In our modern, consumer-driven society everybody loves a good bargain. One method to get significant savings on your purchases is to use Cra Gst Rebate Eligibilitys. Cra Gst Rebate Eligibilitys are an effective marketing tactic that retailers and manufacturers use to provide customers with a portion of a refund on their purchases after they have completed them. In this article, we will examine the subject of Cra Gst Rebate Eligibilitys. We'll discuss the nature of them and how they work and how to maximize your savings by taking advantage of these cost-effective incentives.

Get Latest Cra Gst Rebate Eligibility Below

Cra Gst Rebate Eligibility

Cra Gst Rebate Eligibility -

Home News Canada Explainer Eligible Canadians will receive the GST HST credit today Here s how much you can expect The quarterly non taxable

1 Overview 2 Eligibility 3 Apply 4 How much you can expect to receive 5 Payment dates The goods and services tax harmonized sales tax GST HST credit is a tax free

A Cra Gst Rebate Eligibility, in its simplest form, is a refund that a client receives after purchasing a certain product or service. It is a powerful tool that businesses use to draw customers, increase sales and to promote certain products.

Types of Cra Gst Rebate Eligibility

New Condo HST Rebates Sproule Associates

New Condo HST Rebates Sproule Associates

To qualify for the GST HST credit you must be a Canadian resident for income tax purposes in the month prior and at the start of the month in which the CRA makes a

Who is eligible to get the payment If you are already entitled to receive the GST credit in October of this year you will automatically qualify for the one time GST

Cash Cra Gst Rebate Eligibility

Cash Cra Gst Rebate Eligibility are the simplest kind of Cra Gst Rebate Eligibility. Clients receive a predetermined amount of cash back after purchasing a item. These are typically for big-ticket items, like electronics and appliances.

Mail-In Cra Gst Rebate Eligibility

Mail-in Cra Gst Rebate Eligibility require customers to send in evidence of purchase to get the money. They're somewhat more involved, however they can yield significant savings.

Instant Cra Gst Rebate Eligibility

Instant Cra Gst Rebate Eligibility are applied right at the point of sale, which reduces prices immediately. Customers do not have to wait around for savings in this manner.

How Cra Gst Rebate Eligibility Work

AY 2022 2023 GST Vouchers Everything You Need To Know

AY 2022 2023 GST Vouchers Everything You Need To Know

If the CRA determines that you are eligible for the GST HST credit based on your 2022 tax return and that you will receive payments you will receive a GST HST credit notice in

The Cra Gst Rebate Eligibility Process

The procedure usually involves a few simple steps

-

When you buy the product, you buy the product like you normally do.

-

Complete the Cra Gst Rebate Eligibility forms: The Cra Gst Rebate Eligibility form will have to fill in some information including your address, name, and purchase details, to get your Cra Gst Rebate Eligibility.

-

In order to submit the Cra Gst Rebate Eligibility: Depending on the type of Cra Gst Rebate Eligibility, you may need to mail a Cra Gst Rebate Eligibility form in or make it available online.

-

Wait for the company's approval: They will examine your application to confirm that it complies with the guidelines and conditions of the Cra Gst Rebate Eligibility.

-

Enjoy your Cra Gst Rebate Eligibility When it's approved you'll receive your refund either by check, prepaid card or through a different method specified by the offer.

Pros and Cons of Cra Gst Rebate Eligibility

Advantages

-

Cost savings Cra Gst Rebate Eligibility are a great way to lower the cost you pay for the product.

-

Promotional Offers They encourage customers to try new items or brands.

-

Improve Sales The benefits of a Cra Gst Rebate Eligibility can improve an organization's sales and market share.

Disadvantages

-

Complexity Cra Gst Rebate Eligibility that are mail-in, particularly may be lengthy and tedious.

-

Extension Dates Some Cra Gst Rebate Eligibility have specific deadlines for submission.

-

Risk of Not Being Paid: Some customers may not receive their Cra Gst Rebate Eligibility if they don't adhere to the requirements exactly.

Download Cra Gst Rebate Eligibility

[su_button url="https://printablerebateform.net/?s=Cra Gst Rebate Eligibility" target="blank" style="3d" background="#000000" size="5" wide="yes" center="yes" icon="icon: calculator" rel="dofollow"]Download Cra Gst Rebate Eligibility[/su_button]

FAQs

1. Are Cra Gst Rebate Eligibility similar to discounts? Not at all, Cra Gst Rebate Eligibility provide a partial refund upon purchase, whereas discounts decrease the cost of purchase at point of sale.

2. Do I have to use multiple Cra Gst Rebate Eligibility on the same item This depends on the terms of Cra Gst Rebate Eligibility offers and the product's eligibility. Certain companies may permit the use of multiple Cra Gst Rebate Eligibility, whereas other won't.

3. How long will it take to get a Cra Gst Rebate Eligibility What is the timeframe? differs, but could be anywhere from a few weeks up to a several months to receive a Cra Gst Rebate Eligibility.

4. Do I have to pay tax with respect to Cra Gst Rebate Eligibility values? most cases, Cra Gst Rebate Eligibility amounts are not considered taxable income.

5. Should I be able to trust Cra Gst Rebate Eligibility offers from brands that aren't well-known It is essential to investigate and verify that the organization providing the Cra Gst Rebate Eligibility is reputable prior to making purchases.

GST HST New Housing Rebate And New Residential Rental Property Rebate

Next GST HST Payment Date By CRA Check Payment Status Eligibility

Check more sample of Cra Gst Rebate Eligibility below

10 Days GST Return Service Accounts Details Rs 1000 month RCS GST

New Grocery Rebate To Help Canadians Combat Rising Food Costs August

ITBP Recruitment 2022 Check Post Qualification Eligibility And Other

Singapore Company GST Registration Procedure Importance And

CRA Grocery Rebate Eligibility Understanding The CRA Grocery Rebate

Gst Return Working Form Fill Out And Sign Printable PDF Template

https://www. canada.ca /en/revenue-agency/services...

1 Overview 2 Eligibility 3 Apply 4 How much you can expect to receive 5 Payment dates The goods and services tax harmonized sales tax GST HST credit is a tax free

https:// turbotax.intuit.ca /tips/tax-tip-how-do-i...

You are eligible for the GST HST credit if you are considered a Canadian resident for income tax purposes the month before and at the beginning of the month in

1 Overview 2 Eligibility 3 Apply 4 How much you can expect to receive 5 Payment dates The goods and services tax harmonized sales tax GST HST credit is a tax free

You are eligible for the GST HST credit if you are considered a Canadian resident for income tax purposes the month before and at the beginning of the month in

Singapore Company GST Registration Procedure Importance And

New Grocery Rebate To Help Canadians Combat Rising Food Costs August

CRA Grocery Rebate Eligibility Understanding The CRA Grocery Rebate

Gst Return Working Form Fill Out And Sign Printable PDF Template

Types Of GST Return And Their Due Dates Enterslice

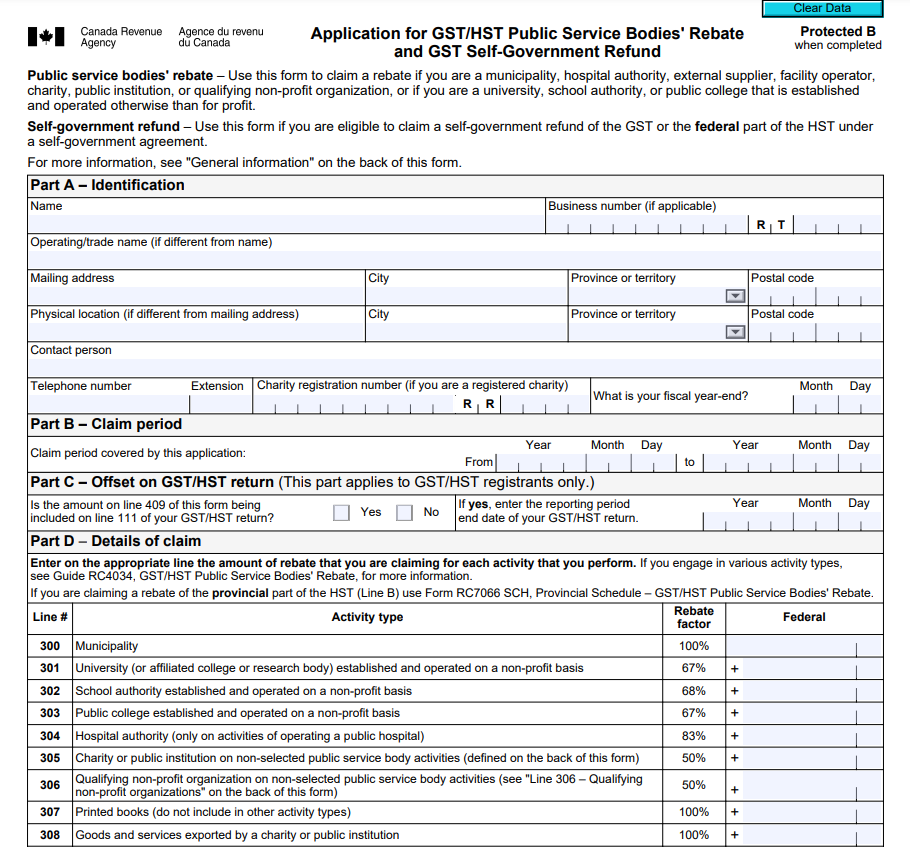

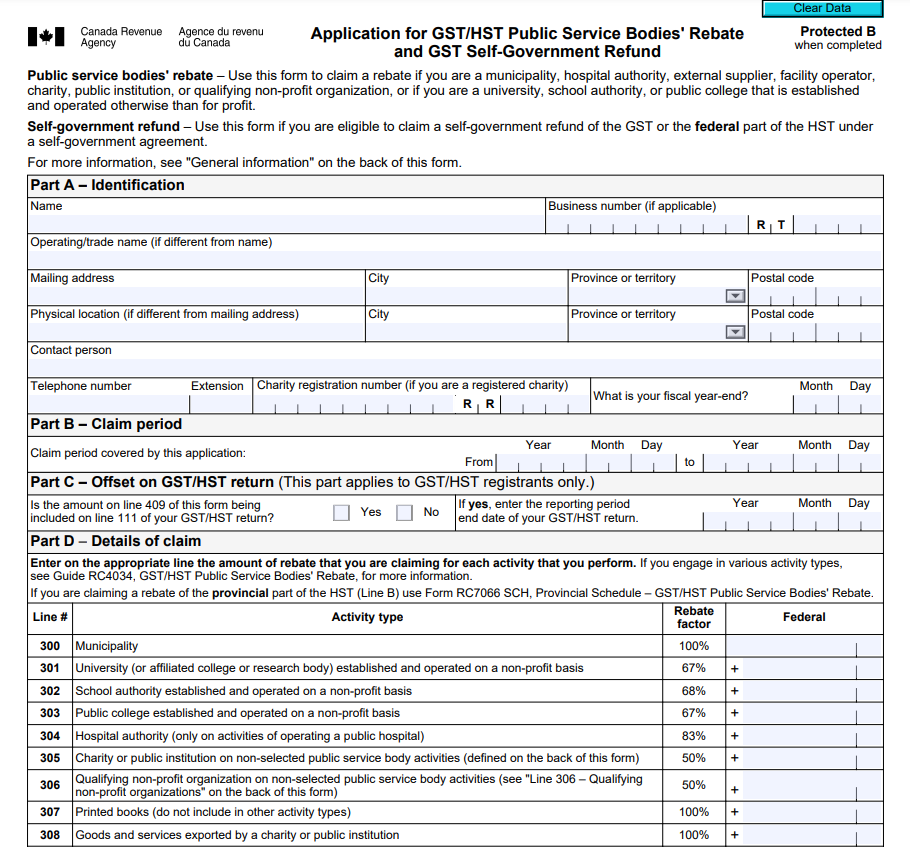

GST Rebate Form For Charities PrintableRebateForm

GST Rebate Form For Charities PrintableRebateForm

Expired 15 Rebate From P G Freebies 4 Mom