In our current world of high-end consumer goods everyone appreciates a great deal. One way to make significant savings for your purchases is through Is Rental Rebate Taxables. Is Rental Rebate Taxables are a marketing strategy that retailers and manufacturers use to offer consumers a partial return on their purchases once they have purchased them. In this article, we will look into the world of Is Rental Rebate Taxables and explore the nature of them about, how they work, and how you can maximise the value of these incentives.

Get Latest Is Rental Rebate Taxable Below

Is Rental Rebate Taxable

Is Rental Rebate Taxable -

The IRS has created a FAQ page addressing tax issues related to Section 501 Emergency Rental Assistance Q1 I am a renter who received Section 501 Emergency Rental Assistance payments from a Distributing Entity for use in paying my rent Are these payments includible in my gross income

Landlords are required to provide rental waivers to eligible tenants through any of these methods Monetary payments to the tenants and or Reduction of rent or licence fee provided to the tenant and or Passing on the Property Tax Rebate to the tenants fully or partly

A Is Rental Rebate Taxable as it is understood in its simplest form, is a payment to a consumer after having purchased a item or service. It's a highly effective tool employed by companies to attract clients, increase sales and even promote certain products.

Types of Is Rental Rebate Taxable

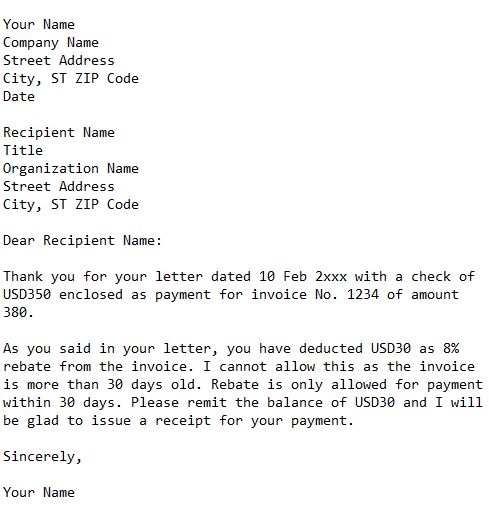

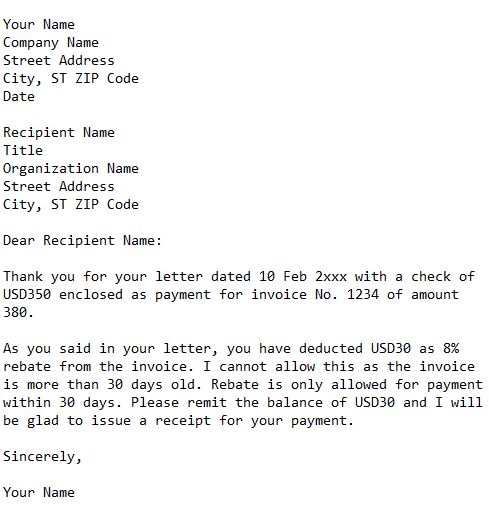

Letter Disallowing Rebate Financial Letter 101 Business Letter

Letter Disallowing Rebate Financial Letter 101 Business Letter

Emergency Rental Assistance is intended to help eligible households that require financial assistance to pay for rent utilities home energy expenses and other related expenses and the payments are excluded from income only for those households

The Rental Relief Framework is designed to provide mandated equitable co sharing of rental obligations between the Government landlords and tenants The principal aim is to help affected Small and Medium sized Enterprises SMEs who need more time and support to recover from the pandemic

Cash Is Rental Rebate Taxable

Cash Is Rental Rebate Taxable are the most straightforward type of Is Rental Rebate Taxable. Customers are given a certain amount back in cash after purchasing a particular item. These are usually used for products that are expensive, such as electronics or appliances.

Mail-In Is Rental Rebate Taxable

Customers who want to receive mail-in Is Rental Rebate Taxable must submit evidence of purchase to get their refund. They're a bit more involved but can offer significant savings.

Instant Is Rental Rebate Taxable

Instant Is Rental Rebate Taxable are applied at moment of sale, cutting the price of purchases immediately. Customers don't have to wait for their savings by using this method.

How Is Rental Rebate Taxable Work

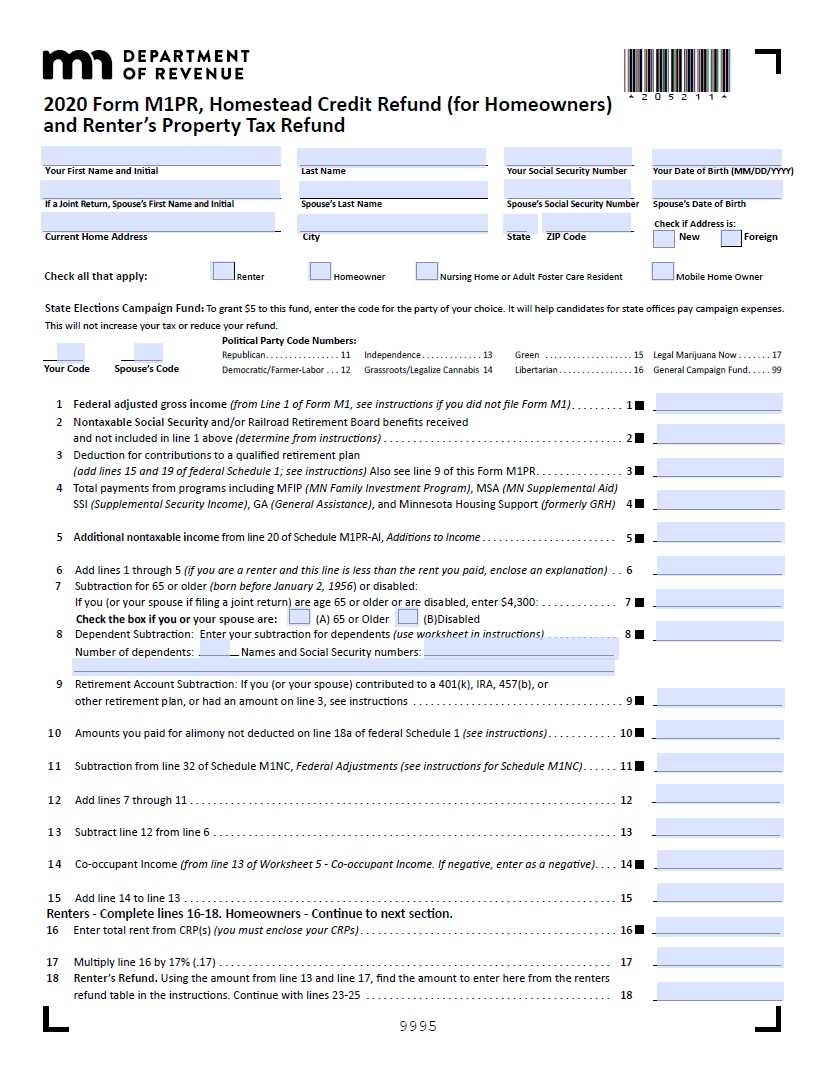

Form For Renters Rebate RentersRebate

Form For Renters Rebate RentersRebate

South Carolina s tax credit offers 25 of the cost of your solar system up to 35 000 or 50 of your tax liability for the year The state of Idaho offers a 40 tax deduction on the cost of a

The Is Rental Rebate Taxable Process

It usually consists of a number of easy steps:

-

Purchase the product: First you purchase the product just as you would ordinarily.

-

Fill in this Is Rental Rebate Taxable application: In order to claim your Is Rental Rebate Taxable, you'll have to supply some details, such as your name, address, as well as the details of your purchase in order to take advantage of your Is Rental Rebate Taxable.

-

Complete the Is Rental Rebate Taxable depending on the kind of Is Rental Rebate Taxable you will need to mail in a form or submit it online.

-

Wait for approval: The business will review your submission to confirm that it complies with the guidelines and conditions of the Is Rental Rebate Taxable.

-

Accept your Is Rental Rebate Taxable When it's approved the amount you receive will be either by check, prepaid card, or any other procedure specified by the deal.

Pros and Cons of Is Rental Rebate Taxable

Advantages

-

Cost Savings Rewards can drastically cut the price you pay for products.

-

Promotional Offers These promotions encourage consumers to explore new products or brands.

-

boost sales Is Rental Rebate Taxable can help boost sales for a company and also increase market share.

Disadvantages

-

Complexity In particular, mail-in Is Rental Rebate Taxable in particular are often time-consuming and tedious.

-

Day of Expiration Some Is Rental Rebate Taxable have specific deadlines for submission.

-

Risk of Non-Payment Certain customers could not receive their refunds if they don't comply with the rules exactly.

Download Is Rental Rebate Taxable

[su_button url="https://printablerebateform.net/?s=Is Rental Rebate Taxable" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Is Rental Rebate Taxable[/su_button]

FAQs

1. Are Is Rental Rebate Taxable the same as discounts? No, Is Rental Rebate Taxable offer only a partial reimbursement following the purchase, whereas discounts cut prices at time of sale.

2. Are there any Is Rental Rebate Taxable that I can use for the same product This is dependent on terms for the Is Rental Rebate Taxable provides and the particular product's admissibility. Certain businesses may allow it, and some don't.

3. How long does it take to receive an Is Rental Rebate Taxable? The amount of time will vary, but it may take anywhere from a few weeks to a few months to get your Is Rental Rebate Taxable.

4. Do I have to pay taxes of Is Rental Rebate Taxable the amount? the majority of instances, Is Rental Rebate Taxable amounts are not considered to be taxable income.

5. Can I trust Is Rental Rebate Taxable offers from brands that aren't well-known it is crucial to conduct research and confirm that the brand giving the Is Rental Rebate Taxable is legitimate prior to making a purchase.

Pa Rental Rebate Status Printable Rebate Form

Many Alberta Apartment And Condo Dwellers Unlikely To See 300

Check more sample of Is Rental Rebate Taxable below

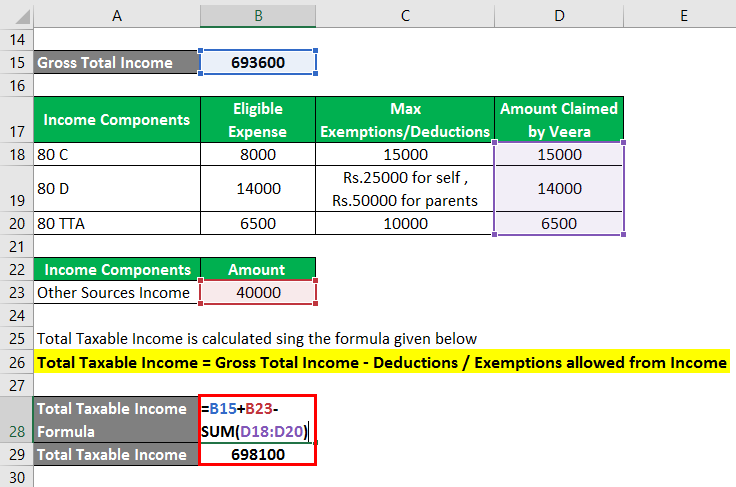

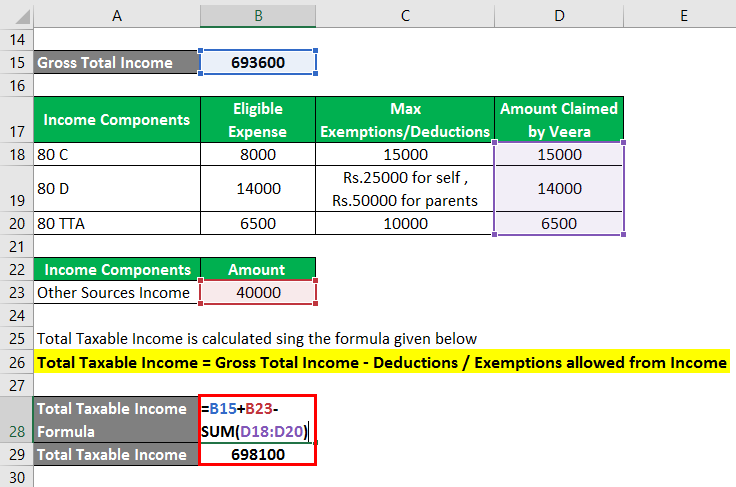

What Is Taxable Income And How To Calculate Taxable Income

Oral B Rebate Form Printable Rebate Form

Rent Rebate Form Missouri Printable Rebate Form

Traderider Rebate Program Verify Trade ID

Pensioner Rebate Doubled To Provide Support Bundaberg Now

How To Calculate Gross Income Tax Haiper

https://www.iras.gov.sg/news-events/singapore...

Landlords are required to provide rental waivers to eligible tenants through any of these methods Monetary payments to the tenants and or Reduction of rent or licence fee provided to the tenant and or Passing on the Property Tax Rebate to the tenants fully or partly

https://revenue-pa.custhelp.com/app/answers/detail/a_id/181

Renters must make certain their landlords were required to pay property taxes or has made a payment in lieu of tax payments on the rental property You are eligible for a Property Tax Rent Rebate if you meet the requirements in each of the three categories below Category 1 Type of Filer

Landlords are required to provide rental waivers to eligible tenants through any of these methods Monetary payments to the tenants and or Reduction of rent or licence fee provided to the tenant and or Passing on the Property Tax Rebate to the tenants fully or partly

Renters must make certain their landlords were required to pay property taxes or has made a payment in lieu of tax payments on the rental property You are eligible for a Property Tax Rent Rebate if you meet the requirements in each of the three categories below Category 1 Type of Filer

Traderider Rebate Program Verify Trade ID

Oral B Rebate Form Printable Rebate Form

Pensioner Rebate Doubled To Provide Support Bundaberg Now

How To Calculate Gross Income Tax Haiper

Taxable Payments Annual Report Bosco Chartered Accountants

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

RebateDaily Auto Rebate XM Forex