In this day and age of consuming people love a good bargain. One way to make significant savings in your purchase is through Income Tax Rebate On Electric Cars. Income Tax Rebate On Electric Cars are a method of marketing used by manufacturers and retailers to provide customers with a portion of a reimbursement on their purchases following the time they've created them. In this post, we'll examine the subject of Income Tax Rebate On Electric Cars and explore what they are about, how they work, and how to maximize the savings you can make by using these cost-effective incentives.

Get Latest Income Tax Rebate On Electric Car Below

Income Tax Rebate On Electric Car

Income Tax Rebate On Electric Car -

Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Web 22 ao 251 t 2022 nbsp 0183 32 The Biden administration s climate and health care bill revamps the available tax credits for buyers of electric cars Here s what

A Income Tax Rebate On Electric Car at its most basic form, is a partial refund given to a client after having purchased a item or service. It's a highly effective tool for businesses to entice clients, increase sales and to promote certain products.

Types of Income Tax Rebate On Electric Car

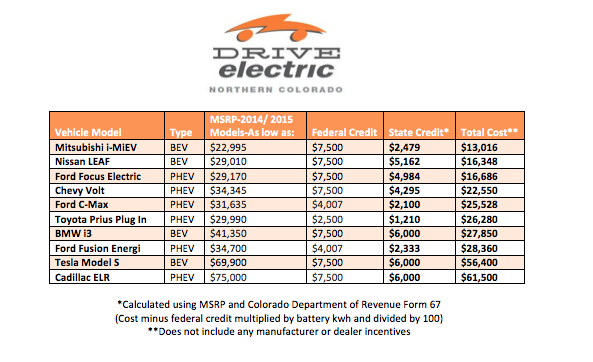

Electric Car Available Rebates 2023 Carrebate

Electric Car Available Rebates 2023 Carrebate

Web 7 mai 2022 nbsp 0183 32 1 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Web 27 juin 2023 nbsp 0183 32 Spain will reimburse up to 15 of income tax to people who buy an electric vehicle EV before the end of the year to encourage cleaner driving Economy Minister

Cash Income Tax Rebate On Electric Car

Cash Income Tax Rebate On Electric Car are the simplest type of Income Tax Rebate On Electric Car. Customers are offered a certain sum of money back when buying a product. These are often used for more expensive items such electronics or appliances.

Mail-In Income Tax Rebate On Electric Car

Mail-in Income Tax Rebate On Electric Car demand that customers provide proof of purchase to receive their money back. They're more involved, but can result in huge savings.

Instant Income Tax Rebate On Electric Car

Instant Income Tax Rebate On Electric Car are made at the points of sale. This reduces the cost of purchase immediately. Customers don't need to wait for their savings with this type.

How Income Tax Rebate On Electric Car Work

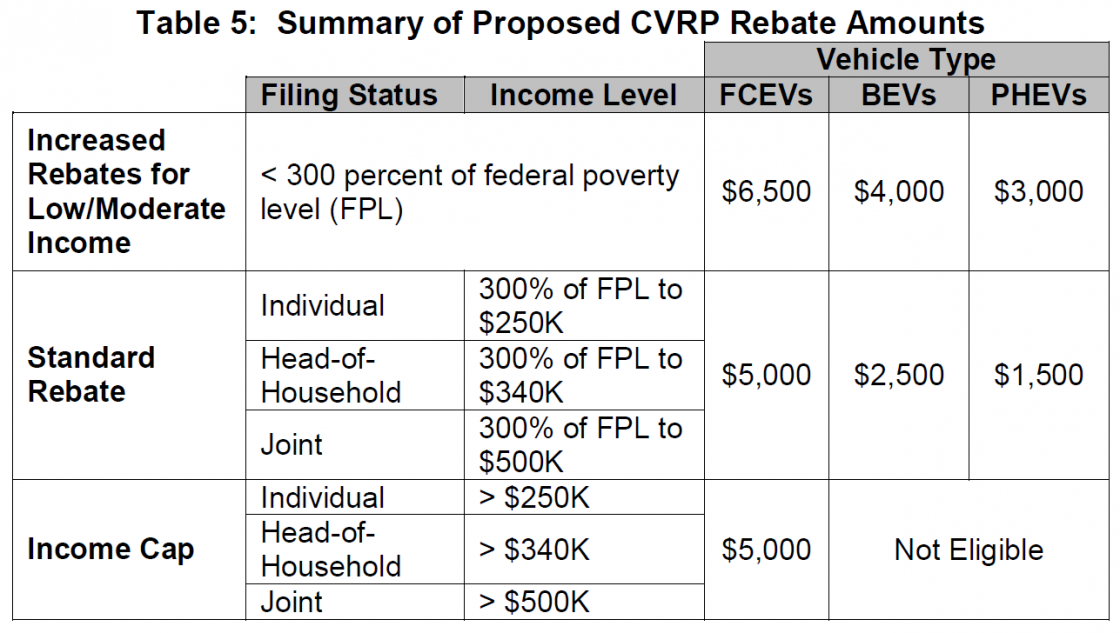

Ca Electric Car Rebate Income Limit ElectricRebate

Ca Electric Car Rebate Income Limit ElectricRebate

Web But this robust tax break which offers up to 7 500 toward the purchase of a new electric vehicle was overhauled by the Inflation Reduction Act Here s what you need to know

The Income Tax Rebate On Electric Car Process

The process typically involves a number of easy steps:

-

Then, you purchase the product then, you buy the item like you normally do.

-

Fill out this Income Tax Rebate On Electric Car questionnaire: you'll need to provide some information, such as your address, name, and purchase details in order to claim your Income Tax Rebate On Electric Car.

-

In order to submit the Income Tax Rebate On Electric Car depending on the nature of Income Tax Rebate On Electric Car there may be a requirement to either mail in a request form or upload it online.

-

Wait for the company's approval: They will review your submission for compliance with requirements of the Income Tax Rebate On Electric Car.

-

Accept your Income Tax Rebate On Electric Car Once it's approved, you'll be able to receive your reimbursement, using a check or prepaid card or through a different option specified by the offer.

Pros and Cons of Income Tax Rebate On Electric Car

Advantages

-

Cost Savings: Income Tax Rebate On Electric Car can significantly decrease the price for the product.

-

Promotional Deals The aim is to encourage customers in trying new products or brands.

-

Accelerate Sales Income Tax Rebate On Electric Car can enhance the sales of a business and increase its market share.

Disadvantages

-

Complexity Income Tax Rebate On Electric Car that are mail-in, in particular could be cumbersome and demanding.

-

Extension Dates Some Income Tax Rebate On Electric Car have extremely strict deadlines to submit.

-

Risk of Non-Payment Certain customers could not get their Income Tax Rebate On Electric Car if they don't comply with the rules exactly.

Download Income Tax Rebate On Electric Car

[su_button url="https://printablerebateform.net/?s=Income Tax Rebate On Electric Car" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Income Tax Rebate On Electric Car[/su_button]

FAQs

1. Are Income Tax Rebate On Electric Car equivalent to discounts? Not necessarily, as Income Tax Rebate On Electric Car are a partial refund after purchase, and discounts are a reduction of costs at moment of sale.

2. Can I get multiple Income Tax Rebate On Electric Car on the same item This depends on the conditions on the Income Tax Rebate On Electric Car is offered as well as the merchandise's eligibility. Certain companies may allow it, but some will not.

3. What is the time frame to get a Income Tax Rebate On Electric Car? The duration is different, but it could range from several weeks to few months to get your Income Tax Rebate On Electric Car.

4. Do I need to pay tax upon Income Tax Rebate On Electric Car values? the majority of circumstances, Income Tax Rebate On Electric Car amounts are not considered taxable income.

5. Should I be able to trust Income Tax Rebate On Electric Car deals from lesser-known brands? It's essential to research and confirm that the company that is offering the Income Tax Rebate On Electric Car is trustworthy prior to making the purchase.

Tax Rebate Lease Electric Car 2022 2023 Carrebate

Income Tax Rebate On Electric Car 2022 Carrebate

Check more sample of Income Tax Rebate On Electric Car below

Tax Rebate On Electric Cars 2022 2023 Carrebate

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Do Electric Cars Still Qualify For A Tax Rebate ElectricRebate

California Electric Car Rebate EV Tax Credit Incentives Eligibility

Federal Tax Rebate For Electric Cars 2023 Carrebate

Delaware Electric Car Tax Rebate Printable Rebate Form

https://www.npr.org/2022/08/22/1118052620

Web 22 ao 251 t 2022 nbsp 0183 32 The Biden administration s climate and health care bill revamps the available tax credits for buyers of electric cars Here s what

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit

Web 22 ao 251 t 2022 nbsp 0183 32 The Biden administration s climate and health care bill revamps the available tax credits for buyers of electric cars Here s what

Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit

California Electric Car Rebate EV Tax Credit Incentives Eligibility

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Federal Tax Rebate For Electric Cars 2023 Carrebate

Delaware Electric Car Tax Rebate Printable Rebate Form

Residential Electric Vehicle Incentive Program Volkswagen Pasadena

Politics Be Damned Electric Cars Aren t Really So Polarizing

Politics Be Damned Electric Cars Aren t Really So Polarizing

Tax Credits For Electric Vehicles TaxProAdvice