In our current world of high-end consumer goods everybody loves a good deal. One way to score substantial savings on your purchases is to use Does Tesla Get Tax Credits. Does Tesla Get Tax Credits are a method of marketing that retailers and manufacturers use in order to offer customers a small reimbursement on their purchases following the time they've purchased them. In this post, we'll dive into the world Does Tesla Get Tax Credits. We will explore what they are and how they work and ways you can increase your savings through these cost-effective incentives.

Get Latest Does Tesla Get Tax Credit Below

Does Tesla Get Tax Credit

Does Tesla Get Tax Credit -

Sign in to your Tesla Account Select Documents Select IRA Clean Vehicle Credit Report Review the IRS website for a full list of requirements Your 2023 Clean Vehicle Report IRS form 15400 is available by request through your Tesla Account

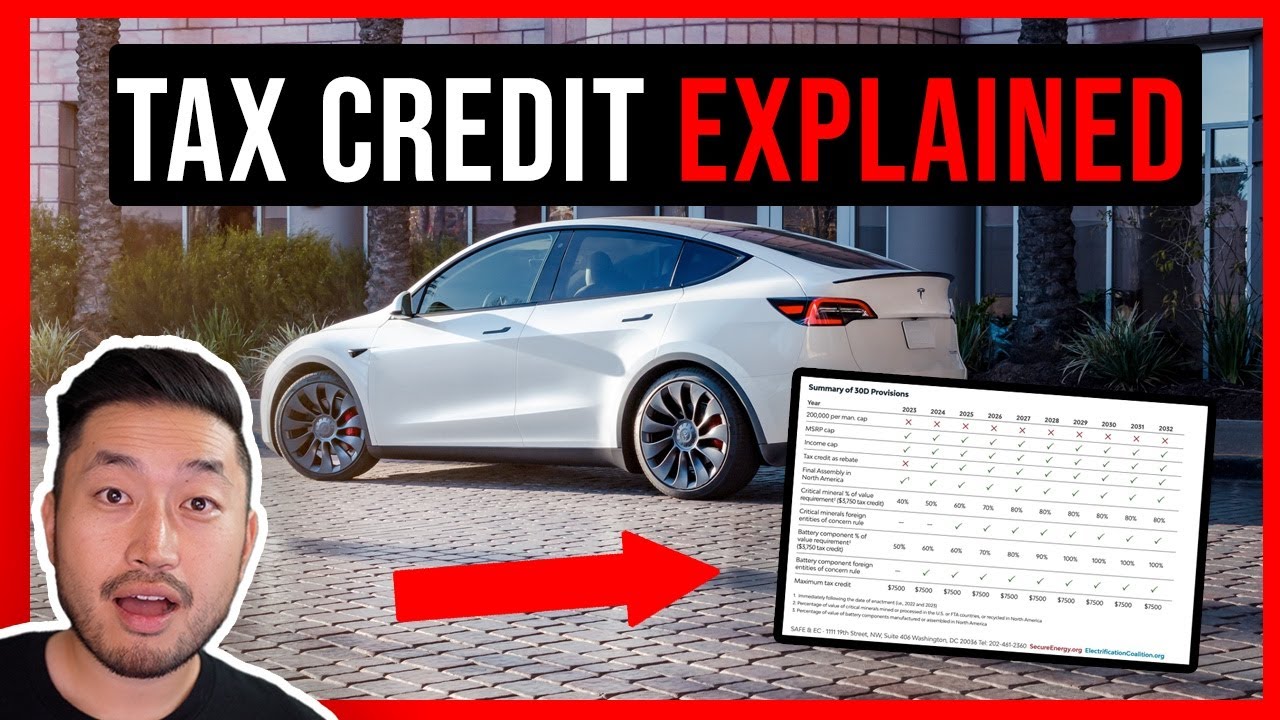

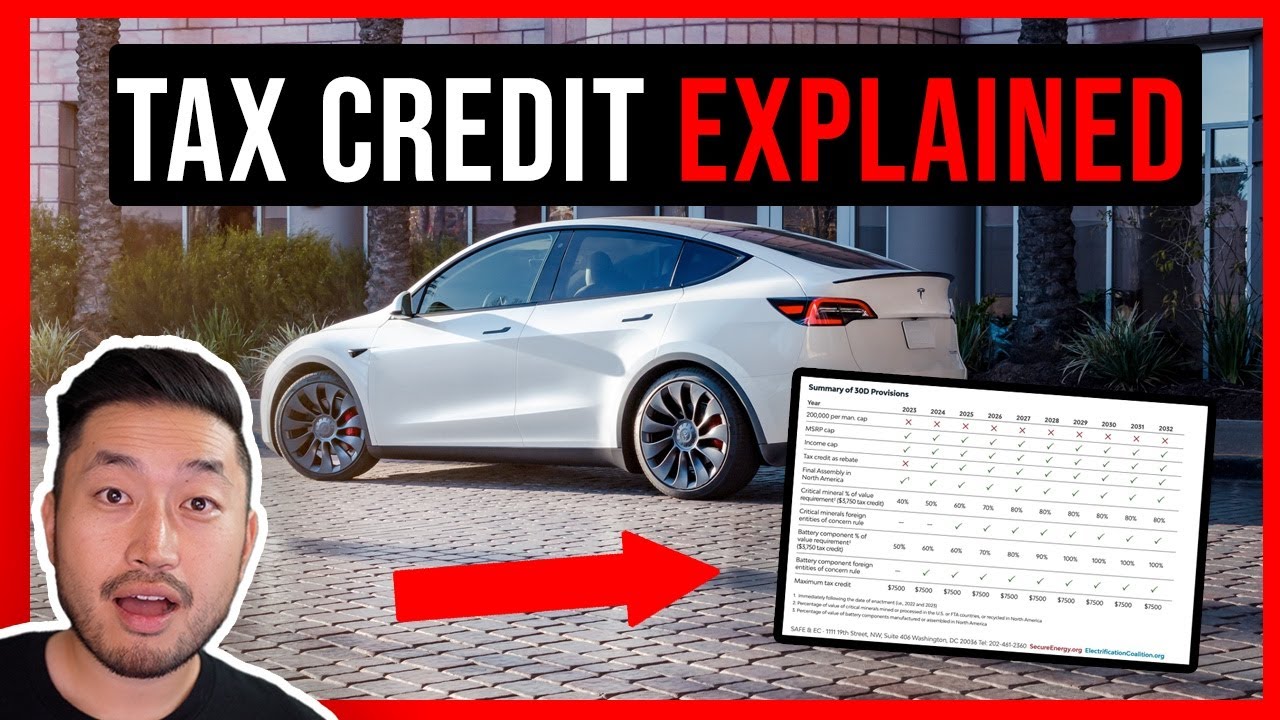

Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

A Does Tesla Get Tax Credit or Does Tesla Get Tax Credit, in its most basic form, is a partial return to the customer after purchasing a certain product or service. It's a powerful instrument for businesses to entice buyers, increase sales and also to advertise certain products.

Types of Does Tesla Get Tax Credit

TESLA EV TAX CREDIT EXPLAINED YouTube

TESLA EV TAX CREDIT EXPLAINED YouTube

Yes The government allows for various tax credits for the purchase of plug in electric vehicles EV or fuel cell vehicles FCV Tesla arguably the most famed EV in the game is on that

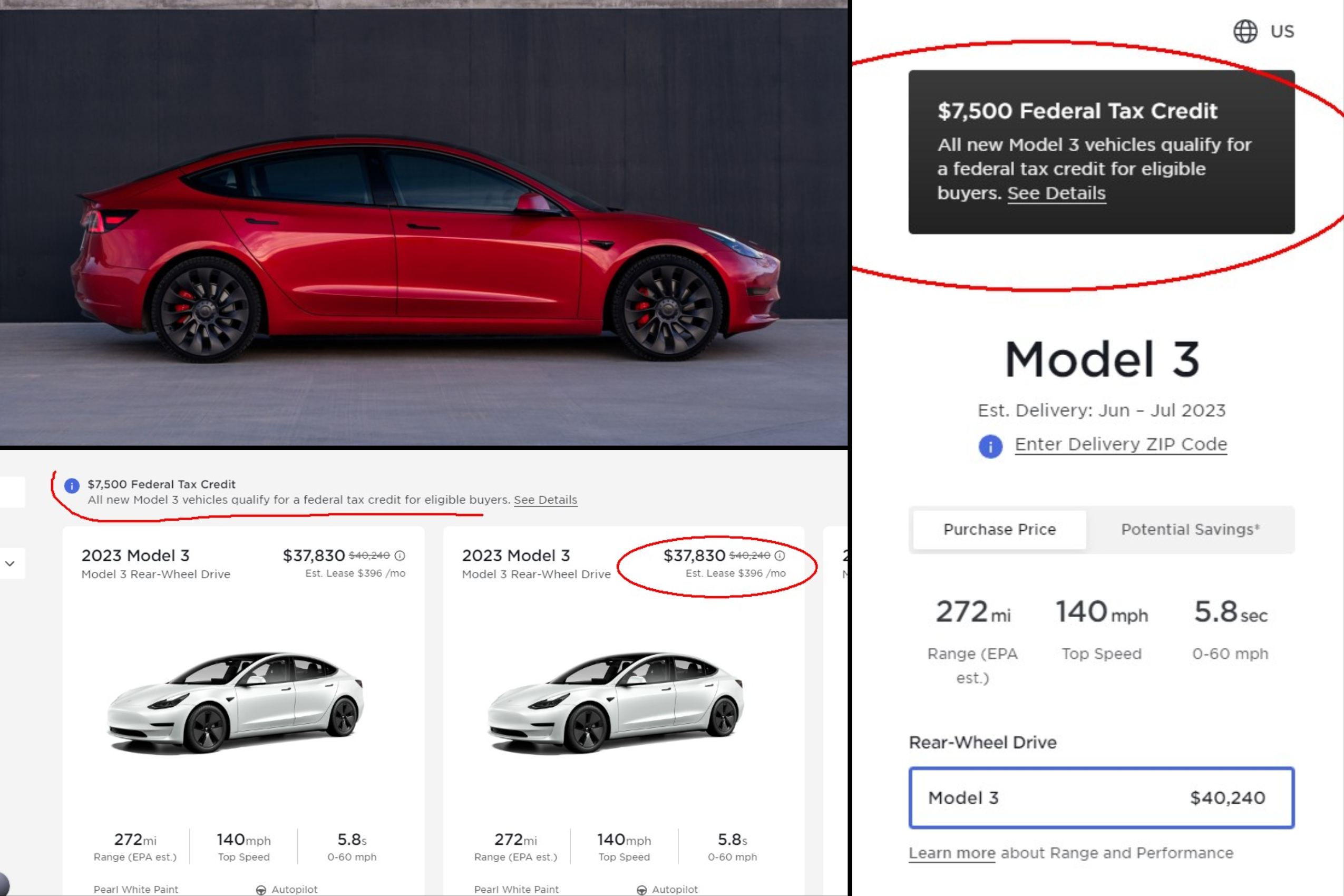

Today Tesla officially updated its list of vehicles eligible to the federal tax credit and confirmed that Model Y variants are all retaining access to the full tax credit Model 3

Cash Does Tesla Get Tax Credit

Cash Does Tesla Get Tax Credit are probably the most simple type of Does Tesla Get Tax Credit. Customers are offered a certain amount of money back upon purchasing a product. These are typically applied to high-ticket items like electronics or appliances.

Mail-In Does Tesla Get Tax Credit

Customers who want to receive mail-in Does Tesla Get Tax Credit must send in evidence of purchase to get the refund. They're a bit more involved but offer huge savings.

Instant Does Tesla Get Tax Credit

Instant Does Tesla Get Tax Credit are applied right at the point of sale. They reduce the price of your purchase instantly. Customers do not have to wait long for savings when they purchase this type of Does Tesla Get Tax Credit.

How Does Tesla Get Tax Credit Work

Why Tesla GM Benefit From Treasury Department s EV Tax Credit Scheme

Why Tesla GM Benefit From Treasury Department s EV Tax Credit Scheme

The big climate and health care bill signed into law by President Biden has what at first sight looks like a big incentive for those shopping for a car a revamped 7 500 tax credit if you buy

The Does Tesla Get Tax Credit Process

The process usually involves a few easy steps:

-

Buy the product: At first you purchase the product just like you normally would.

-

Fill in the Does Tesla Get Tax Credit questionnaire: you'll have to supply some details including your address, name, and the purchase details, in order in order to get your Does Tesla Get Tax Credit.

-

You must submit the Does Tesla Get Tax Credit According to the type of Does Tesla Get Tax Credit you could be required to submit a form by mail or send it via the internet.

-

Wait for approval: The business is going to review your entry to determine if it's in compliance with the guidelines and conditions of the Does Tesla Get Tax Credit.

-

Take advantage of your Does Tesla Get Tax Credit After you've been approved, you'll receive your money back, via check, prepaid card or another option that's specified in the offer.

Pros and Cons of Does Tesla Get Tax Credit

Advantages

-

Cost savings Does Tesla Get Tax Credit are a great way to reduce the price you pay for a product.

-

Promotional Offers These promotions encourage consumers to try new products and brands.

-

Improve Sales Reward programs can boost sales for a company and also increase market share.

Disadvantages

-

Complexity Mail-in Does Tesla Get Tax Credit particularly are often time-consuming and tedious.

-

The Expiration Dates Some Does Tesla Get Tax Credit have certain deadlines for submitting.

-

Risk of Not Being Paid Some customers might not receive their refunds if they do not follow the rules exactly.

Download Does Tesla Get Tax Credit

[su_button url="https://printablerebateform.net/?s=Does Tesla Get Tax Credit" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Does Tesla Get Tax Credit[/su_button]

FAQs

1. Are Does Tesla Get Tax Credit similar to discounts? No, Does Tesla Get Tax Credit are a partial refund after the purchase, whereas discounts decrease costs at moment of sale.

2. Can I get multiple Does Tesla Get Tax Credit on the same product It's contingent upon the terms on the Does Tesla Get Tax Credit promotions and on the products admissibility. Certain companies may allow it, while others won't.

3. How long does it take to receive an Does Tesla Get Tax Credit? The timing differs, but it can range from several weeks to few months to receive your Does Tesla Get Tax Credit.

4. Do I have to pay taxes on Does Tesla Get Tax Credit funds? most instances, Does Tesla Get Tax Credit amounts are not considered to be taxable income.

5. Do I have confidence in Does Tesla Get Tax Credit deals from lesser-known brands It's crucial to research and ensure that the business giving the Does Tesla Get Tax Credit has a good reputation prior to making purchases.

The Tesla Tax Credit Explained That Tesla Channel

How Tesla Bent IRA Rules To Get Full 7 500 Tax Credit For Model 3 RWD

Check more sample of Does Tesla Get Tax Credit below

Tesla s Genius Pricing Plan To Save You Thousands My Tech Methods

Tesla Confirms Hitting Federal Tax Credit Threshold 7 500 Credit Cut

Tesla Model 3 Tax Credit Check Your Eligibility Eduvast

Confusion On EV Tax Credit Tesla Semi Supercharging YouTube

Tesla Says All New Model 3s Now Qualify For Full 7 500 Tax Credit

How Does Tesla Get The Most Out Of EPA Range Testing

www.irs.gov/credits-deductions/credits-for...

Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

www.nerdwallet.com/article/taxes/ev-tax...

The electric vehicle tax credit or the EV credit is a nonrefundable tax credit offered to taxpayers who purchase qualifying electric vehicles or plug in hybrid vehicles Nonrefundable

Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses

The electric vehicle tax credit or the EV credit is a nonrefundable tax credit offered to taxpayers who purchase qualifying electric vehicles or plug in hybrid vehicles Nonrefundable

Confusion On EV Tax Credit Tesla Semi Supercharging YouTube

Tesla Confirms Hitting Federal Tax Credit Threshold 7 500 Credit Cut

Tesla Says All New Model 3s Now Qualify For Full 7 500 Tax Credit

How Does Tesla Get The Most Out Of EPA Range Testing

Tesla Model 3 Tax Credit Explained Real Example YouTube

Elon Musk Promises To Repay Tax Credit If Tesla Misses Year End Delivery

Elon Musk Promises To Repay Tax Credit If Tesla Misses Year End Delivery

Tesla s Ingenious Plan For Qualifying Tax Incentives Vehiclesuggest