Today, in a world that is driven by the consumer everyone appreciates a great bargain. One method to get substantial savings on your purchases is by using Nj Property Tax Reimbursement Applications. Nj Property Tax Reimbursement Applications are a method of marketing used by manufacturers and retailers in order to offer customers a small discount on purchases they made after they have done so. In this article, we will delve into the world of Nj Property Tax Reimbursement Applications. We'll explore the nature of them and how they operate, and how you can maximize the value of these incentives.

Get Latest Nj Property Tax Reimbursement Application Below

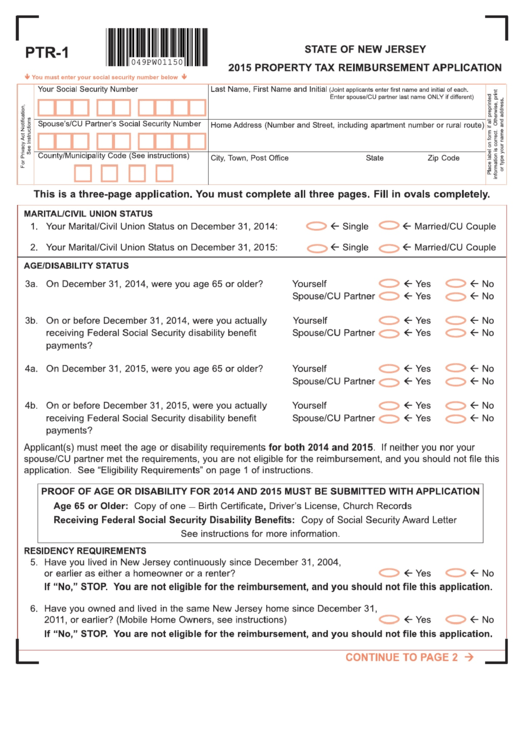

Nj Property Tax Reimbursement Application

Nj Property Tax Reimbursement Application -

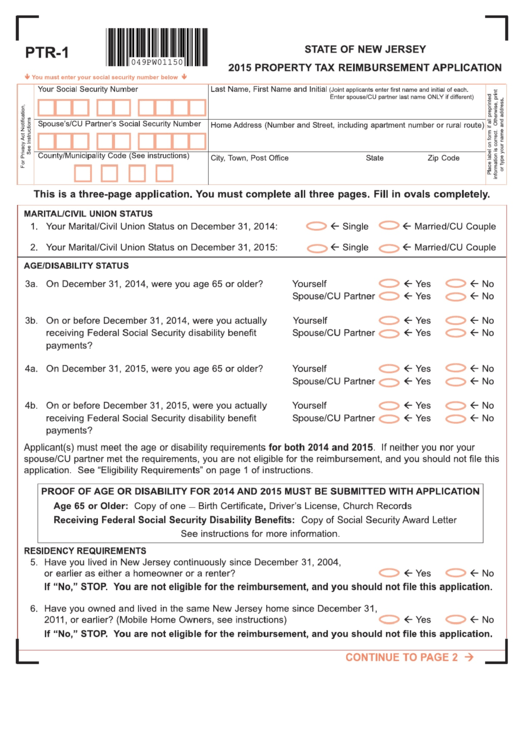

New Jersey Senior Freeze Property Tax Reimbursement Application Create a new PTR 1 application Continue an in progress application or review a submitted

Check your Senior Freeze Property Tax Reimbursement status here This application will allow you to upload the following supporting documentation PTR 1 Proof of

A Nj Property Tax Reimbursement Application as it is understood in its simplest version, is an ad-hoc refund to a purchaser after they've bought a product or service. It's an effective method for businesses to entice customers, increase sales or promote a specific product.

Types of Nj Property Tax Reimbursement Application

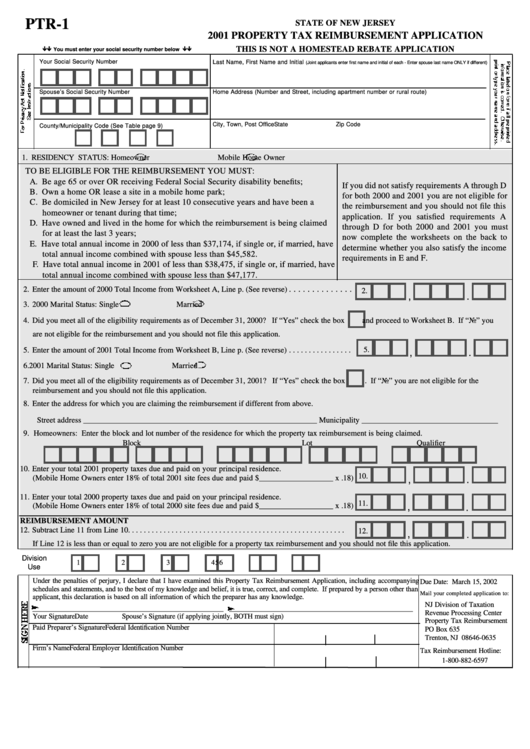

Fillable Form Ptr 1 Property Tax Reimbursement Application 2001

Fillable Form Ptr 1 Property Tax Reimbursement Application 2001

Property Tax Reimbursement Inquiry NJ Taxation Check the status of your New Jersey Senior Freeze Property Tax Reimbursement If a reimbursement has been issued

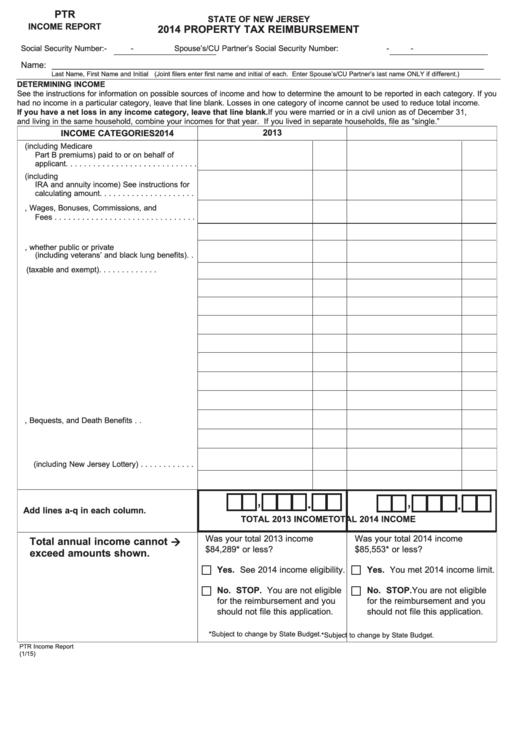

This form establishes your base year property tax amount which is used to calculate the reimbursement going forward You must meet the eligibility requirements for 2

Cash Nj Property Tax Reimbursement Application

Cash Nj Property Tax Reimbursement Application can be the simplest type of Nj Property Tax Reimbursement Application. Customers receive a certain amount of money back after purchasing a item. These are typically applied to costly items like electronics or appliances.

Mail-In Nj Property Tax Reimbursement Application

Mail-in Nj Property Tax Reimbursement Application require that customers present an evidence of purchase for their money back. They are a bit longer-lasting, however they offer huge savings.

Instant Nj Property Tax Reimbursement Application

Instant Nj Property Tax Reimbursement Application are applied at the point of sale, which reduces your purchase cost instantly. Customers don't have to wait for their savings through this kind of offer.

How Nj Property Tax Reimbursement Application Work

Fillable Property Tax Reimbursement Income Report 2014 Printable Pdf

Fillable Property Tax Reimbursement Income Report 2014 Printable Pdf

If you don t want to wait for the application to arrive you can file online on the Treasury s website If you purchase a product or register for an account through a link on our site we

The Nj Property Tax Reimbursement Application Process

The process typically comprises a number of easy steps:

-

Purchase the product: Then you buy the product like you would normally.

-

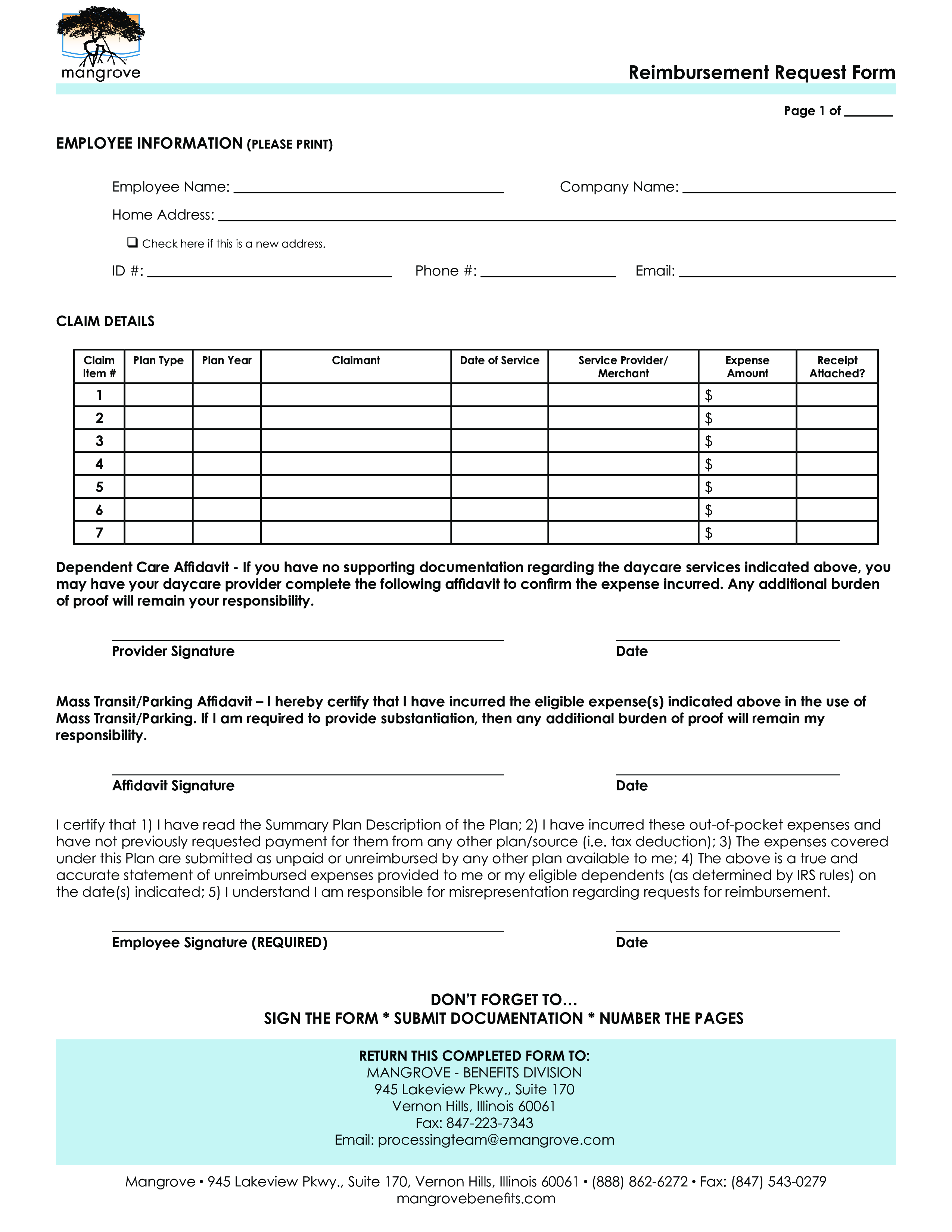

Complete the Nj Property Tax Reimbursement Application request form. You'll have to give some specific information like your name, address and the purchase details, in order in order to take advantage of your Nj Property Tax Reimbursement Application.

-

To submit the Nj Property Tax Reimbursement Application It is dependent on the nature of Nj Property Tax Reimbursement Application the recipient may be required to mail in a form or submit it online.

-

Wait until the company approves: The company will scrutinize your submission for compliance with terms and conditions of the Nj Property Tax Reimbursement Application.

-

Redeem your Nj Property Tax Reimbursement Application Once you've received your approval, the amount you receive will be using a check or prepaid card, or a different way specified in the offer.

Pros and Cons of Nj Property Tax Reimbursement Application

Advantages

-

Cost Savings Nj Property Tax Reimbursement Application can substantially cut the price you pay for the item.

-

Promotional Offers They encourage customers to experiment with new products, or brands.

-

Help to Increase Sales Nj Property Tax Reimbursement Application are a great way to boost the company's sales as well as market share.

Disadvantages

-

Complexity Pay-in Nj Property Tax Reimbursement Application via mail, particularly difficult and long-winded.

-

Extension Dates A lot of Nj Property Tax Reimbursement Application have the strictest deadlines for submission.

-

The risk of non-payment Customers may miss out on Nj Property Tax Reimbursement Application because they don't comply with the rules exactly.

Download Nj Property Tax Reimbursement Application

[su_button url="https://printablerebateform.net/?s=Nj Property Tax Reimbursement Application" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Nj Property Tax Reimbursement Application[/su_button]

FAQs

1. Are Nj Property Tax Reimbursement Application similar to discounts? No, Nj Property Tax Reimbursement Application are a partial refund after the purchase whereas discounts will reduce costs at point of sale.

2. Can I get multiple Nj Property Tax Reimbursement Application for the same product It is contingent on the conditions on the Nj Property Tax Reimbursement Application offered and product's qualification. Certain companies might allow it, but others won't.

3. How long will it take to receive an Nj Property Tax Reimbursement Application? The time frame is variable, however it can take several weeks to a several months to receive a Nj Property Tax Reimbursement Application.

4. Do I have to pay tax with respect to Nj Property Tax Reimbursement Application montants? the majority of circumstances, Nj Property Tax Reimbursement Application amounts are not considered to be taxable income.

5. Can I trust Nj Property Tax Reimbursement Application deals from lesser-known brands It's important to do your research and confirm that the brand offering the Nj Property Tax Reimbursement Application is credible prior to making any purchase.

Kostenloses Reimbursement Request Form

Apply For Senior Freeze Property Tax Reimbursement Program ere

Check more sample of Nj Property Tax Reimbursement Application below

NJ Division Of Taxation NJ Division Of Taxation Senior Freeze

NJ Division Of Taxation Senior Freeze Property Tax Reimbursement

Property Tax Reimbursement Program Toms River Township NJ

How To Fill Out A New Jersey Property Tax Reimbursement Form Property

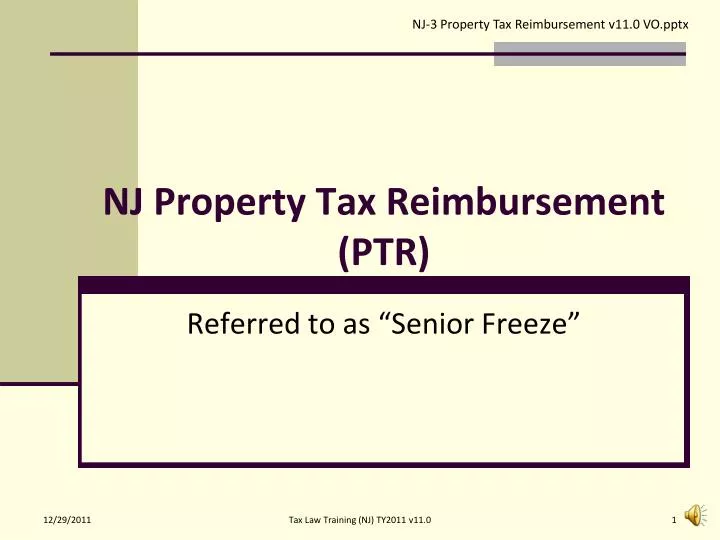

PPT NJ Property Tax Reimbursement PTR PowerPoint Presentation Free

Fillable Form Ptr 1 Property Tax Reimbursement Application 2015

https://www.njportal.com › taxation › ptr

Check your Senior Freeze Property Tax Reimbursement status here This application will allow you to upload the following supporting documentation PTR 1 Proof of

https://nj.gov › treasury › taxation › pdf › ptr

New Jersey Senior Freeze Property Tax Reimbursement Application File your application by October 31 2024 You can file online at

Check your Senior Freeze Property Tax Reimbursement status here This application will allow you to upload the following supporting documentation PTR 1 Proof of

New Jersey Senior Freeze Property Tax Reimbursement Application File your application by October 31 2024 You can file online at

How To Fill Out A New Jersey Property Tax Reimbursement Form Property

NJ Division Of Taxation Senior Freeze Property Tax Reimbursement

PPT NJ Property Tax Reimbursement PTR PowerPoint Presentation Free

Fillable Form Ptr 1 Property Tax Reimbursement Application 2015

NJ Division Of Taxation Senior Freeze Property Tax Reimbursement

St 5 Form Nj Fill Online Printable Fillable Blank PdfFiller

St 5 Form Nj Fill Online Printable Fillable Blank PdfFiller

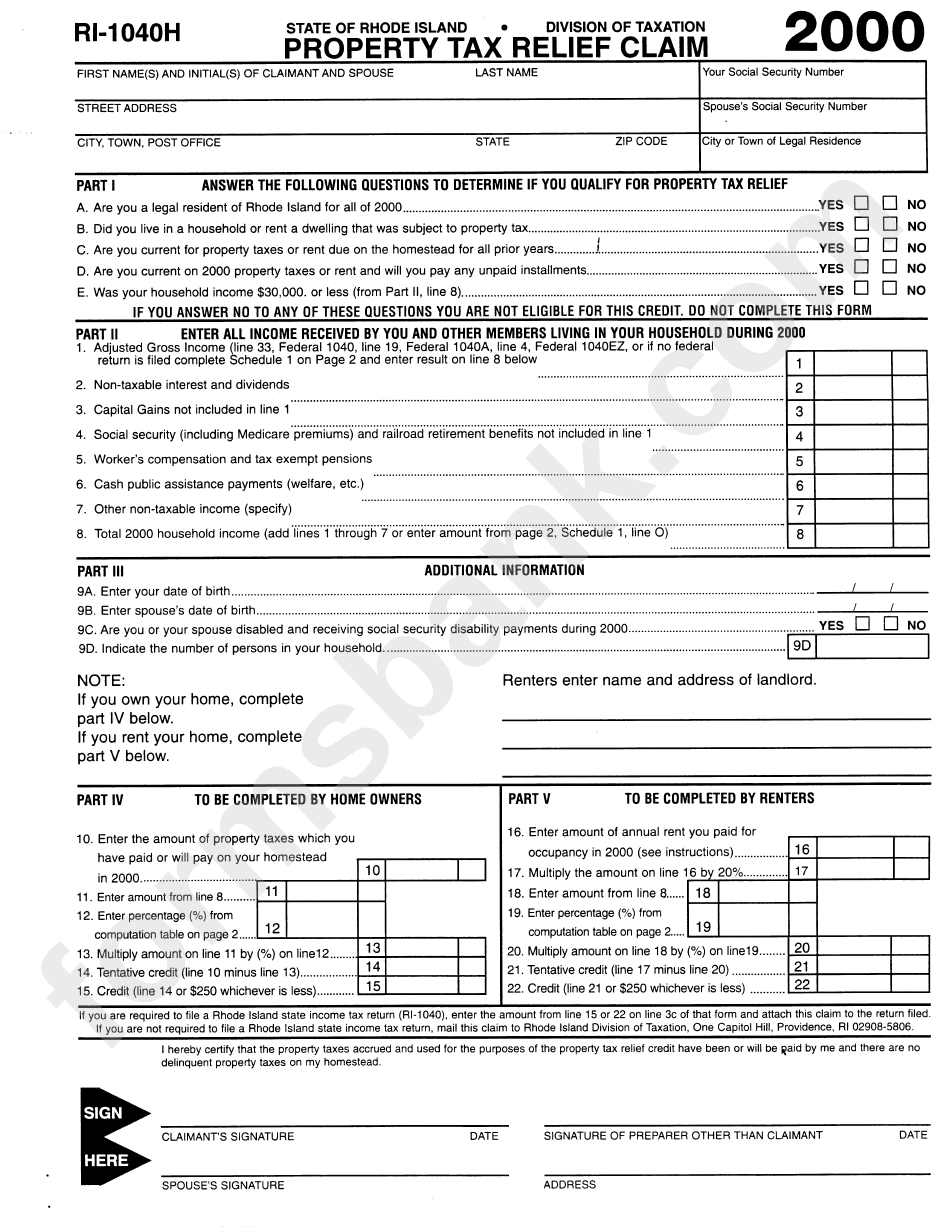

Form Ri 1040h Property Tax Relief Claim 2000 Printable Pdf Download