Status are made at the point of sale, which reduces your purchase cost instantly. Customers do not have to wait long for savings through this kind of offer.

How Pennsylvania Tax Rebate Status Work

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Web 6 ao 251 t 2023 nbsp 0183 32 PHILADELPHIA CBS Pennsylvania s property tax and rent rebate program is expanding Under a bill Governor Josh Shapiro signed on Friday the

The Pennsylvania Tax Rebate Status Process

It usually consists of a number of easy steps:

-

Buy the product: Firstly purchase the product just like you normally would.

-

Complete the Pennsylvania Tax Rebate Status paper: You'll have to fill in some information, such as your address, name, and purchase information, in order to make a claim for your Pennsylvania Tax Rebate Status.

-

To submit the Pennsylvania Tax Rebate Status If you want to submit the Pennsylvania Tax Rebate Status, based on the kind of Pennsylvania Tax Rebate Status you will need to mail a Pennsylvania Tax Rebate Status form in or submit it online.

-

Wait for approval: The business will scrutinize your submission and ensure that it's compliant with guidelines and conditions of the Pennsylvania Tax Rebate Status.

-

Receive your Pennsylvania Tax Rebate Status Once you've received your approval, you'll receive your cash back via check, prepaid card, or by another option specified by the offer.

Pros and Cons of Pennsylvania Tax Rebate Status

Advantages

-

Cost Savings A Pennsylvania Tax Rebate Status can significantly decrease the price for a product.

-

Promotional Offers: They encourage customers in trying new products or brands.

-

Improve Sales Pennsylvania Tax Rebate Status can increase sales for a company and also increase market share.

Disadvantages

-

Complexity Mail-in Pennsylvania Tax Rebate Status particularly, can be cumbersome and time-consuming.

-

Extension Dates Many Pennsylvania Tax Rebate Status are subject to specific deadlines for submission.

-

Risque of Non-Payment Some customers might have their Pennsylvania Tax Rebate Status delayed if they do not adhere to the guidelines exactly.

Download Pennsylvania Tax Rebate Status

[su_button url="https://printablerebateform.net/?s=Pennsylvania Tax Rebate Status" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Pennsylvania Tax Rebate Status[/su_button]

FAQs

1. Are Pennsylvania Tax Rebate Status similar to discounts? No, Pennsylvania Tax Rebate Status are an amount of money that is refunded after the purchase, while discounts lower the purchase price at point of sale.

2. Are there multiple Pennsylvania Tax Rebate Status I can get on the same product The answer is dependent on the conditions that apply to the Pennsylvania Tax Rebate Status incentives and the specific product's eligibility. Some companies may allow the use of multiple Pennsylvania Tax Rebate Status, whereas other won't.

3. How long does it take to receive the Pennsylvania Tax Rebate Status? The duration differs, but it can be from several weeks to couple of months before you get your Pennsylvania Tax Rebate Status.

4. Do I need to pay taxes regarding Pennsylvania Tax Rebate Status montants? most circumstances, Pennsylvania Tax Rebate Status amounts are not considered to be taxable income.

5. Can I trust Pennsylvania Tax Rebate Status offers from lesser-known brands it is crucial to conduct research and ensure that the brand giving the Pennsylvania Tax Rebate Status is reputable prior making any purchase.

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Fillable Pa 40 Fill Out Sign Online DocHub

Check more sample of Pennsylvania Tax Rebate Status below

Land Transfer Tax Rebate Rental Property PropertyRebate

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

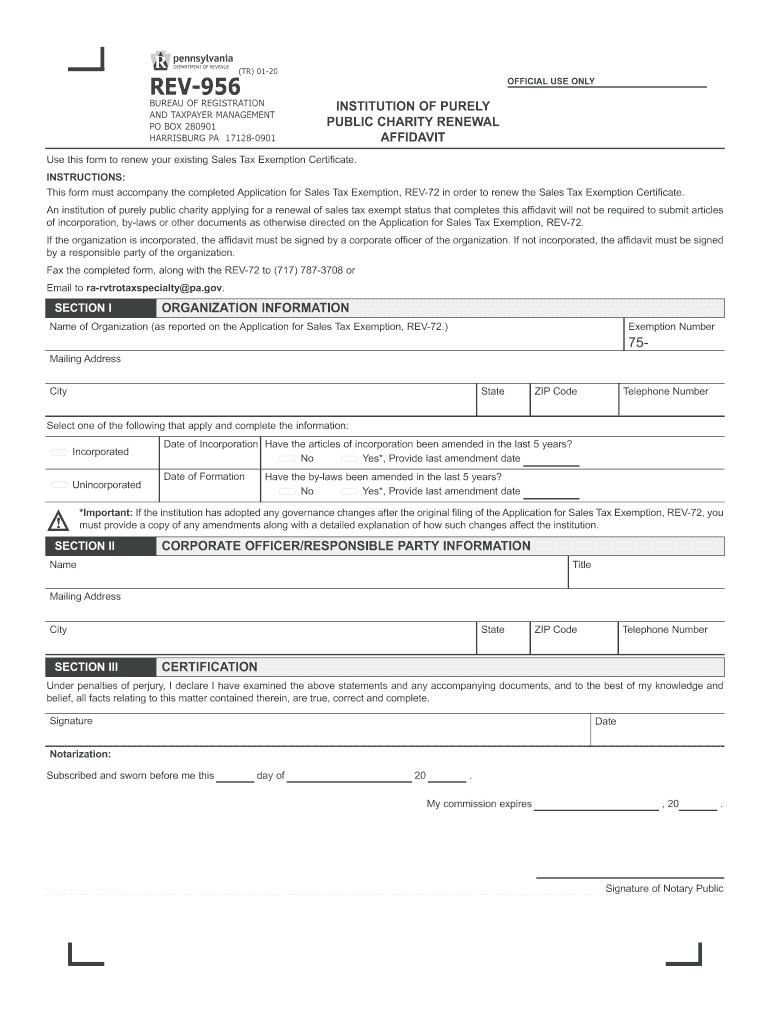

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

Rev 1220 Fill Out Sign Online DocHub

Ptr Tax Rebate Libracha

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

https://www.revenue.pa.gov/OnlineServices/mypath/Individuals/Pages/...

Web Features myPATH offers for Property Tax Rent Rebate claimants Fast processing and direct deposit options The quot Where s My Rebate quot system to track the status of a claim

https://www.revenue.pa.gov/IncentivesCreditsPrograms...

Web The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older The income

Web Features myPATH offers for Property Tax Rent Rebate claimants Fast processing and direct deposit options The quot Where s My Rebate quot system to track the status of a claim

Web The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older The income

Rev 1220 Fill Out Sign Online DocHub

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Ptr Tax Rebate Libracha

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

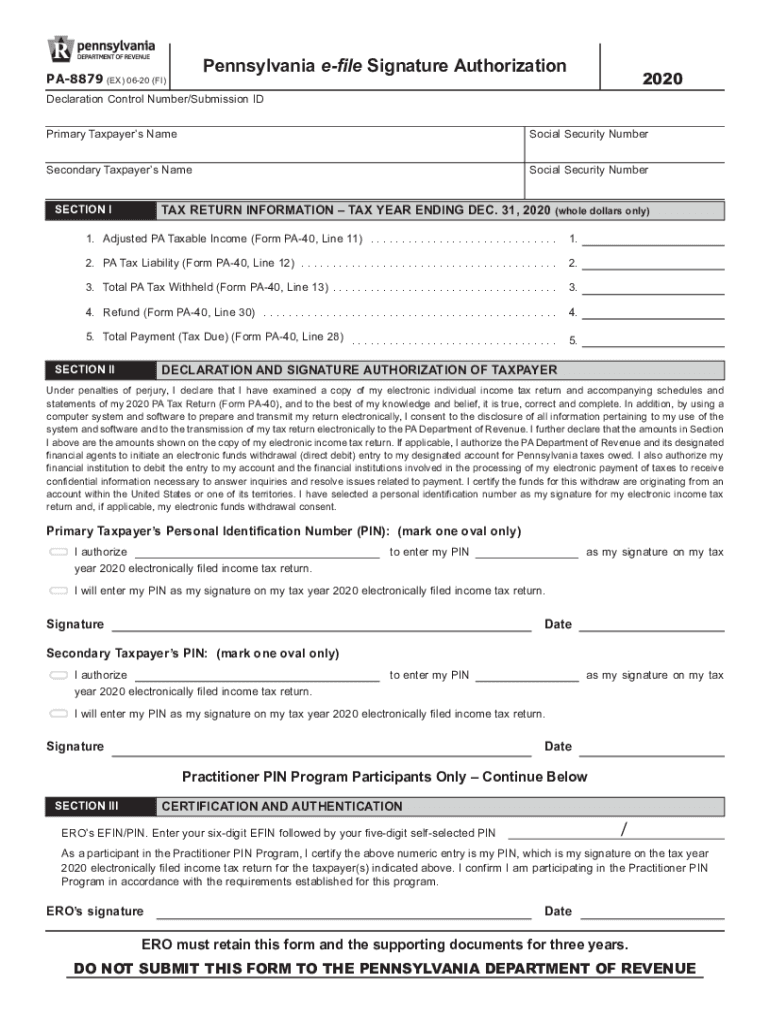

Pa Form 8879 Fill Out Sign Online DocHub

Increase The Threshold For Qualifying For Tax Forgiveness PennLive

Increase The Threshold For Qualifying For Tax Forgiveness PennLive

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word