In our modern, consumer-driven society every person loves a great bargain. One method of gaining significant savings from your purchases is via Federal Rebates For Solar Installations. Federal Rebates For Solar Installations are an effective marketing tactic used by manufacturers and retailers to offer consumers a partial cash back on their purchases once they've made them. In this post, we'll investigate the world of Federal Rebates For Solar Installations. We'll discuss what they are and how they operate, and ways to maximize your savings through these efficient incentives.

Get Latest Federal Rebates For Solar Installation Below

Federal Rebates For Solar Installation

Federal Rebates For Solar Installation -

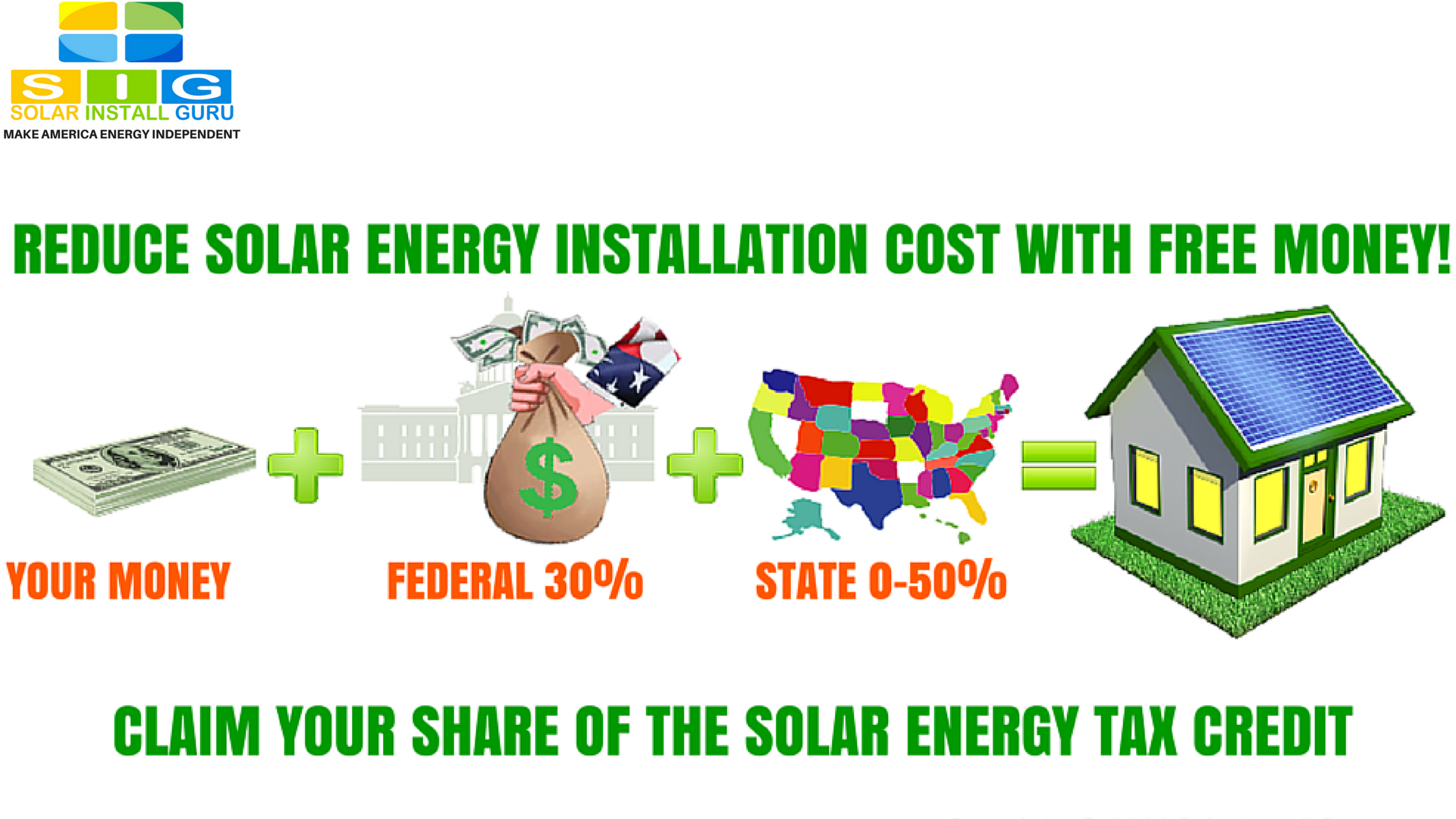

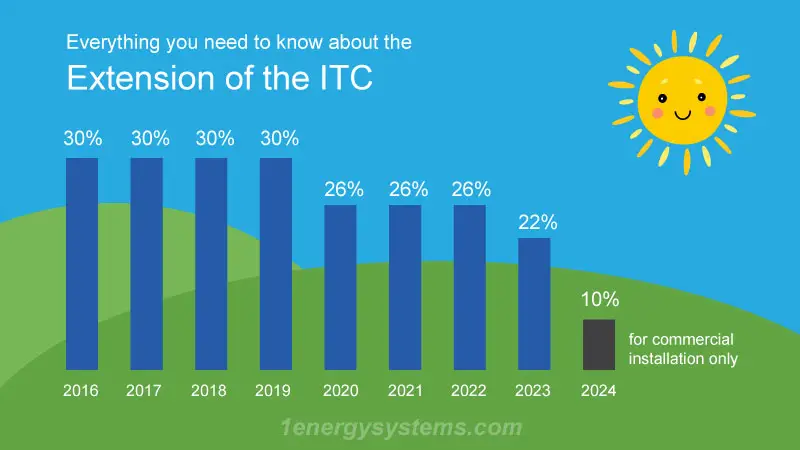

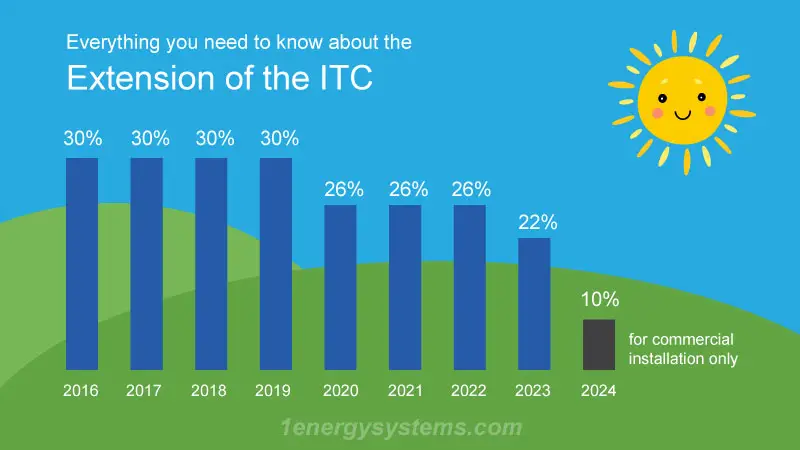

Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC

Web federal solar tax credit You might be eligible for this tax credit inspection costs and developer fees if you meet all of the following criteria Your solar PV system was

A Federal Rebates For Solar Installation, in its simplest format, is a refund given to a client after they've bought a product or service. It's a powerful instrument utilized by businesses to attract customers, boost sales, and promote specific products.

Types of Federal Rebates For Solar Installation

Federal State Local Rebates Are Available Now Home Solar Rebate

Federal State Local Rebates Are Available Now Home Solar Rebate

Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit

Web 10 mars 2023 nbsp 0183 32 A 30 tax credit is now available until the end of 2032 for residential solar installations The federal solar tax credit was set to expire at the end of 2024 with

Cash Federal Rebates For Solar Installation

Cash Federal Rebates For Solar Installation are by far the easiest type of Federal Rebates For Solar Installation. Customers receive a certain amount back in cash after purchasing a particular item. These are often used for costly items like electronics or appliances.

Mail-In Federal Rebates For Solar Installation

Mail-in Federal Rebates For Solar Installation need customers to present the proof of purchase in order to receive the money. They're somewhat more involved but offer substantial savings.

Instant Federal Rebates For Solar Installation

Instant Federal Rebates For Solar Installation are applied right at the point of sale, and can reduce the cost of purchase immediately. Customers do not have to wait long for savings in this manner.

How Federal Rebates For Solar Installation Work

The Future Of Solar Energy Rebates Solaris

The Future Of Solar Energy Rebates Solaris

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

The Federal Rebates For Solar Installation Process

The process typically comprises a number of easy steps:

-

Purchase the item: First make sure you purchase the product the way you normally do.

-

Fill in your Federal Rebates For Solar Installation paper: You'll need to supply some details like your name, address, and details about your purchase, in order in order to make a claim for your Federal Rebates For Solar Installation.

-

Send in the Federal Rebates For Solar Installation In accordance with the type of Federal Rebates For Solar Installation you might need to send in a form, or send it via the internet.

-

Wait for the company's approval: They will examine your application to make sure it is in line with the requirements of the Federal Rebates For Solar Installation.

-

Pay your Federal Rebates For Solar Installation When it's approved you'll be able to receive your reimbursement, either by check, prepaid card or through a different method specified by the offer.

Pros and Cons of Federal Rebates For Solar Installation

Advantages

-

Cost savings: Federal Rebates For Solar Installation can significantly lower the cost you pay for an item.

-

Promotional Offers These promotions encourage consumers to try new products or brands.

-

Increase Sales A Federal Rebates For Solar Installation program can boost a company's sales and market share.

Disadvantages

-

Complexity: Mail-in Federal Rebates For Solar Installation, particularly, can be cumbersome and tedious.

-

End Dates Many Federal Rebates For Solar Installation impose extremely strict deadlines to submit.

-

Risk of Non-Payment Some customers might not receive their Federal Rebates For Solar Installation if they do not adhere to the guidelines exactly.

Download Federal Rebates For Solar Installation

[su_button url="https://printablerebateform.net/?s=Federal Rebates For Solar Installation" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Federal Rebates For Solar Installation[/su_button]

FAQs

1. Are Federal Rebates For Solar Installation equivalent to discounts? No, Federal Rebates For Solar Installation are a partial refund upon purchase, whereas discounts cut your purchase cost at time of sale.

2. Are there Federal Rebates For Solar Installation that can be used for the same product It is contingent on the terms and conditions of Federal Rebates For Solar Installation promotions and on the products ability to qualify. Some companies will allow it, but others won't.

3. What is the time frame to receive an Federal Rebates For Solar Installation? The time frame is different, but it could take anywhere from a few weeks to a couple of months to receive your Federal Rebates For Solar Installation.

4. Do I need to pay tax upon Federal Rebates For Solar Installation quantities? most instances, Federal Rebates For Solar Installation amounts are not considered to be taxable income.

5. Can I trust Federal Rebates For Solar Installation offers from brands that aren't well-known it is crucial to conduct research and make sure that the company giving the Federal Rebates For Solar Installation is reputable prior to making any purchase.

Solar 101 A Guide To Buying Solar Power Systems

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

Check more sample of Federal Rebates For Solar Installation below

How To Claim The Solar Rebate VIC NSW QLD SA

Solar Installation Services

The Federal Rebate For Solar Will Keep Your Installation Affordable

Benefits Of Going Solar In 2022 Solar Solar Electric Solar Panel

2019 Texas Solar Panel Rebates Tax Credits And Cost

Here s How To Claim The Federal 30 Tax Credit For Installing Solar

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web federal solar tax credit You might be eligible for this tax credit inspection costs and developer fees if you meet all of the following criteria Your solar PV system was

https://www.energy.gov/sites/default/files/2023-03/Homeown…

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Web federal solar tax credit You might be eligible for this tax credit inspection costs and developer fees if you meet all of the following criteria Your solar PV system was

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Benefits Of Going Solar In 2022 Solar Solar Electric Solar Panel

Solar Installation Services

2019 Texas Solar Panel Rebates Tax Credits And Cost

Here s How To Claim The Federal 30 Tax Credit For Installing Solar

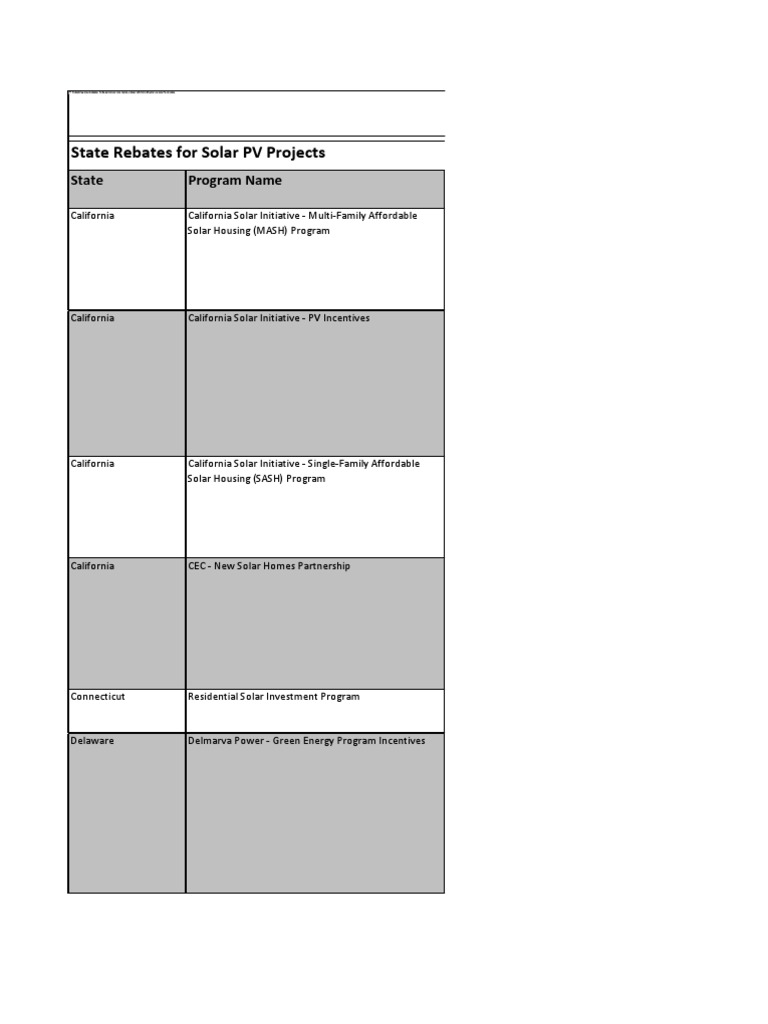

States Rebates For Solar PV Projects Photovoltaic System Renewable

Solar Panel Rebates And Incentives A Comprehensive Guide

Solar Panel Rebates And Incentives A Comprehensive Guide

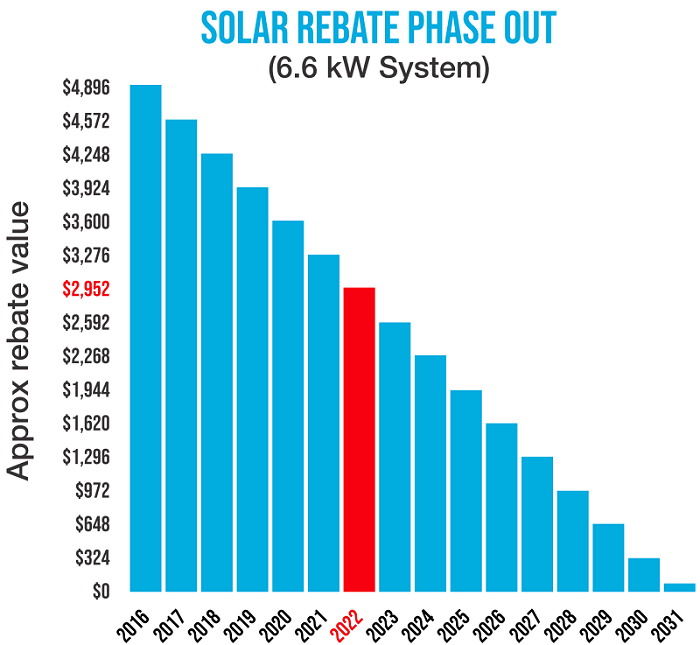

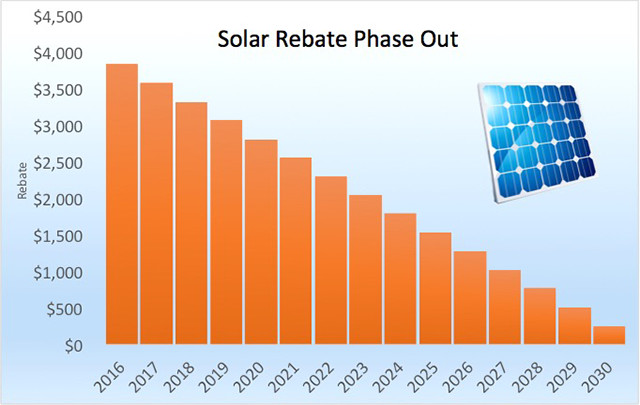

Solar Panel Rebate To Be Phased Out From 1st Of January 2017 Solar