In our current world of high-end consumer goods every person loves a great bargain. One way to gain substantial savings on your purchases is through Economic Recovery Rebate Forms. Economic Recovery Rebate Forms can be a way of marketing used by manufacturers and retailers to offer consumers a partial discount on purchases they made after they've done so. In this article, we will take a look at the world that is Economic Recovery Rebate Forms. We'll discuss what they are as well as how they work and how you can maximize the value of these incentives.

Get Latest Economic Recovery Rebate Form Below

Economic Recovery Rebate Form

Economic Recovery Rebate Form -

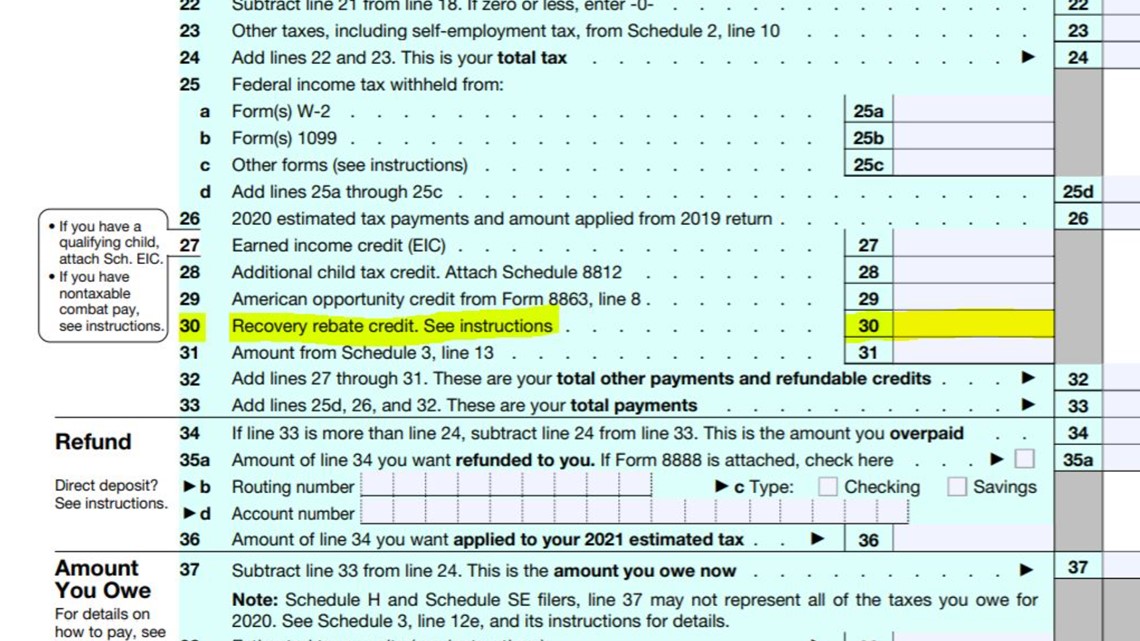

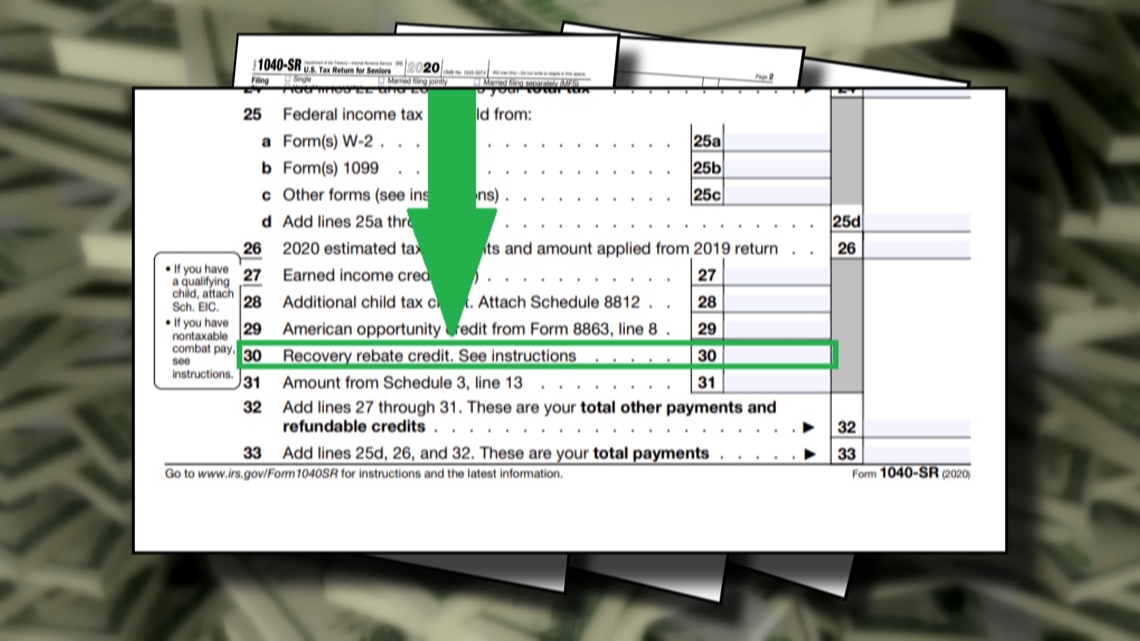

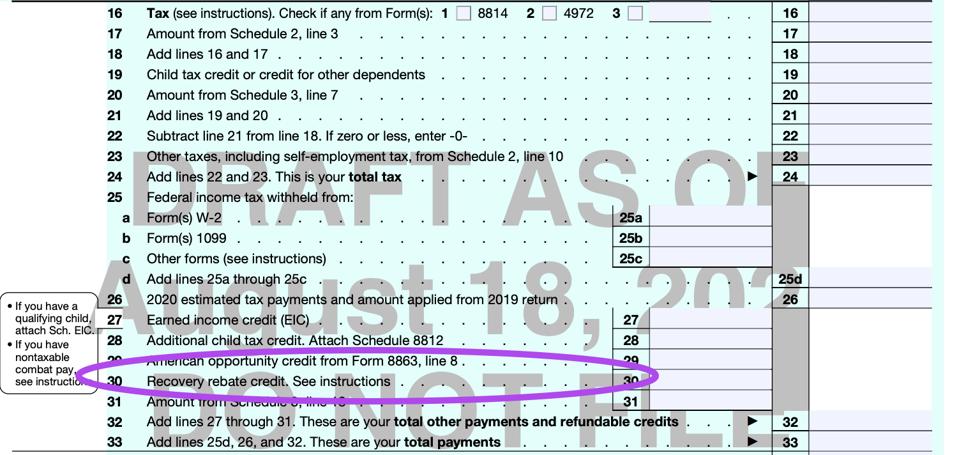

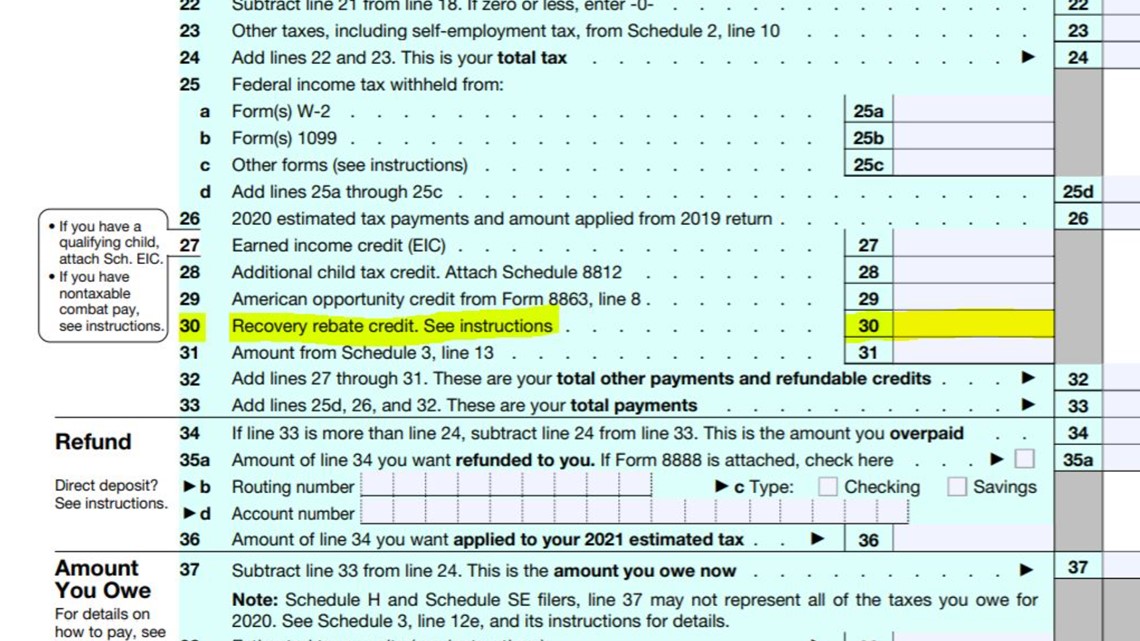

Web 13 janv 2022 nbsp 0183 32 When you file your 2021 tax return your tax preparation software or the line 30 worksheet found in the 2021 Form 1040 and Form 1040 SR Instructions can help

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit Log into

A Economic Recovery Rebate Form as it is understood in its simplest definition, is a cash refund provided to customers after purchasing a certain product or service. This is a potent tool utilized by businesses to attract clients, increase sales and to promote certain products.

Types of Economic Recovery Rebate Form

IRS Releases Draft Form 1040 Here s What s New For 2020

IRS Releases Draft Form 1040 Here s What s New For 2020

Web IRS gov rrc Claiming the 2021 Recovery Rebate Credit on a 2021 Tax Return Most people who are eligible for the 2021 Recovery People received the full amount of the

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the

Cash Economic Recovery Rebate Form

Cash Economic Recovery Rebate Form are the most basic kind of Economic Recovery Rebate Form. The customer receives a particular amount back in cash after purchasing a product. This is often for large-ticket items such as electronics and appliances.

Mail-In Economic Recovery Rebate Form

Mail-in Economic Recovery Rebate Form are based on the requirement that customers submit the proof of purchase to be eligible for their refund. They're longer-lasting, however they offer huge savings.

Instant Economic Recovery Rebate Form

Instant Economic Recovery Rebate Form are made at the point of sale, and can reduce your purchase cost instantly. Customers don't need to wait around for savings when they purchase this type of Economic Recovery Rebate Form.

How Economic Recovery Rebate Form Work

Form 8038 R Request For Recovery Of Overpayments Under Arbitrage

Form 8038 R Request For Recovery Of Overpayments Under Arbitrage

Web 15 janv 2021 nbsp 0183 32 IRS Free File is all taxpayers need to claim the Recovery Rebate Credit and other tax benefits such as the Earned Income Tax Credit EITC In 2020 the IRS issued

The Economic Recovery Rebate Form Process

The process generally involves a few steps

-

When you buy the product you buy the product like you would normally.

-

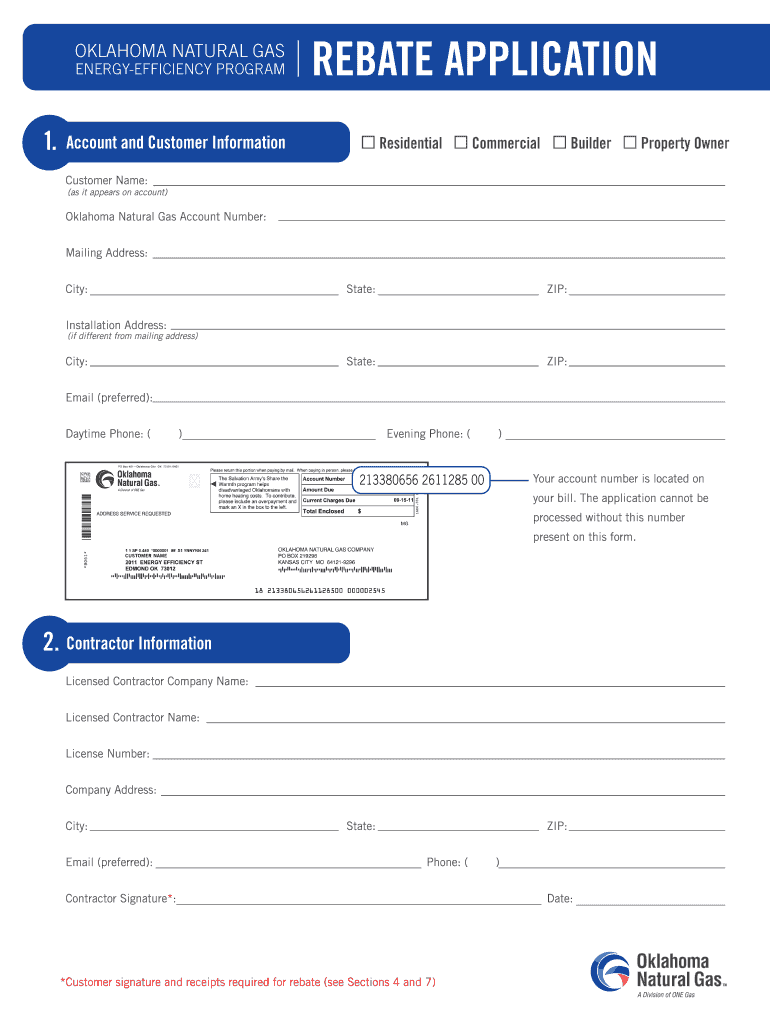

Fill out this Economic Recovery Rebate Form application: In order to claim your Economic Recovery Rebate Form, you'll have provide certain information, such as your name, address, as well as the details of your purchase to claim your Economic Recovery Rebate Form.

-

Submit the Economic Recovery Rebate Form According to the kind of Economic Recovery Rebate Form you will need to either mail in a request form or make it available online.

-

Wait for approval: The business will scrutinize your submission to determine if it's in compliance with the Economic Recovery Rebate Form's terms and conditions.

-

Receive your Economic Recovery Rebate Form After being approved, you'll get your refund, using a check or prepaid card or another way specified in the offer.

Pros and Cons of Economic Recovery Rebate Form

Advantages

-

Cost savings The use of Economic Recovery Rebate Form can greatly reduce the price you pay for an item.

-

Promotional Offers They encourage customers to try new items or brands.

-

Improve Sales A Economic Recovery Rebate Form program can boost companies' sales and market share.

Disadvantages

-

Complexity Economic Recovery Rebate Form that are mail-in, in particular is a time-consuming process and costly.

-

The Expiration Dates Many Economic Recovery Rebate Form are subject to deadlines for submission.

-

Risk of not receiving payment Certain customers could not receive their refunds if they do not follow the rules exactly.

Download Economic Recovery Rebate Form

[su_button url="https://printablerebateform.net/?s=Economic Recovery Rebate Form" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Economic Recovery Rebate Form[/su_button]

FAQs

1. Are Economic Recovery Rebate Form similar to discounts? No, they are an amount of money that is refunded after the purchase, but discounts can reduce the purchase price at the moment of sale.

2. Can I get multiple Economic Recovery Rebate Form on the same product This depends on the terms for the Economic Recovery Rebate Form provides and the particular product's potential eligibility. Certain companies allow it, but some will not.

3. How long will it take to receive an Economic Recovery Rebate Form? The amount of time will differ, but can last from a few weeks until a couple of months to receive your Economic Recovery Rebate Form.

4. Do I need to pay taxes of Economic Recovery Rebate Form montants? most cases, Economic Recovery Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Economic Recovery Rebate Form offers from brands that aren't well-known You must research and confirm that the company giving the Economic Recovery Rebate Form is reliable prior to making the purchase.

T20 0233 Additional 2020 Recovery Rebates For Individuals In Senate

The Recovery Rebates And Economic Stimulus For The American People Act

Check more sample of Economic Recovery Rebate Form below

The Recovery Rebate Credit Explained Expat US Tax

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

Ong Rebates Form Fill Out And Sign Printable PDF Template SignNow

Recovery Rebate Credit Worksheet Explained Support

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit Log into

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 2021 Recovery Rebate Credit Topic A General Information These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit Log into

Web 17 f 233 vr 2022 nbsp 0183 32 2021 Recovery Rebate Credit Topic A General Information These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If

Recovery Rebate Credit Worksheet Explained Support

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

T20 0114 Senate Republican Recovery Rebate Distribution Of Federal

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

T20 0116 Senate Republican Recovery Rebate Size Of Rebate Amount By