In the modern world of consumerization everybody loves a good bargain. One method to get substantial savings on your purchases is through Pennsylvania Sales Tax Filing Requirementss. Pennsylvania Sales Tax Filing Requirementss are marketing strategies that retailers and manufacturers use to offer customers a refund for their purchases after they have bought them. In this article, we will explore the world of Pennsylvania Sales Tax Filing Requirementss. We'll look at what they are about, how they work, and how you can maximise your savings through these efficient incentives.

Get Latest Pennsylvania Sales Tax Filing Requirements Below

Pennsylvania Sales Tax Filing Requirements

Pennsylvania Sales Tax Filing Requirements -

The following is what you will need to use TeleFile for sales use tax Eight digit Sales Tax Account ID Number Nine digit Federal Employer Identification Number or Social Security number or your 10 digit Revenue ID Tax period end date PA state gross sales rentals and services PA net taxable sales rentals and services The amount of use

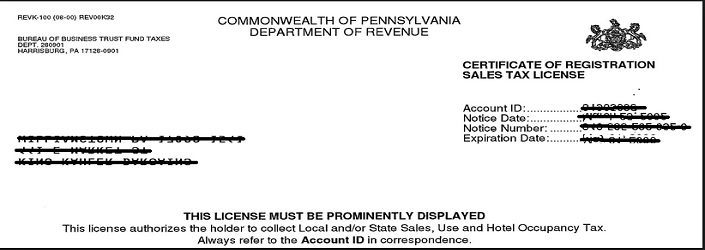

To file a sales tax return you must have a Sales and Use Tax account registered with the PA Department of Revenue See How do I register for business taxes for more information To file a sales tax return on myPATH Log in to myPATH

A Pennsylvania Sales Tax Filing Requirements the simplest model, refers to a partial cash refund provided to customers following the purchase of a product or service. It's a very effective technique employed by companies to attract customers, increase sales and promote specific products.

Types of Pennsylvania Sales Tax Filing Requirements

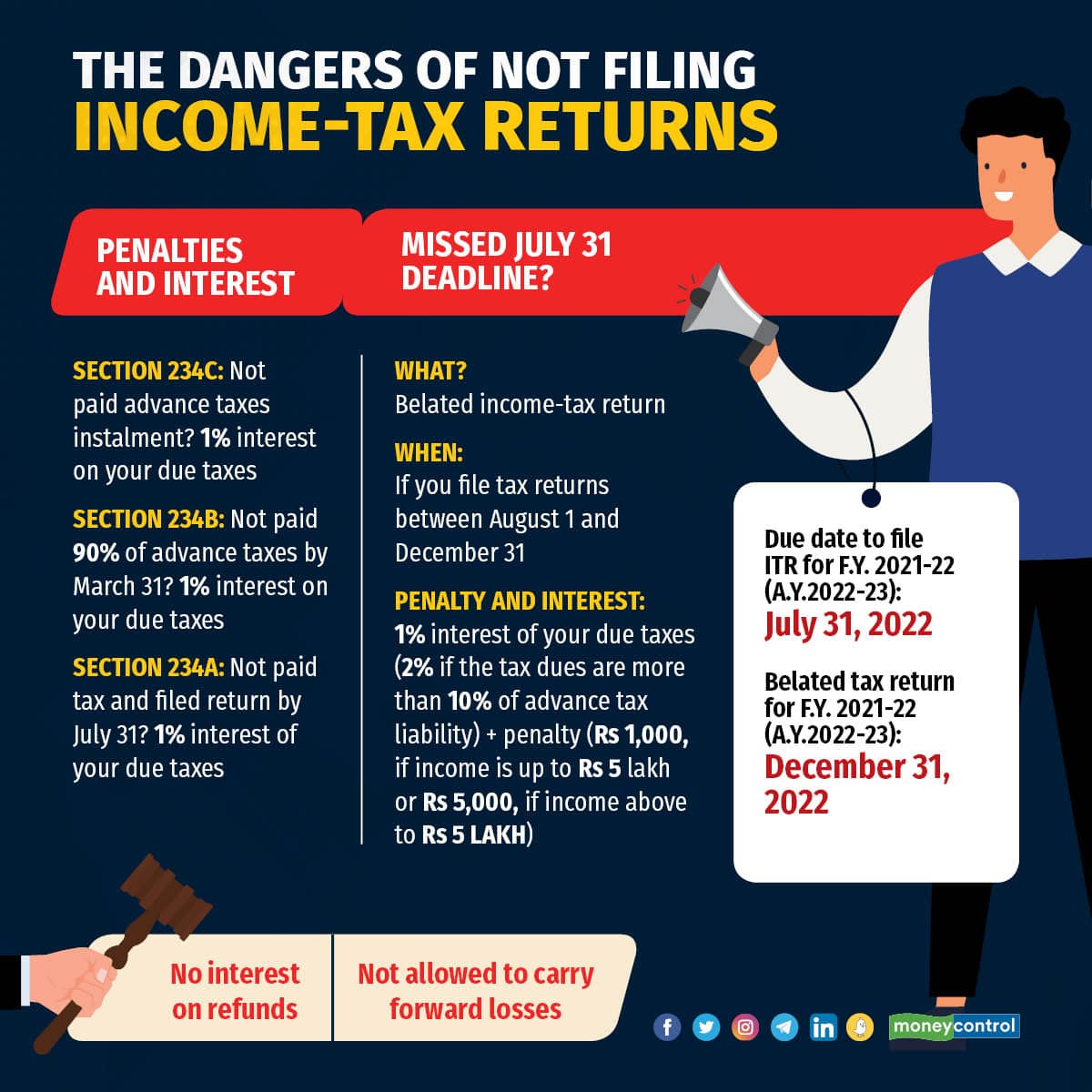

I T Return Filing Interest Penalties On The Cards If Failed To File

I T Return Filing Interest Penalties On The Cards If Failed To File

To file sales tax in Pennsylvania you must begin by reporting gross sales for the reporting period and calculate the total amount of sales tax due from this period The state of Pennsylvania provides all taxpayers with three choices for filing their taxes

PA 1 Online Use Tax Return Pennsylvania Online Business Tax Registration REV 221 Sales and Use Tax Rates REV 227 Pennsylvania Sales and Use Tax Credit Chart REV 588 Starting a Business in Pennsylvania A Guide to Pennsylvania Taxes REV 72 Application For Sales Tax Exemption

Cash Pennsylvania Sales Tax Filing Requirements

Cash Pennsylvania Sales Tax Filing Requirements are the most straightforward kind of Pennsylvania Sales Tax Filing Requirements. Customers get a set amount of money when purchasing a product. These are typically for the most expensive products like electronics or appliances.

Mail-In Pennsylvania Sales Tax Filing Requirements

Mail-in Pennsylvania Sales Tax Filing Requirements are based on the requirement that customers submit proof of purchase to receive the refund. They're a bit more complicated, but they can provide substantial savings.

Instant Pennsylvania Sales Tax Filing Requirements

Instant Pennsylvania Sales Tax Filing Requirements are applied at the moment of sale, cutting the purchase cost immediately. Customers do not have to wait long for savings by using this method.

How Pennsylvania Sales Tax Filing Requirements Work

An Introduction To Sales Tax For Blogging Pinterest Sales Tax

An Introduction To Sales Tax For Blogging Pinterest Sales Tax

6 Economic Sales Threshold 100 000 Transactions Threshold Website Department of Revenue Tax Line 717 787 1064 Pennsylvania Sales Tax Calculator Calculate Rates are for reference only may not include all information needed for filing Try the API demo or contact Sales for filing ready details Results Total Sales Tax Rate

The Pennsylvania Sales Tax Filing Requirements Process

The process usually involves a few steps:

-

Then, you purchase the product you purchase the item in the same way you would normally.

-

Fill out the Pennsylvania Sales Tax Filing Requirements paper: You'll have to give some specific information including your name, address, and purchase details, in order to get your Pennsylvania Sales Tax Filing Requirements.

-

Make sure you submit the Pennsylvania Sales Tax Filing Requirements The Pennsylvania Sales Tax Filing Requirements must be submitted in accordance with the kind of Pennsylvania Sales Tax Filing Requirements it is possible that you need to submit a claim form to the bank or submit it online.

-

Wait for the company's approval: They will review your submission to ensure it meets the refund's conditions and terms.

-

Take advantage of your Pennsylvania Sales Tax Filing Requirements After being approved, you'll receive a refund in the form of a check, prepaid card, or by another option specified by the offer.

Pros and Cons of Pennsylvania Sales Tax Filing Requirements

Advantages

-

Cost Savings The use of Pennsylvania Sales Tax Filing Requirements can greatly reduce the cost for the item.

-

Promotional Deals Incentivize customers to experiment with new products, or brands.

-

Boost Sales Pennsylvania Sales Tax Filing Requirements can enhance the sales of a company as well as its market share.

Disadvantages

-

Complexity Pennsylvania Sales Tax Filing Requirements that are mail-in, in particular the case of HTML0, can be a hassle and demanding.

-

Days of expiration Many Pennsylvania Sales Tax Filing Requirements are subject to very strict deadlines for filing.

-

Risk of not receiving payment Customers may miss out on Pennsylvania Sales Tax Filing Requirements because they do not adhere to the guidelines precisely.

Download Pennsylvania Sales Tax Filing Requirements

[su_button url="https://printablerebateform.net/?s=Pennsylvania Sales Tax Filing Requirements" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Pennsylvania Sales Tax Filing Requirements[/su_button]

FAQs

1. Are Pennsylvania Sales Tax Filing Requirements the same as discounts? No, the Pennsylvania Sales Tax Filing Requirements will be some form of refund following the purchase whereas discounts will reduce the purchase price at the point of sale.

2. Are there multiple Pennsylvania Sales Tax Filing Requirements I can get on the same product It's dependent on the conditions for the Pennsylvania Sales Tax Filing Requirements is offered as well as the merchandise's qualification. Some companies will allow this, whereas others will not.

3. What is the time frame to get an Pennsylvania Sales Tax Filing Requirements? The timing differs, but could range from several weeks to few months for you to receive your Pennsylvania Sales Tax Filing Requirements.

4. Do I need to pay taxes upon Pennsylvania Sales Tax Filing Requirements montants? most cases, Pennsylvania Sales Tax Filing Requirements amounts are not considered taxable income.

5. Do I have confidence in Pennsylvania Sales Tax Filing Requirements offers from brands that aren't well-known It is essential to investigate and ensure that the business providing the Pennsylvania Sales Tax Filing Requirements is reliable prior to making the purchase.

2023 Income Tax Filing Threshold Printable Forms Free Online

Pennsylvania Sales Tax Guide For Businesses Tax Guide Pennsylvania

Check more sample of Pennsylvania Sales Tax Filing Requirements below

Fillable Online Pa sales tax exemption form pdf Fax Email Print PdfFiller

Michigan Llc Tax Return Filing Requirements LLC Bible

What To Expect When Filing Your Taxes This Year

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

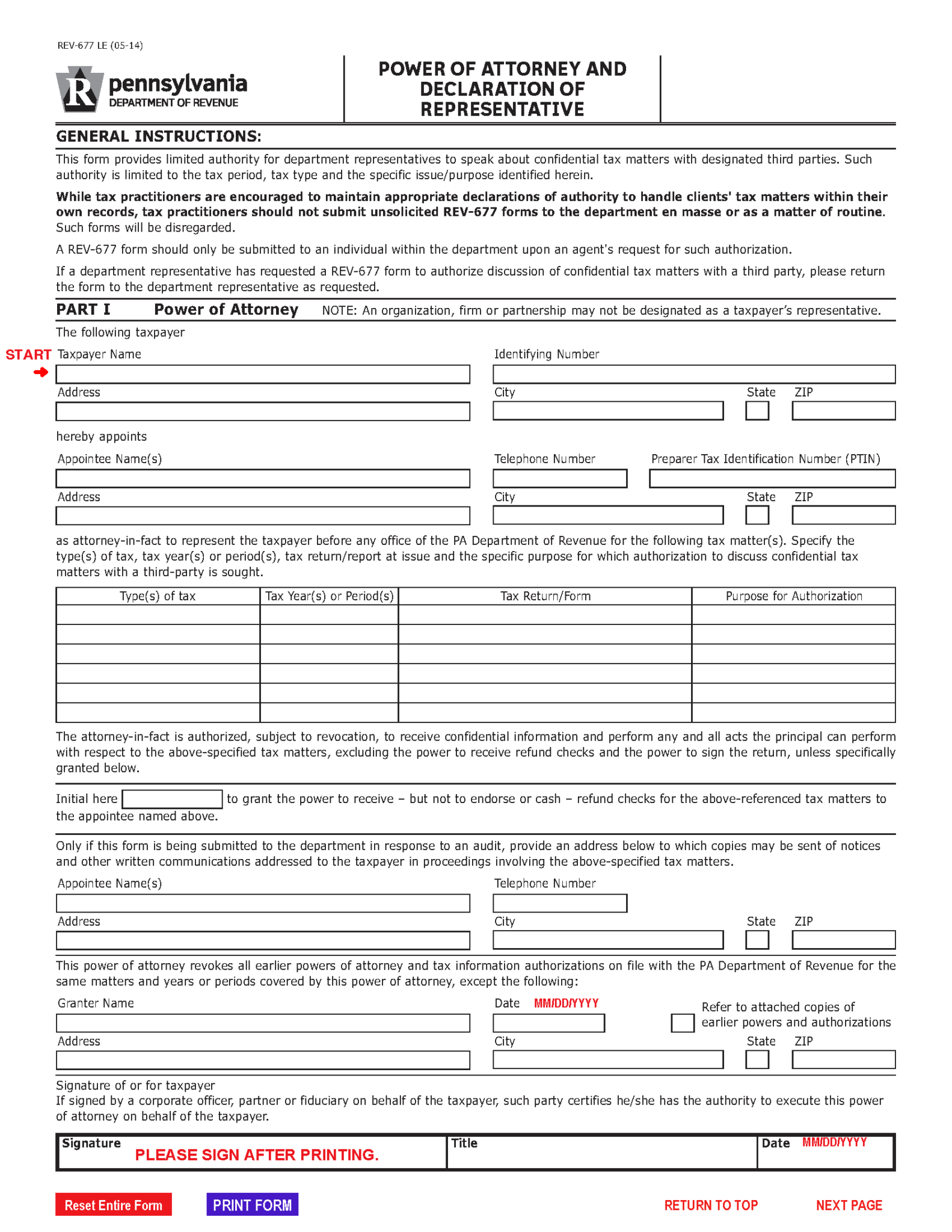

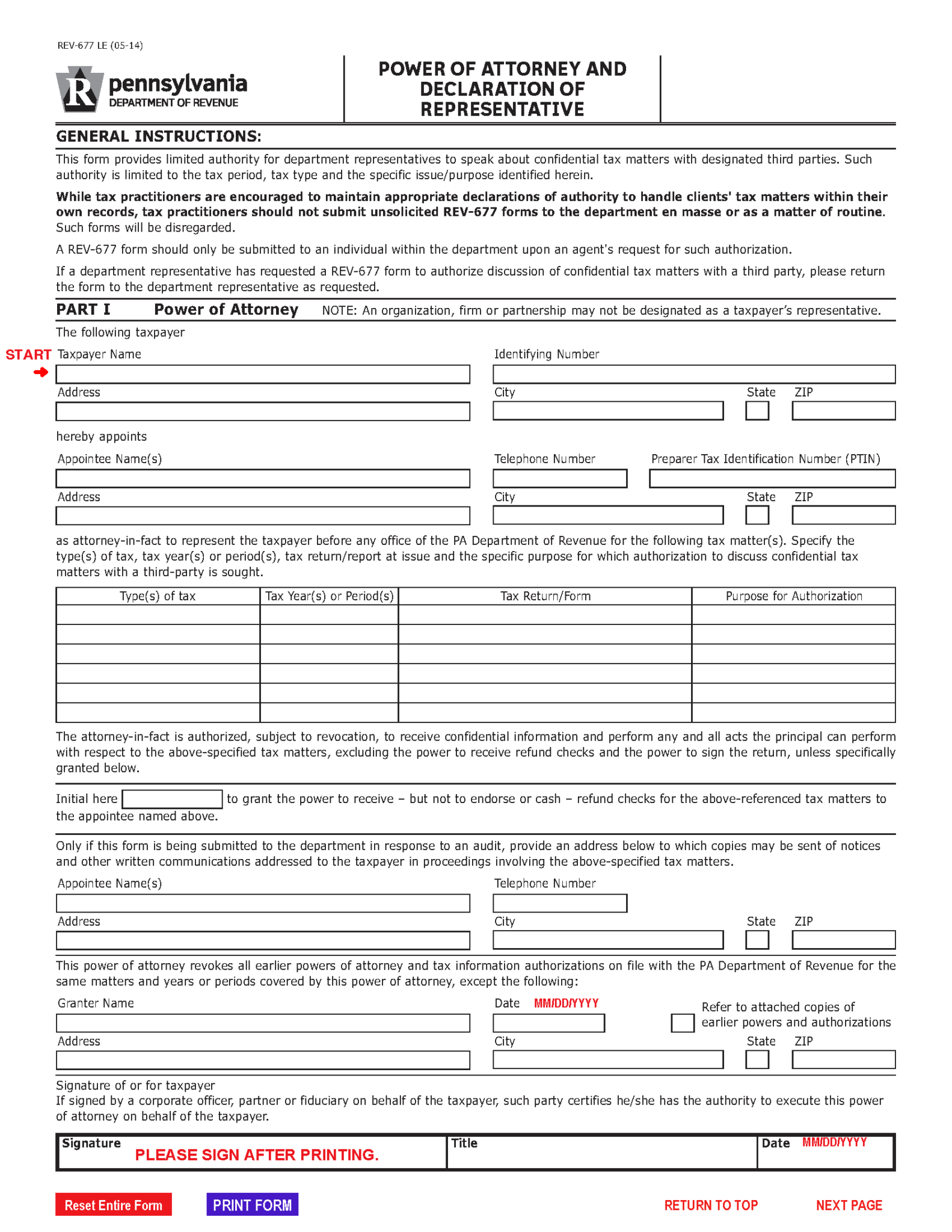

Free Pennsylvania Tax Power Of Attorney Form REV 677 LE PDF

Pennsylvania Sales Tax Guide

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://revenue-pa.custhelp.com/app/answers/detail/a_id/4172

To file a sales tax return you must have a Sales and Use Tax account registered with the PA Department of Revenue See How do I register for business taxes for more information To file a sales tax return on myPATH Log in to myPATH

https://revenue-pa.custhelp.com/app/answers/detail/a_id/215

For semi annual accounts the filing frequency for the next calendar year is determined by the total amount of sales tax reported during the last half of the previous tax year and the first half of the current tax year

To file a sales tax return you must have a Sales and Use Tax account registered with the PA Department of Revenue See How do I register for business taxes for more information To file a sales tax return on myPATH Log in to myPATH

For semi annual accounts the filing frequency for the next calendar year is determined by the total amount of sales tax reported during the last half of the previous tax year and the first half of the current tax year

Free Pennsylvania Tax Power Of Attorney Form REV 677 LE PDF

Michigan Llc Tax Return Filing Requirements LLC Bible

Pennsylvania Sales Tax Guide

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Sales Tax Implications With Your Service Based Business DHJJ

Pennsylvania Sales Tax Guide

Pennsylvania Sales Tax Guide

Register Pennsylvania Sales Tax License