In our current world of high-end consumer goods everybody loves a good deal. One way to make substantial savings on your purchases is by using How To Claim Tax Credit For Evs. How To Claim Tax Credit For Evs can be a way of marketing that retailers and manufacturers use to offer customers a partial refund for their purchases after they've taken them. In this post, we'll go deeper into the realm of How To Claim Tax Credit For Evs. We'll discuss what they are and how they function, as well as ways to maximize your savings via these cost-effective incentives.

Get Latest How To Claim Tax Credit For Ev Below

How To Claim Tax Credit For Ev

How To Claim Tax Credit For Ev -

The US Treasury s EV charger tax credit which is claimed on IRS Form 8911 is limited to 1 000 for individuals claiming for home EV charging and 100 000

How to qualify for the 2024 EV tax credit Used EV tax credit qualifications How the electric vehicle tax credit is calculated How to claim the federal EV tax credit

A How To Claim Tax Credit For Ev in its simplest model, refers to a partial cash refund provided to customers after purchasing a certain product or service. It is a powerful tool for businesses to entice customers, increase sales, and advertise specific products.

Types of How To Claim Tax Credit For Ev

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

There are now two types of EV tax credits and three ways to claim them The EV tax credit for new vehicles is either 3750 or 7500 but very few new vehicles

Getty You could call it a tax pre fund Starting in January you ll be able to get an electric vehicle tax credit of up to 7 500 without having to wait for the IRS to

Cash How To Claim Tax Credit For Ev

Cash How To Claim Tax Credit For Ev is the most basic type of How To Claim Tax Credit For Ev. Clients receive a predetermined amount of money after buying a product. This is often for large-ticket items such as electronics and appliances.

Mail-In How To Claim Tax Credit For Ev

Mail-in How To Claim Tax Credit For Ev require that customers present the proof of purchase in order to receive the refund. They're a bit more complicated but could provide substantial savings.

Instant How To Claim Tax Credit For Ev

Instant How To Claim Tax Credit For Ev can be applied at the point of sale and reduce the price of purchases immediately. Customers don't need to wait for their savings through this kind of offer.

How How To Claim Tax Credit For Ev Work

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Eligible people can claim the credit using Form 8936 otherwise called Qualified Plug in Electric Drive Motor Vehicle Credit The form also applies to two or

The How To Claim Tax Credit For Ev Process

It usually consists of a handful of simple steps:

-

Purchase the product: First you buy the product just as you would ordinarily.

-

Fill in this How To Claim Tax Credit For Ev Form: To claim the How To Claim Tax Credit For Ev you'll have to provide some information like your address, name, along with the purchase details, to take advantage of your How To Claim Tax Credit For Ev.

-

Send in the How To Claim Tax Credit For Ev If you want to submit the How To Claim Tax Credit For Ev, based on the nature of How To Claim Tax Credit For Ev, you may need to fill out a form and mail it in or upload it online.

-

Wait for approval: The company will examine your application and ensure that it's compliant with How To Claim Tax Credit For Ev's terms and conditions.

-

Redeem your How To Claim Tax Credit For Ev: Once approved, you'll receive a refund either through check, prepaid card, or any other method specified by the offer.

Pros and Cons of How To Claim Tax Credit For Ev

Advantages

-

Cost Savings How To Claim Tax Credit For Ev could significantly cut the price you pay for an item.

-

Promotional Offers These promotions encourage consumers to try new items or brands.

-

Increase Sales How To Claim Tax Credit For Ev can increase an organization's sales and market share.

Disadvantages

-

Complexity Reward mail-ins particularly, can be cumbersome and time-consuming.

-

Days of expiration Most How To Claim Tax Credit For Ev come with deadlines for submission.

-

Risque of Non-Payment Certain customers could not get their How To Claim Tax Credit For Ev if they don't follow the rules precisely.

Download How To Claim Tax Credit For Ev

[su_button url="https://printablerebateform.net/?s=How To Claim Tax Credit For Ev" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download How To Claim Tax Credit For Ev[/su_button]

FAQs

1. Are How To Claim Tax Credit For Ev equivalent to discounts? No, the How To Claim Tax Credit For Ev will be only a partial reimbursement following the purchase, whereas discounts reduce the purchase price at time of sale.

2. Do I have to use multiple How To Claim Tax Credit For Ev on the same product This depends on the conditions in the How To Claim Tax Credit For Ev deals and product's admissibility. Certain companies might permit it, while other companies won't.

3. What is the time frame to receive a How To Claim Tax Credit For Ev? The timing will vary, but it may take a couple of weeks or a couple of months before you get your How To Claim Tax Credit For Ev.

4. Do I have to pay tax when I receive How To Claim Tax Credit For Ev values? the majority of situations, How To Claim Tax Credit For Ev amounts are not considered to be taxable income.

5. Should I be able to trust How To Claim Tax Credit For Ev offers from brands that aren't well-known It's crucial to research and ensure that the business which is providing the How To Claim Tax Credit For Ev is reputable prior to making an acquisition.

What Is An R D Tax Credit

Tution Tax Credit For Students NCS CA

Check more sample of How To Claim Tax Credit For Ev below

Pandemic Tax Credit Gets A Boost IndustryWeek

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

Georgia Tax Credits For Workers And Families

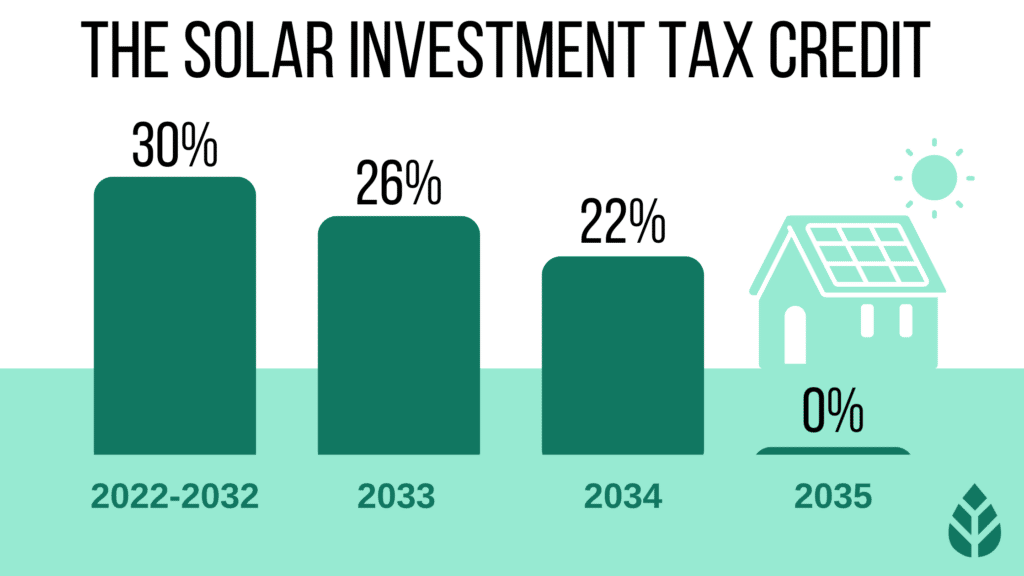

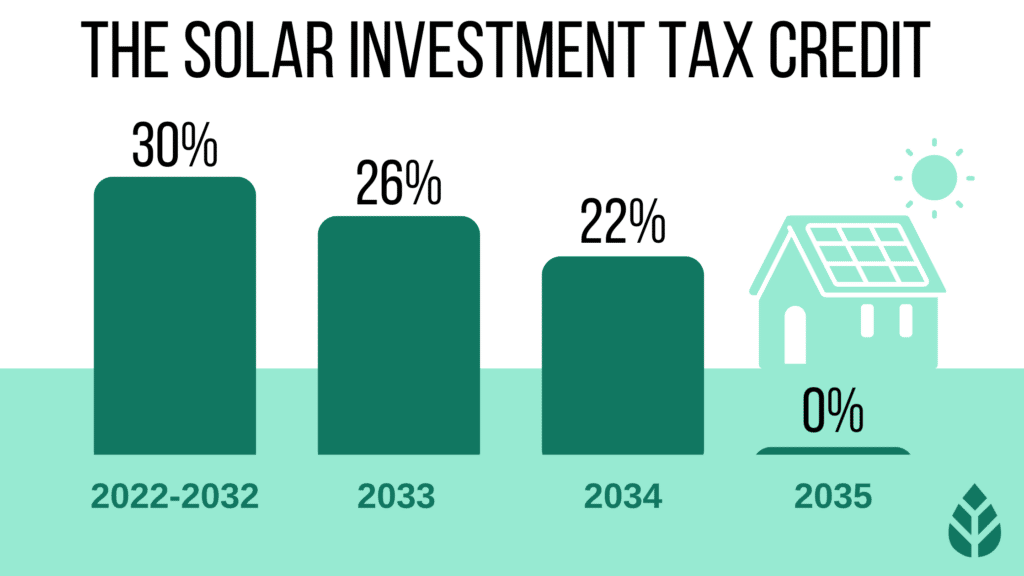

When Does Solar Tax Credit End SolarProGuide 2022

Modifications To The 45Q Tax Credit Great Plains Institute

FAQ WA Tax Credit

www. nerdwallet.com /article/taxes/ev-tax...

How to qualify for the 2024 EV tax credit Used EV tax credit qualifications How the electric vehicle tax credit is calculated How to claim the federal EV tax credit

turbotax.intuit.com /tax-tips/going-green/...

Use Form 8936 to claim either the Qualified Plug In Electric Drive Motor Vehicle Credit or the new Clean Vehicle Credit The Qualified Plug In Electric Drive

How to qualify for the 2024 EV tax credit Used EV tax credit qualifications How the electric vehicle tax credit is calculated How to claim the federal EV tax credit

Use Form 8936 to claim either the Qualified Plug In Electric Drive Motor Vehicle Credit or the new Clean Vehicle Credit The Qualified Plug In Electric Drive

When Does Solar Tax Credit End SolarProGuide 2022

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

Modifications To The 45Q Tax Credit Great Plains Institute

FAQ WA Tax Credit

Federal EV Tax Credit Explained YouTube

California Solar Incentives Rebates Tax Credits 2023 Guide

California Solar Incentives Rebates Tax Credits 2023 Guide

How To Claim Tax Benefits On More Than One Home Loan