In today's consumer-driven world everyone appreciates a great bargain. One way to score substantial savings for your purchases is through Energy Tax Credit Form 2022s. Energy Tax Credit Form 2022s are a method of marketing that retailers and manufacturers use to provide customers with a partial discount on purchases they made after they have bought them. In this article, we'll delve into the world of Energy Tax Credit Form 2022s. We'll discuss what they are and how they work as well as ways to maximize the value of these incentives.

Get Latest Energy Tax Credit Form 2022 Below

Energy Tax Credit Form 2022

Energy Tax Credit Form 2022 -

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your

A Energy Tax Credit Form 2022 in its most basic definition, is a refund given to a client after having purchased a item or service. It is a powerful tool that companies use to attract buyers, increase sales and also to advertise certain products.

Types of Energy Tax Credit Form 2022

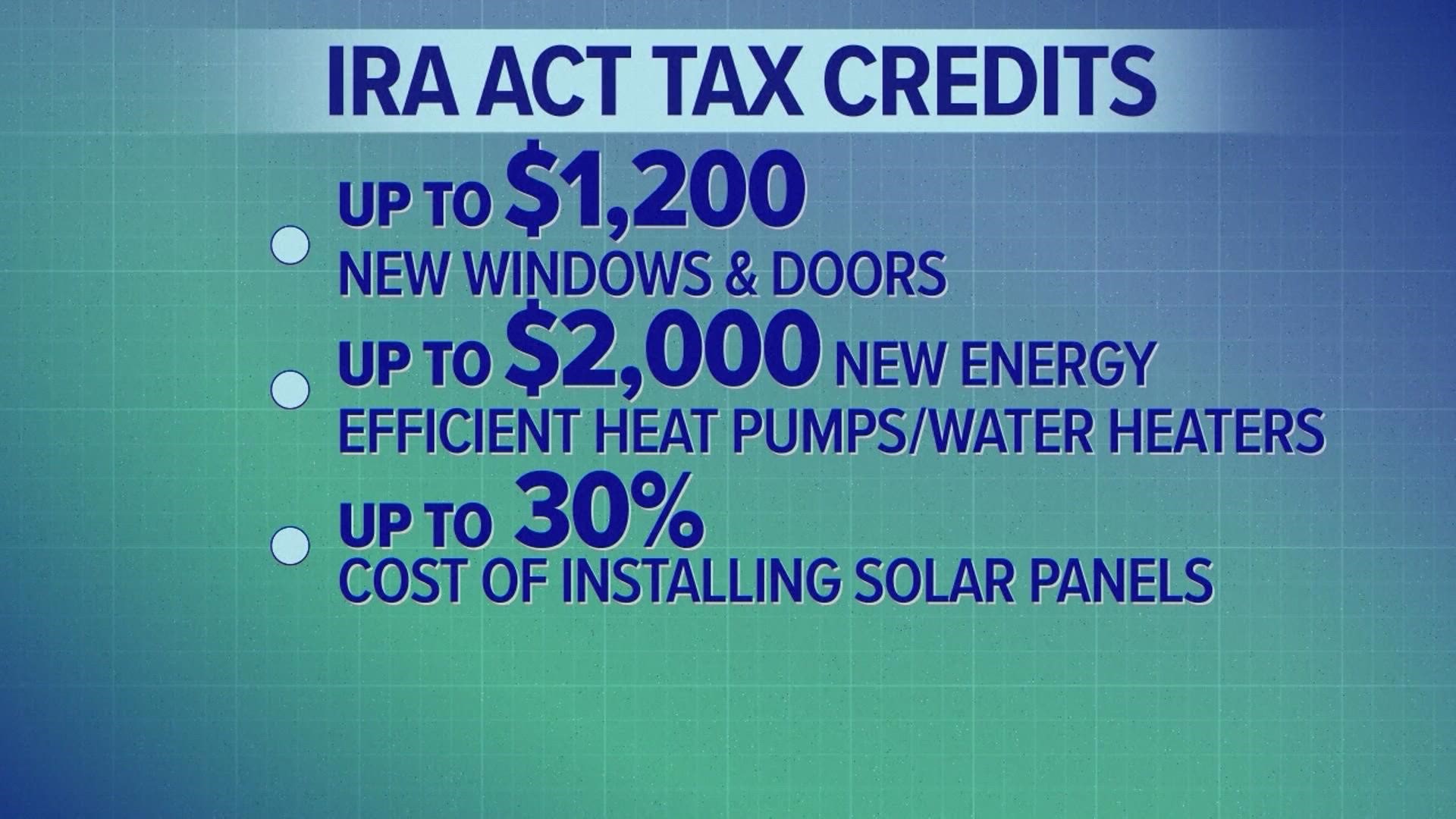

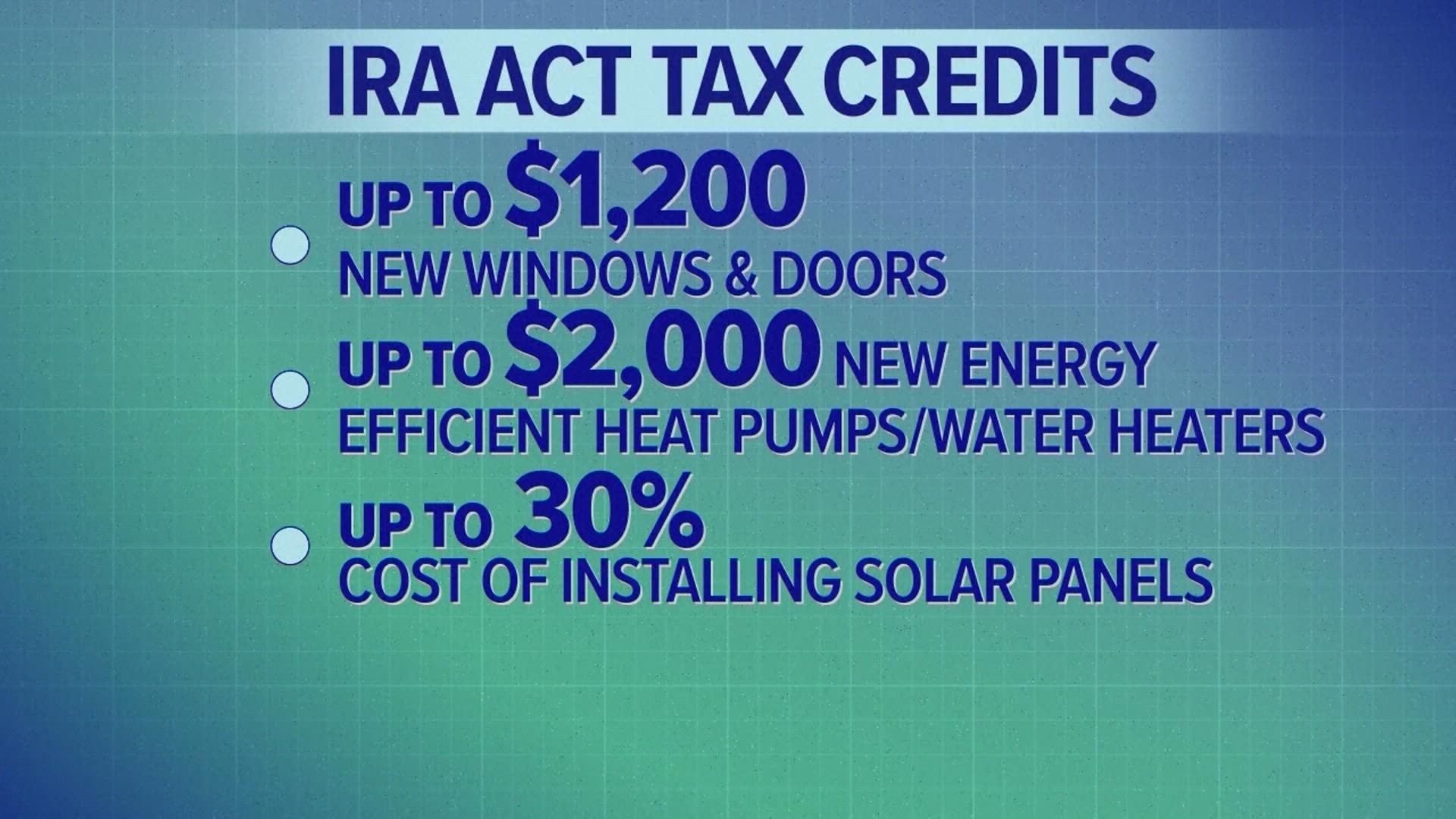

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help

2022 Tax Credit Information Information updated 12 30 2022 The Non Business Energy Property Tax Credits outlined below apply retroactively through

Cash Energy Tax Credit Form 2022

Cash Energy Tax Credit Form 2022 are probably the most simple kind of Energy Tax Credit Form 2022. Customers receive a specific amount of money back after buying a product. These are typically for products that are expensive, such as electronics or appliances.

Mail-In Energy Tax Credit Form 2022

Mail-in Energy Tax Credit Form 2022 demand that customers provide documents of purchase to claim the refund. They are a bit more complicated, but they can provide huge savings.

Instant Energy Tax Credit Form 2022

Instant Energy Tax Credit Form 2022 apply at the point of sale, and can reduce the price instantly. Customers do not have to wait around for savings through this kind of offer.

How Energy Tax Credit Form 2022 Work

California Solar Tax Credit LA Solar Group

California Solar Tax Credit LA Solar Group

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

The Energy Tax Credit Form 2022 Process

The process typically involves a couple of steps that are easy to follow:

-

Purchase the product: First you purchase the product just as you would ordinarily.

-

Fill in this Energy Tax Credit Form 2022 request form. You'll have to fill in some information, such as your address, name, and purchase information, in order to take advantage of your Energy Tax Credit Form 2022.

-

Send in the Energy Tax Credit Form 2022 The Energy Tax Credit Form 2022 must be submitted in accordance with the type of Energy Tax Credit Form 2022 you could be required to fill out a form and mail it in or submit it online.

-

Wait for approval: The company will look over your submission to make sure it is in line with the rules and regulations of the Energy Tax Credit Form 2022.

-

Enjoy your Energy Tax Credit Form 2022: Once approved, you'll receive your cash back either through check, prepaid card, or by another option as per the terms of the offer.

Pros and Cons of Energy Tax Credit Form 2022

Advantages

-

Cost savings A Energy Tax Credit Form 2022 can significantly lower the cost you pay for an item.

-

Promotional Offers The aim is to encourage customers to try new items or brands.

-

boost sales Energy Tax Credit Form 2022 can increase the sales of a company as well as its market share.

Disadvantages

-

Complexity Reward mail-ins in particular are often time-consuming and take a long time to complete.

-

End Dates: Many Energy Tax Credit Form 2022 have strict time limits for submission.

-

Risk of Not Being Paid: Some customers may not receive their Energy Tax Credit Form 2022 if they don't follow the regulations precisely.

Download Energy Tax Credit Form 2022

[su_button url="https://printablerebateform.net/?s=Energy Tax Credit Form 2022" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Energy Tax Credit Form 2022[/su_button]

FAQs

1. Are Energy Tax Credit Form 2022 equivalent to discounts? No, Energy Tax Credit Form 2022 involve a partial refund after purchase whereas discounts will reduce the price of the purchase at the point of sale.

2. Are there any Energy Tax Credit Form 2022 that I can use for the same product The answer is dependent on the conditions of Energy Tax Credit Form 2022 deals and product's ability to qualify. Certain companies might allow the use of multiple Energy Tax Credit Form 2022, whereas other won't.

3. What is the time frame to receive an Energy Tax Credit Form 2022? The duration will differ, but can be from several weeks to couple of months before you get your Energy Tax Credit Form 2022.

4. Do I need to pay taxes for Energy Tax Credit Form 2022 quantities? the majority of cases, Energy Tax Credit Form 2022 amounts are not considered to be taxable income.

5. Do I have confidence in Energy Tax Credit Form 2022 deals from lesser-known brands it is crucial to conduct research to ensure that the name that is offering the Energy Tax Credit Form 2022 is reliable prior to making an purchase.

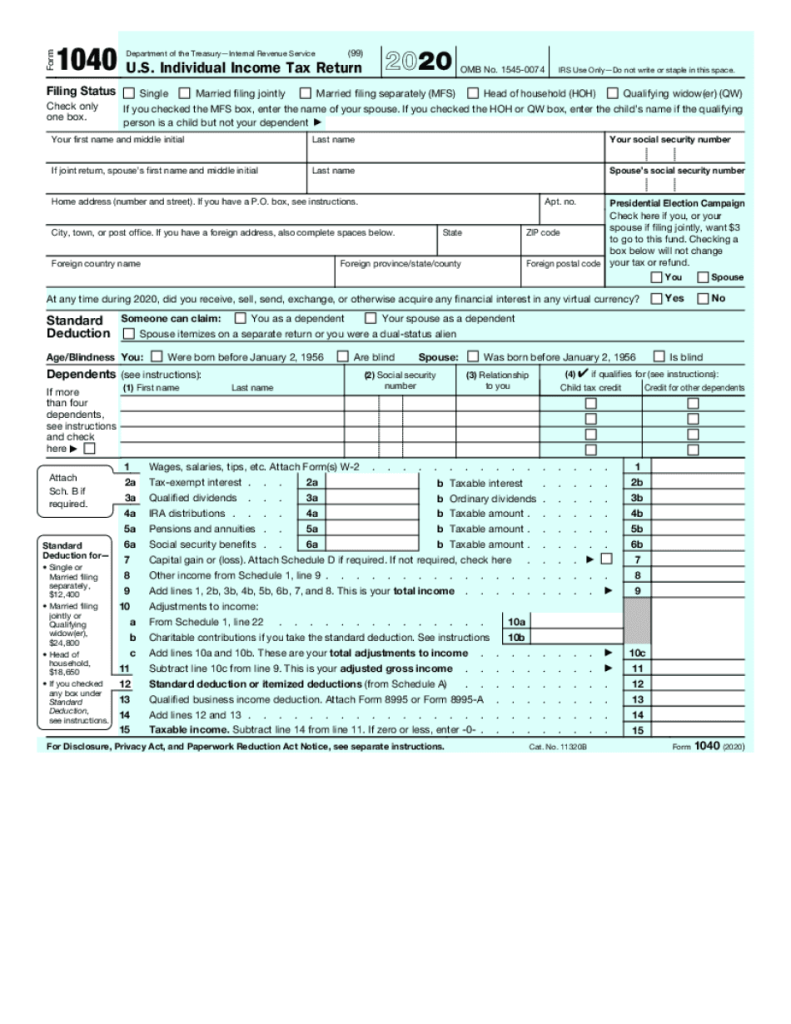

2022 1040a Fillable Tax Form Free Fillable Form 2023

2023 Residential Clean Energy Credit Guide ReVision Energy

Check more sample of Energy Tax Credit Form 2022 below

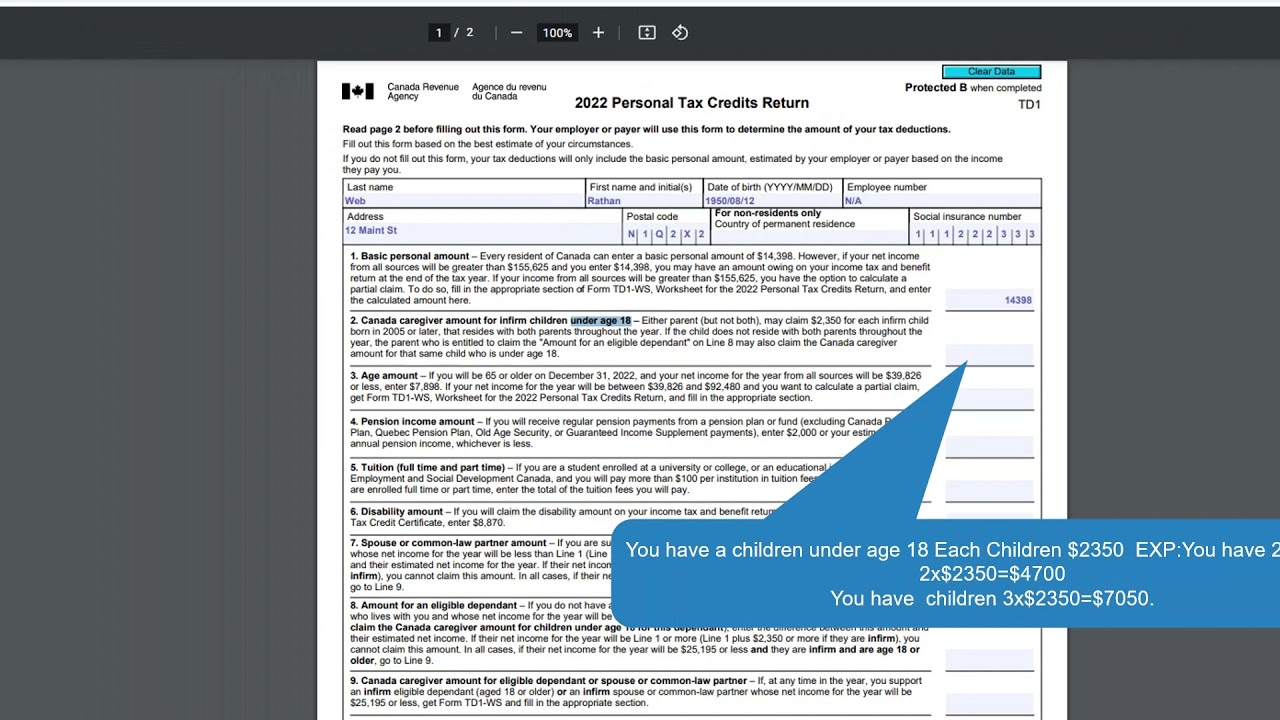

2022 Form WI I 010i Fill Online Printable Fillable Blank PdfFiller

2022 Form MO DoR MO PTS Fill Online Printable Fillable Blank PdfFiller

Agnus Good

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Tax Credits Save You More Than Deductions Here Are The Best Ones

8 Incredible Tips How To Claim Solar Tax Credit Outbackvoices

https://www.irs.gov/forms-pubs/about-form-5695

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

File Form 5695 Residential Energy Credits with your tax return to claim the credit You must claim the credit for the tax year when the property is installed not

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your

File Form 5695 Residential Energy Credits with your tax return to claim the credit You must claim the credit for the tax year when the property is installed not

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2022 Form MO DoR MO PTS Fill Online Printable Fillable Blank PdfFiller

Tax Credits Save You More Than Deductions Here Are The Best Ones

8 Incredible Tips How To Claim Solar Tax Credit Outbackvoices

2022 Education Tax Credits Are You Eligible

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

22 Questions Answered For 2022 Tax Filing Emerald Advisors